Invesco Select Trust Plc – Global Equity Income Share Portfolio

Overview

Global equity markets recovered strongly in Q2 and have remained well supported through July.

Following the most rapid declines in equity markets in Q1 we saw one of the fastest recoveries in Q2.

Co-ordinated monetary and fiscal policy of unprecedented scale was unleashed to help alleviate the economic, market and societal cost of the lockdown response to the Covid-19 pandemic.

Most asset classes delivered positive returns for the second quarter with the tech heavy NASDAQ index leading equity index returns.

Investment Outlook

What are the key market dynamics we observe today?

Firstly, technology. In the near term the pandemic has acted as an accelerant to many of the trends which were already in motion; online shopping, increased usage of digital technologies, more flexible working and use of cloud-based IT infrastructure.

Given the devastating impact of lockdown on many industries, it is rational that the market has latched on to an industry where the outlook is improving in this backdrop.

Indeed, the portfolio is overweight (versus its weighting in the MSCI World reference index) the technology sector due principally to our positions in semiconductors, although we also have holdings in some large well-known software and e commerce companies.

Despite this overweight position, one of our key performance detractors this year has been our lack of exposure to technology stocks in emerging niches or with cutting edge, conceptual business models

Typically, they exhibit the fastest forecast revenue growth, but with little earnings and even scarcer dividends.

Our holdings in this sector, such as semiconductors, are more mature business models in consolidated markets and usually generate substantial free cashflow and thus the ability to pay sustainable and growing dividends.

However, whilst the performance of these holdings has been good in absolute terms, they have not matched their more racy ‘emerging growth’ counterparts.

The sharp rise in the share price performance (and now valuations) of the 75 fastest growing companies in the technology sector provide some eerie similarities to prior periods which, with hindsight, showed that reality did not quite match the hype.

From looking back at 1999/2000 we know that only a fraction of the most highly valued companies during that period went on to be attractive investments in subsequent years.

Market enthusiasm for well-founded stories is nothing new; but neither is the ability of the market to push expectations and thus share prices, too far. The 1999/2000 technology boom is an obvious analogy but there are many others.

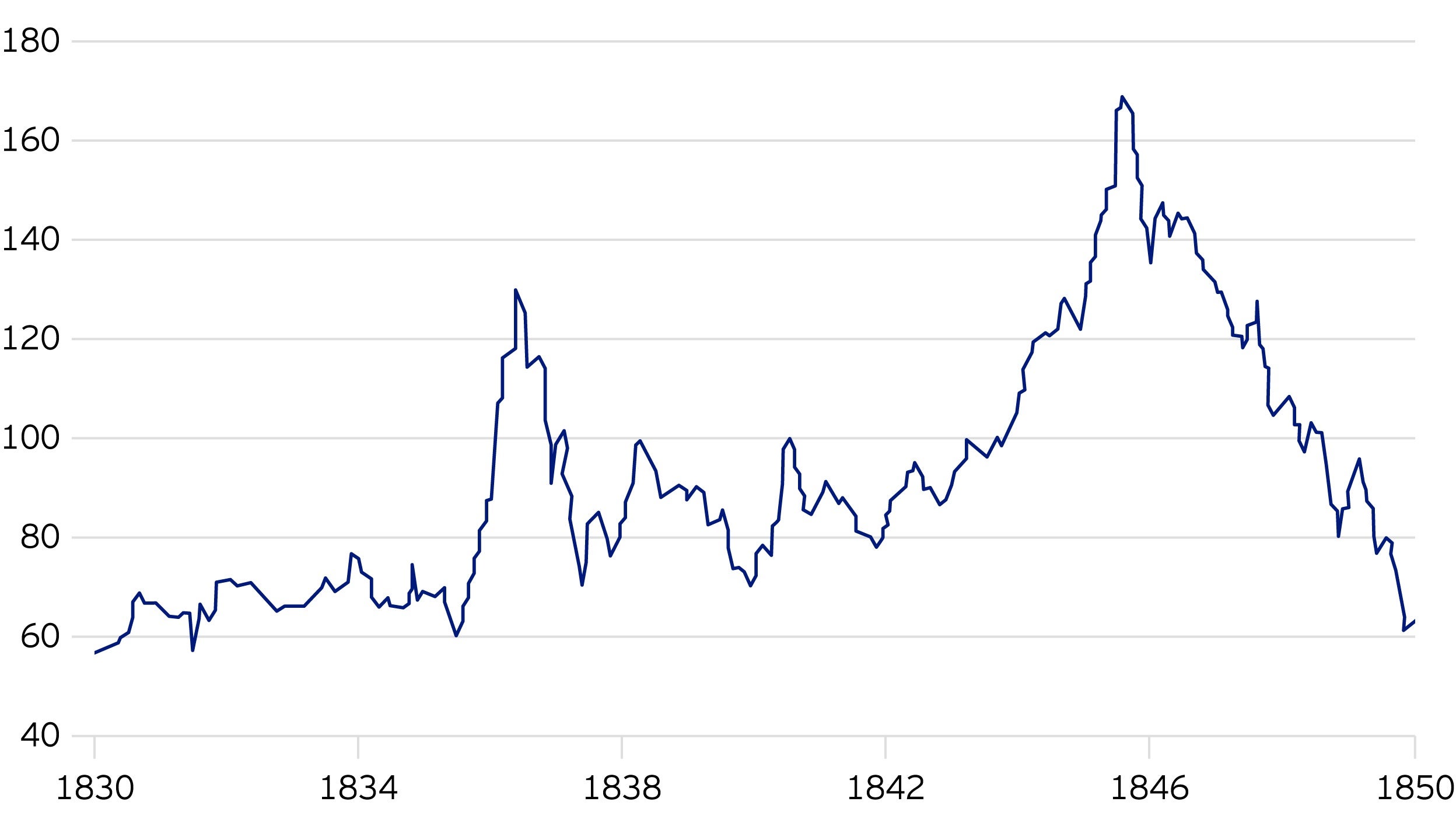

Below is a chart from the 1800’s showing the index of British railway companies as rail began to be built out - the reality did not live up to the growth expectations.

It is our view that much of the excitement around ‘tech’ is valid; many are excellent, cash generative and growing businesses.

But in some instances, we believe the market has taken these qualities to an extreme level in terms of valuations.

In part this reflects the current unusual interest rate environment.

As we write the US 10-year government bond yield has fallen close to an all-time low.

Such a low yield has implications for investors when they value future cash flows such that the value of growth in the future is much higher.

This has been a key driver to the share price performance of companies for whom positive cash flows and dividends remain many years in the future.

Can we rely on bond yields to remain at these levels to support this thesis?

The answer to that question strikes us as critical; we have all become used to low and falling bond yields, the market narrative and valuation structure seemingly suggests lower forever, not just lower for longer.

We believe it is worth considering that things may well be changing - driven by the response to the pandemic, which has been unprecedented; trillions of dollars of fiscal and monetary policy have either already been enacted or is soon to be introduced.

Should economic conditions not improve, we believe it is inevitable that we will see further stimulatory measures.

The reason we have highlighted this as a key market dynamic is that we believe there will be consequences that stem from this.

Without this response we risked turning a health crisis into a banking crisis.

However, herein lies the issue.

Whilst the policy response is akin to what happened following the 2008/09 global financial crisis, the underlying causes and challenges are different this time around.

We frequently hear that QE (quantitative easing) post-2008 was not inflationary - we disagree.

It is an inflationary policy; it just didn’t create inflation because broad money growth in the economy fell as the banking crisis unfolded.

2008/9 was caused by a banking crisis, bank lending contracted, and QE was enacted to offset the impact of this contraction.

The current situation is quite different.

We are not ‘top-down’ investors but nonetheless it is important to recognise the forces at play in the market.

Several companies which have performed well this year are excellent businesses, with many benefiting from the current conditions of working from home and an acceleration toward a digital economy.

However, we must consider that interest rates and policy are impacting valuations.

Any change to the perception that rates are ‘lower for longer’ and that yields could increase from current levels could change equity market leadership markedly in our view.

Risks

We see a number of ‘risks’ on the horizon, not all of which are downside risks.

There are clear negative risks around the virus, the economic consequences of lockdown and unemployment.

Jobless numbers have risen sharply, consumer habits may well have changed permanently and asset classes such as commercial real estate face an uncertain future.

However, there are of course upside risks; we may discover a new treatment or vaccine, herd immunity may be reached faster than predicted or indeed the virus may ‘burn out’ in the population as previous viruses have done.

Coupled with the quantity of stimulus now being injected into the global economy there could be a powerful recovery.

We are not offering odds on any of those outcomes, merely that we must acknowledge that the risks around virus control and economies are not all skewed to the downside - which makes portfolio construction more challenging than ever.

We believe it is right to have a portion of the portfolio allocated to companies which could do well once virus fears begin to dissipate.

We appreciate this may take time but there are excellent businesses in travel & leisure, financial services and retail which could emerge from this crisis stronger as weaker competitors stumble.

We believe the market is over-looking the prospects for many of these companies; we would highlight JP Morgan, Amadeus and Zurich as excellent businesses within their respective industries.

We appreciate that our holdings in select companies such as these are quite different to market consensus but believe the long-term asymmetry of returns to be very much in our favour at this juncture.

Portfolio performance

| Standardised rolling 12-month performance (%) growth | |||||

|---|---|---|---|---|---|

30.06.15 30.06.16 |

30.06.16 30.06.17 |

30.06.17 30.06.18 |

30.06.18 30.06.19 |

30.06.19 30.06.20 |

|

| Ordinary Share Price | 2.7 |

2.7 |

5.6 |

3.0 |

-7.0 |

| Net Asset Value | 9.9 |

9.9 |

8.1 |

3.1 |

-5.9 |

| MSCI World Index (£) Total Return | 15.1 |

15.1 |

9.9 |

10.9 |

6.5 |

Past performance is not a guide to future returns

Ordinary share price performance figures have been calculated using daily closing prices with dividends reinvested. NAV performance figures have been calculated using daily NAV with dividends reinvested. The NAV used includes current period revenue and values debt at fair. The MSCI World Index (£) Total Return performance shown is total return (net of withholding tax). All performance figures are in sterling as at 30 June 2020 except where otherwise stated. Standardised past performance figures are updated on a quarterly basis. Source: Morningstar.