2025 Investment Outlook

Global markets face a structural reset. Discover how evolving macro trends may impact positioning and portfolio strategy in H2 2025.

Allow our global network of experts and external partners to provide the inspiration you need to stay ahead of markets and industry trends.

In our monthly market roundup for September, Invesco experts review a mixed month for global equity markets, alongside key updates in fixed income.

We speak with IFI portfolio managers about the factors driving US investment grade and how they are navigating the current fixed income environment. Read online.

Get an in-depth Q3 report from our alternatives experts, including their outlook, positioning, and insight on valuations, fundamentals, and trends.

Paul Jackson, Global Head of Asset Allocation Research, discusses his insights on portfolio allocations and strategies for the Q4 2025 outlook.

In today’s environment, we believe properties with income growth that’s less tied to the business cycle are best positioned to outperform.

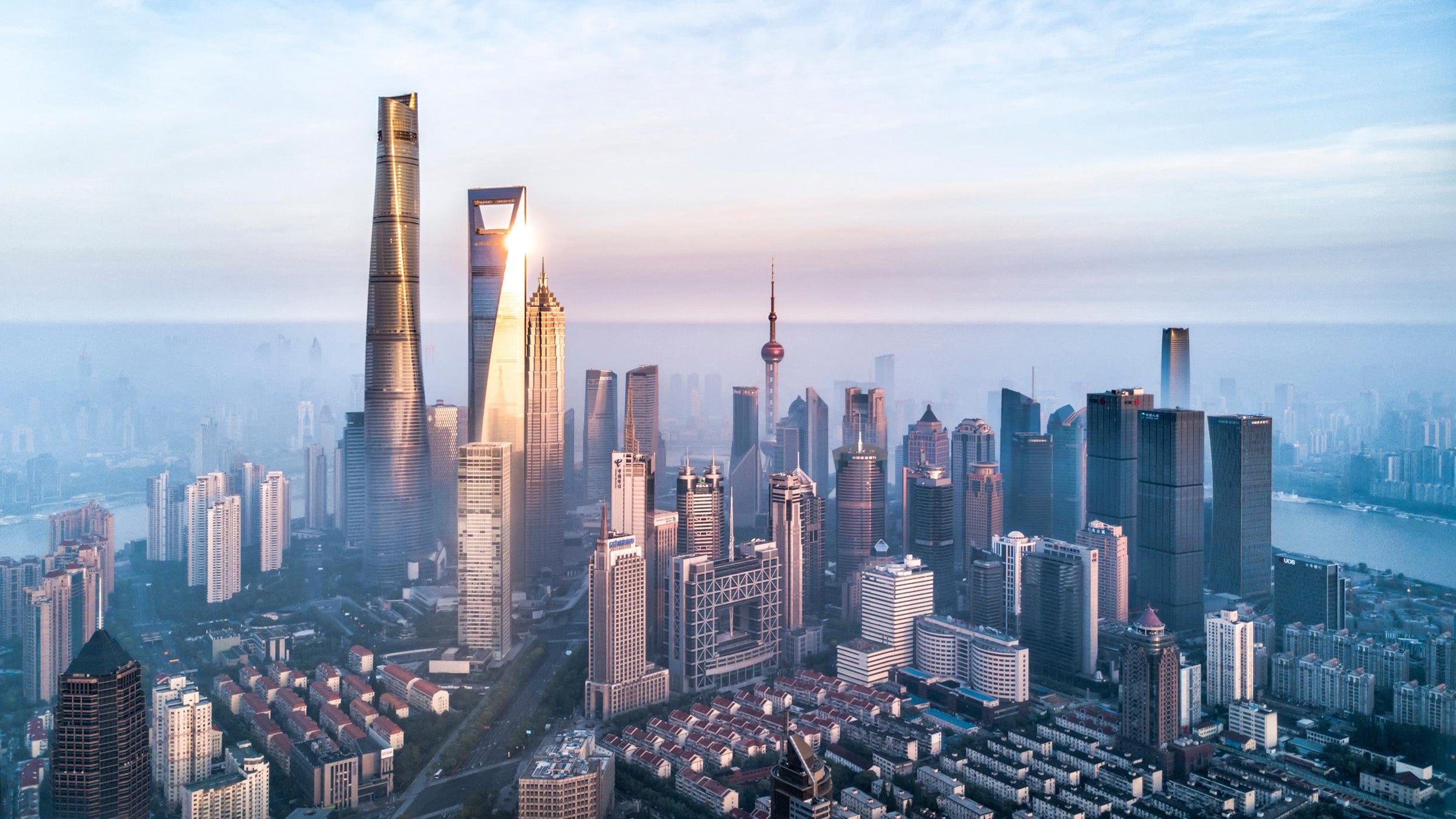

Why APAC real estate may offer growth, diversification, and value for institutional investors amid global market uncertainty in 2025.

Reduced cross-border investment in new US commercial real estate may impact US and global property sectors, markets, and assets differently.

Welcome to Applied philosophy, our view on global equity market model sector allocation.

The gold price has made a series of new all-time highs over the past year, driven partly by demand from investors. Find out more about what’s been driving the gold price, as well as answers to some of the other questions that many investors have when considering adding gold to their portfolios.

Experts from Invesco's bank loan, direct lending and distressed credit teams to share their views from the second quarter of 2025.

Find out what objectives a systematic active approach might aim to achieve and how an equity ETF using this strategy fits in between pure passive and traditional active management.

Why has the Nasdaq-100 historically outperformed over the past 15 years? Read the latest on this innovative index.