Real Estate US and global commercial real estate — fourth quarter 2025 outlook

In today’s environment, we believe properties with income growth that’s less tied to the business cycle are best positioned to outperform.

Single-family rentals (SFR) total about 15 million units in the U.S., similar to the traditional rental apartment market.

Home prices have outstripped incomes over the past decade making it challenging to save for down payments.

Tech advances are improving sector inefficiencies, driving operating economies and institutionalization.

With attractive yield premiums compared to the traditional apartment sector and demand-supply dynamics expected to drive income growth, there’s opportunity in the single-family rental (SFR) sector in the U.S.

Several trends have driven positive performance for this sector of the U.S. real estate market, including changing demographics and a limited market supply. Many millennials are becoming long-term renters because homeownership is out of reach, while others like the flexibility of renting versus buying. Upgrades in technology and infrastructure advancements are making SFRs more attractive to larger, more sophisticated developers/owners.

Get the full story about SFR investing with our in-depth analysis.

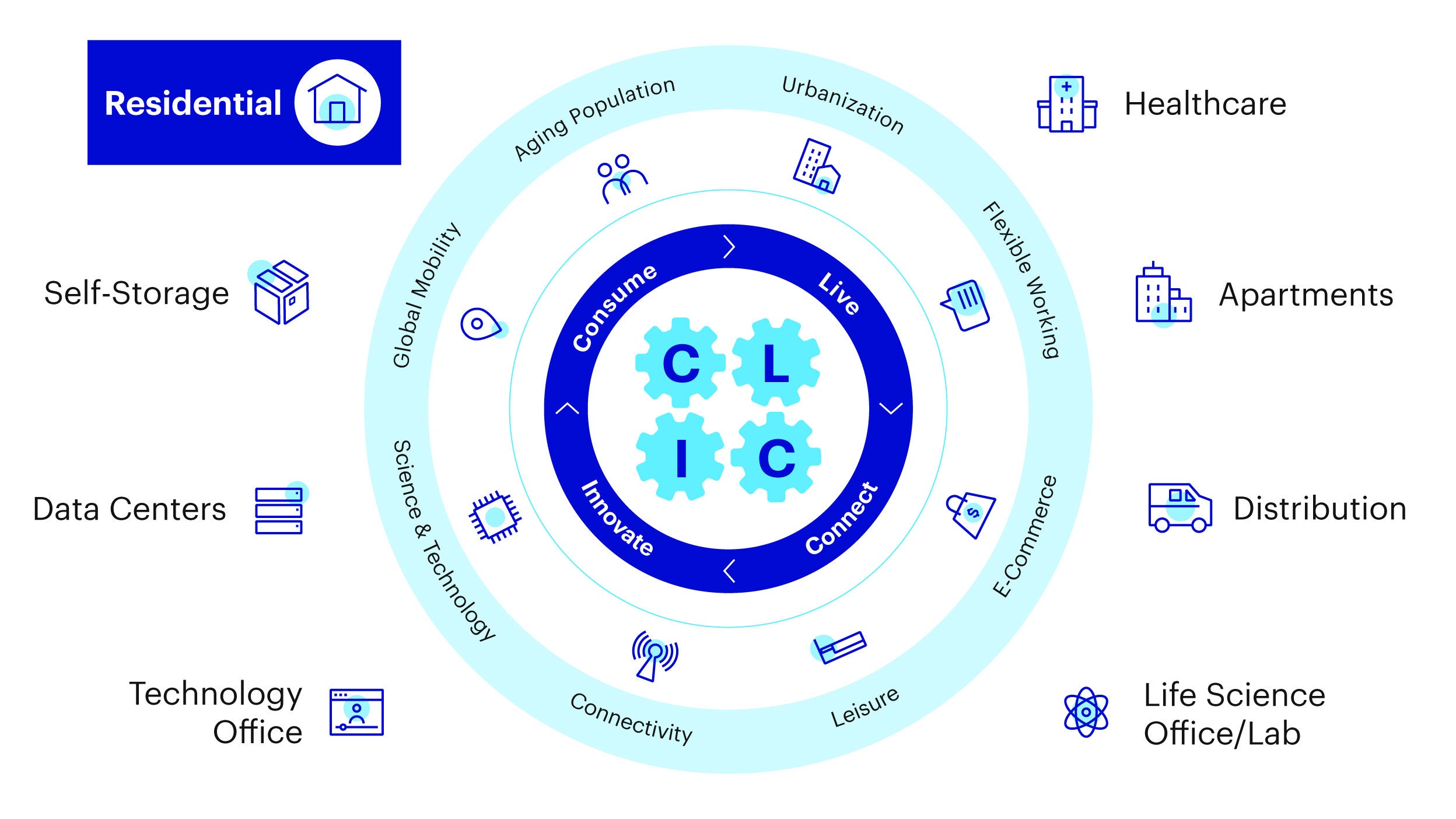

Our investing lens: Consume, Live, Innovate, and Connect (CLIC)

The Invesco Real Estate (IRE) team takes a unique approach to investing — focusing on evolving secular themes and demand drivers in sectors where we Consume, Live, Innovate, and Connect (CLIC). Get a deep dive providing education, fundamentals, and performance on one of the ten sectors within CLIC each month.

Source: Invesco Real Estate. For illustrative purposes only.

In today’s environment, we believe properties with income growth that’s less tied to the business cycle are best positioned to outperform.

Reduced cross-border investment in new US commercial real estate may impact US and global property sectors, markets, and assets differently.

An important leading indicator for commercial real estate is suggesting a high probability for property value growth in 2025, even amid tariff policy volatility.

NA2475518

Important information

Header image: Misha Dumov / Stocksy

Some references are U.S. centric and may not apply to Canada.

Past performance in not indicative of future results.

The opinions expressed are those of the speakers and are based on current market conditions as of October 12, 2022, unless otherwise noted, and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Investments in real estate related instruments may be affected by economic, legal, or environmental factors that affect property values, rents or occupancies of real estate. Real estate companies, including REITs or similar structures, tend to be small and mid-cap companies and their shares may be more volatile and less liquid.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.