Insurance Insights Q4 2024: Key considerations for insurers

Jaijit Kumar, Invesco’s Head of Asia Insurance Solutions shares his Q4 analysis on key considerations for insurers.

This newsletter brings the latest topics impacting insurers, aimed to help those managing investment portfolios while considering an insurer’s business, regulatory and solvency needs.

For the first edition of our Invesco Insurance Insights for 2025, we illustrate the approach used to assess/re-assess the all-important strategic asset allocation – we consider how return expectations for various asset classes have changed over the year, whether portfolios are still positioned appropriately, and if incorporation of different asset classes can help make these portfolios more efficient.

These series of Insights are typically structured to highlight and illustrate steps and processes that insurers can refer to when managing portfolios and how they can seek out efficiencies at various levels of asset allocations. Indeed, we believe that such analyses should be carried out on a regular basis.

As always, please do not hesitate to reach out to us – your thoughts on such topics are always much appreciated.

Jaijit Kumar, Head of Asia Insurance Solutions

Capital Market Assumptions (CMAs) are critical inputs for asset allocation analyses and allow insurers to assess their portfolios on an ongoing basis. In this video, Jaijit Kumar and Chang Hwan Sung discuss the key insights from CMAs compared to last year. Watch the video to learn more.

Hello everyone – welcome to our first edition of the Invesco Insurance Insights newsletter for 2025 – where we illustrate the process of reviewing a Strategic Asset Allocation – incorporating the latest Capital Markets Assumptions. The main elements we look at – what have the last 12 months brought in terms of changing expectations, are the portfolios still able to deliver on long-term prospects, and finally consider adjustments that could enhance the profile of those portfolios.

While insurance portfolios tend to be designed for the long-term, it remains important to assess them frequently to ensure they are still appropriate and have the capability to deliver the desired results.

In this newsletter, we’ve looked at the impact of adding certain asset classes - including private markets. And, of course, it remains important to have a deep and thorough understanding of any such new asset classes, and to ensure that portfolio parameters remain well managed and contained under various scenarios and in accordance with an insurer’s risk appetite.

As always, we hope that this topic will be of benefit to you in your on-going assessment, construction, and management of portfolios, and we’ll be more than happy to discuss any of these aspects further.

Thank you.

In this analysis, Jaijit Kumar, Head of Asia Insurance Solutions shares his Q1 2025 strategic asset allocation review and illustrates how insurers can enhance their portfolios using updated capital market assumptions. He then evaluates which asset classes can be incorporated into an insurer’s portfolio to improve the risk-return profile, namely how the efficient frontier improves with an increase in exposure to private markets.

Jaijit Kumar, Invesco’s Head of Asia Insurance Solutions shares his Q4 analysis on key considerations for insurers.

Jaijit Kumar, Invesco’s Head of Asia Insurance Solutions shares his case study for Q3 2024 which looks at optimizing insurers’ fixed income portfolios.

Jaijit Kumar, Invesco’s Head of Asia Insurance Solutions shares his Q2 2024 review of Strategic Asset Allocations (SAAs) using multi-alternatives.

David Chao and Thomas Wu in Invesco’s GMS Office share their macro outlook for Q1 2025. They believe the overhang of US policy uncertainty is starting to weigh on consumer and business sentiment. As US equities face headwinds, they are positive on Chinese and European stocks and underscore the importance of regional diversification. They also think alternatives, including global infrastructure and hedge funds look attractive relative to traditional assets as they offer a higher return-to-risk than US equities.

Invesco Solutions is proud to present our 2025 Capital Market Assumptions providing the long-term estimates for over 170 major asset classes to aid in strategic and tactical asset allocation decisions.

Charles Moussier, Head of EMEA Insurance Client Solutions shares his views on the outlook and opportunities for Insurance clients, including why the Insurance team are underweight equities relative to fixed income and may see opportunities for insurers in private credit.

Our experts unpack the 2025 market outlook on the evolving private credit market. We explore the implications of recent trends on bank loans, distressed credit and direct lending.

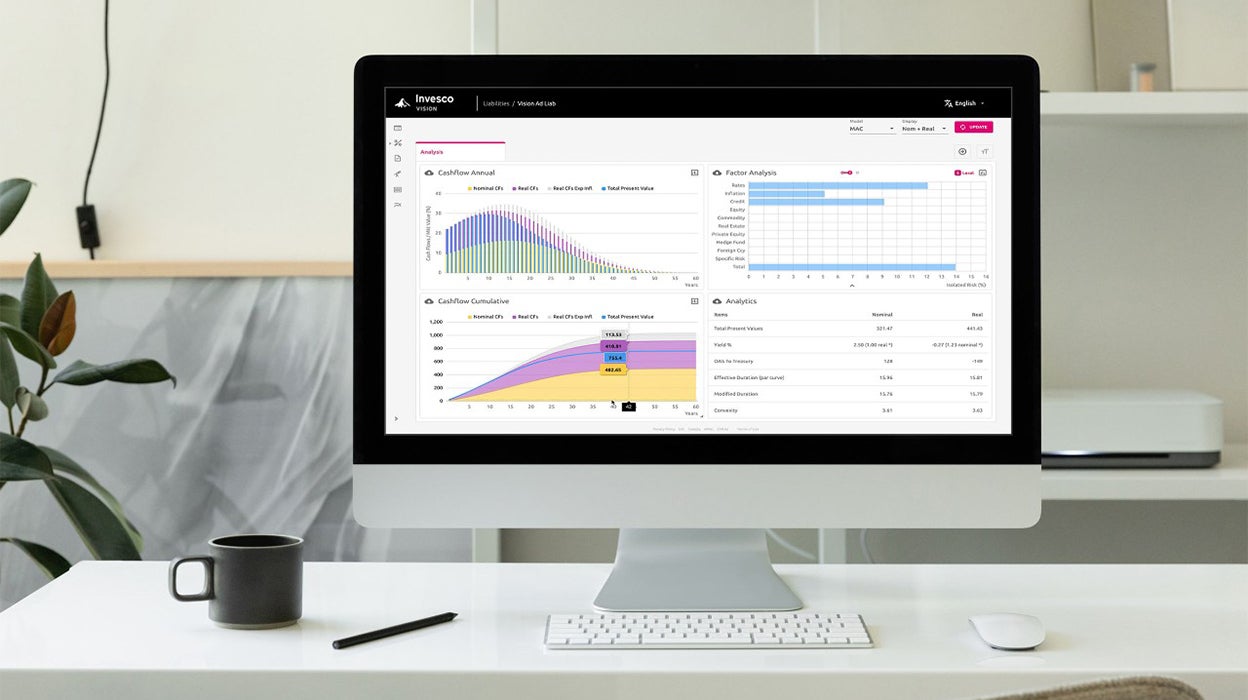

The Vision platform is a state-of-the art, portfolio diagnostics tool to “pre-experience” how different variables affect investment outcomes. By identifying risk and return drivers, including under certain risk-based capital regimes, as well as exposures to an array of factors, Vision effectively characterizes the inherent risks in a defined liability or cash flow profile to identify optimal investment strategies.

Request a demonstration of the complimentary portfolio management research and analytics service.