2023 Annual Investment Outlook

We expect inflation to moderate and central banks to pause tightening in the first half of 2023, which should help take the global economy from the current contraction to a recovery regime and set the stage for the next market cycle.

Executive summary

In 2022, central banks across the globe raised interest rates with “a degree of synchronicity not seen over the past five decades," the World Bank warned in September. Will they ease off the gas in 2023? That depends largely on the path of inflation going forward. Our annual outlook addresses the breadth of possibilities that lie ahead in the new year.

Inflation: The critical question for investors

Transcript

Brian Levitt:

Hi, this is Brian Levitt, Global Investment Strategist at Invesco. Will a difficult 2022 give way to a less volatile and more productive 2023? We believe that it will and are preparing for a recovery to commence in early 2023. But first, let's start with where we are.

The global economy is currently in contraction, meaning that growth is below trend and is decelerating. It has been driven in large part by policy tightening. Now, where we head largely comes down to inflation and interest rates. Fortunately, inflation appears to be moderating as economic activity weakens. Weaker economic activity may not be great for main street and will lead to perhaps job losses and even a recession. However, it ironically sets the stage for a market recovery. The market will be focused on inflation becoming better relative to expectations. Not necessarily good, but better relative to expectations.

As this process plays out, the market will turn its expectations to a so-called “Fed pause,” the moment when the US Federal Reserve is no longer tightening policy. And we expect the markets to begin to recover even ahead of the Fed signaling a backing-off from its tightening stance. The market, as it so often does, will lead the economy and to begin to price for the recovery stage of the cycle. Now, that environment tends to favor higher yielding bonds, such as high yield corporates and bank loans as well as equities typically led by more cyclical, value oriented and smaller cap stocks, including those outside of the United States. Now, 2022's "everything bear market" likely sets the stage for opportunity in 2023 and beyond. Thank you.

What do we see ahead?

Global Investment Strategist Brian Levitt summarizes our expectations for 2023, including the view that inflation should moderate and central banks should pause tightening in the first half of the new year.

Time to watch: 2:37 minutes

Our base case and alternate scenario

Our base case anticipates that a pause in central bank tightening in the first half should help usher in an economic recovery. We also consider an alternate scenario in which central banks find themselves battling stubbornly high inflation, increasing the probability of a global recession.

-

How did we get here?

Following the extraordinary loosening of monetary and fiscal policies across the world in 2020 and 2021, inflation has become broad-based and significantly above target in most economies, leading to aggressive central bank tightening. The major outliers are China (where policy is loosening), and Japan.

Global central banks have been tightening aggressivelyNote: Number of central banks among 38 leading central banks. The number of central banks hiking or cutting rates is measured on a one-month rolling basis.

Source: Macrobond and Bank for International Settlements, Sept. 30, 2022.

-

Persistent inflation may attract hawks

An alternate possibility we have considered is that inflation could persist higher for longer, requiring central banks to be hawkish for longer than we expect in our base case. We would expect this to increase the probability of a global recession, resulting in worse growth and further pain in risk assets.

With inflation expectations priced above target, easing may be delayed (%)Note: Chart shows market inflation expectations derived from the difference between nominal and inflation-protected government bond yields for relatively liquid short- to medium-term bonds.

Sources: Bloomberg and Invesco, as of Nov. 4, 2022.

What are the asset allocation implications?

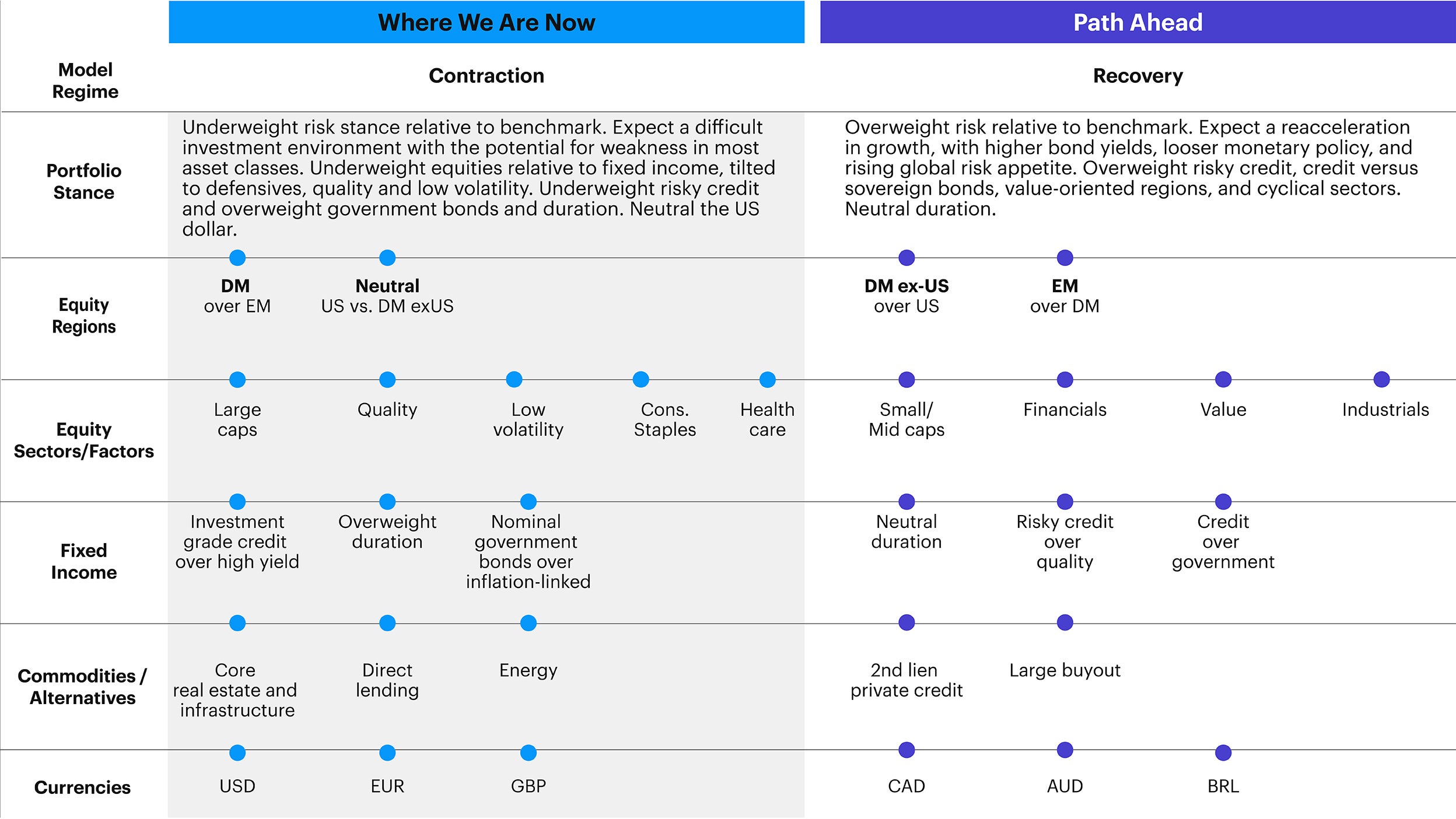

Our base case calls for the global economy to move from the current contraction to a recovery regime. Below, we show which assets we would favor in each regime.

Download the full investment outlook

A collection of charts that illustrate the details of our base case and alternate scenarios.