Keep the faith: look beyond peak growth

Some of the world’s major marathons are about to take place this autumn season. Athletes across the globe will have been preparing for them for quite some time, during which they will have experienced the usual ups and downs of training.

Running a marathon isn’t just a test of physical endurance, it also challenges an athlete’s emotional and mental strength. They can set a personal best in a minor race, but this can be followed by severe fatigue in another: performance doesn’t always follow a linear curve. Athletes are likely to rethink and adjust their pace to find their perfect rhythm, but what’s equally important is for them to keep focused and keep their eye on the finish line.

Long-term investing is much like marathon running. There will be fluctuations that can test one’s faith, and investors may choose to take a step back and adjust to a new situation. But they also need to bear in mind that they’re in it for the long run and not lose sight of their objectives.

Our team has long believed that the market had underappreciated the strength and sustainability of economic growth in Europe. The first part of 2021 certainly saw our thesis play out: ‘Value’ stocks outperformed their ‘Growth’ counterparts significantly. During the summer, however, the market seemed to return to its long-term preference for Growth and Quality. But is this reversal a return to the defensive mindset of the market in recent years, or can we expect valuations in more cyclical sectors to be recognised as we head into the final quarter of the year?

The current environment

Markets are currently worried about economic growth beginning to peak. Meanwhile, slowing growth and a rise in Covid-19 cases linked to the new Delta variant have led to a rally in bonds, with yields subsequently falling.

Bond markets have had a meaningful influence on the equity markets for quite some time, even determining the types of stocks that do well. Longer duration assets like Quality and Growth have led the market, with shorter duration assets like Value and Cyclicals significantly lagging. Our portfolios are more exposed to the latter. As long-term investors, we are reassessing what’s happening and why, and are studiously checking whether our positioning continues to be appropriate going forward.

Are we at peak GDP?

Concerns around peak economic growth have been reinforced by Delta variant outbreaks, weakening momentum in China and supply chain disruption. However, we believe the biggest trigger has been peak US manufacturing ISM (see Figure 1).

Source: Haver Analytics, Datastream, Goldman Sachs Global Investment Research as at 15 July 2021.

We are not entirely surprised by the market’s reaction, as it was only natural that the very high rates of growth coming out of the pandemic would begin to lose altitude. However, where we may differ most is that we don’t believe growth rates will inevitably slow to the anaemic levels of the last decade.

Many actions taken during the pandemic will remain with us for a long time, underpinning growth for years ahead. Some crisis related stimulus, such as furlough schemes, will end but others have a long way to go. The EU recovery fund, for example, will provide grants and loans until 2026.

This highlights the different response to this crisis, with European governments getting much more support (fiscal as well as monetary) than they did coming out of the global financial crisis. We’d expect this approach to be maintained. There are also other good reasons to believe that strong economic growth, especially in Europe, can continue.

Economic growth in Europe: the key themes

Services vs goods. The service sector is relatively resilient during a recession relative to the manufacturing sector, but that hasn’t been the case this time. Figure 2 shows that services also fell sharply and, in terms of the recovery, is lagging manufacturing. In our view, the service sector will power the next leg of the recovery, and with this part of the economy being much larger than manufacturing, we expect this to be a significant contributor to top-line growth.

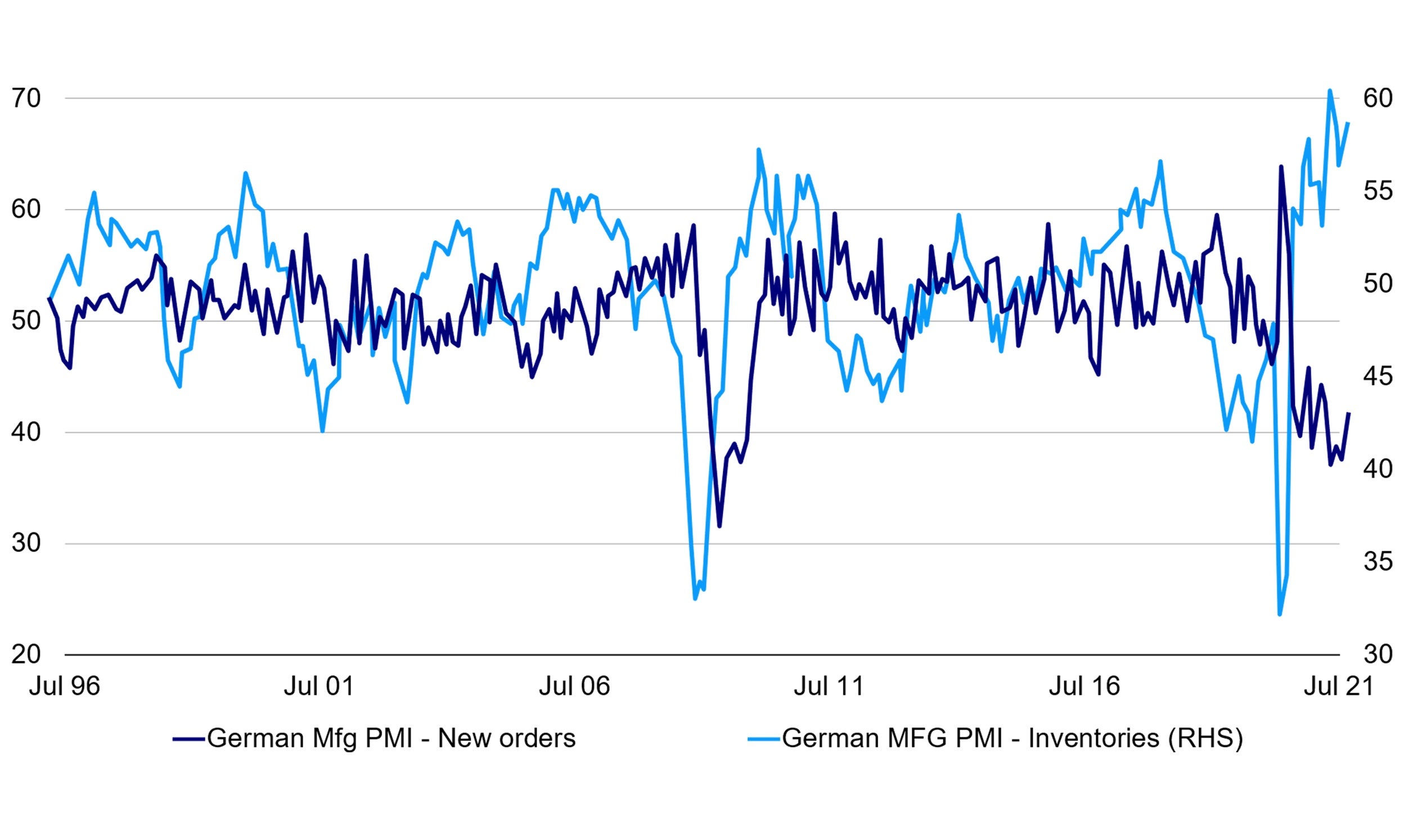

On the manufacturing side, low inventory levels and high levels of new orders should continue to be supportive (Figure 3). Meanwhile, household savings, which remain at high levels, should be helpful for both areas.

Source: ASR as at 16 August 2021.

Structural growth. Some long-term themes are emerging that has the potential to drive structural change and growth across Europe: climate change, digitalisation, and social inequality. This is a topic that we’ve covered in extensive detail in our recent piece, ‘Why invest in European equities’.

Reducing carbon emissions in particular is receiving global attention and is set to underpin investment over the long term. Some estimate that efforts being made in this area could be worth 1% of global GDP each year.

Forecasts have improved

Encouragingly, the consensus forecasts for Eurozone GDP for 2021 and 2022 is higher today than at the start of the year. And if anything, we believe these forecasts to be conservative, only partially incorporating some of the factors/themes discussed above.

Source: ASR, Invesco as at 3 August 2021.

Why medium-term inflation outlook matters

Another key debate within the markets is inflation and whether this is expected to persevere. Obviously, this has significant implications for US monetary policy and further afield. It is a subject we’ve discussed in detail in a piece written by Oliver Collin, ‘Entering the inflation debate: transitory or here to stay?’.

He concluded that the outlook for medium term inflation is what really matters (as opposed to the very high numbers today). Some of the headwinds to inflation are likely to fade/be less intense going forward. For example, the last few decades have seen a continued acceleration in globalisation – something that’s deflationary in nature: produce your goods where they can be produced for the lowest possible cost. However, the pandemic has highlighted the importance of having manufacturing onshore, particularly for essential goods.

At the same time, new structural inflationary forces are emerging (as mentioned earlier). Covid-19 is changing people’s view of the world, with voters demanding governments to prioritise issues they care about, such as inequality and climate change. This feeds into government policy, resulting in programmes like the EU Recovery Fund. This doesn’t mean we expect rampant inflation over the medium term. Instead, we expect to move away from the low inflation/disinflation era that has persisted since the global financial crisis.

The inflation markets seem to share our view. Looking at the 5-year EU inflation linked swap (Figure 5), inflation expectations are higher today than immediately prior to the pandemic. What we struggle with is how inflation expectations appear at odds with bond yields. Bond yields in Europe are now lower today than they were at the start of the pandemic. It is an inconsistency that both bond and equity markets will need to address at some stage.

Source: Bloomberg as at 31 August 2021.

Confident about economic and earnings growth

The short-term ebbs and flows of stock and bond markets are always a challenge. This is not going to change. The debate over the strength of current inflation in the US is a bit of red herring to us. What really matters is that we are moving away from a disinflationary world. This is significant.

Overall, we expect strong real and nominal economic growth in Europe and further afield over the next few years. This would be a marked change from the last decade.

We are encouraged by seeing the backdrop of economic recovery translating into a strong earnings recovery. Figure 6 shows that the consensus estimates are being revised upwards by 15 percentage points year-to-date. Meanwhile, 2021 earnings are on course to grow by more than 50%. Interestingly, earnings expectations for next year still look very low to us at around 10% and very much at odds with GDP growth that is set to grow at over 4% (Figure 4).

Source: MSCI, IBES, Morgan Stanley Research as at 2 August 2021.

Our conclusion: keep the faith

If we are right, this should be the start of a prolonged period of earnings growth – even more so for shorter duration assets like Value. This is something we haven’t seen since the 2003-2007 period, which translated into very strong returns for these types of stocks.

Source: Morgan Stanley, MSCI, Datastream, Factset as at 2 August 2021.

From a top-down perspective, the types of companies that benefit from nominal growth are the short duration equities and these are the cheapest parts of the market. In addition, from a bottom-up perspective it’s the same sectors and companies that are set to benefit from the political shifts we’ve mentioned. We believe that the environmental agenda is pro-investment and pro-cyclicality.

To conclude, we do not believe we have already reached peak European GDP. Whilst the rate of growth will slow down, there is plenty of fuel in the economic tank for growth above trend for 2022 and beyond. We believe the strategies managed by our team are well-positioned to benefit, but can also mitigate against more inflationary scenarios given the shorter duration of our portfolios.

Investment risks

-

The value of investments and any income will fluctuate (this may partly be the result of exchange-rate fluctuations) and investors may not get back the full amount invested.

Important information

-

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.