CIO, Invesco Solutions Scott Wolle

CFA®

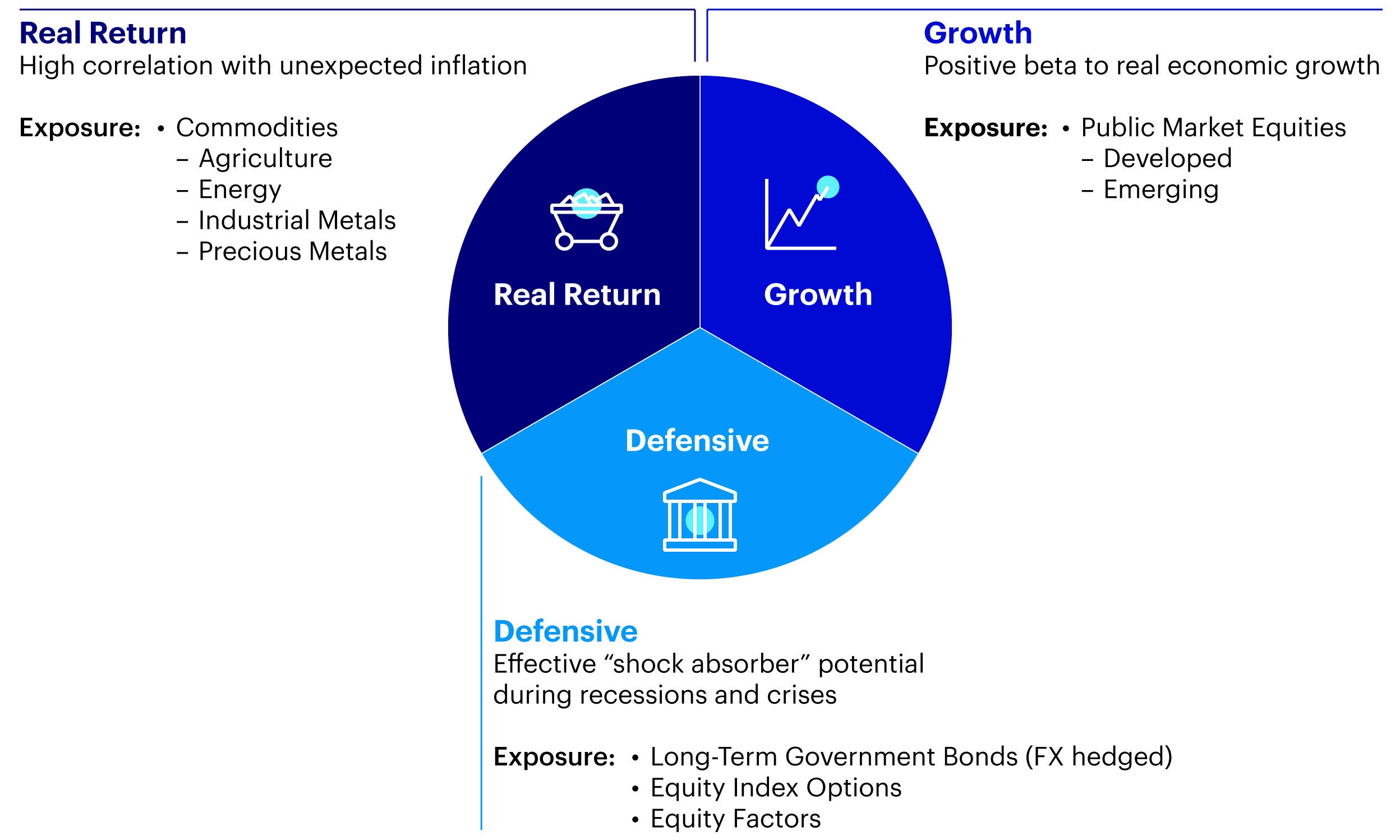

Invesco’s Balanced-Risk Allocation Strategy (IBRA) is diversified across three major macro factors – growth, defensive, and real return – represented by three major asset classes – equities, bonds and commodities – with each of these benefitting from either growth, recessionary or inflationary macro-economic environments.

The strategy balances risk across the three major economic scenarios (growth, recession and inflation). As such, we believe the risk of a large drawdown is significantly lower than that of an equity strategy, or even a traditional balanced portfolio consisting of equities and bonds.

The portfolio’s strategy is essentially an alternative beta strategy, but comes with the benefits of a mutual fund. For example, it has daily liquidity, daily valuation, high transparency and lower costs compared to most other alternative strategies.

Most investors are focused on balancing their exposure to asset classes. Often, this leaves them heavily overexposed to equity risk. In contrast, IBRA ensures that the risk contribution from each macro factor (growth, defensive, and real return) never exceeds 50% of total portfolio risk, ensuring a much more balanced risk exposure for investors.

The Invesco Balanced-Risk Allocation Strategy is managed by Invesco’s Global Asset Allocation (GAA) team. This team consists of six seasoned portfolio managers and two analysts, with 23 years of average industry experience.

Scott Wolle, CIOThose who want to successfully invest their money are well advised not to put all their eggs in one basket. Investors should diversify their investments across several asset classes. The key is to get risk and return into the right balance.

IBRA’s portfolio management team aims to outperform traditional balanced portfolios by balancing the strategy's risk exposure across three macro factors; growth, defense and real return. This approach aims to reduce volatility, and maximise the return per unit of risk taken.

Let us know using this form and one of our specialist team will quickly get back to you.

A traditional balanced portfolio is typically invested in bonds and equities, and typically in roughly equal shares. As equities tend to be significantly more volatile than bonds, the overall portfolio is usually significantly overexposed to equity risk.

In contrast, IBRA is invested in bonds, equities and commodities, across three macro factors (growth, defense, and real return) with the exposure to each of these three macro factors guided by its relative risk. To be exact, the ‘neutral’ risk exposure to each macro factor is 33%, and can range from 16% to 50%, depending on where the investment team sees the best opportunities.

A full economic cycle usually takes several years (often around 3-5) and is dominated by three market environments: growth, inflation and recession. Equities tend to perform well in periods of economic growth, commodities in periods of inflation, and bonds in periods of recession. IBRA is invested in all three asset classes and can therefore help smooth the performance over the full economic cycle.

Most investors believe splitting investments fairly equally across different asset classes gets them most of the way to a truly diversified portfolio. While this may be true for portfolio returns, this is certainly not true for portfolio risk. And for many investors, diversifying portfolio risk can be more relevant than diversifying portfolio return. Typically, risk-diversified portfolios have a higher allocation to asset classes with lower market risk (such as bonds), and a lower allocation to asset classes with higher market risk (such as equities). This allows them to balance the risk contribution from each single asset class such that each has more equal opportunity to fulfil their intended roles.