Markets and Economy Inside the markets | Helping you guide clients

Looking at market trends, political developments, the macroeconomic landscape and the impact it has on market volatility, stay ahead with expert commentary.

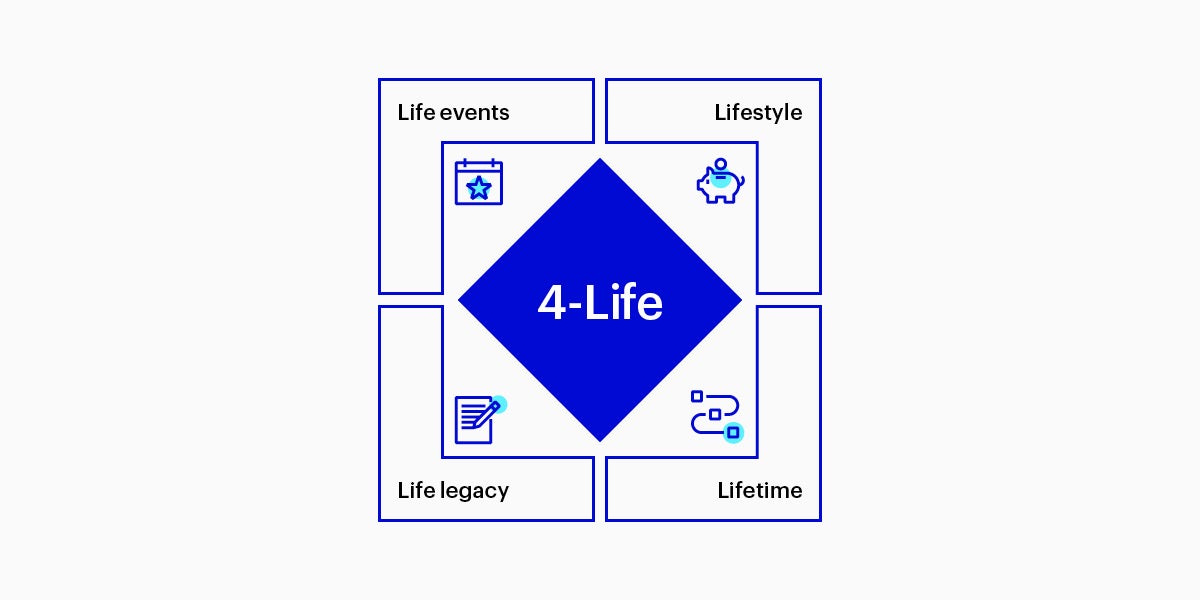

There is a seismic shift underway in the UK pensions market, with responsibility for retirement moving from employers to individuals. The issues may be well-known, but they are difficult to solve, especially given the intensely personal nature of retirement and how to fund the lifestyle and legacy each client wants to build. To help solve these challenges, Invesco has created the 4-Life framework, designed to drive better outcomes for retirees.

By dividing the retirement journey into four manageable building blocks, the 4-Life framework helps individuals prioritise and achieve their own specific retirement goals — and it helps financial professionals better frame what products and solutions can best serve the needs and aspirations of all retirees.

A full exploration to the framework is available here, including detailed examples of how each building block may be managed for different client personas. Below, we highlight a few client needs and investment implications within each category to consider as a starting point.

Source: Invesco

We believe the 4-Life framework helps put in place a robust retirement plan that explicitly addresses the risks people are increasingly facing as they seek to take control of their retirement path. These risks can be managed at an individual level or aggregated to build default options for pre-determined ‘personas’ within pension schemes.

Explore more in our 4-Life framework brochure, which includes an analysis of building individuality into a pension scheme through personas.

Looking at market trends, political developments, the macroeconomic landscape and the impact it has on market volatility, stay ahead with expert commentary.

We see an overall constructive market backdrop with easing inflation and softer growth in the medium term, amid policy shifts and global uncertainties.

In this regular piece, Ben Gutteridge recaps the key headlines from the previous quarter and highlight any short-term impact they’ve had on investment performance.