Key takeaways from the Opportunity in European Private Credit webinar

Discover how European upper mid‑market private credit may offer resilient income, attractive risk‑adjusted returns, and efficient portfolio diversification.

As the long-term return expectations across traditional markets are declining and concerns around the impact of inflation rising, navigating the markets will be even more challenging.

The unique characteristics of alternative assets means that they typically generate higher returns than what might be found in public market assets, so capturing the benefits of private markets will be increasingly critical to achieving key investment outcomes.

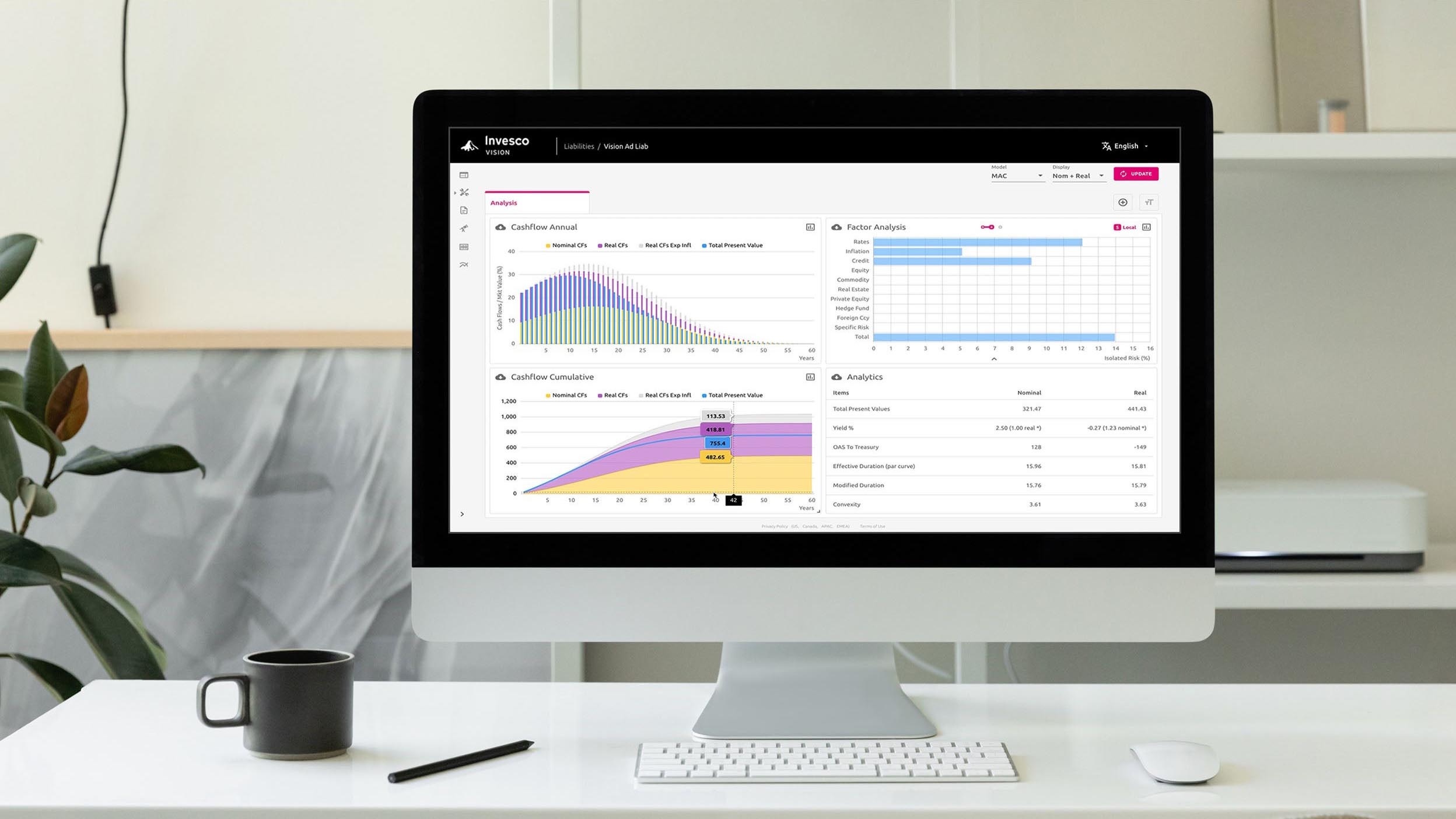

Invesco Vision is a state-of-the art, proprietary portfolio diagnostics tool created by practitioners to “pre-experience” how different variables affect investment outcomes. Learn more about our unique custom portfolio analysis service.

With allocations to alternatives increasing, investors need to consider the drivers of risk and return to align investments with desired outcomes. Below are three thematic objectives that institutions may seek when designing alternative portfolios; income, real return and growth.

| Asset | Allocation |

|---|---|

| Senior Direct Lending | 35% |

| Alt Credit | 20% |

| Real Estate Debt | 20% |

| Infrastructure Debt | 10% |

| Second Lien/Mezz Corporate | 10% |

| Senior Loans | 5% |

| Asset | Allocation |

|---|---|

| Real Estate | 43% |

| Infrastructure | 32% |

| Natural Resources | 25% |

| Asset | Allocation |

|---|---|

| Large Buyout | 27.5% |

| Real Estate Value-Add | 17.5% |

| Opportunistic & Distressed | 15.0% |

| Venture | 12.5% |

| Middle Market Buyout | 10.0% |

| Growth Equity | 10.0% |

| Real Estate Opportunistic | 7.5% |

Key takeaways from the Opportunity in European Private Credit webinar

Discover how European upper mid‑market private credit may offer resilient income, attractive risk‑adjusted returns, and efficient portfolio diversification.

Unlocking Opportunities: Private Real Estate Debt for the LGPS

Private real estate debt offers the LGPS a way to diversify their portfolios, generate stable income streams, and match their long-term liabilities.

A new partnership to help investors rethink the possibilities of private markets

We are excited to announce a new partnership designed to help investors realise the full return potential of the global economy by unlocking new opportunities in private markets.

Private credit: Attractive risk-adjusted return potential in the new year

The private credit market delivered strong returns in 2025. Can investors expect the same in 2026? Our experts discuss where they’re seeing potential for compelling risk-adjusted returns.

Alternative opportunities: Outlook for private credit and equity, real assets, and hedge funds

Get an in-depth Q3 report from our alternatives experts, including their outlook, positioning, and insight on valuations, fundamentals, and trends.

Discover alternative investments with Invesco, ideal for anyone looking for diversification, inflation protection or capital growth.

Our solutions are comprised of several ranges of advisory models, discretionary models and fund-of-funds, which provide options for clients with income, growth, retirement or responsible investment goals.

Connect with us for an in-depth presentation focused on your investment challenges and opportunities.