Alternatives Private credit quarterly roundup: Liberation Day market responses

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

As we continue our series on private markets investing through an outcome-oriented lens, we thought it would make sense to address a specific subtopic of keen interest to many of our clients – distressed debt. While not a formal component of our four-part series, the topic of distressed investing, particularly portfolio integration of this unique asset class, is quickly capturing investor attention.

Intuitively, distressed debt investing involves taking positions in the existing debt of an entity, typically a financially distressed company. These investments are made with the hopes of initiating a turnaround, reorganization, or restructuring at the targeted entity, with a high probability that these positions will eventually be converted to equity. Often times, these entities are engaged in bankruptcy proceedings. Highly skilled managers can assist companies in navigating these complex situations and in the process generate outsized returns for investors. Unsurprisingly, the primary source of these returns comes from capital appreciation (not income). This is a key point as we move into the analysis.

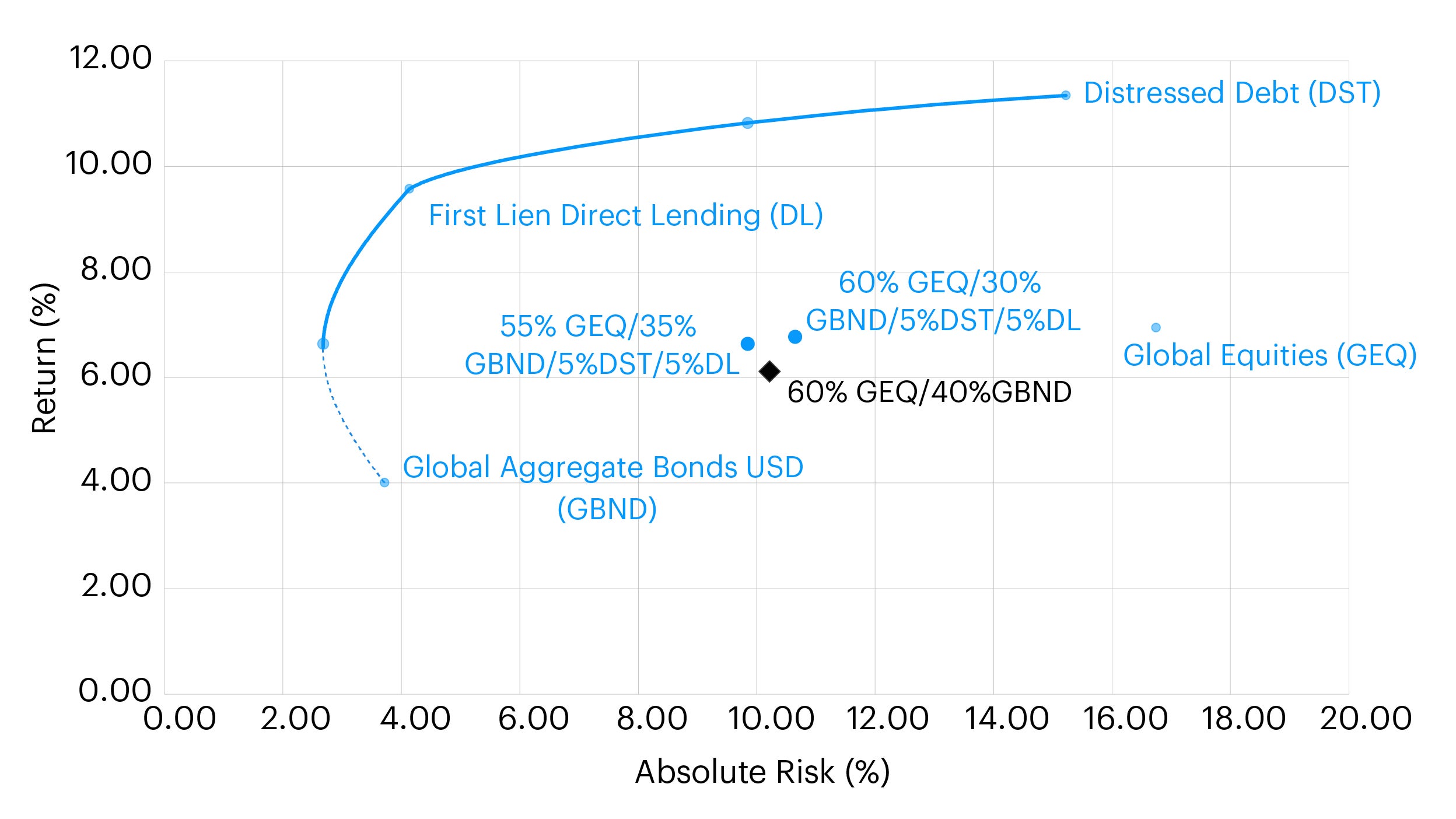

One item that is less intuitive for investors is where this sub-asset class fits in a diversified portfolio. While it might be tempting to lump this investment into the “private credit” allocation, we’d argue that it fits in the private market growth sleeve (along with private equity and venture capital), given its equity-like characteristics. Distressed debt has distinctly different characteristics from typical direct lending investments and a similar volatility profile to global equities, which we’ll demonstrate using our Invesco Vision tool and Long-term Capital Market Assumptions.

Source: Invesco Vision, data as of 31 March 2023. Return estimates are based on the Q1 2023 Long-Term Capital Market Assumptions. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

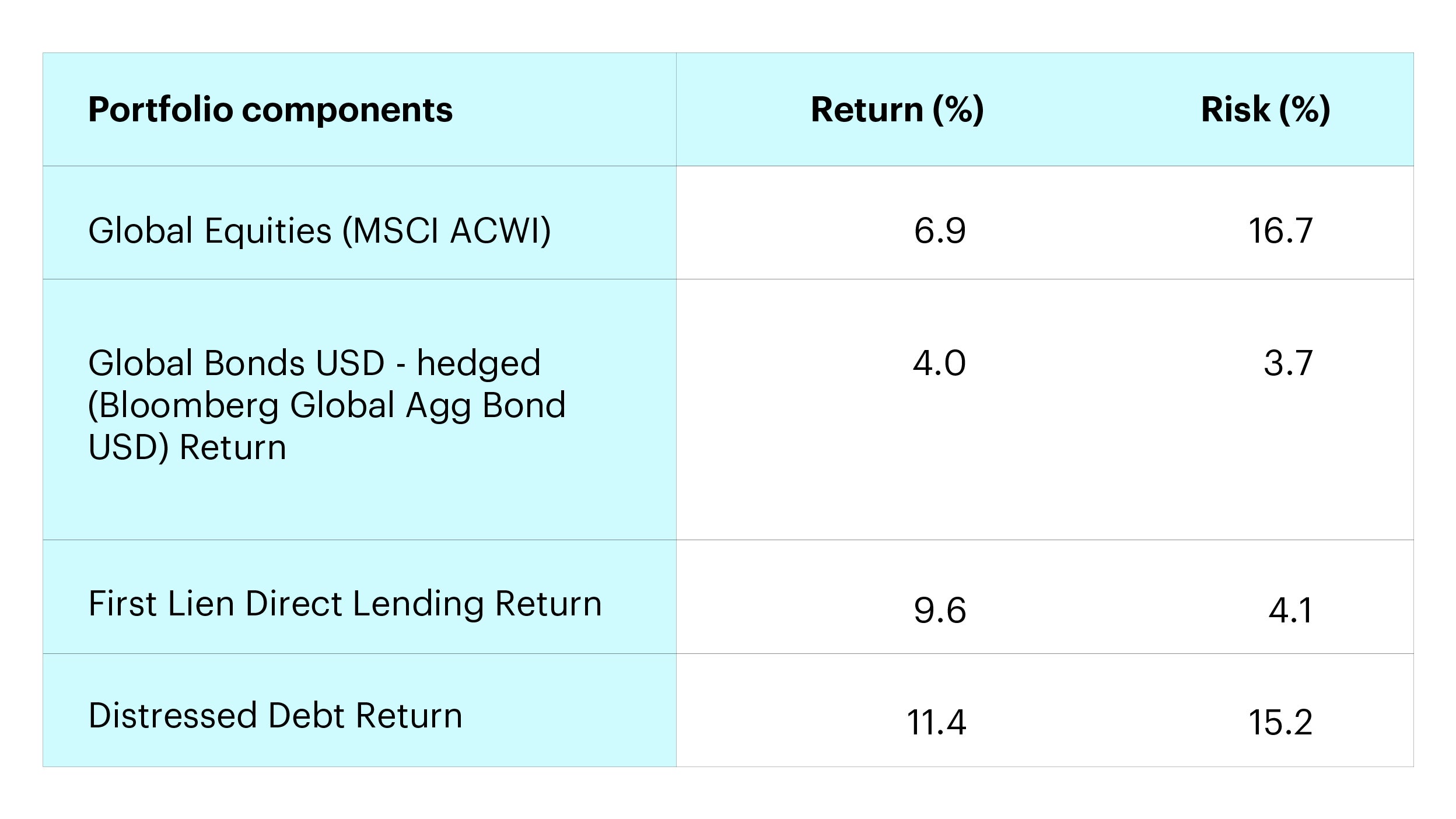

We analyzed the following building blocks to construct an efficient frontier analysis, and have included their expected return and risk, which are generated through our Long-term Capital Market Assumptions framework.

Source: Invesco Vision, data as of 31 March 2023. These estimates are forward-looking, are not guarantees, and they involve risks, uncertainties, and assumptions.

As you can see from the return and risk expectations, distressed debt has a volatility much closer to equities than to global core bonds or direct lending. When thinking through the proper funding mechanism for making a distressed allocation, we believe it is more effective to fund this position from equities to both reduce risk and increase return.

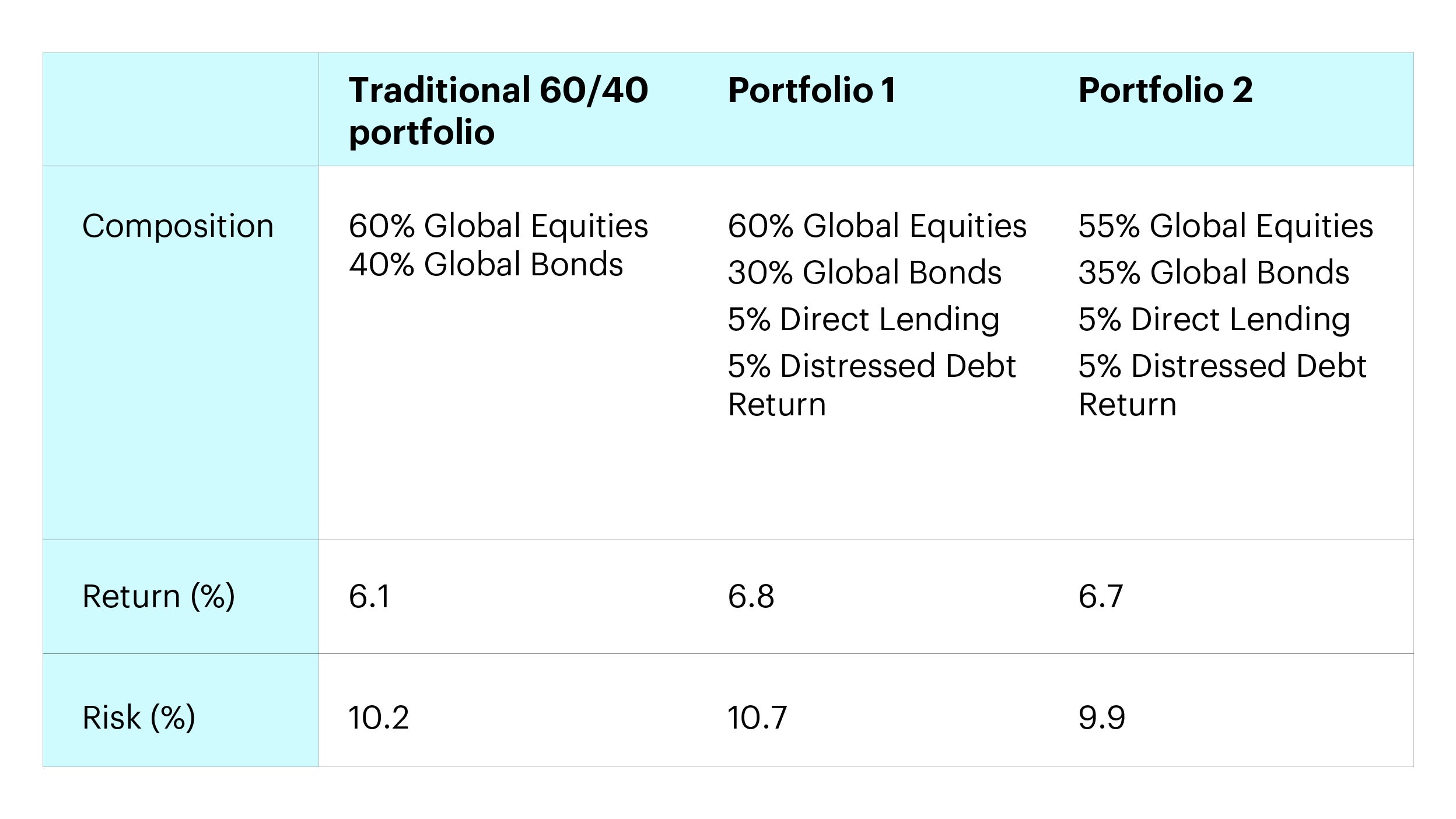

Further diving into the Vision analysis, we created two sample portfolios to highlight this process.

Source: Invesco Vision, data as of 31 March 2023. For illustrative purposes only. There can be no assurance that any estimated returns or projections can be realized.

While integrating both direct lending and distressed debt improves the portfolio, Portfolio 2 provides the best risk-adjusted outcome, with higher returns and lower risk than a traditional 60/40 portfolio. The enhanced diversification from the “equity-funding” of distressed debt allows the investor much more portfolio flexibility, which for example could be leveraged to allow for additional exposure to growth assets to enhance returns and scale the portfolio to the level of risk comparable to a traditional 60/40 portfolio.

In sum, it’s important to not only think about which asset classes to implement in a diversified portfolio, but how to best effectuate those positions to maximize benefits to investors. Additionally, and particularly when investing in private markets, the final step of manager selection is integral. For distressed debt, a successful active manager can generate returns meaningfully higher than the asset class median or asset-class level return forecast (i.e., CMA). It’s essential that investors partner with the right manager to leverage strong opportunities in the space, in addition to properly implementing the overall portfolio construction approach.

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

Get an in-depth Q2 report from our alternatives experts including their outlook, positioning, and insight on valuations, fundamentals, and trends.

Invesco Real Estate’s value-add team discusses its approach in a challenging market highlighting a disciplined, local team-based execution programme and strategic investments in sectors like logistics and living.