UK recovery: is this just the start?

We believe the weight of evidence is now supportive of a sustained multi-year recovery in UK equities.

Key takeaways

UK earnings momentum has not yet been priced in

Twelve-month earnings estimates for the FTSE All-Share index have risen by +50% since 30 June 2020, when market concerns around the possible effect of the pandemic on corporate earnings were at their most negative. Over the same period, the total return on the FTSE All-Share Index has been +23%.1

By way of comparison, the corresponding increase in earnings estimates for the S&P 500 has been +44% with a total return of +43%, and for the MSCI Europe ex-UK an increase of +44% with a total return of +30%.

The growth in earnings in the UK has been driven by the strong fundamentals underpinning many companies within the UK market, and supported by a particularly strong recovery in UK GDP. It is notable that, in the second quarter of 2021, the UK flipped from the bottom of the international GDP growth league table to the top. Based on latest revised consensus estimates, it is now set to stay there on through 2022.

A further important factor is that the FTSE All-Share has a greater proportion of global cyclicals than US or European indices. When looking at earnings revisions in the early stages of the pandemic, it is clear that these businesses weighed on estimates on the downside. However, as the world continues to emerge from the pandemic, these same areas of the market are recovering more strongly. The price of many commodities, for example, is significantly above pre-pandemic levels, yet equity markets have refused to price in the resulting upgrades to corporate earnings in the mining and energy sectors.

The favourable revisions to UK earnings estimates made to date, the favourable outlooks communicated by UK companies over the course of the H1 2021 reporting season, and the line-of-sight afforded by a favourable macro outlook are, in our view, ample reason for optimism for the continuation of an earnings-driven recovery in UK listed equities.

Re-rating of UK equities

As the earnings story becomes better appreciated, we believe there will be substantial room for further valuation re-rating. We have previously written at length that the valuation of UK equities is at a discount to history and relative to international peers. As time goes by, almost every month brings with it a new low. So, the fair question is: is this valuation discount real?

Opportunity underpinned by M&A

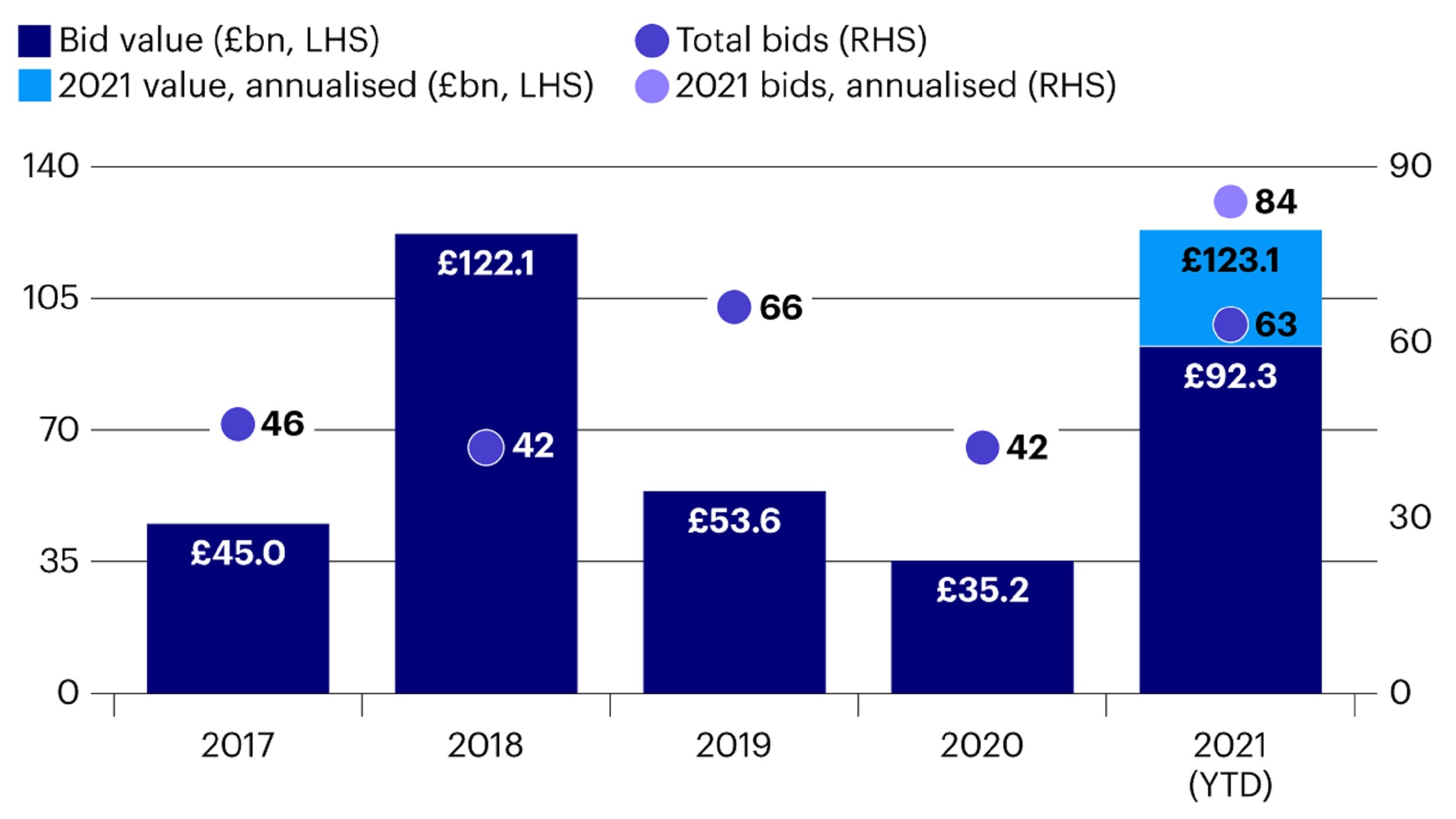

To answer the question raised previously, it is instructive to look at the level of M&A activity in the market, set out in the chart below. It is evident from the scale of M&A that, while the UK public equity market may not yet be willing to pay up for the intrinsic value in UK companies, a combination of private equity, foreign buyers and some UK companies are very much prepared to.

Nine months into 2021, takeover activity is already substantially higher than has been seen in 2017, 2019 and 2020. Activity in 2018 was particularly skewed by just two transactions (Shire £45bn and Sky £30bn). The largest transaction disclosed to date in 2021 involves sports betting company Entain PLC at a valuation of around £12bn, and the average transaction value is around £1.5bn.

Significantly, M&A activity is spread right across 10 of the 11 industrial groups, with Energy being the outlier. In short, the valuation opportunity seen by acquirors is widespread, consistent with our own market valuation analysis. The two biggest areas of M&A activity have been in Industrials and Consumer Discretionary, both of which have a relatively high UK domestic tilt to revenues.

This year, within our own portfolios, we have already seen activity involving: Spire Healthcare, Vectura Group, RSA Group, Ultra Electronics, Meggitt, St Modwen, Arrow Global, Scapa and Sanne Group.

We are excited about our portfolios

There is likely to be near term volatility in markets as a result of concerns around inflation, with practical supply-chain issues in some sectors as the global economy gradually re-opens.

But the bottom line is that the improvement in outlook for UK corporate earnings and both the UK and global economies should, in an undervalued market, boost the outlook for UK listed equities. Key beneficiaries will likely include high quality businesses, which form a significant part of our portfolios.

This last point is key. While we are optimistic about the UK market, our portfolios are what excite us the most. This excitement comes from our positioning in high quality, cash-generative businesses, with strong liquidity, that we think are likely to emerge from the pandemic in an even better competitive position than beforehand.

If you want to know more, we’re holding a webinar covering the above topics on 14th October 2021 at 2:30pm.

Footnotes

-

1 Source: Factset as of 29 September 2021.

Investment risks

-

The value of investments and any income will fluctuate. This may partly be the result of exchange rate fluctuations and investors may not get back the full amount invested.

Important information

-

This is marketing material and is not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable, nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions. They may differ from those of other investment professionals. They are subject to change without notice and are not to be construed as investment advice.