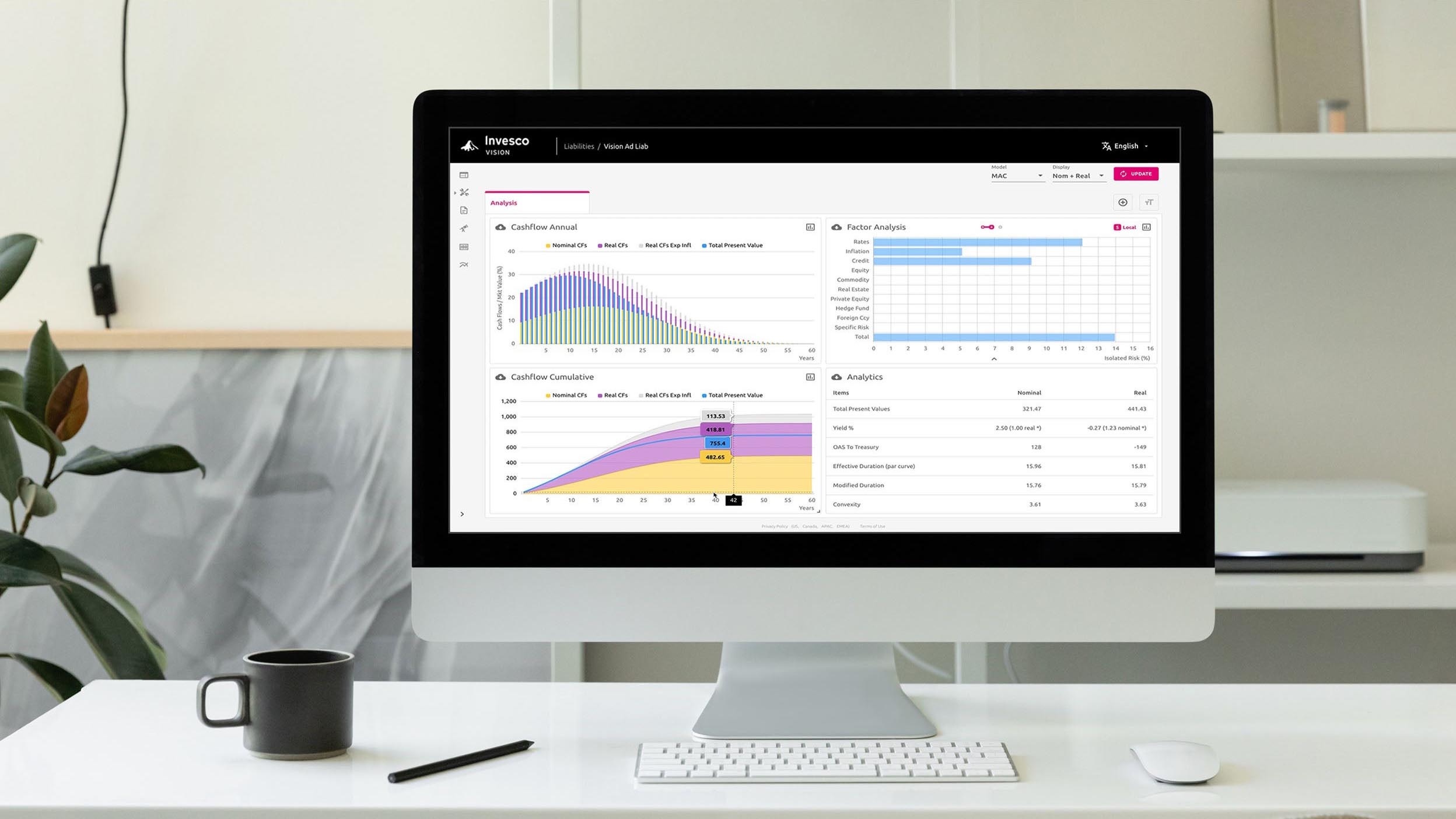

INVESCO VISION Power your portfolio with Invesco Vision

Invesco Vision is a state-of-the art, proprietary portfolio diagnostics tool created by practitioners to “pre-experience” how different variables affect investment outcomes. Learn more about our unique custom portfolio analysis service.