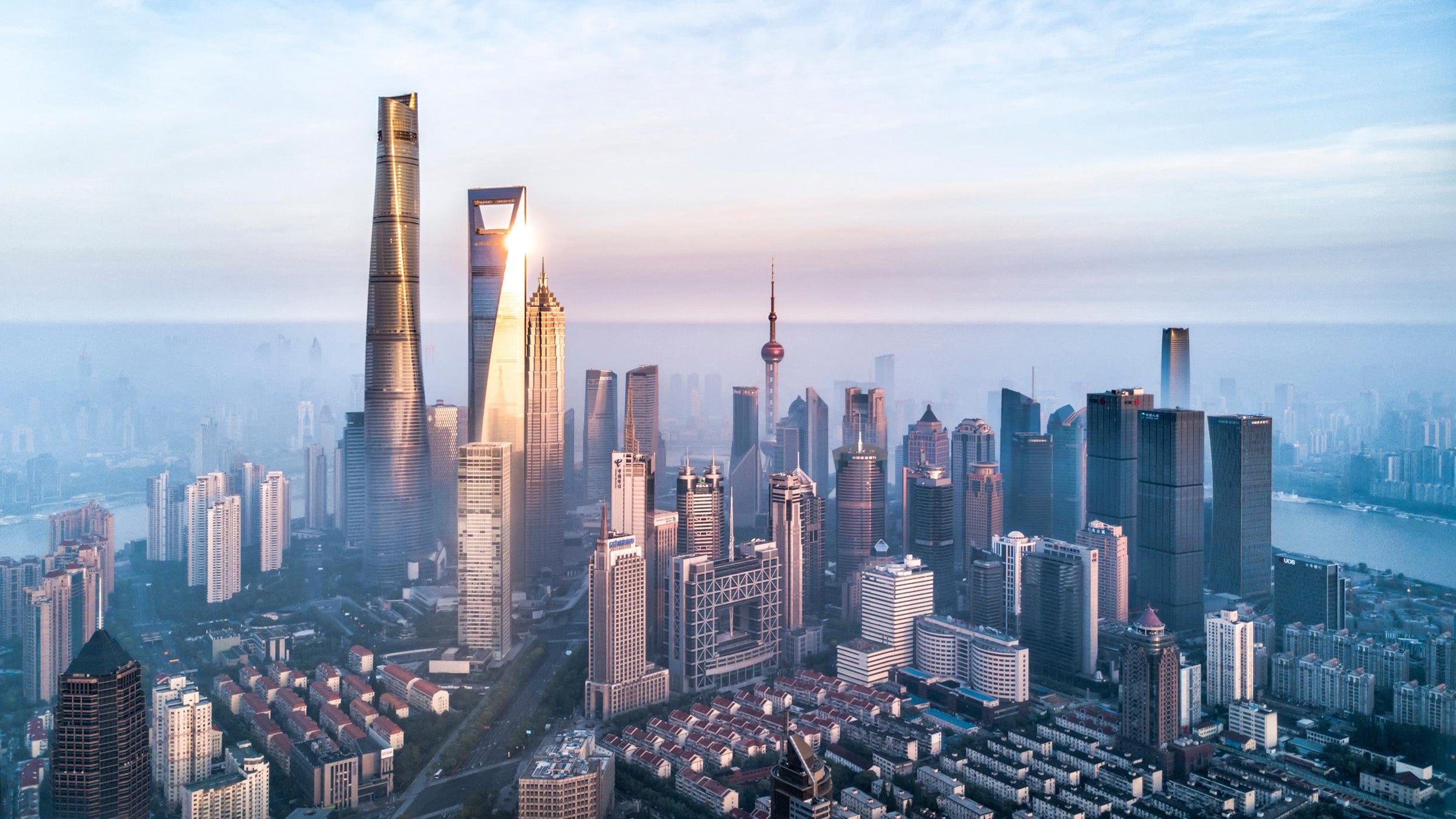

Real estate Why consider global real estate?

Explore the trends reshaping global real estate opportunities today.

Alternative investment strategies are becoming increasingly mainstream. From private credit to real estate, read the latest from Invesco as we explore opportunities beyond traditional capital markets.

Explore the trends reshaping global real estate opportunities today.

Get an in-depth 2026 outlook from our alternatives experts, including positioning and insight on valuations, fundamentals, and trends.

Gold and silver prices set new record highs earlier this year. Find out what’s been driving precious metal prices as well as what investors should know when considering these assets for their portfolios.

We are excited to announce a new partnership designed to help investors realise the full return potential of the global economy by unlocking new opportunities in private markets.

To optimise income yield and growth, we look for opportunities that are supported by long-term structural demand drivers, or where active management can enhance cash flows.

The private credit market delivered strong returns in 2025. Can investors expect the same in 2026? Our experts discuss where they’re seeing potential for compelling risk-adjusted returns.

In today’s environment, we believe properties with income growth that’s less tied to the business cycle are best positioned to outperform.

Why APAC real estate may offer growth, diversification, and value for institutional investors amid global market uncertainty in 2025.

Reduced cross-border investment in new US commercial real estate may impact US and global property sectors, markets, and assets differently.

Sign up to our newsletter to receive the latest investment insights, our upcoming events and webinars, and information about our products and capabilities.