Could you be rewarded for exploring the untapped potential of fixed income?

With inflation and low yields combining to create negative real yields, traditional investment solutions no longer provide the returns investors need. But perhaps looking further afield to more innovative options could provide the answer.

Key takeaways

1

2

3

Is this the right time to explore non-traditional fixed income?

Asset allocation to bonds is at a record low according to a survey of fund managers1. It’s the same amongst institutional investors, with 65% cutting allocations by at least 10%.2

Investors have seemingly grown tired of weak yields. 42% blame this for disinvestment3, with more than $4.9 trillion of negative yielding debt available in the market.4

Volatility, driven by rising rates and inflation, is also putting off new investment with 53% of survey respondents blaming this for their flight from fixed income.5

So, with these challenges in mind, let’s explore some unconventional parts of the market. These may offer a range of benefits – from higher yield potential and diversification to limited duration risk and flexibility.

Could unconstrained bond funds offer resilience during periods of volatility?

Unconstrained bond funds offer a way of accessing different areas of the bond market. This is because they are not tied to a specific benchmark.

Instead, they can follow investment themes to generate positive returns, or seek to defend assets during choppiness in markets.

One of the major advantages of unconstrained investing is that an active fund manager can be rewarded for independent value judgements rather than being led by an index. Managers can step outside traditional fixed income allocations to government or corporate bonds to pursue outperformance.

Accessing different geographies, currencies, sectors or asset types can provide flexibility and a broader scope. Opportunistic investment approaches should mean a focus on bonds that represent value and resilience, while avoiding exposure to areas that appear overvalued.

Another key benefit of unconstrained bond funds in the current rising rates environment is their ability to limit duration. This may allow funds to offer some mitigation against the challenges posed by rising yields and subsequently lower bond prices.

The ability to hold low or even negative levels of duration is a key attribute of the unconstrained Invesco Tactical Bond Fund (UK) and has helped manage risk. The result of successfully managing this is strong risk adjusted returns, shown by the fund’s high Sharpe Ratio.

The fund has top decile Sharpe Ratios in the Strategic Bond sector over three years. During this period, the Sharpe Ratio is 1.3 compared to a sector average of 0.6.6

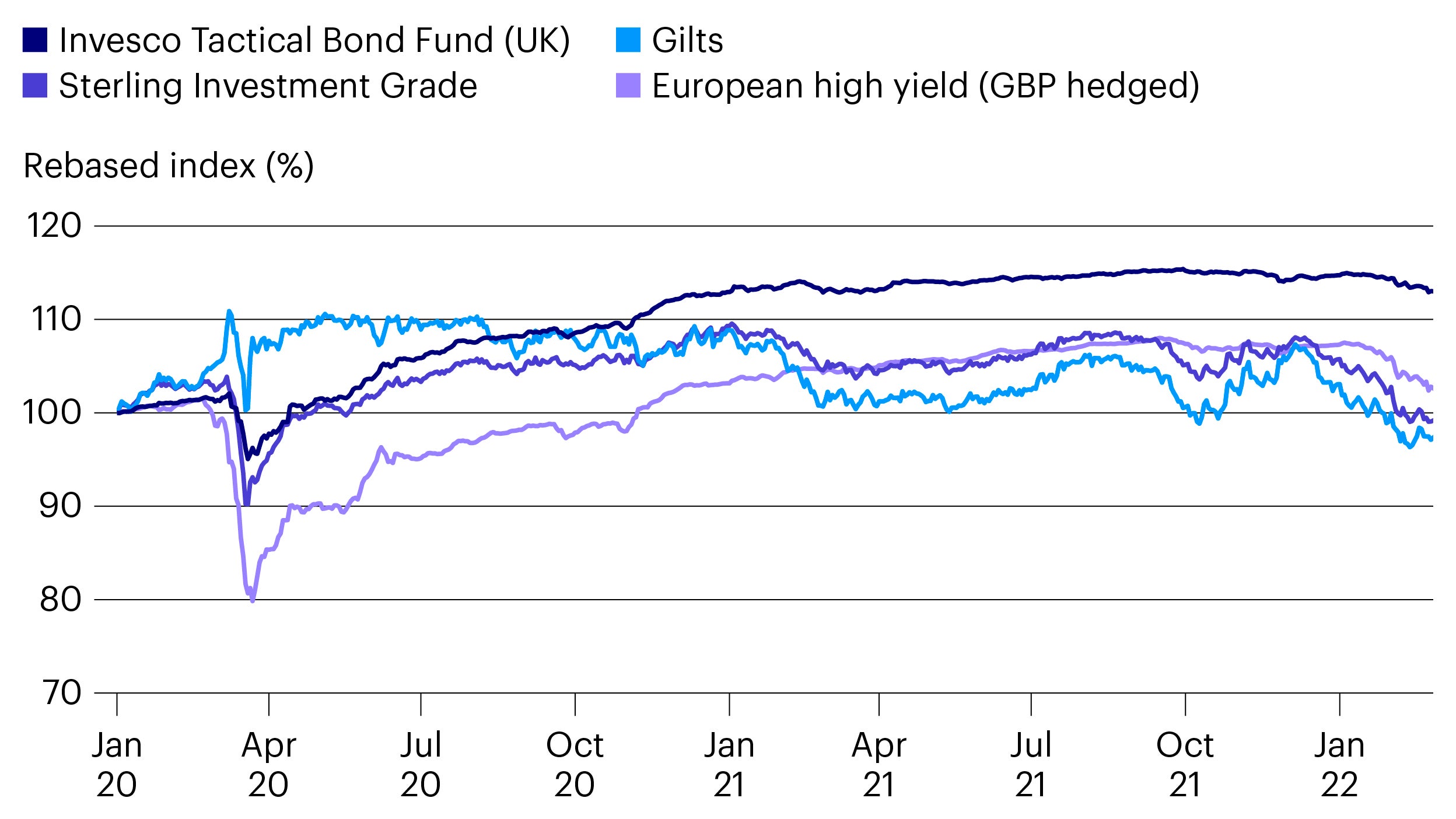

The chart below helps show this risk and reward pay off. The fund was positioned defensively at the start of the pandemic as it had reduced risk in the low yield environment of 2019. It added risk opportunistically during the crisis and the recovery.

Source: ICE BoA Sterling Corporate Index, ICE BoA European Ccy High Yield Index (£ hgd), ICE BoA UK Gilt Index, Invesco Tactical Bond Fund (UK) Z Acc GBP, Bloomberg, 28 Feb 2022

Past performance does not predict future returns

Rolling 12-month returns, % |

28/02/2018 |

28/02/2019 |

29/02/2020 |

28/02/2021 |

28/02/2022 |

Invesco Tactical Bond Fund (UK) Z Acc GBP |

1.90 |

-0.91 |

4.83 |

11.55 |

0.11 |

UK Treasury Bills 3 Months |

0.26 |

0.63 |

0.74 |

0.07 |

0.13 |

IA £ Strategic Bond NR |

2.35 |

0.77 |

7.85 |

3.77 |

-1.64 |

ICE BofAML UK Gilts TR Index |

-1.23 |

2.61 |

12.63 |

-4.25 |

-3.20 |

ICE Sterling Inv Grade |

1.47 |

1.79 |

11.62 |

2.11 |

-5.09 |

ICE European Currencty HY £ hgd |

5.49 |

1.74 |

6.67 |

5.76 |

-1.74 |

Past performance does not predict future returns. Invesco Tactical Bond Fund (UK) Z Acc GBP. The fund’s benchmark is shown by the UK Treasury Bills 3 months data. All performance is net of fees.

Is there a rising tide for Fixed Income ETFs?

ETFs focused on innovative segments of the fixed income market have risen in popularity. That’s because investors are seeking new ways to generate income and diversify portfolios, without having to take on duration risk given the outlook for interest rate rises in 2022.

The more innovative among these fixed income securities derive higher yields. They achieve this through characteristics such as subordination rather than due to the riskiness of the issuers themselves, as is often the case with conventional high yield.

Additional Tier 1 capital bonds (AT1s) are a type of contingent convertible bond that offer these characteristics and are available within Invesco’s ETF structure. They are issued by European banks, most of which have investment grade credit ratings and historically low level of default.

One of the key benefits is their low correlation to government and investment-grade bonds, which often comprise the majority of core bond portfolios.

AT1s have a mechanism in place whereby the bonds are converted or liquidated if the bank’s capital falls below a certain threshold. This feature, along with the subordination in the issuer’s capital structure, are what drives the AT1’s high yield. They don’t have to rely on the bank’s credit quality.

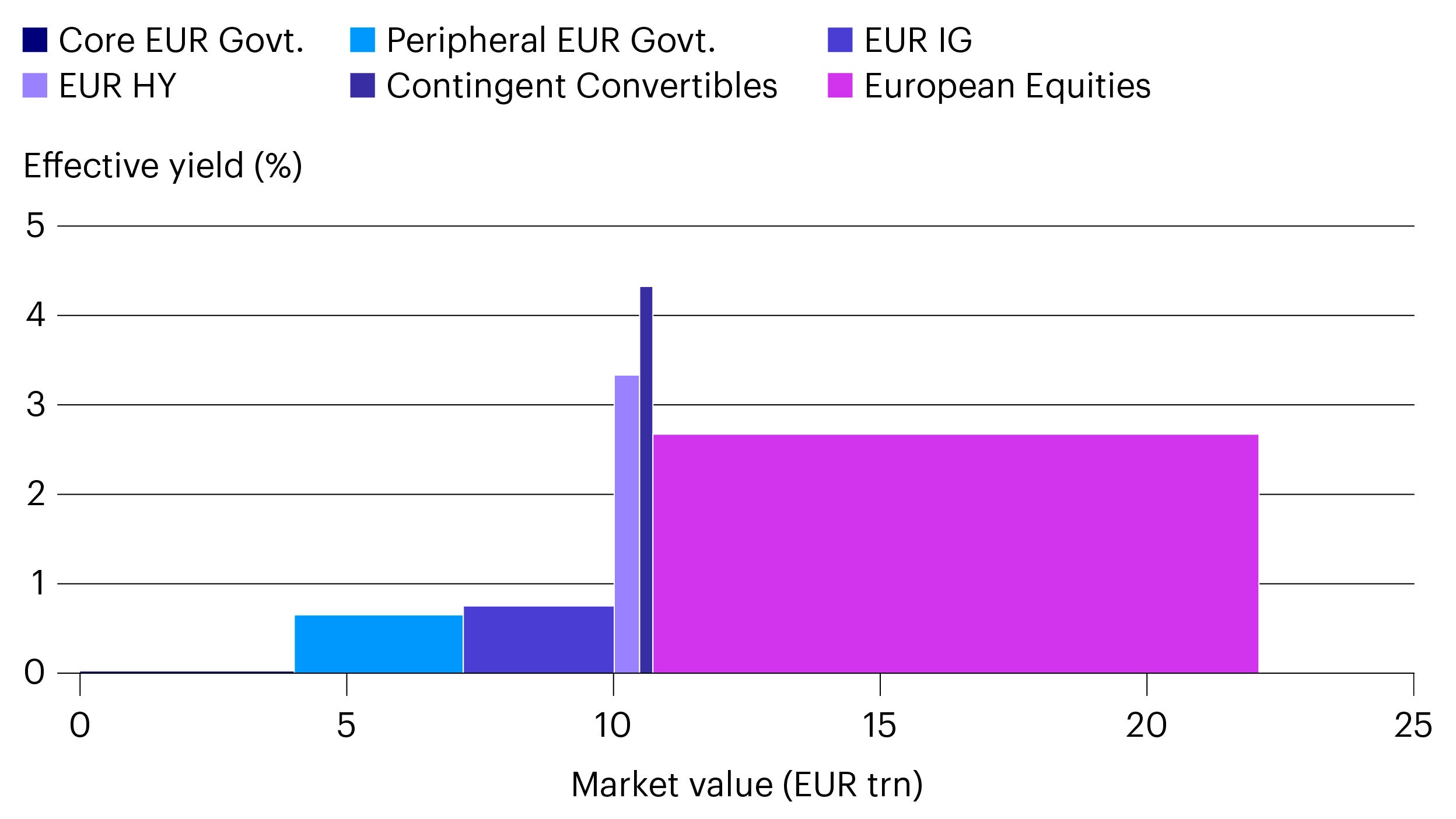

Contingent convertible bond, like AT1s, offer a strong comparison with other asset classes as figure 2 shows

Source: ICE BoA Sterling Corporate Index, ICE BoA European Ccy High Yield Index (£ hgd), ICE BoA UK Gilt Index, Invesco Tactical Bond Fund (UK) Z Acc GBP, Bloomberg, 28 Feb 2022.

Past performance does not predict future returns

ETFs that provide exposure to corporate hybrid bonds offer many of the same features as AT1s although they are issued by companies in non-financial sectors. The yields of corporate hybrids are driven by their subordination, being just ahead of the company’s equity and below senior and other debt.

Corporate hybrids are usually called on their first call date, typically after five years, which gives them a low duration.

Many of the issuers of corporate hybrids are also well-known, investment-grade names. This makes the sub asset class an interesting alternative to taking on increased credit risk in the conventional High Yield segment.

Invesco are the only ETF issuer in Europe to provide specific access to Euro Corporate Hybrid Bonds. This is in addition to the only fixed-rate Preferred Shares, Variable-Rate Preferred Shares and Taxable US Municipal Bond ETFs in Europe.

Innovation is also front and centre within the only High Yield Fallen Angels ETF in Europe that applies a “time-weighted” methodology, which aims to maximise recovery potential.

Beyond these innovative segments, there are opportunities to invest in ETFs which enable investors to express specific monetary policy views. There are ETFs with exposure to specific maturity buckets in Treasuries or other government bonds, as well as those offering exposure across the maturity spectrum.

Invesco has a suite of fixed income ETFs which can help provide exposure to these different options.

Emerging Market debt yields remain attractive

Emerging market (EM) local debt is also a maturing sub-asset class and can offer a compelling opportunity for investors to broaden their fixed income exposure.

One of the major advantages of the asset class is inherent diversification it offers when compared to developed market bonds. That’s because the asset class enjoys higher relative yields and, during periods of dollar weakness, there is an opportunity to benefit from the strength of local currencies. These may provide uncorrelated returns driven by different parts of the global market.Beyond this, there can be unsynchronised monetary and fiscal policy moves which raises the prospects of active investors taking advantage of changing risk premia. As inflation increases globally in 2022, central banks in developed economies are only gradually increasing interest rates.

Yet many emerging market economies acted sooner, with 23 raising rates in 2021. This provides the scope for a traditional carry trade, as investors can borrow where rates are low and invest where they are high.

The differences in real rates, interest rates once inflation is taken into account, are attractive relative to their developed market peers following falling EM valuations in 2021. Real yields on 10-year EM bonds are pretty much in the middle of their historical range. By contrast, equivalent DM real yields are in record negative territory which could provide healthy return potential. [1]

Evidently, the conflict between Russia and Ukraine has led to some heightened volatility across financial markets. However, for emerging markets, the headwinds caused by the invasion may be limited.

Higher and stable commodity prices will be a benefit for the longer term, as Russian sanctions will last for an extended period of time. While this tailwind will be somewhat offset by tighter financial conditions in the US, the overall impact could be positive for most EM countries.

As global growth remains resilient, conditions could remain positive for international fixed income, led by emerging markets, to outperform over the next two to three years.

Explore the Invesco Emerging Markets Local Debt Fund and the benefits of emerging market corporate debt to find out more about the opportunities in less traditional economies.

Discover (un)fixed income

We know investors are living through an unprecedented period of market disruption and volatility. As we face these new realities, we think taking an unfixed approach to fixed income is an advantage.

From active to passive, from mainstream to innovative, we have the expertise, the strategies and the flexibility needed to match your objectives as markets evolve.