Over the last few weeks, most companies within our European Small Cap strategy have reported their third quarter results and have shared their thoughts and expectations on Q4. As always, investors go through these statements in detail to get a glimpse into the future and try to draw conclusions, if – and how – prospects of the companies and industries they invest in have changed.

At the same time, shorter-term market participants trade the headlines that these earnings releases provide, causing sharp moves up and down in these stocks. It seems to us that the risk tolerance of these participants is lower than it used to be, causing more excessive share price reactions on the day, as they adjust their positions on changing share prices.

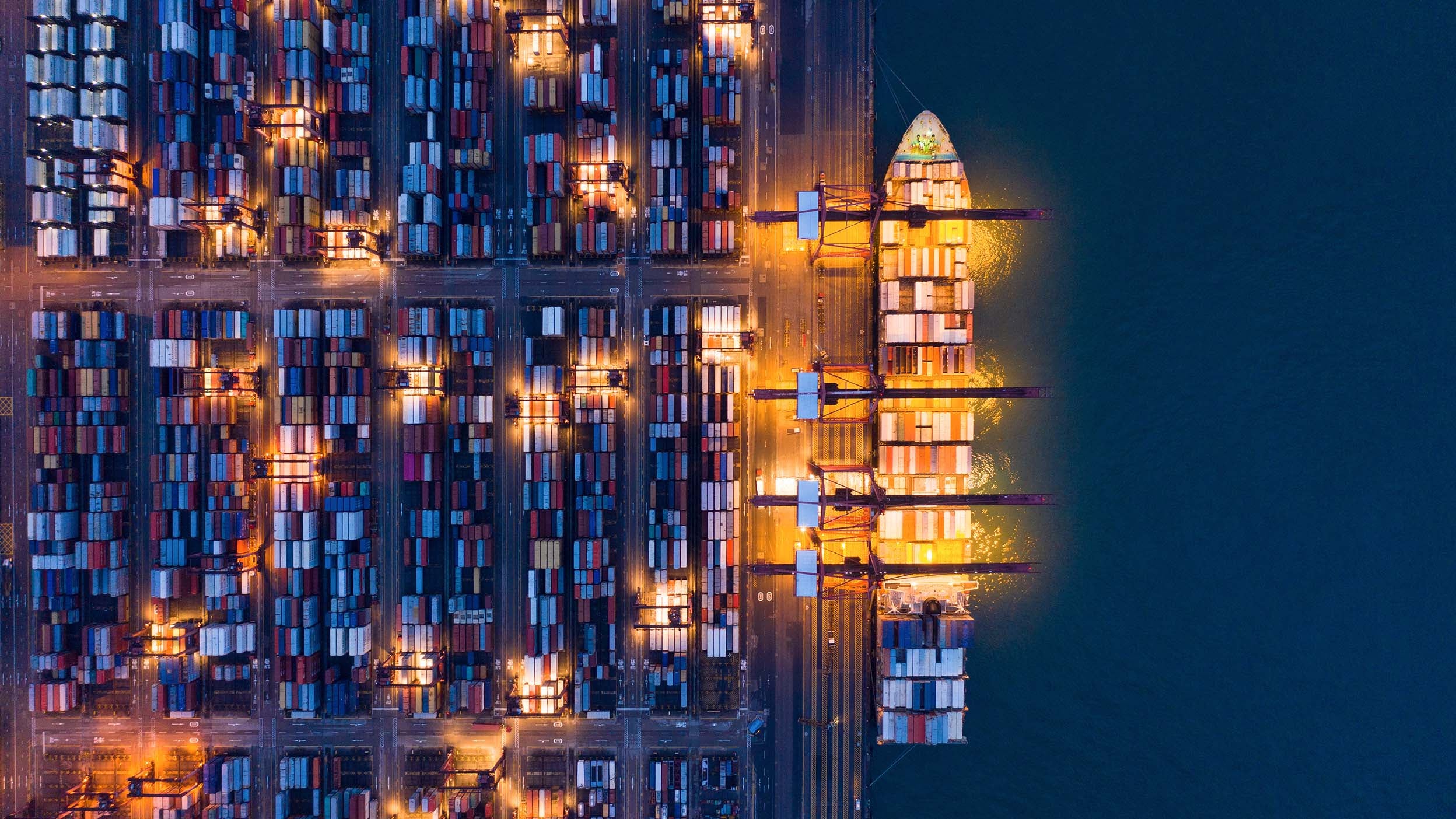

For industrial and consumer-facing companies, the key issue during this earnings season was the interplay between raw material cost inflation, component shortages and logistical challenges on the one hand, and pricing power and customer demand on the other. A lot of companies lumped these input challenges together and called them supply chain challenges. This has led to some confusion – some issues are transitory in nature, while others are potentially the start of an inflationary cycle that could last for many quarters.

Signify – A case study

We could have chosen a number of strategy holdings to make the same point. Signify is a world leader in LED lighting and LED lighting solutions. As some of you will know, we’ve been shareholders of Signify for a long time, and even though we reduced its weight in our strategy significantly during Q1 and Q2, we remain admirers of Signify’s long-term strategy and its business.

This is partly based on its excellent supply-chain management. Signify was one of the first companies worldwide to call out the supply chain issues in their Q1 report, and hence, we take their comments seriously.

In our discussion with management, Signify’s CEO explained the main components of the headwinds they face and how the company copes with this. They need to protect margins in the short term, but maintain good supplier and customer relations in the long term.

Firstly, the company notes that raw material prices like steel and copper have increased and the company passes this on to their clients without much resistance – this helps revenue growth and is margin neutral.