The potential for higher UK inflation

The UK has experienced a high level of headline inflation this year. But is this a short-term consequence of the economic bounce-back post-covid, or the start of a longer-term pick-up in price pressure?

One of 2021’s most talked about topics, gilt investors haven’t been overly concerned about inflation in the past couple of months, with yields falling since May. But there’s a substantial amount of data to suggests that inflation is continuing to build.

First, it’s worth remembering something about the headline data itself. In July 2020, the UK government reduced the rate of VAT for hospitality and accommodation sector supplies from 20% to 5%, to support these industries and their jobs through the pandemic-related disruption. Originally, this was to be for six months but was extended. It’s now due to end on 30th September, to be replaced by a rate of 12.5%, with the ‘normal’ rate of 20% to resume in March 2022.

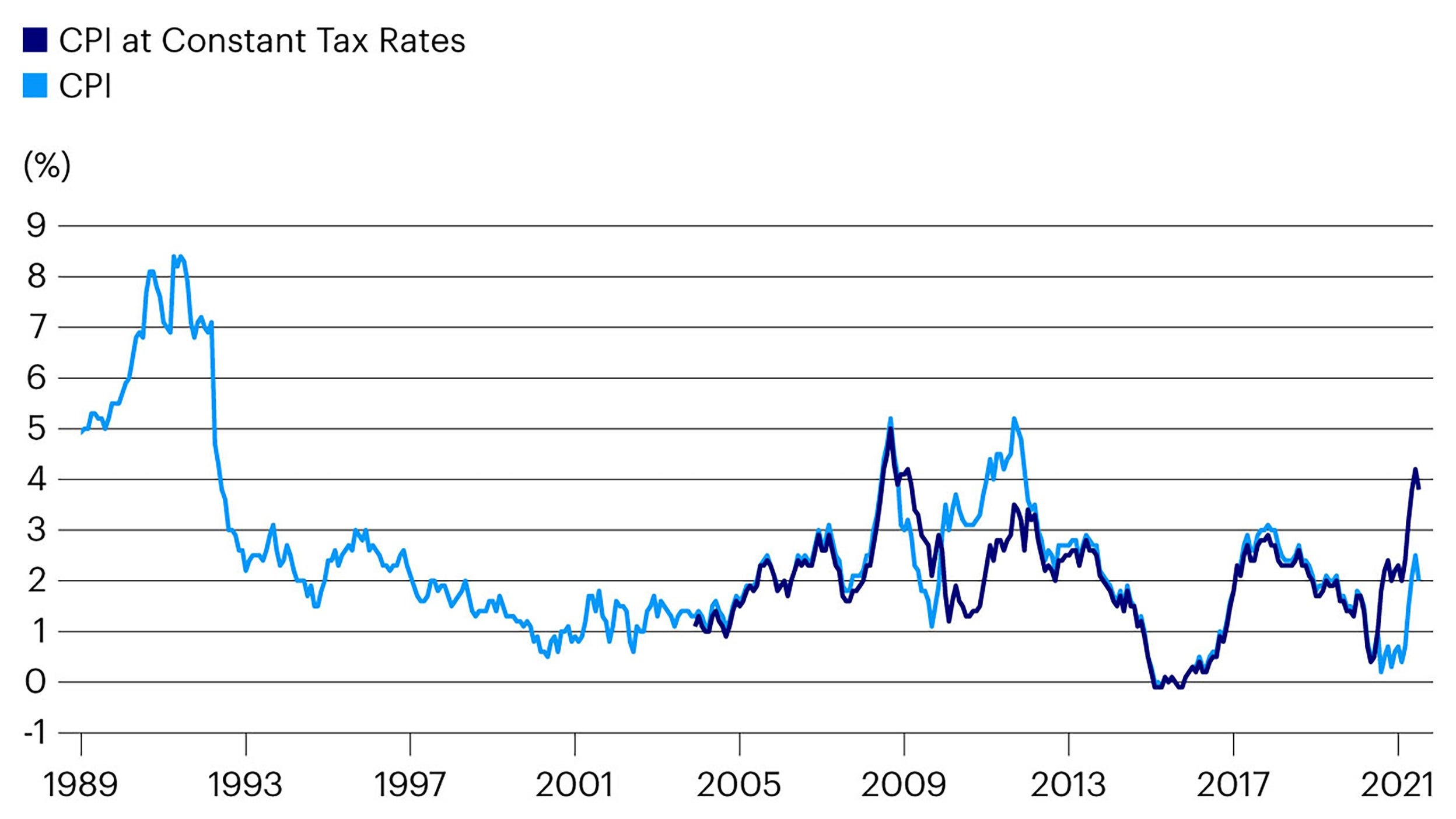

This tax cut has pushed official inflation down and it should re-adjust when it expires. In July, headline UK CPI fell to 2.0%, from 2.5% in June. If based on constant tax rates (in other words, allowing for the impact of the VAT cut), it would have been 3.8% in July – high compared to the past 30 years (see chart), and considerably above the Bank of England’s target of 2%.

Whether or not the headline rate changes exactly in line with this model at the end of September, we think this higher level is reflective of an economy under considerable price pressure.

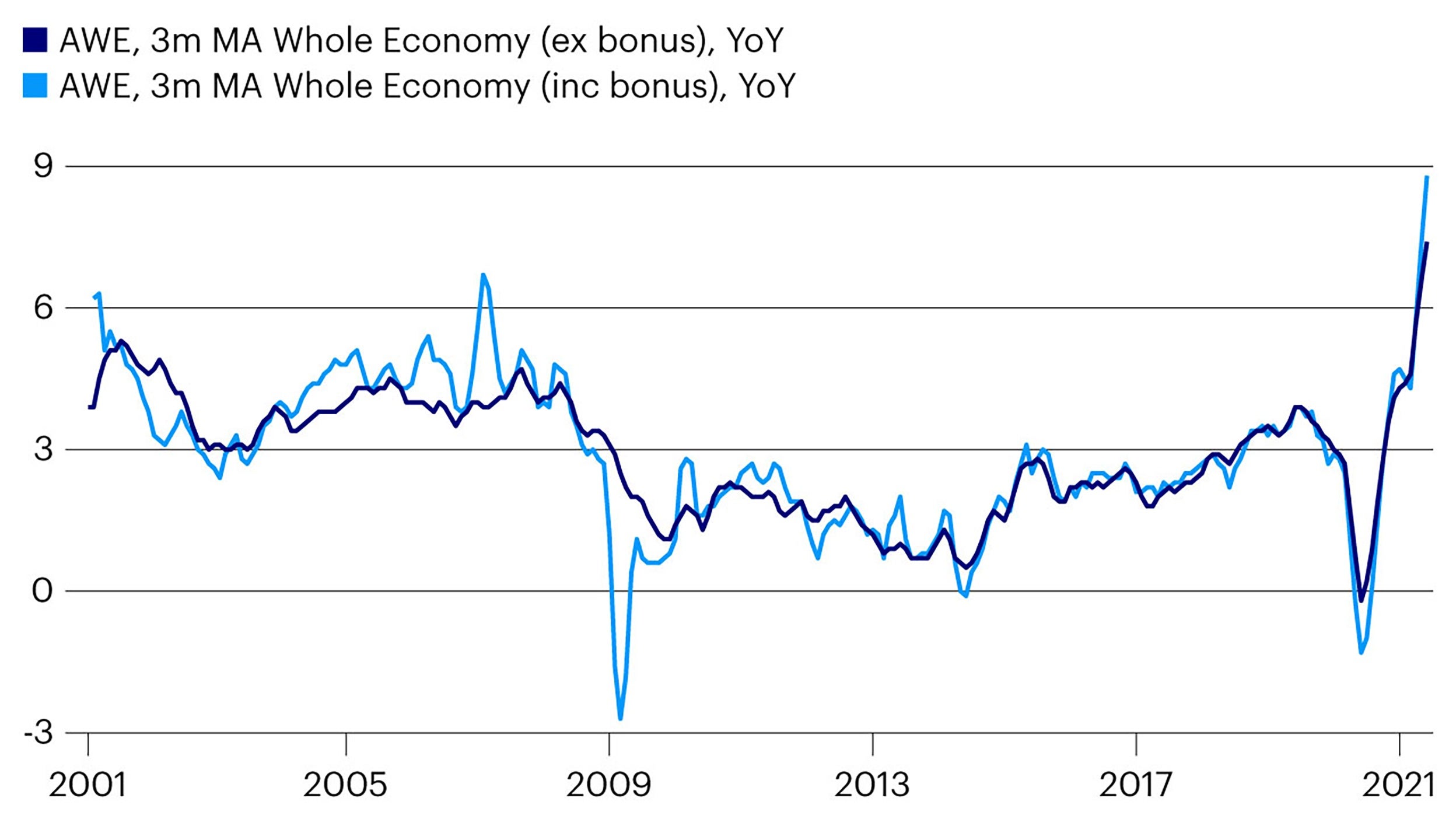

UK earnings quickly bounced back from 2020’s dip. The growth rate now is well above pre-Covid levels. Annual growth of weekly earnings, including bonuses, hit 8.8% in June. Measured with or without bonus, the growth rate is above 7% and the highest since the beginning of these series in 2001. Unit Labour Cost in the UK rose at a rate of 5.1% in the first quarter.

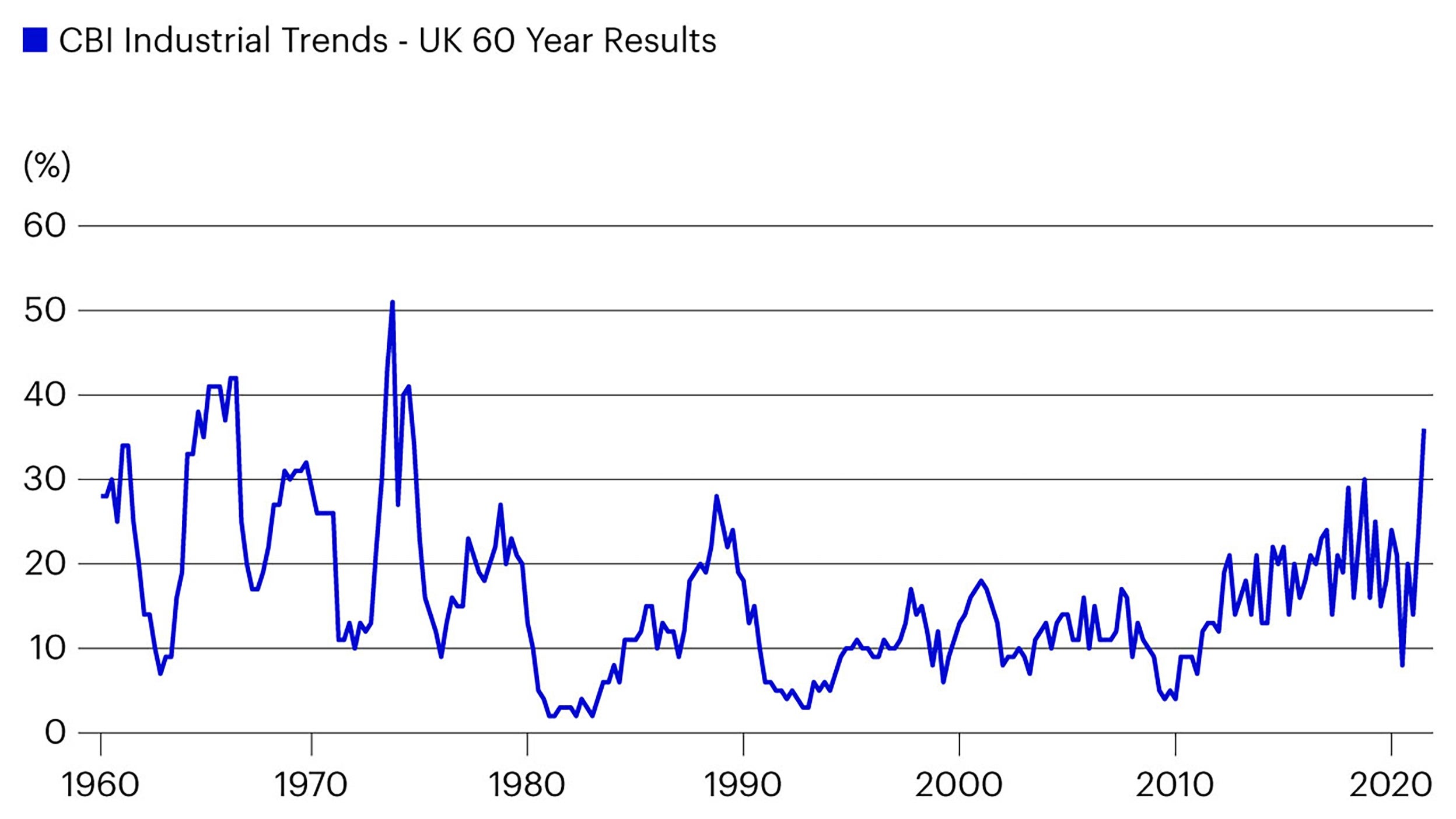

Labour cost pressures are likely to continue, given the state of the employment market. The number of job vacancies in the UK now easily exceeds pre-Covid levels. According to data from both the Bank of England and the CBI, recruitment is a rapidly increasing challenge for firms. The CBI Industrial Trends survey, with data stretching back 60 years, indicates that a lack of “Skilled Labour” is now more likely to limit output than at any time since the 1970s.

Data also suggests that cost increases for the business sector will flow through to consumer prices. A CBI survey shows that the net balance of firms that plan to increase prices in the next three months is over +40, the highest since 1984.

This trend is more pronounced in manufacturing. The British Chamber of Commerce, in a similar survey, estimates that 58% of firms in this sector intend to raise prices. But 31% of services firms do too, a level not exceeded in the past 20 years.

Apart from firms’ willingness to impose higher consumer prices, one important regulated cost is changing too. Household energy rates for many are set to rise by about 12% this October, as the energy price cap increases in response to wholesale fuel prices.

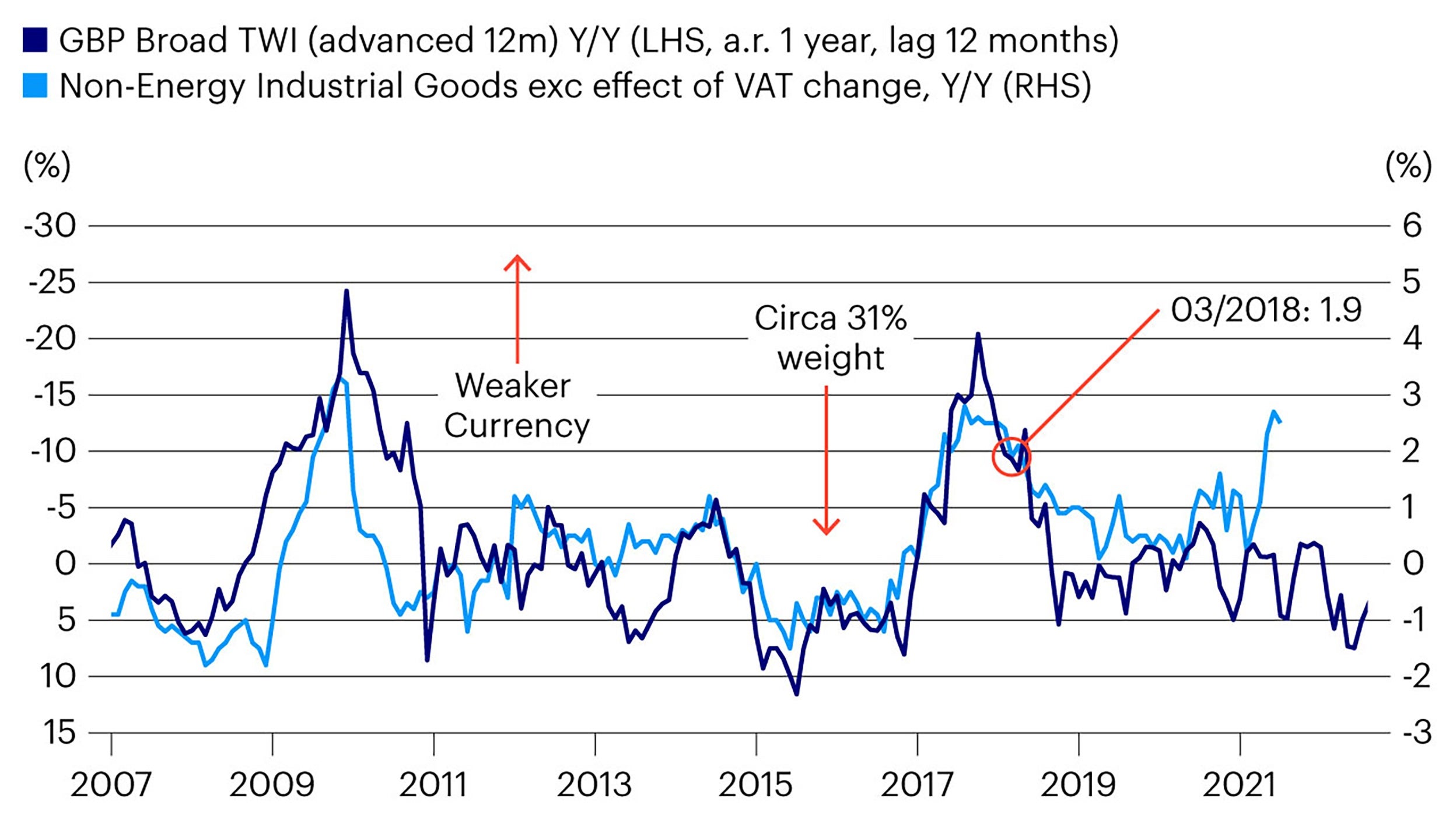

While all of this data points strongly to continued cost pressure, there is one notable factor providing some mitigation – sterling. The strength of the currency tends to have a strong inverse relationship with inflation. The chart below compares Non-Energy Industrial Goods inflation, which has a 31% weight in the total UK consumer price index, to a trade-weighted index of sterling, pushed forward 12 months. It suggests that the recent strength of sterling will exert some downward price pressure over the next few quarters.

We aren’t economic forecasters; we don’t make changes to our portfolios based on what we think inflation might do in the future. Our job is to try to align risk and reward within the mandates of our funds. While UK inflation is one of the risks for our sterling-based funds¹, other factors - not least central bank policy- are crucial too. All these factors must be viewed in the context of the reward: the yield we’ll receive?

Our assessment, based partly on the evidence pointing to potential persistent price pressure in the economy, is that UK rates are not great compensation for the risk. The level of duration in our portfolios reflects this. In our investment grade funds, Invesco Corporate Bond Fund (UK) and Invesco Sterling Bond Fund, duration is significantly lower than the sterling investment grade market level and we have trimmed in recent months. In the Invesco Tactical Bond Fund (UK), where our mandate gives us a great deal of flexibility in the management of all risks, including duration, we’ve reduced total duration sharply since the final quarter of 2020, cutting our sterling exposure by a third.