Real estate Unlocking Opportunities: Private Real Estate Debt for the LGPS

Private real estate debt offers the LGPS a way to diversify their portfolios, generate stable income streams, and match their long-term liabilities.

Private real estate debt offers the LGPS a way to diversify their portfolios, generate stable income streams, and match their long-term liabilities.

To optimise income yield and growth, we look for opportunities that are supported by long-term structural demand drivers, or where active management can enhance cash flows.

Private real estate debt offers insurers a way to diversify their portfolios, generate stable income streams, and match their long-term liabilities.

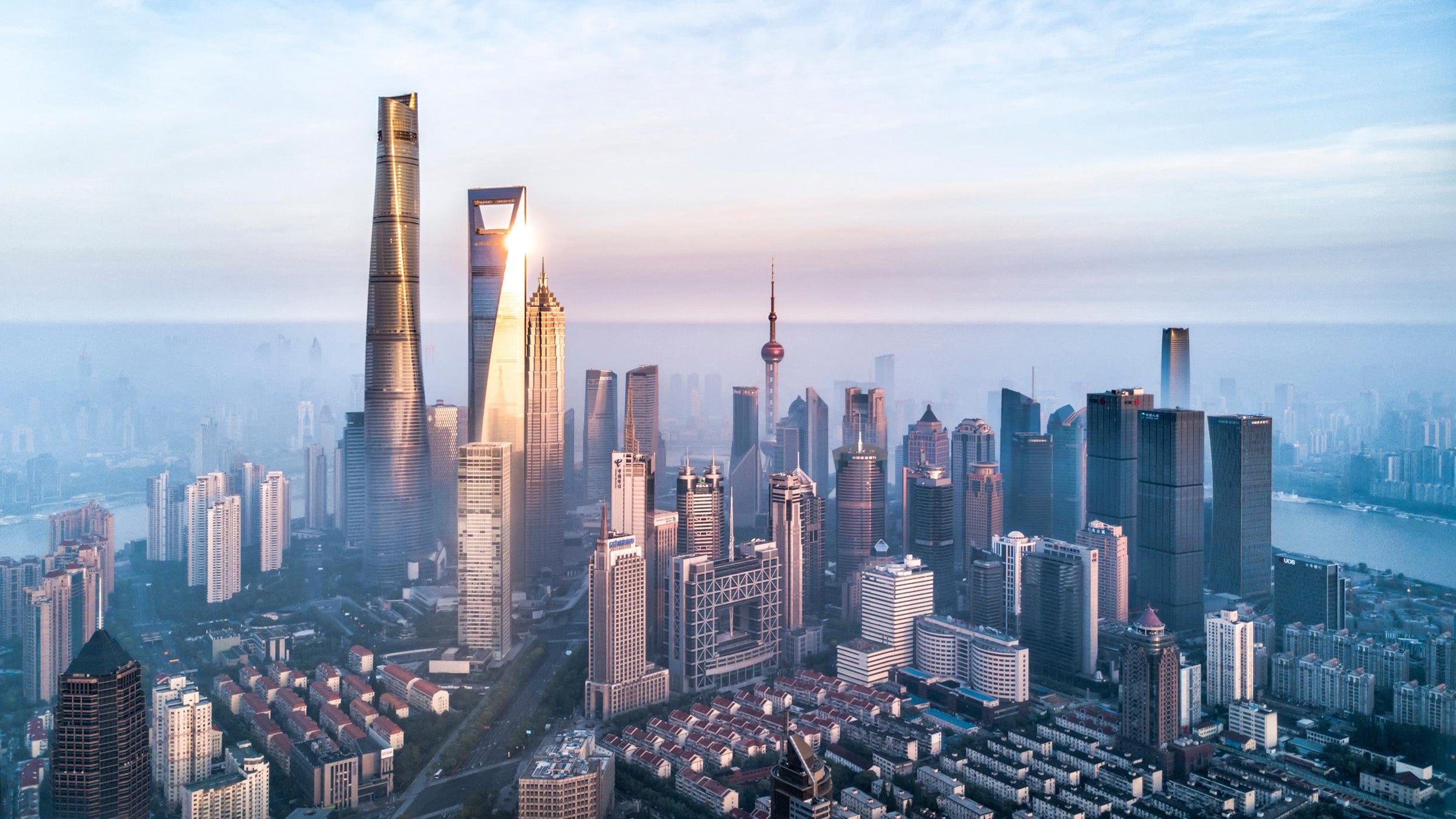

Why APAC real estate may offer growth, diversification, and value for institutional investors amid global market uncertainty in 2025.

Reduced cross-border investment in new US commercial real estate may impact US and global property sectors, markets, and assets differently.

Is the current short-term noise and volatility an early indicator of a cyclical movement or a structural shift in commercial real estate investing?

Invesco Real Estate’s value-add team discusses its approach in a challenging market highlighting a disciplined, local team-based execution programme and strategic investments in sectors like logistics and living.

Invesco Real Estate, the £67.2bn global real estate investment business of Invesco Ltd. (NYSE: IVZ), recently announced that it has been appointed by Legal & General’s Private Markets Access Fund to provide real estate exposure in the US and Asia.

Levelling Up involves spreading opportunity equally, ending geographical inequality and encouraging private sector investment. Can Build to Rent support this ambition and work for the Local Government Pension Scheme?