Four key forces should support low inflation for years to come: IFI Monthly Outlook (July 2021)

Key takeaways

Economic reopening is taking time and has not been without its frictions

Interest rate outlook for Canada

Canadian dollar outlook

Inflation in the U.S. and other countries has been high lately, raising the question of whether the low inflation era we have experienced since the 1990s is over. Central bankers and many economists argue that the current high level of inflation is transitory, and mainly due to the pandemic. As economies closed parts of their services sectors and supported incomes through fiscal policy, demand for goods became very strong. Supply was not able to catch up, blocked by COVID-related disruptions to production. But inflation has been surprising to the upside, challenging the belief in the transitory story. Where do we go from here?

Despite upside surprises, inflation data in the U.S. have so far been consistent with the tensions associated with a reopening economy. In the U.S., much of the increase in headline inflation can be explained by items such as used cars and travel services, for which there is strong pent-up demand and supply has not caught up fast enough.

Economic reopening is taking time and has not been without its frictions. As time passes, we believe supply will catch up and demand may also cool as consumers resume a normal level of activity. After this volatile period of strong pent-up demand and supply bottlenecks due to the reopening, we believe the structural forces that kept inflation low for decades will resume and drive inflation trends going forward.

Structural forces have kept inflation low over the past few decades

Low inflation is a global story. Inflation has been remarkably low and stable over the past three decades in the developed economies and many emerging market economies, though there are exceptions. What are the theories that attempt to explain this? Given the somewhat high inflation numbers we are observing in the U.S. and some other countries, should we expect a change in inflation trends in the coming years, and even worry about high inflation?

There are several hypotheses that attempt to explain the long period of low and stable inflation in developed markets. The most prominent of these include the roles of globalization, technology, demographics and successful monetary policy.

One of the explanations for low inflation is the impact of globalization. While globalization was not new, it accelerated in the 1990s with the collapse of the Soviet Union in 1989 and integration of China into the world economy. This allowed production, especially in manufacturing, to move to low-wage, low-cost regions, reducing price pressures. The rise of global supply chains turbocharged this process.

One concern is that globalization has peaked and may even be reversed, becoming an inflationary force. However, this is not showing up in the data. Globalization in goods, for example, has lost momentum, but it doesn’t seem to have reversed.

Figure 1 suggests that economic globalization has moved roughly sideways since the global financial crisis, but not reversed. Many firms are still exposed to intense global competition, limiting their pricing power.

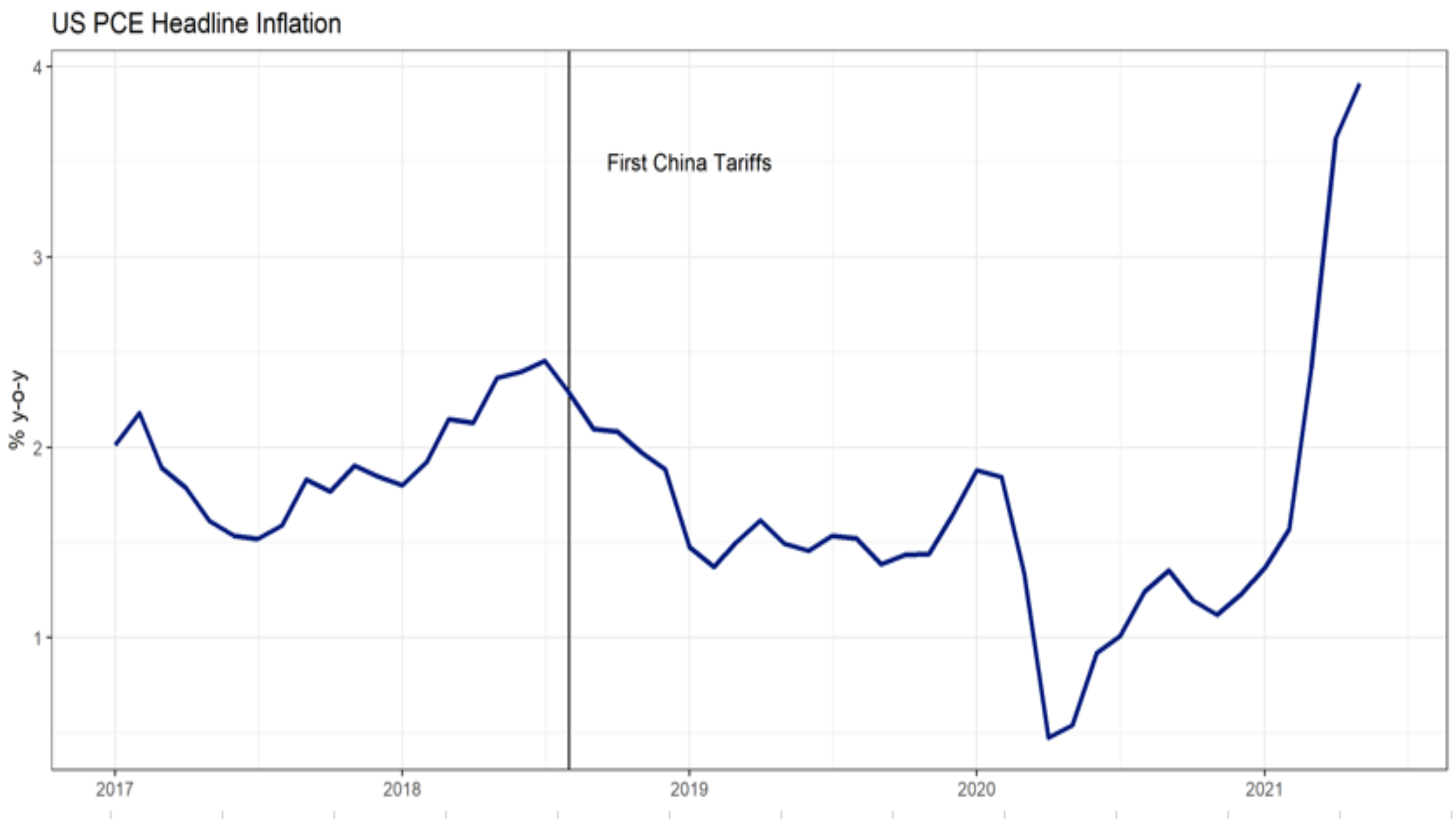

A good case in point is the U.S., where tariffs on China, (where a large share of U.S. imports originate), were raised substantially. Hundreds of billions of dollars worth of goods from China have been subject to a 25% tariff since the beginning of the tariff wars, which has not been reversed. Inflation did not rise, and actually fell during the two years after the tariffs were imposed (Figure 2).

Source: KOF Institute. Data from January 1, 1970 to January 1, 2018. Data avialable as of July 22, 2021.

Technology is another factor that has kept inflation low. Technology has reduced price pressures through its dampening effect on labour costs by raising productivity gains, or because of the threat that machines or software could replace workers, keeping wage growth muted. But there are other factors at play.

Retail shopping, for example, is increasingly moving online, which is often cheaper and more convenient than brick and mortar stores. Online shopping has also made price comparisons easier, leading to price convergence and limiting firms’ pricing power. Such benefits are well-known in retail but relevant in services too. Online shopping makes price comparisons easier in travel services, insurance prices, and many other services.

Aging populations are another force keeping inflation low. Workers in the aggregate produce more than they consume, creating a surplus. Dependents, i.e., children and retirees, on the other hand, consume more than they produce. A decline in the dependency ratio leads to muted demand and higher savings, constraining inflation, which has been the case in developed markets in recent decades.

Some commentators argue that this trend is now becoming inflationary, as societies age and dependents grow faster than the number of workers. That may be a relevant risk down the road but evidence suggests that countries have not yet reached that demographic tipping point.

Japan, which has one of the world’s oldest populations, has had very low inflation since the 1990s, with no change in sight. Other countries may also have a long timeline before their low inflation conditions reverse. For example, supply of labour can be quite elastic when the labour market runs hot. Japan has increased its labour supply in recent years by improving its worker participation rate and relaxing constraints on immigration.

Finally, successful monetary policy has been another factor in low and stable inflation. After the inflationary 1970s, central banks adopted new monetary frameworks with an increased focus on price stability. These new frameworks became very successful, keeping inflation near targets. As a result, wage and price setting behaviour and inflation expectations have been anchored close to central banks’ inflation targets, reinforcing price stability.

There is generally broad political support for these monetary frameworks and independent central banks, meaning commitment to price stability will likely continue in the years to come.

Conclusion

The bottom line is that the forces that have kept inflation low over the past few decades are likely to remain forceful, keeping inflation low in the coming years. It is true that some of these forces can wane in the long run, but major reversals are not in sight and unlikely to happen rapidly. Meanwhile other forces that keep inflation low, such as technology and monetary policy, are here to stay. Therefore, we expect the low inflation trends of recent decades to remain intact through our investment horizon. In fact, the challenge for global central banks is to push against such disinflationary trends and avoid undershooting their inflation targets. The new frameworks adopted by the U.S. Federal Reserve and the European Central Bank aim to do just that.

Interest rate outlook

Canada: Overweight. High vaccination levels and household savings are expected to support strong domestic demand for large parts of the service sector through the end of the year. An additional source of demand will likely be arriving from the south, as the Canadian border is set to re-open to U.S. tourism. Commodity price rises have slowed but remain a meaningful source of improving export volumes. The Bank of Canada will likely continue its tepid taper, but we don’t anticipate a market “tantrum” given the attractive valuations in Canadian fixed income.

U.S.: Underweight. Fundamentals still support an underweight in the U.S. rates market, in our view. While the COVID-19 Delta variant could threaten our baseline view, we do not yet see data to support a change in our view, which is robust growth with elevated, noisy inflationary pressures. Therefore, we expect the economic recovery to continue at a broad level in the U.S. Inflation data continue to show signs of strength, with COVID-related sectors getting hit with pricing pressures. We believe the U.S. Federal Reserve (Fed) is willing to be patient in the wake of improving growth and a messy inflation picture, given its Average Inflation Target mandate. We are likely to see rates pressured higher as a result, particularly at the long end of the yield curve. Recent declines in Treasury yields seem to be related to positioning unwinds and concerns about the Delta variant. We expect upward pressure on U.S. yields due to fundamentals to reassert itself in the coming period.

Europe: Underweight. As the European economy opens further and optimism and growth have rebounded, surprisingly, European bond yields have fallen back to levels last seen in the midst of the winter COVID wave. While this dynamic can be partly attributed to the spread of the Delta variant in the region and a potentially slower reopening for some countries, the fact that the European Central Bank (ECB) will likely mop up all net supply for the remainder of the year is a powerful driver of bond prices. While our analysis indicates that bond yields should be higher in the second half of the year given the robust recovery, we suspect that, absent a rise in global bond yields, European bonds may struggle to sell off.

Japan: Underweight. 10-year Japanese government bond (JGB) yields have fallen to their lowest level this year, largely in response to the global decline in yields led by long-term U.S. Treasuries. However, with yields now at two basis points, there is limited scope for a further decline, in our view. Banks are unlikely to buy 10-year JGBs below 0% when they can receive 0% from the Bank of Japan (BoJ) on their excess reserves. In addition, the BoJ again cut the size of its quantitative easing (QE) operations for the July-September period. If the current pace of quantitative easing (QE) operations is maintained for the next 12 months, it should result in an increase in gross JGB supply, net of QE, with the majority of the increased supply in the 6-10 year and 11-20 year maturity buckets. If the global recovery persists, it is also likely that foreign central banks will start to increase interest rates, incentivizing Japanese investors to seek higher yields abroad.

China: Neutral. We continue to be neutral on Chinese onshore government bonds. China’s economic growth momentum, as we have expected since late last year, has come in weaker than market expectations. Interbank liquidity has been relatively stable and the central bank (PBoC) has managed market expectations well through open market operations. At the current juncture, we are not convinced that the recent cut in the reserve requirement ratio (RRR) is the start of an easing cycle. As mentioned by the PBoC, the liquidity released from the latest RRR cut was to mitigate the liquidity drainage from the medium-term lending facility (MLF) and tax payment. There is a sizable maturity wall of MLF, and we expect relatively heavier rates bond supply pressure in the second half of 2021. We will be watching how the central bank manages the MLF maturities in the third quarter before reassessing our investment view.

UK: Underweight. The rise in COVID cases due to the Delta variant poses some near-term downside risks to growth, but it appears the bar for the government to U-turn on the reopening of the economy is now relatively high. Furthermore, recent inflation and employment data have both surprised to the upside, giving more credence to the fears of Bank of England (BoE) hawks that inflation risks are building in a way that might justify a more rapid tapering of QE and/or an earlier than expected rate hike. Long-term forward interest rates already appear to discount a relatively low growth and inflation outlook. Five-year overnight index swap rates 5-years forward are just 0.8%, almost 100 basis points below the peak of the last cycle and the lowest level since February, which was prior to the vaccine rollout and when some members of the BoE’s Monetary Policy Committee were debating interest rates cuts.1

Australia: Neutral. The recent spread of the Delta variant in Australia and the resulting lockdowns in Sydney and Melbourne increase the downside risk to near term growth. However, if the outbreak is contained, our outlook is for higher bond yields over the medium term. The Reserve Bank of Australia (RBA) is gradually moving in a more hawkish direction and the economy is recovering rapidly, with the unemployment rate now below pre-COVID levels. The RBA has not extended yield curve control beyond April 2024, as was widely expected, but the reduction in QE and the modification of the forward guidance to imply that the probability of hitting the triggers for policy tightening prior to 2024 have increased was more hawkish than the market had expected. Should Australia navigate the current COVID outbreak and vaccinate a large majority of its population in the second half of this year, it is likely the RBA will signal an end to QE early next year and possibly the dropping of yield curve control after that. Both moves will likely place upward pressure on yields, particularly if yields are also rising in the U.S. and elsewhere due to better global growth and QE tapering by the Fed, ECB and BoJ.

Currency outlook

CAD: Overweight. The recent slide in global commodity prices has negatively impacted what had been the best performing developed market currency this year. Long positioning had become extended, but the recent selloff appears overdone, in our view. Commodity export volumes will likely continue to remain supportive, while foreign investor appetite for Canadian assets remains robust. We believe the recent correction is an opportunity for bullish exposure.

USD: Underweight. The U.S. dollar has seen support following the June Fed meeting and more recently due to developing concerns about the Delta variant. Recent inflation data have revealed that COVID-related sectors continue to be the most impacted – consistent with our view that these pressures are transitory, which should allow the Fed to be patient in its policy stance. Therefore, over the longer term, we expect the Fed to continue to be one of the more accommodative central banks globally, pressuring the dollar lower as investors seek higher yields elsewhere. That said, the direction of the U.S. dollar in the near term could be less clear than expected. While we see no reason to change our baseline view that the U.S. re-opening will continue, we could see a global impact on the recovery if the Delta variant gains momentum, particularly in areas where vaccine distribution has been less successful. This could provide safe-haven support to the dollar, as investors grow concerned about the global impact. We are watching this closely.

EUR: Underweight. With the U.S. economy powering ahead and the European Union contemplating the response to the Delta variant and implications of easing restrictions, we remain cautious on the euro, especially versus the U.S. dollar. The uncertain implications of the Delta variant may provide the ECB with the cover to maintain very easy accommodative policies well beyond the September meeting. The ECB recently announced an updated framework for monetary policy, suggesting that it would tolerate above-target inflation. Simply put, rates are going nowhere, and the euro is unlikely to appreciate much in that environment.

RMB: Neutral. We expect the renminbi to consolidate in the near term on the back of the U.S. dollar’s strength against major currencies. However, we continue to be positive on the renminbi’s performance against the U.S. dollar in the medium term. This is due to favourable fundamental and policy factors, which could support the renminbi’s appreciation momentum. In addition to strong export data, which have continued in recent months, the softening of U.S.-China trade tensions in the past few years could provide a catalyst for the renminbi’s performance. We expect a relatively limited impact on net capital flows from China’s upcoming measures to open more channels for capital outflows.

JPY: Neutral. The Japanese yen has been relatively stable versus the U.S. dollar over the last month, but has outperformed the euro and higher beta currencies, such as the Australian dollar. The move probably reflects weaker risk sentiment, lower international bond yields, and a reduction in short yen positioning. Although, the recent spread of the Delta variant might weigh on risk sentiment, potentially supporting flows into the yen as a safe haven, in the medium term, the prospect of higher yields internationally, higher commodity prices and increased merger and acquisition flows should all weigh on the yen.

GBP: Neutral: The British pound has managed to stay range bound on a trade-weighted basis over the last month, as depreciation against the U.S. dollar has been offset by gains against the euro. Going forward we expect the range bound dynamic to persist, especially against the euro. A significant worsening of the COVID situation could be a trigger for further depreciation, but as the Delta variant is now spreading across the world, it is unlikely this will have a particularly idiosyncratic impact on the UK. It is possible that the pound could decline further versus the U.S. dollar in this scenario, as the U.S. dollar benefits from flight to safety flows and the perception that the U.S. is less likely to pursue further lockdowns relative to Europe. On the other hand, if the UK can navigate the Delta variant spike, it will likely accelerate reopening and demonstrate the power of the vaccines, which in turn could lead to some growth outperformance and an increased scope for higher UK interest rates.