Bringing you the world in one simple ETF

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

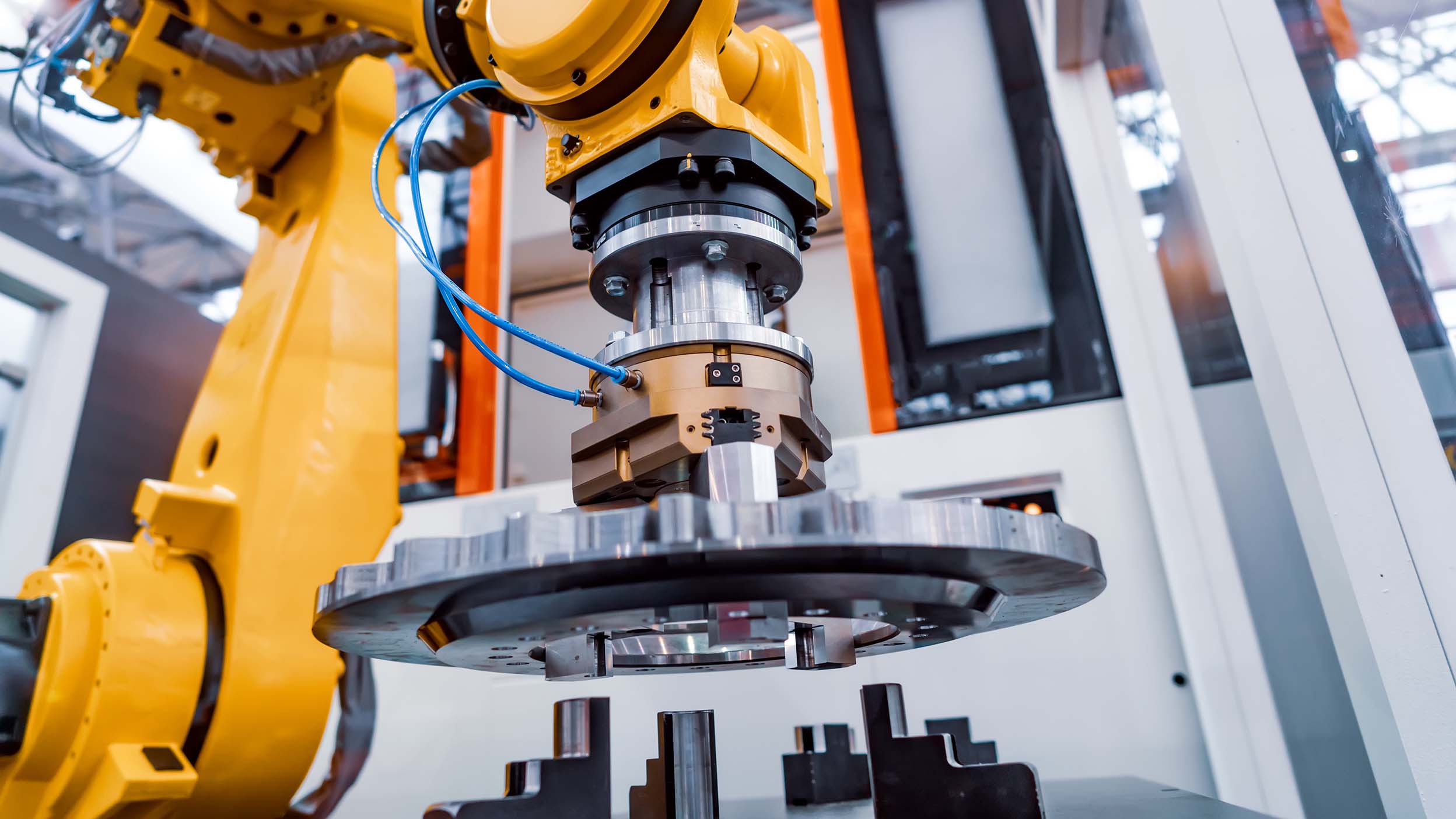

Technology has a broad reach across industries not usually associated with technological innovation, such as those in the Nasdaq-100 index, which Invesco’s Nasdaq UCITS ETFs track.

Greater integration between physical and virtual coffee-buying interactions allows for a new dimension of customer experience, enhanced by the greater personalisation and flexible payment options technology can offer.

The use of data analytics through technology can help companies create better efficiency in business operations, such as supply chain management and product development.

Technology is everywhere, even in your morning coffee. What was once a simple ritual is now a showcase of innovation, powered by companies in the Nasdaq-100 index. Whether it’s ordering ahead via an app, receiving tailored promotions, or enjoying a seamless payment experience, technology is enhancing how we interact with brands.

But innovation doesn’t stop at the counter. The following case studies showcase how the Nasdaq-100 index companies are redefining what it means to be innovative, not just in technology, but across every sector. From harnessing artificial intelligence to optimising supply chains, to deploying cloud computing and data science to forecast demand and accelerate product development, these companies are pushing boundaries. Even those outside the traditional technology sphere are embracing digital transformation to stay competitive, connect with consumers in new ways, and deliver smarter, faster, more personalised experiences.

A global leader in specialty coffee, is redefining how technology can elevate customer experience, drive loyalty, and fuel product innovation. As a Nasdaq-100 index company, it exemplifies how digital transformation is reshaping even the most traditional industries.

Starbucks is leveraging technology to create smoother, smarter interactions between their customers and baristas1. How? Through a series of innovations that blend convenience with customisation:

In 2022, Starbucks began piloting a blockchain-powered extension of its loyalty programme. Members can earn coffee-themed non-fungible tokens (NFTs), unique digital assets, that unlock real-world experiences, blending digital engagement with tangible rewards3.

Cold-brew coffees and other customisations have grown in popularity among the coffee-drinking population in recent years. It’s quite a labour-intensive process though, taking up to 20 hours to produce. To combat this, Starbucks developed Cold Pressed Technology, which, through low-pressure immersion technique, can now produce cold brew on demand in just seconds4.

A renowned manufacturer and distributor of non-alcoholic beverages, offering a diverse portfolio which includes coffee, carbonated soft drinks, ready-to-drink teas, water, juices, and mixers. While Keurig is widely recognised for its single-serve coffee brewing system, the technology behind it reveals a deeper story of innovation powered by embedded software, connectivity, and data science.

Keurig’s connected technology is built on a cloud-computing platform that powers its smart brewers5. These appliances integrate with mobile apps and voice assistants like Alexa and Google Home, allowing users to start their brew remotely. The BrewID system customises brewing settings for a wide range of K-Cup® pods, optimising each cup based on roaster recommendations. This not only enhances the user experience but also enables Keurig to collect valuable data for continuous product improvement and more informed decision-making.

Through BrewID, Keurig’s SMART Auto-Delivery feature tracks pod usage and automatically reorders inventory, ensuring customers never run out. The Keurig app also offers personalised coffee recommendations and access to a recipe library of coffeehouse-style drinks, deepening customer engagement and loyalty6.

Sustainability is a core pillar of Keurig Dr Pepper’s strategy. The company partnered early with an AI and robotics firm focused on reclaiming raw materials for the global supply chain7. By converting its coffee pods to polypropylene, a recyclable plastic, Keurig enabled robotic systems to accurately identify and sort K-Cup pods in recycling facilities. This collaboration exemplifies how smart design and technology can drive environmental progress.

What happens when two global giants, one known for fizzy drinks and snacks, the other for premium coffee join forces? You get a powerhouse partnership that’s not just serving beverages but also serving up serious innovation. PepsiCo, one of the top 10 companies in the Nasdaq-100 index, has teamed up with Starbucks to take coffee global and they’re doing it with cutting-edge technology, bold product ideas, and a shared vision for the future.

Through their joint venture, the North American Coffee Partnership (NACP), these companies are delivering ready-to-drink coffee products to millions of consumers. Think bottled Frappuccinos, canned cold brews, and even oat milk-infused drinks, all designed for convenience and crafted with quality. But this isn’t just about coffee. It’s about how technology is transforming consumer brands. PepsiCo is leveraging AI, data analytics, and cloud computing to streamline everything from manufacturing to marketing. That same technology muscle is helping Starbucks innovate with new formats like juice-based energy drinks and draft-style boxed beverages8.

This partnership is a prime example of how non-technology companies are becoming technology -powered innovators, and many more just like they are also listed on the Nasdaq exchange. From smarter supply chains to personalised customer experiences, the future of retail is being shaped by data and digital transformation.

These innovations underline how technological innovation is being leveraged in, and benefitting companies outside of, the traditional technology sector. Their experience also highlights some broad lessons on the critical role of technology across the entire consumer and retail realm.

Combining traditional shopping methods with virtual interactions and greater personalisation is being driven using data analytics, creating better customer experiences. Customisable and flexible payment options are another customer benefit facilitated through technological advance.

For the companies highlighted, data applications can also gather valuable information on customer behaviour and preferences which in turn can be used to build personalised products and services. The importance of better supply chain management took precedence during the pandemic. Applications developed then continue to play a critical role in allowing companies to operate more efficient supply lines, inventory management, costs, and labour.

Going forward, technology will continue to influence how companies innovate and operate across all industries. We believe investment and innovation go hand-in-hand and our Nasdaq ETF strategies provide exposure to innovative companies across multiple sectors all in one investment.

From smart coffee machines to blockchain-powered loyalty programmes, Nasdaq-listed companies are turning everyday moments into technology -powered experiences. And the best part, you don’t need to be a technology expert to invest in this future. With Invesco Nasdaq UCITS ETFs, you can get exposure to some of the companies that are leading the charge, not just in Silicon Valley, but across industries like food, retail, and consumer technology. It’s a simple way to tap into innovation, all in one investment.

We offer a range of Nasdaq UCITS ETFs offering exposure to growing companies with strong fundamentals. Access disruptive technologies, revolutionary giants, and household names from a range of different sectors, helping provide investors with unique diversification benefits with the US large- and mid-cap equity space.

The reason many people invest is to grow their money, so they’ll have enough in the future to spend on some financial goal they have. But how do you do this? Find out more.

Learn how the Nasdaq-100 index and Invesco Nasdaq UCITS ETFs can offer investors access to companies that are driving innovation across the global economy.

If you’re among the millions worldwide considering diving into the world of exchange-traded funds (ETFs), here’s what you should know about the different replication methods used.