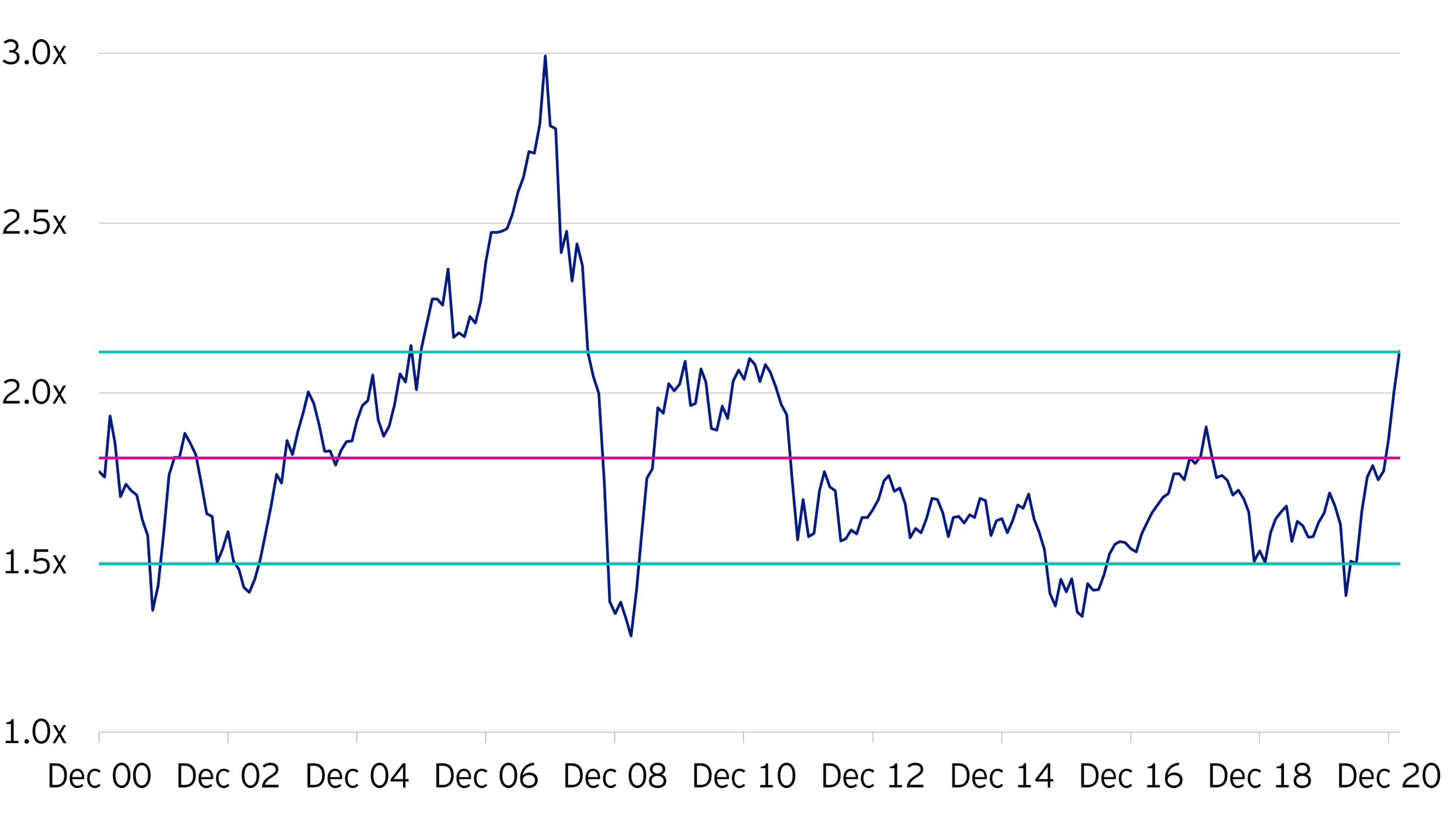

However, the composition of the market has changed over time. Tech hardware and internet businesses now account for approximately 45% of the index compared to 15% ten years ago. Many of these businesses are asset-light, giving the index a natural bias towards having a higher price to book ratio. They have also been amongst the biggest Covid-beneficiaries and drivers of index performance over the last 12 months.

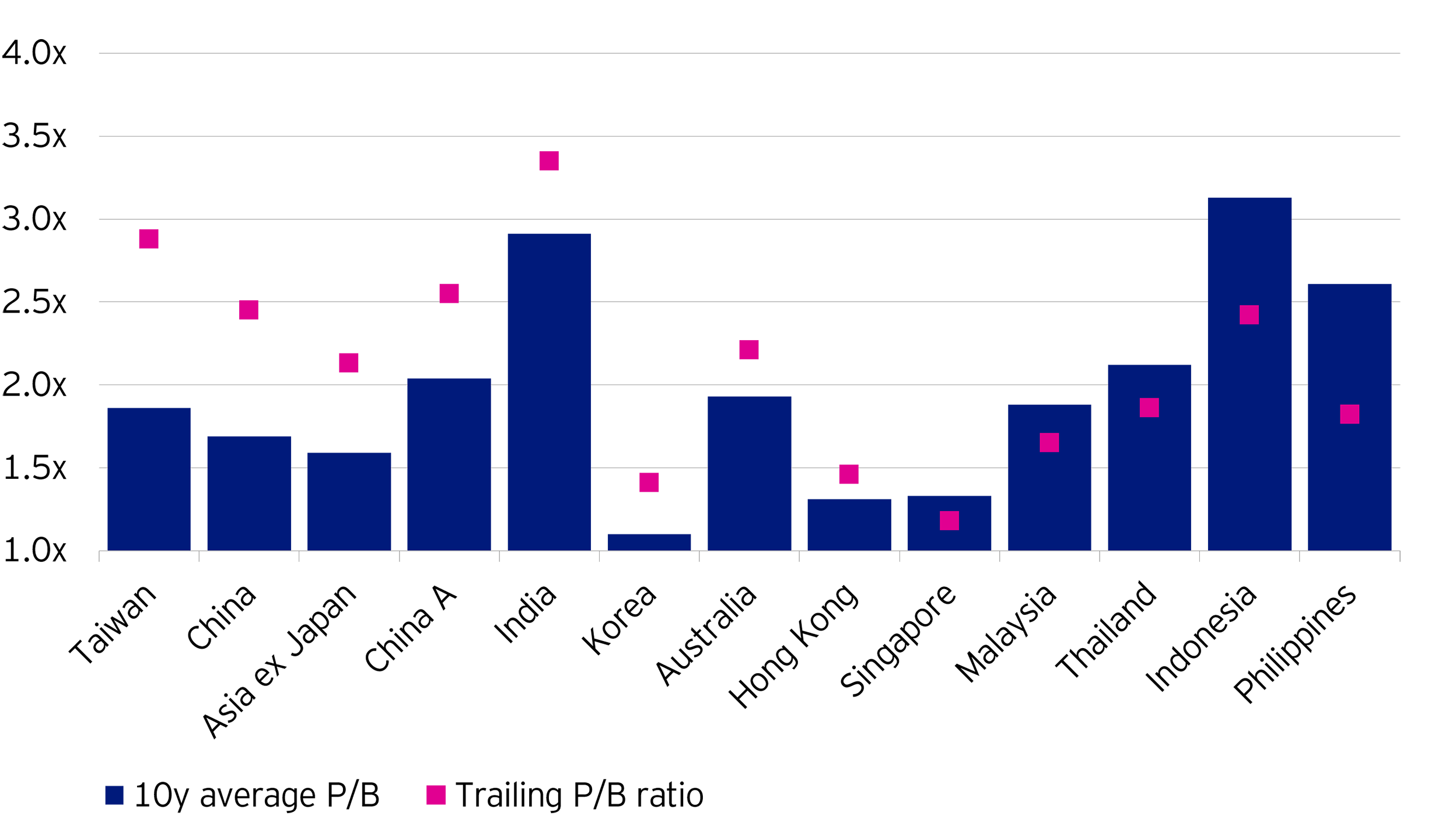

As one can see in the Figure 2 below, those sectors in Asia that have enjoyed the largest re-rating in recent months, such as internet and technology companies, are now trading at a significant premium to their long-term average. Conversely, there are several unloved sectors trading at or below their long-term averages for example the financials, energy and travel-related companies. Of course, we need to be selective as some companies are cheap for a reason.

We believe that buying shares in businesses for less than they are worth is the most sustainable way to achieve attractive returns which is why we spend most of our time working out the true value of these businesses and buying when we judge them to be significantly mispriced.