Key takeaways from the Opportunity in European Private Credit webinar

Discover how European upper mid‑market private credit may offer resilient income, attractive risk‑adjusted returns, and efficient portfolio diversification.

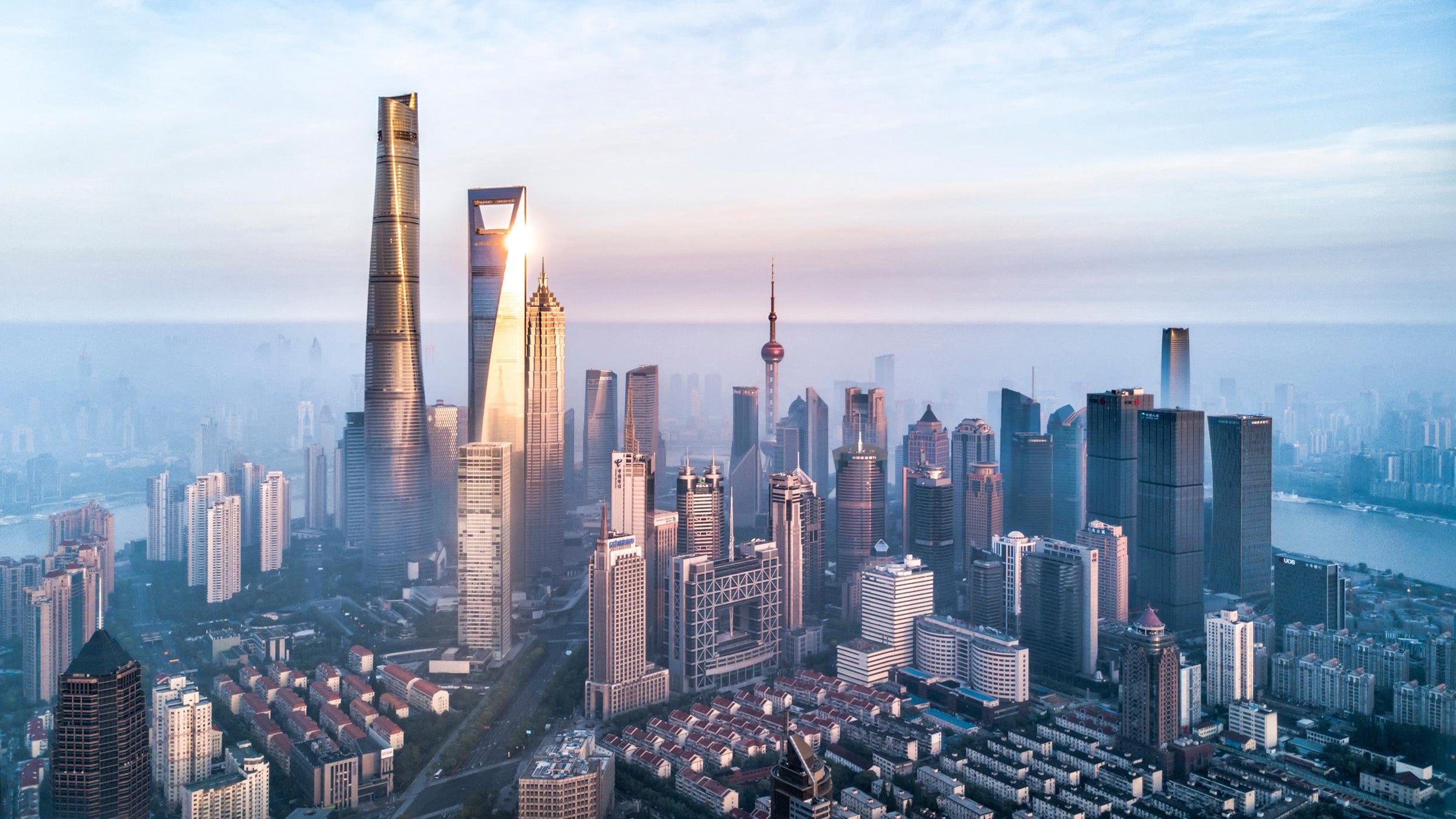

As global markets navigate heightened geopolitical tensions and economic uncertainty, institutional investors are increasingly seeking resilient, growth-oriented opportunities. The Asia Pacific (APAC) real estate market stands out as a potentially compelling destination, offering a distinct combination of macroeconomic strength, policy support, and portfolio diversification benefits.

The APAC region is projected to contribute over 60% of global GDP growth in 20251, with its total GDP expected to be nearly 50% larger than the US by 20341. This economic momentum is underpinned by proactive monetary and fiscal policies across key markets such as China, Korea, and Australia.

Source: Oxford Economics as of April 2025

As the US dollar weakens and disinflationary pressures rise, APAC central banks are easing rates—creating a favorable environment for real estate investment.

The region is undergoing a transformation from goods-based to services-led growth, supported by rapid digitalization and AI adoption. This shift is reshaping real estate demand across sectors—from commercial and residential to logistics and data centers.

Source: Data are estimated by ESCAP (United Nations Economic and Social Commission for Asia and the Pacific), based on WTO annual merchandise and commercial services data (accessed November 2024). Data from 2024 onwards are estimated by ESCAP, using EIU database for selected economies. Note: f indicates forecast.

Services now employ over half of Asia’s workforce, up from just 22% in 19902, driving demand for office, residential, and hospitality assets.

Cross-border capital flows into APAC real estate have surged, with transaction volumes up 125% between 2009–2014 and 2020–2024.3 Improved market transparency and lower return correlations with Western markets enhance APAC’s appeal as a diversification play.

APAC real estate valuations remain below peak levels, with cap rate spreads in markets like Japan and Australia offering attractive risk-adjusted returns. As interest rates decline and bond yields stabilize, the region is well-positioned for a capital value recovery.

With resilient economic fundamentals, evolving trade dynamics, and sector-specific opportunities, APAC real estate presents a timely and strategic investment opportunity for institutional investors. Invesco may consider value-add and opportunistic strategies, as well as real estate debt in high-rate markets, particularly well-suited to this phase of the cycle.

For the full analysis, read “Why APAC Real Estate Now?”

Discover our broad range of real estate strategies, with investment opportunities from around the globe.

Discover how European upper mid‑market private credit may offer resilient income, attractive risk‑adjusted returns, and efficient portfolio diversification.

We are excited to announce a new partnership designed to help investors realise the full return potential of the global economy by unlocking new opportunities in private markets.

To optimise income yield and growth, we look for opportunities that are supported by long-term structural demand drivers, or where active management can enhance cash flows.