Capital market assumptions

Invesco Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

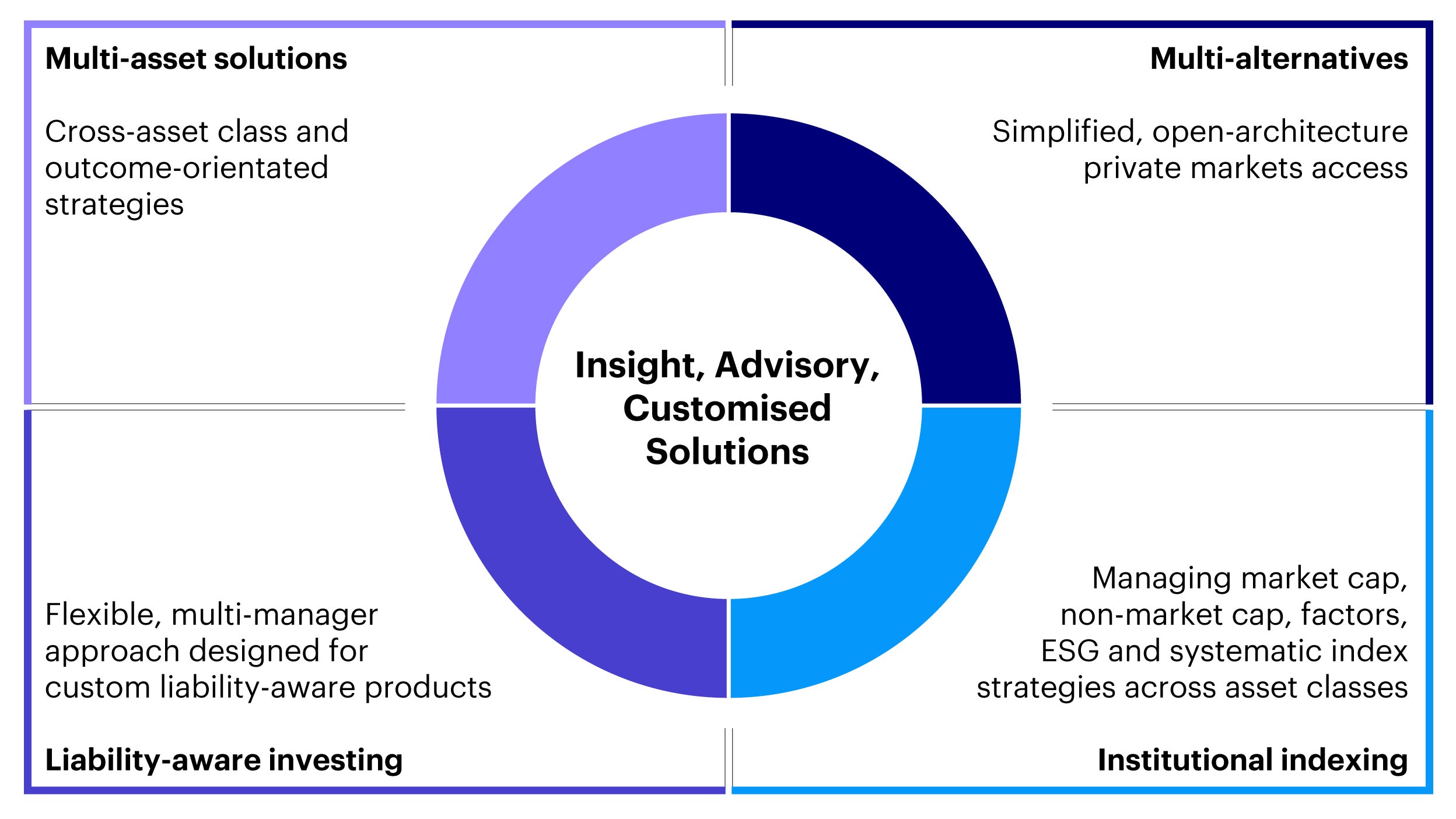

The Solutions team’s mission is to help clients solve simple and complex challenges, harnessing the wide range of capabilities available across Invesco. As part of this, we deliver a comprehensive range of services and solutions. Often clients rely on insights from our proprietary analytics engine, Invesco Vision, and capital market assumptions that cover 180+ asset classes. Other times, they seek customised solutions, aiming to deliver positive investment outcomes.

Learn more about our expertise below.

We work as an extension of your team, developing multi-asset solutions that are tailored to your objectives. These can include:

Portfolio management is becoming increasingly challenging. Markets are growing more complex, technology is advancing, and daily news flow is proliferating, which can create more confusion than clarity. Furthermore, more investors are looking beyond public markets to alternative investments to help meet liabilities and dampen volatility.

To help, we have created a state-of-the-art, proprietary technology solution, Invesco Vision. This is a portfolio research and analytics platform. By identifying risk and return drivers, as well as exposures to an array of factors, Vision identifies optimal investment strategies. Vision can stress-test portfolios and run “what if” scenarios to learn how different variables affect investment outcomes, for interactive, on-the-spot portfolio analysis.

Our experienced investment professionals work as an extension of staff to develop tailored solutions that help investors meet their desired investment outcomes. We combine an outcome-based focus with Vision analytics to develop a wide range of custom solutions, designed around investor goals.

Real world client examples include guidance on strategic and tactical asset allocation, manager selection across public and private markets, index solutions, managing liabilities, regulatory considerations, and engaging in strategic partnerships.

When constructing and optimising portfolios, Invesco Vision helps us consider:

Our capital market assumptions provide long-term estimates for the behaviour of over 170 different asset classes. These are based on a 10-year investment horizon and can help guide your strategic asset allocation.

We focus on expected return, volatility and correlation with other asset classes.

As investors seek to enhance growth, income and diversification, alternative assets have become an increasingly important part of institutional portfolios.

Our alternatives platform simplifies the process of investing in alternatives - providing access to Invesco’s in-house capabilities alongside specialist managers who offer complementary expertise in private credit, private equity and real assets.

Invesco’s Alternatives Platform

CDI solutions focus on sourcing and delivering income to meet liabilities as they fall due. This can be achieved by holding a mix of public and private assets, which deliver a combination of stable income and long-term cashflows. We focus on three key types of strategy:

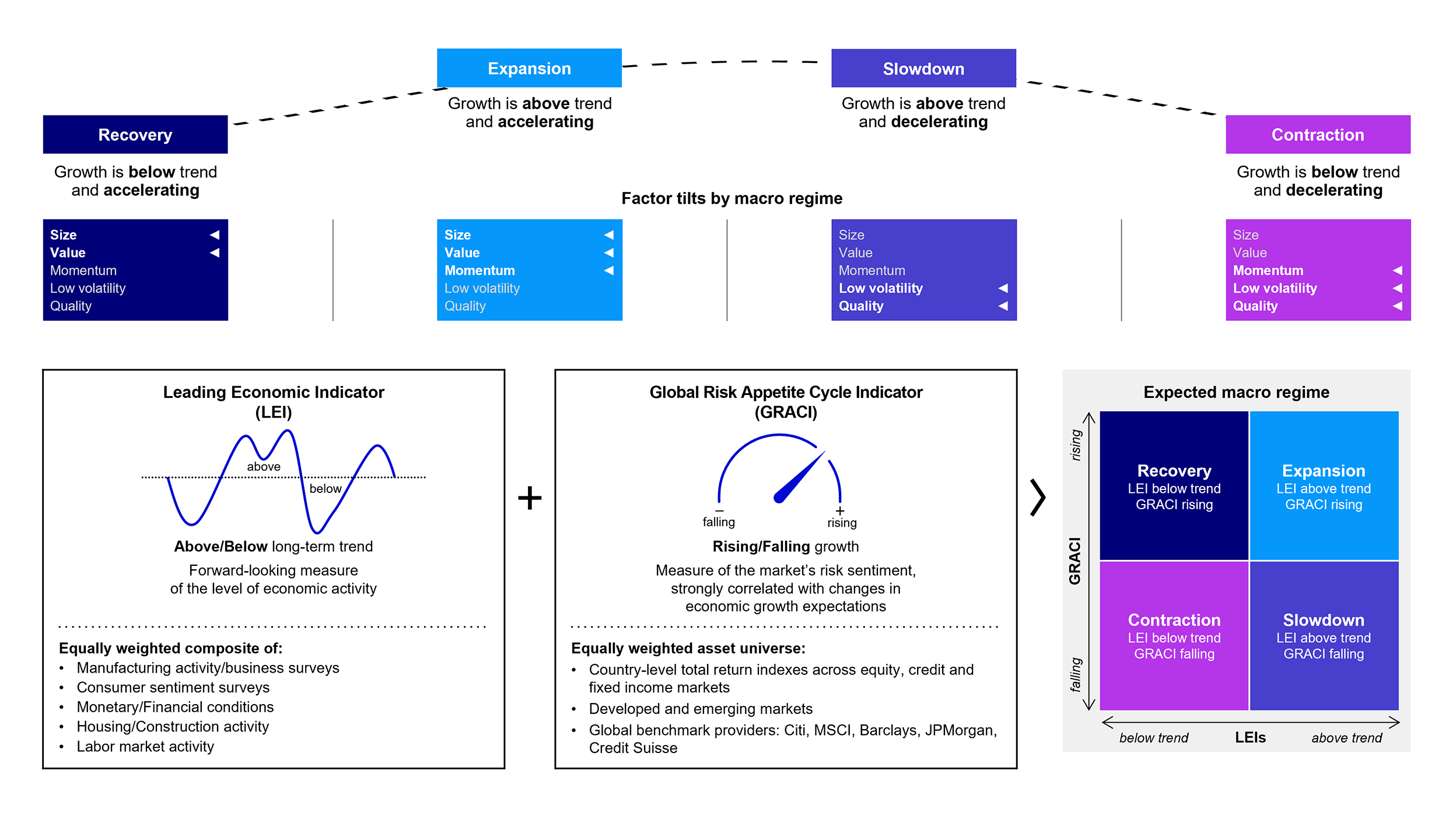

Dynamic factor allocations aim to achieve better results by anticipating changes in the business cycle.

For more information about our strategies, please provide your details below and we will get back to you.

Alternatively, you can sign up to receive our latest updates, insights and newsletters via email.

Select the asset classes you are interested in to receive related insights to your inbox, including our quarterly alternatives newsletter.

You can update your selection or unsubscribe at any time.

Let us know using this form and one of our specialist team will quickly get back to you.

We are a global team serving a wide range of clients, from pension funds to insurers. We partner with you to fully understand your goals, harnessing strategies from across Invesco’s active, passive, factor and alternative capabilities.

From robust research and analysis to bespoke investment solutions, our team brings insight and innovation to your portfolio construction process. Our approach starts with a complete understanding of your needs:

Investment professionals

Assets under advisement

Advanced degrees and designations

Capital market assumptions

Invesco Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

Alternative opportunities: Outlook for private credit and equity, real assets, and hedge funds

Get an in-depth Q3 report from our alternatives experts, including their outlook, positioning, and insight on valuations, fundamentals, and trends.

Invesco Solutions (IS) is a global independent multi-asset team comprising 65+ professionals based in Europe, the US and Asia. Our assets under advisement total $108 billion.¹

Our purpose is to help clients reduce uncertainties and achieve their investment goals. We focus on combining strategic and tactical asset allocation with manager selection capabilities, delivering outcome-oriented solutions.

We partner with you to fully understand your goals. We then harness strategies across Invesco’s global spectrum of active, passive, factor and alternative investments to address your unique needs.

From robust research and analysis to bespoke investment solutions, our team brings insight and innovation to your portfolio construction process.

We offer advice and solutions across a comprehensive range of asset classes and strategies. Our aim is to help clients get the best from Invesco – a global organisation with over $1.7 trillion in equity, fixed income and alternative assets.²

Clients can access our expertise at many levels, from investment analysis and advice on portfolio optimisation to working together to create fully customised solutions including:

We have developed capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally. The assumptions, which are based on a 10-year investment time horizon, are intended to guide strategic asset allocations.

For each selected asset class, we develop assumptions for expected return, standard deviation of return (volatility), and correlation with other asset classes.

Our capital market assumptions form the basis of our analysis and recommendations. We use these as guidelines when making long-term strategic asset allocation decisions. We are also able to conduct tactical asset allocation based on extensive regime and macro analysis that seeks to capture cyclical opportunities in the current environment.

We use Invesco Vision, our advanced portfolio management research and analytics platform, to help clients make better-informed investment decisions that are aligned with their objectives.

Alternative assets like private equity, private debt and direct real estate have unique characteristics, which means they can offer diversification benefits. They also have the potential to generate more attractive risk-adjusted returns than might typically be found in public market assets.

The movement towards alternatives has accelerated over the last few years, particularly as investors have adapted to lower forecast return assumptions from equities and bonds. This is shown through Invesco’s capital market assumptions, which provide long-term estimates for the behaviour of major asset classes globally.

The alternative investment market is broad, complex and dynamic. It requires extensive analysis, due diligence and monitoring. There are practical considerations to navigate too, such as investment illiquidity. Unless you’re a large institution, there can be challenges gaining access to certain managers.

Invesco’s alternatives platform has been created to help overcome many of these challenges, simplifying the process of investing in alternative assets and bridging the gap between your investment strategy and execution. Alongside Invesco’s in-house capabilities, we have sourced high-quality third-party managers who offer scale, global presence and complementary expertise in private market investments.

Discover Invesco private credit. We introduce broadly syndicated loans, direct lending and distressed credit investment strategies and share key insights.

Learn about the benefits of real estate investing with Invesco, one of the largest real estate investment managers worldwide with a global approach.