Regulation changes causing headwinds for Chinese equities

Key Takeaways

- Chinese equities underperforming global after regulation crackdown

- Communist Party “Common Prosperity” goals spurring regulatory action

- New regulation changing the business models of certain companies

Chinese equities suffered a sharp downturn in July as the Communist Party “Common Prosperity” goals aimed at improving social and economic inequalities prompted the government to introduce regulatory restrictions on corporations.

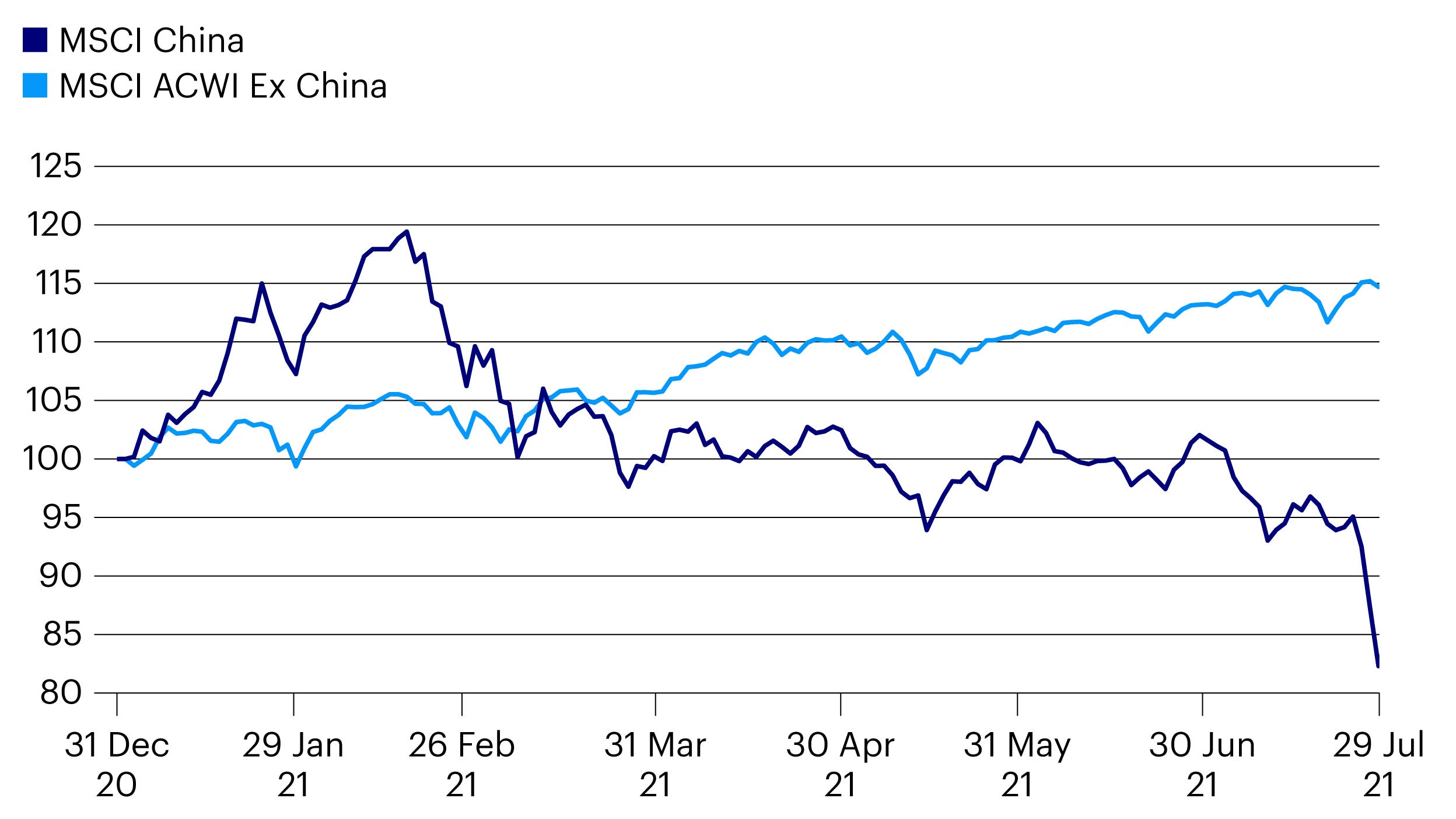

After a strong start to 2021, Chinese equities have progressively underperformed global equities, especially in the second half of July. As of July 30th, the MSCI China Index was down 17.7% whilst the MSCI World Index (ex China) hit new highs, up 14.7% (in US$, source Datastream/Invesco).

What has been driving this weakness?

We had noted in recent months an increased assertion of influence by the Chinese Communist party over private enterprises seen as not fully in step with or critical of state institutions; most publicly, Jack Ma and Alibaba.

Many commentators had seen these run ins with regulators as one-off events focused on particular companies. However, more recently we began to hear the term, “Common Prosperity,” as an official goal of the communist party.

This entails a greater focus on the social well-being of the average Chinese, increased social as well as economic equality, and greater corporate responsibility by all enterprises including those in private hands.

This has been cited as the guiding principle behind a wave of regulatory action addressed towards China’s booming internet-enabled new economy sectors, the digestion of which has caused considerable market turmoil.

The catalyst for the recent volatility and sharp movement downwards in Chinese (especially technology sector) share prices, was a “worst case scenario” outcome for a long-awaited supervisory determination for the education industry, specifically After School Tutoring.

This sector has boomed in recent years as middle-class parents have increasingly sought to gain entry for offspring into top academic institutions. Measures include significant restrictions on what classes may be offered, to whom, when, and for what prices.

Indeed, the recent edict says that such businesses should become “Not for Profit” institutions. The business models for such companies have effectively been destroyed.

Underlying these draconian measures is a high-level determination that the companies were producing an outcome contrary to the cause of “Common Prosperity”. At a tangible level they have led to too much pressure on both children academically and parents financially.

At a higher level, there is a view that this pressure was an impediment to China’s birth-rate staging a turnaround from which the country’s demographics would benefit.

What do these changes mean for other sectors in China?

We have no holdings exposed to education in China. Our holdings, Tencent, a leading social media, e-commerce, gaming and search player, and Netease, which is US listed but a dominant player in China’s gaming industry have both been impacted by the uncertainty, falling by around 15% over the last two weeks of July and early August.

We retain our conviction in both holdings, judging that the superior growth of these companies and their ability to navigate increased regulation without materially impairing their core business remains intact.

The market has immediately raised the risk premium on all other Chinese “new economy” sectors, leading to falling share prices. As such, while there is read-through to other sectors, it must be handled carefully. While the same principles guide regulation, very few companies or sectors will be perceived as so problematic as the education sector.

What most companies in sectors such as e-commerce, social media and gaming are likely to see is more a matter of regulatory catch-up after a period in which many companies and sub-sectors have grown faster than the regulators have been able to keep pace with.

In coming months, we expect to see a range of measures to address, for example, monopolistic behaviour by dominant internet platforms, better employment protection for taxi and delivery drivers and better data privacy for consumers.

All being issues which we in the West have grappled now for several years. While we would expect such measures to cause in the short run some headwinds to revenue growth, in the longer run we would expect business models to become more stable and sustainable.

As ever in China, understanding the state and its vision for the nation and its role as stakeholder are vital but these are idiosyncrasies we understand well.

We draw both on our own analysis within the global team as well as input and advice from colleagues who specialise in Asian and Chinese equities, and external experts.

We believe we are thus well positioned in companies aligned with the likely emerging regulatory principles and as such we believe that this regulatory wave will come to be seen as a short-term share price headwind rather than a long-term thesis changer.