Invesco Solutions (IS) is a global independent multi-asset team comprising 65+ professionals based in Europe, the US and Asia. Our assets under advisement total $108 billion.¹

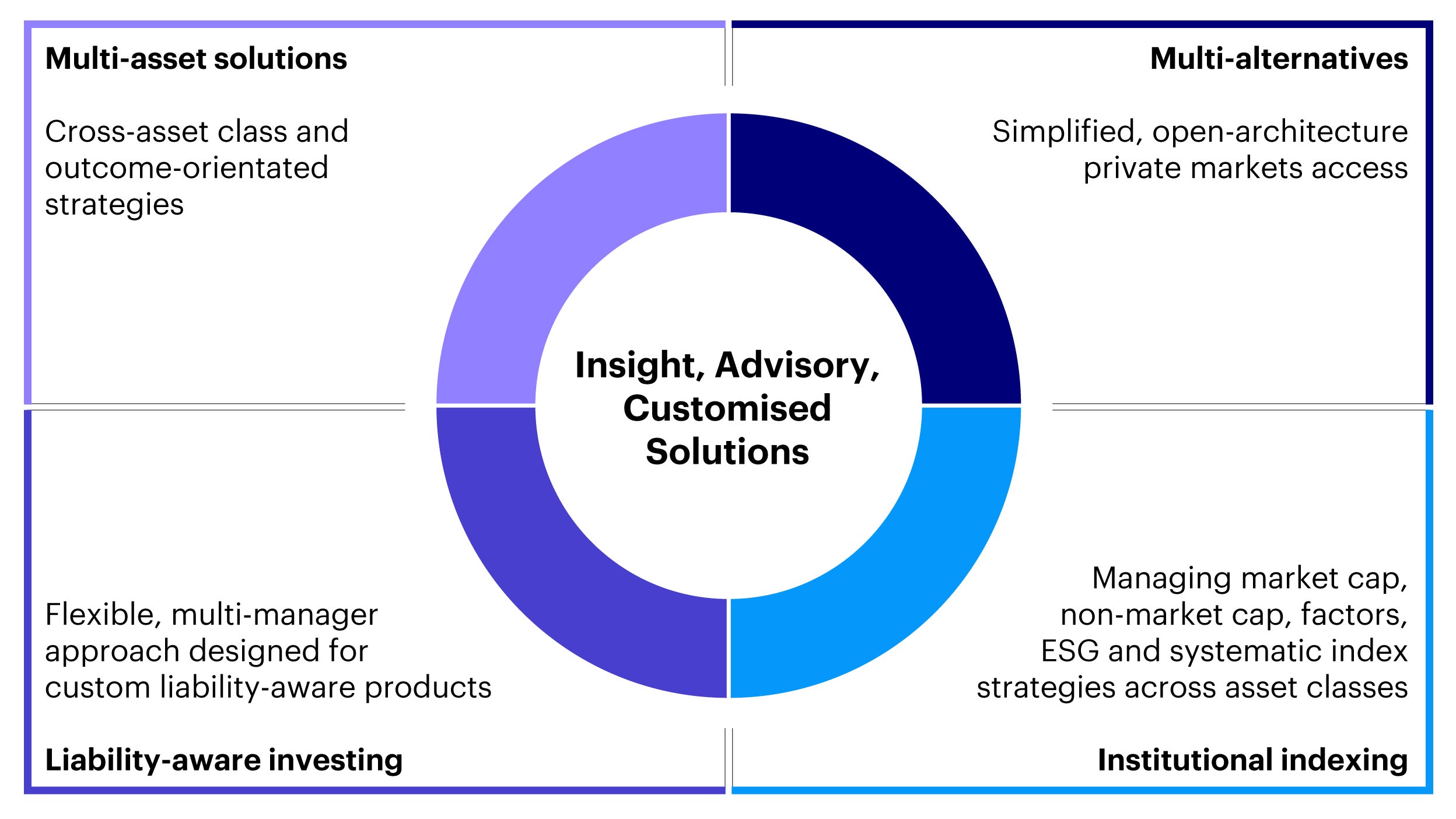

Our purpose is to help clients reduce uncertainties and achieve their investment goals. We focus on combining strategic and tactical asset allocation with manager selection capabilities, delivering outcome-oriented solutions.

We partner with you to fully understand your goals. We then harness strategies across Invesco’s global spectrum of active, passive, factor and alternative investments to address your unique needs.

From robust research and analysis to bespoke investment solutions, our team brings insight and innovation to your portfolio construction process.