Defined contribution pensions

For more than 30 years, Invesco has worked alongside defined contribution schemes and consultants across the globe to help optimise member outcomes.

Flexibility and personalisation: The importance of adaptable and personalised retirement planning to meet diverse member needs.

Regulatory alignment: The role of regulation in shaping future pension strategies and ensuring member protection.

Three access pathways: The significance of advised, guided, and default pathways in delivering better retirement outcomes.

In the past the savings and pensions landscape was segmented, separated by a fixed line between savings and investments and defined benefit pensions.

With the move towards defined contribution schemes, the lines between pensions and savings have become blurred. For some individuals, defined contribution assets are now being used as an alternative savings solution for retirement.

This shift was initiated by a move from defined benefit pensions, where the amount an individual receives is based on one’s salary and how long they’ve been part of the scheme, to defined contribution pensions, where the amount one receives is based on how much they and their employers invest and how their investments perform.

Government backed pension reforms empower people to actively manage their pensions and financial future, which is a change from the passive approach of the past. This has initiated a transfer of risk from corporates to individuals. However, this change has added a layer of complexity for pension holders to manage.

Regulation is increasingly shaping the future of retirement planning. More individuals are taking charge of their own retirement savings, often adopting a "do-it-yourself" approach. Regulatory measures have been designed to empower engaged members with the resources necessary to make informed decisions about their investments and withdrawals.

For unengaged members, who may default into retirement drawdown schemes, regulation aims to establish a structured support system that ensures they receive adequate resources and protection.

It is important that we build a financial infrastructure to underpin all three pathways for decumulation:

There are now three clear pathways individuals can use to manage their retirement savings: Through a pension scheme, through an adviser or a ‘do it yourself’ approach through a guided route. Regulatory change impacts all three, but the guided route is likely to see the most change given the potential move to targeted support.

At Invesco, we engage with clients who span all three access pathways and believe we can learn important lessons from all three that can help us deliver better outcomes for defined contribution scheme members. The important factor driving our approach is consistency regardless of the access pathway.

For example, flexibility is a key factor that underpins retirement planning. While this seems very much a personal, behavioural, factor influencing retirement, it directly impacts which building blocks are appropriate for someone entering retirement. If flexibility is desired, a guaranteed income product that is seen as a one and done decision is unlikely to be appropriate. A more flexible stable income product could be deemed a better choice for delivering the income requirements of that scheme member.

Personalisation has been seen as an outcome reserved for those who are able to access a financial adviser. We do not believe this should be the case going forward. While personalisation one for one within a pension scheme is complex to deliver, a degree of personalisation is possible by introducing the concept of personas. The introduction of targeted support would allow individuals to choose a combination of building blocks or select specific funds that are most appropriate for them, providing a more personalised experience for those self-managing their pension access through a guided route.

Given personalisation and flexibility are both critical to keeping people invested and engaged in their pensions, we believe a solutions mindset needs to lie at the heart of investment design for retirement offerings. Building solutions that deliver specific outcomes and giving members access to investment building blocks that were designed for delivering investment outcomes that are most appropriate for each stage of their own retirement journey, are critical to improving member outcomes. There is no one size fits all approach.

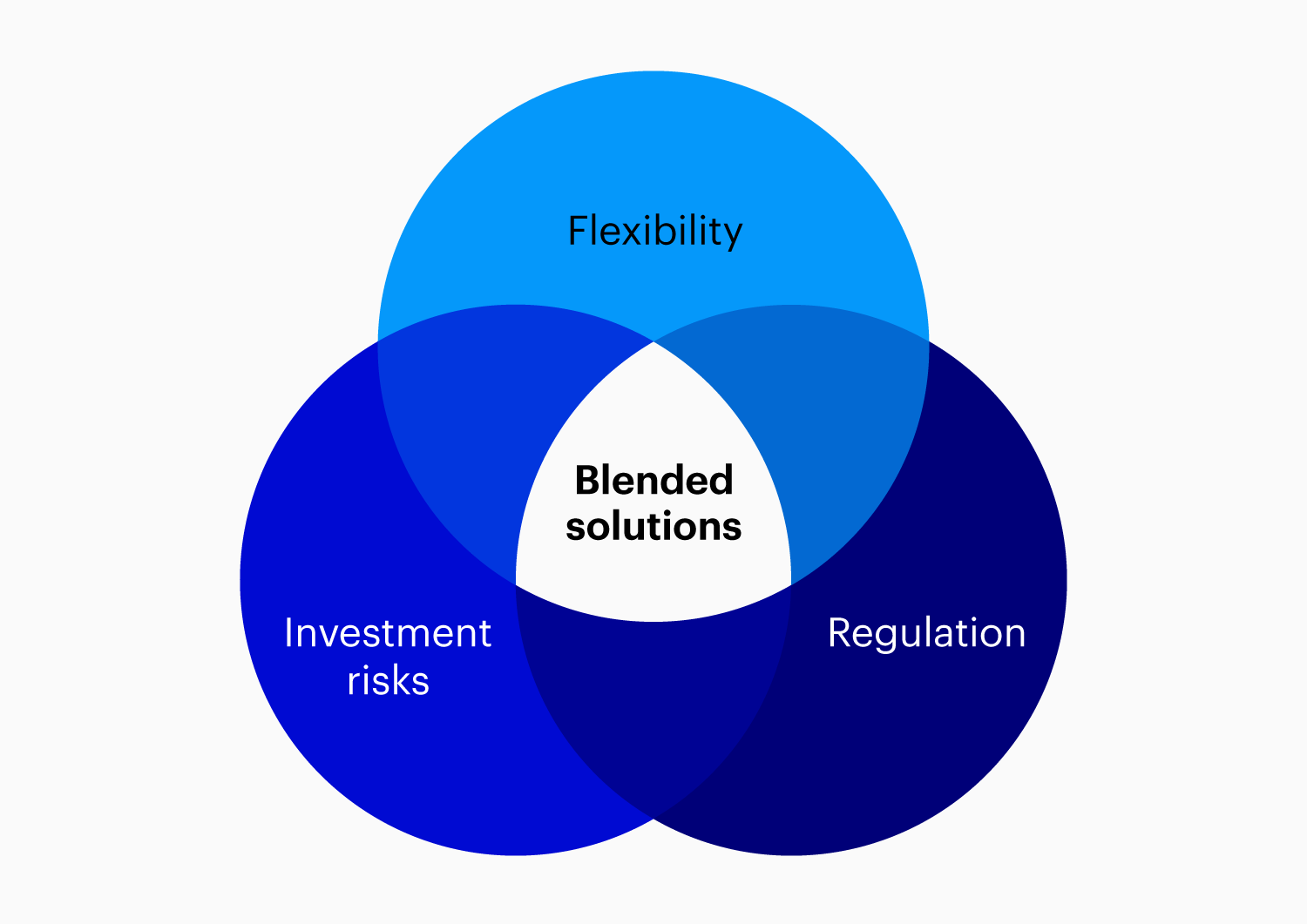

Applying a solutions mindset helps us solve for three key aspects of investing for DC - flexibility, regulation and investment risks. While this may seem overwhelming, it helps us define the investment universe and map out the key investment outcomes we can deliver. It is also important to include the ‘philosophy’ behind the access pathway. For example, what is the broad approach that the pension scheme wants to embed in their DC scheme? We can then work with the pension scheme to incorporate that philosophy into the available building blocks and overall approach to portfolio construction.

The more we speak with our clients the more we understand the increasing need for ease of delivery to allow DC members to engage with their pension and manage their retirement savings plan. Partnering with digital platforms and fully understanding a member’s journey to investment is critical so that we can deliver the most appropriate investment outcome to each member. We have put digital delivery at the heart of our strategy as part of our holistic approach to DC in the UK across all client channels.

We can also look across the world to understand how learnings from other DC markets can help inform the UK defined contribution market. In a lot of ways, the UK is leading the way in pensions innovation, and we believe solving for all three access pathways will underpin innovative product development going forward. These three access pathways appear far more aligned and interdependent in the UK than in other parts of the world. From a flexibility perspective there are several investment approaches such as stable value in the US that have embraced an accounting and regulatory framework specific to the US to enable delivery of a more predictable outcome for retirees. We need to ensure we deliver something similar for the UK DC market.

Our global nature and presence in several regions mean that we have a responsibility to care for and support the market as we navigate the changing landscape. Given the rapidly evolving environment and the numerous challenges we face ranging from the regulatory framework to member engagement and improving retirement outcomes we recognise that embracing a partnership approach in the retirement space is more crucial than ever.

We have adopted a member outcome focused partnership approach to collaborate with key stakeholders, including advisers, trustees, in-house team experts, platforms, regulators, and industry bodies. Our goal is to identify the challenges that our industry needs to address and outline the necessary steps to tackle issues such as flexibility, investment risk, and the evolving regulatory landscape. We are supporting the development of a strategic investment framework that promotes adaptability to future changes and aims to more effectively manage investment risks for members, including sequencing and longevity risk.

We strongly believe that by combining insights and resources, we can create comprehensive solutions that transition members across the accumulation, pre-retirement, and post-retirement phases. Our goal is to provide enough flexibility for members to design and access propositions across all pathways: advised, guided, and default strategies.

For example, we have developed a solution for the advised route in partnership with Just Group. We also recently announced a partnership with Guiide and Pathlines to launch a guided drawdown for non-advised pension savers, following the ‘self-managed’ pathway. This first of a kind guidance-based platform, gives defined contribution savers access to self-service guidance tools to manage their own drawdown, whether they are near, already at or post-retirement. Additionally, we are collaborating with Master Trust providers and other stakeholders to identify the necessary components for the default strategy route, particularly as regulations firm up around small pot members and level of personalisation within the default strategies. Our aim is to allow for sufficient personalisation across all access routes.

Ultimately, we hope this partnership approach will foster innovation and resilience, allowing us to tackle current and future challenges within the industry.

We are dedicated to delivering customised DC investment solutions and strategies, thought-provoking insights and tools, and responsive client service to support our shared goal: helping members achieve a comfortable retirement.

For more than 30 years, Invesco has worked alongside defined contribution schemes and consultants across the globe to help optimise member outcomes.

Retirement isn’t what it used to be. The shift from Defined Benefit (DB) to Defined Contribution (DC) schemes and new pension freedoms are reshaping how millions fund their retirement.

Discover how Bond Income Plus can support flexible retirement planning in the UK’s evolving pension landscape. Learn how retirees are adapting post-pension freedoms and managing income sustainability.