Marketing communication directed at per-se professional investors in Switzerland

The precision of bonds. The advantages of ETFs.

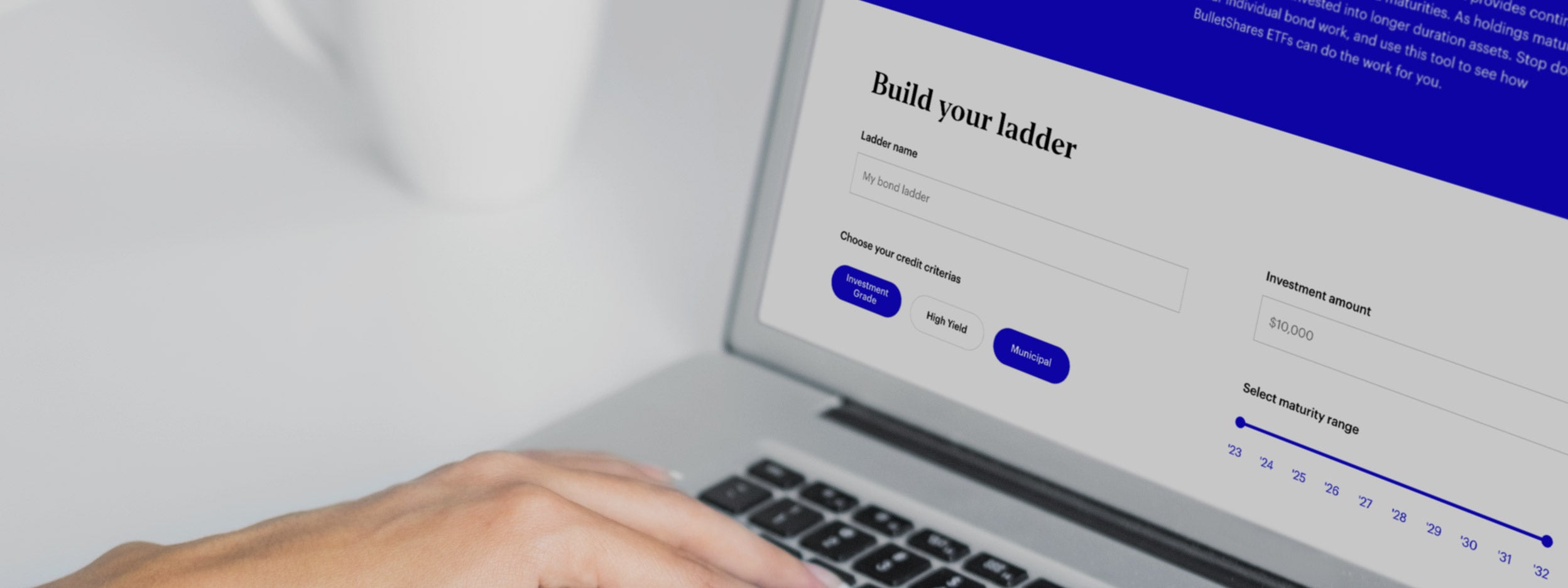

BulletShares® ETFs are a suite of fixed-term exchange-traded funds (ETFs) that enable investors to build customized portfolios tailored to specfic maturity profiles, risk preferences, and investment goals.

BulletShares ETFs

Bond laddering with BulletShares ETFs?

Watch Jason Bloom, our US Head of Fixed Income and Alternatives ETF Product Strategy, explain what BulletShares are and how they can help you build bond ladders.

BulletShares brochure

Find out more about BulletShares ETFs

BulletShares maturity flyer

Access our resources to learn more about how the maturity process works and potential ways to stay invested.

Additional resources

| Ticker | ISIN | Invesco Fund Name | Additional documents |

|---|---|---|---|

| BSCO | US46138J8412 | Invesco BulletShares 2024 Corporate Bond ETF | |

| BSCP | US46138J8255 | Invesco BulletShares 2025 Corporate Bond ETF | |

| BSCQ | US46138J7919 | Invesco BulletShares 2026 Corporate Bond ETF | |

| BSCR | US46138J7836 | Invesco BulletShares 2027 Corporate Bond ETF | |

| BSCS | US46138J6432 | Invesco BulletShares 2028 Corporate Bond ETF | |

| BSCT | US46138J5772 | Invesco BulletShares 2029 Corporate Bond ETF | |

| BSCU | US46138J4601 | Invesco Bulletshares 2030 Corporate Bond ETF | |

| BSCV | US46138J4296 | Invesco Bulletshares 2031 Corporate Bond ETF | |

| BSCW | US46139W8588 | Invesco Bulletshares 2032 Corporate Bond ETF |

| Ticker | ISIN | Invesco Fund Name | Additional documents |

|---|---|---|---|

| BSJO | US46138J8339 | Invesco BulletShares 2024 High Yield Corporate Bond ETF | |

| BSJP | US46138J8172 | Invesco BulletShares 2025 High Yield Corporate Bond ETF | |

| BSJQ | US46138J6358 | Invesco BulletShares 2026 High Yield Corporate Bond ETF | |

| BSJR | US46138J5855 | Invesco BulletShares 2027 High Yield Corporate Bond ETF | |

| BSJS | US46138J4528 | Invesco BulletShares 2028 High Yield Corporate Bond ETF | |

| BSJT | US46138J3959 | Invesco BulletShares 2029 High Yield Corporate Bond ETF | |

| BSJU | US46139W8414 | Invesco BulletShares 2030 High Yield Corporate Bond ETF |

Find out more about ETFs

Frequently asked questions

BulletShares ETFs are a suite of defined-maturity exchange-traded funds (ETFs) that enable investors and financial professionals to build customized portfolios tailored to specific maturity profiles, risk preferences, and investment goals. BulletShares are designed to combine the precision of individual bonds that have specific maturity dates with the potential advantages of ETFs such as diversification and transparency. BulletShares ETFs typically pay monthly distributions.

A bond ladder is built with individual bonds of varying maturities. As the bonds mature, the anticipated proceeds can be used for income needs or reinvested in new bonds that mature in subsequent years. Investors may use bond ladders to help create some predictability and stability regardless of market volatility and interest rate environments. Since they have specific maturity dates, investors can use BulletShares ETFs to build bond ladders without the time and expense of using individual bonds.

BulletShares ETFs can provide investors with an efficient way to establish potential protection from rising rates because the duration of the fund slowly rolls down to zero over the life of the ETF. Most traditional fixed income mutual funds and ETFs typically have a perpetual duration target, making them more sensitive to rising interest rates.

BulletShares ETFs provide targeted exposure to investment-grade and high-yield corporate bonds.

BulletShares ETFs have defined maturities to simulate the investor experience of buying and holding individual bonds to maturity for use in bond ladders and other strategies. BulletShares ETFs have designated years of maturities that are included in the ETF’s name. Each BulletShares ETF is designed to terminate in December of the designated year and make a final distribution at maturity. At each fund’s expected termination, the net asset value (NAV) of the ETF’s assets is distributed to investors without any action on their part3.

As BulletShares ETFs approach maturity, their durations decrease. In the last six months of the ETF’s maturity year, it is anticipated that the bonds in the portfolio will either mature or be called. Proceeds for these events will then be held either in cash or in cash equivalents such as US Treasury bills or commercial paper.

As your BulletShares ETFs mature, you may want to consult with an investment professional and explore having the distribution proceeds invested in a BulletShares ETF in a subsequent maturity year.