Global Fraud Alert

Fraud and scams are global threats, increasingly fueled by technology and operating across borders with growing sophistication and scale.

Frauds may be perpetrated through fake financial promotions and advertisements. Scammers may use the names of genuine firms such as Invesco, or similar name variations to give a false impression of legitimacy or with high returns.

We urge members of the public to exercise extreme caution when pursuing opportunities through advertisements even in well-known public places e.g. google. Always verify potential opportunities through a firm’s publicly available contact information.

For your security, we never request, share, or send information related to accounts, transactions, or any sensitive business or personal details via WhatsApp or other messaging apps. Any text or communication that references the above and claims to be from or associated with Invesco is fraudulent. Please rely only on our official communication channels.

Invesco’s official email domain: invesco.com

1. WhatsApp Investment Fraud

WhatsApp investment fraud involves scammers creating fake investment groups on the messaging app, impersonating financial experts or institutions, and luring victims with promises of high returns—only to steal their money once trust is established

- Scammers lure victims via WhatsApp groups posing as investment educators or experts.

- Victims are introduced to fake cryptocurrency platforms and given “free” crypto to test.

- Contracts and apps are used to simulate legitimacy (e.g., “AI Wealth Creation” agreements).

- Withdrawal of profits is blocked unless victims pay additional fees or commissions.

- Often involves impersonation of legitimate firms or professionals (e.g., use of legitimate images and photos)

2. Cryptocurrency Scams

Cryptocurrency scams are fraudulent schemes that trick individuals into investing in fake digital assets or platforms, often using social engineering, fake websites, or impersonation to steal funds or personal information.

- Known as “pig butchering” scams—scammers build trust over time before stealing funds.

- Victims are contacted via social media, dating apps, or text messages.

- Fake platforms show false profits to encourage more investment.

- Scammers often use romantic or emotional manipulation to gain trust.

- Withdrawals are blocked, and victims are asked to pay more to access funds.

3. Social Media Investment Fraud

Social media investment fraud involves scammers using platforms like Facebook, Instagram, or WhatsApp to promote fake investment opportunities, often impersonating financial experts or firms to lure victims into transferring money or personal information.

- Fraudsters use platforms like Instagram, Facebook, and WhatsApp to promote fake opportunities.

- They impersonate brokers or use fake testimonials and celebrity endorsements.

- Victims are directed to fake websites or WhatsApp groups for “expert advice.”

- Scammers simulate stock trading or crypto investing to build credibility.

- Pressure tactics and urgency are used to push victims into investing.

4. Business Email Compromise (BEC)

Business Email Compromise is a type of cybercrime where attackers impersonate a legitimate business contact—often through a compromised or spoofed email account—to trick employees into transferring funds or sensitive information.

- Unusual or Urgent Requests (sudden requests for wire transfers, gift card purchases, or sensitive data)

- Spoofed or Slightly Altered Email Addresses (email addresses that closely resemble legitimate ones (e.g., john.kelley@example.com vs. john.kelly@example.com).

- Impersonation of Executives or Legal Counsel (scammers pose as CEOs, CFOs, or attorneys to pressure individuals into acting quickly)

5. Fake Job Postings

Fake job posting scams involve fraudulent listings that impersonate legitimate employers to steal personal information or money from job seekers, often by promising high pay, requesting upfront payments, or conducting fake interviews.

General Red Flags

- Unsolicited contact via phone, email, or social media.

- Pressure to act quickly or fear of missing out.

- Promises of high returns with little or no risk.

- Unlicensed professionals or firms not registered with regulators.

- Requests for secrecy or to recruit others.

- Unregistered products or lack of proper documentation.

- Complex strategies that are hard to understand.

- Overly consistent returns regardless of market conditions.

- Fake testimonials or celebrity endorsements (Deepfakes or AI)

- Suspicious job offers (including those that require you to make a payment)

Payment & Communication Red Flags

- Asked to pay via gift cards, wire transfers, or cryptocurrency.

- Evasive answers or refusal to provide clear details.

- Unprofessional behavior, such as avoiding calls or meetings.

- Fake websites or apps mimicking legitimate platforms.

- Emails from unofficial Invesco domains (email other than @invesco.com)

While we do all we can to make our online service secure, there's also a lot you can do to help protect yourself.

1. Protect your PC

Ensuring that your PC is well protected is a critical step in protecting your personal details. Ensure you have a firewall, anti-virus and anti-spyware software installed on your computer and that this is kept up-to-date.

2. Don't write down passwords

Never divulge your username or password to anyone and avoid writing them down. Consider using one of many password vaults available on the Internet to store your passwords, but read reviews and get recommendations first.

3. Change your password regularly

Regularly changing your password can be one of the best defences against someone else accessing your account. Use a different password for every online account.

4. Treat emails with caution

Never respond to unsolicited emails requesting your security details. We will never ask for your security details via email. See How to spot suspicious emails.

5. Don't send your personal information by email

Email is inherently not a secure method of communication. You should never send any personal or account information this way. However, if you're registered for our online valuation service, you can contact us, securely, from your online account. After logging in to your account, select the Secure message link - all the information you send us in this manner is secure.

6. Use secure networks

If you connect to the Internet via a wireless network make sure it's a secured Wi-Fi network (tip - look out for the padlock icon in your browser). If you use a Wi-Fi network that is not secure, be careful about accessing websites that require you to log in with your personal details, or viewing any sites that may show your personal information. No matter how good your anti-virus software and other methods of protection are, if the network is not secure it is open to others to access too. It is therefore possible for your information to be fraudulently obtained.

7. Keep up to date

Checking this site and others, regularly, will help keep you up-to-date with online security and financial crime related matters.

No reputable company will ever ask you to confirm personal or account details by sending you an email. If you ever receive an email, appearing to be from Invesco, asking you to do so, please contact us immediately. It can be incredibly difficult to spot a fraudulent email. If you are ever in any doubt as to the authenticity of an email from Invesco, please call us first, before clicking on any links in the email. Common identifiers of suspicious emails:

Phishing emails:

Phishing emails will copy logos and styles in an attempt to appear genuine. The message may urge you to click on a link within the email which will then direct you to a 'spoof' website that looks like a genuine web page. The website may ask you to enter security details such as account numbers, usernames and passwords. By doing so you may give the fraudsters access to your accounts. If you log in to a website that doesn't have a padlock symbol in the address bar, be suspicious.

False sense of urgency:

Most phishing emails try to deceive you with the threat that your account will be closed or somehow incapacitated if it's not updated right away. An email that urgently requests you to supply sensitive personal information may be fraudulent. Don't be pressured. If you are unsure make enquiries before taking any action.

Fake links:

Many phishing emails include website links that look authentic but instead direct you to a fraudulent website that may or may not have a website address different from the link originally displayed. Always check where a link is going before you click by moving your mouse over the link in the email. Beware if this is different from what is displayed in the text of the link in the email. If it looks suspicious, don't click it.

Attachments:

Similar to fake links, attachments can be used in phishing emails and are dangerous. Never click on an attachment from an unknown source. It could cause you to download spyware or a virus. Invesco will never email you an unsolicited attachment or a software update to install on your computer.

Invesco's email policy:

Exchanging information via email is not a secure method of communication. For this reason, Invesco will never disclose any account specific or personal data in our emails to you. And we won't act upon instructions, received by email, to change your personal details. Forms for changing details on your account can be found on our website. Alternatively, you can call us, and we'll send the forms out to you.

Be suspicious if you receive an email asking you to click on a link to update your details. Do not click on the link.

Invesco will never ask you to send any account specific information by email. If you are in any doubt as to whether the email is from Invesco, please contact us.

Your identity and personal information are very valuable assets. It is easy to fall into the trap of thinking that identity theft only affects other people. Identity theft occurs when your personal information is used by someone else without your knowledge.

It may support criminal activity, which could involve fraud, deception, or obtaining benefits and services in your name. This can be done by taking documents from your rubbish or by making contact with you and pretending to be a legitimate organisation.

Three ways to help protect your identity:

1. Keep your personal information secure

- Be extra careful if you live in a property where other people could have access to your mail. If you have concerns, a bank or credit card company could arrange for you to collect valuable items such as new cards or cheque books from a local branch.

- If you stop receiving mail consider contacting the postal service provider to check whether a mail redirection order has been made in your name without your knowledge. This is a common tactic employed by fraudsters to gain access to your personal data and possibly your identity.

- Tell your bank, card issuer and all other organisations that you deal with in a timely manner if you move house. Ask the postal service provider to redirect any mail from your old address to your new one for a suitable period of time.

- Regularly obtain a copy of your personal credit file from a credit reference agency to see which financial organisations have accessed your details. This is a good way to spot any signs someone may be fraudulently using your identity to apply for services.

2. Keep your documents safe

- Storing documents - Keep your personal documents in a safe place, preferably in a lockable drawer or cabinet at home. Consider storing valuable financial documents such as share certificates with your bank.

- Lost documents - If a valuable document such as your passport or driving licence has been lost or stolen contact the issuing organisation immediately.

- Disposing of documents - Don't throw away entire bills, receipts, credit or debit-card slips, bank statements or even unwanted post in your name. Destroy unwanted documents, preferably by using a shredder.

- Check your documents - Check statements as soon as they arrive. If any unfamiliar transactions are listed, contact the company concerned immediately.

3. Keep your passwords and PINs safe

- Never give personal or account details to anyone who contacts you unexpectedly. Be suspicious even if they claim to be from a well-known organisation such as your bank or the police. Ask for their phone number, check it is genuine and, if so, call them back. Be wary that some scam callers will stay on the phone line and not hang up. To avoid being caught by this make the call back using a different phone to the one you received the call on. If you cannot access another phone, hang up and wait for at least five minutes before you dial out or, alternatively, call a friend or another known phone number to check the phone line is clear before making another call. Remember, Invesco will never call you unexpectedly and we will never ask for your PIN or your full password. Keep them secure.

- Don't use the same password for more than one account. Using different passwords increases security and makes it less likely that someone could access any other accounts.

- Keep your passwords safe and never record or store them in a manner which leaves them open to theft, such as in your purse or wallet.

Tell-tale signs that could mean you are a victim of identity theft

You are at risk of becoming a victim of identity theft, or may already be a victim, if:

- You have lost or had stolen important documents such as your passport or driving licence.

- Post expected from your bank has not arrived or you are receiving no post at all.

- You identify entries on your personal credit file from organisations you do not normally deal with.

- Items have appeared on your bank or credit-card statements that you do not recognise.

- You applied for a state benefit but are told that you are already claiming.

- You receive bills, invoices or receipts addressed to you for goods or services you haven't asked for.

- You have been refused a financial service, such as a credit card or a loan, despite having a good credit history.

- You discover that a mobile-phone contract has been set up in your name without your permission.

- You have received letters from solicitors or debt collectors for debts that aren't yours.

What should you do if you believe your identity has been stolen?

- Take immediate action. Check with credit reference agencies such as Experian, Equifax or Call Credit for any unusual entries and for advice.

- Query any unknown purchases or services with your bank or the company providing them.

- If you believe you are a victim, report the matter to the relevant authorities within your jurisdiction where you will be provided with further guidance and support.

- Notify the relevant postal service provider i.e. Royal Mail or USPS, if you suspect mail theft or that a mail redirection has been fraudulently set up on your address.

- Finally, if you think your account with Invesco may be at risk, please contact us and let us know.

Please send any emails or messages received to BrandProtection@invesco.com.

The guides below will detail the information we need to support our efforts:

- WhatsApp and LinkedIn Reporting Guidance

- How to Forward an Email as an Attachment

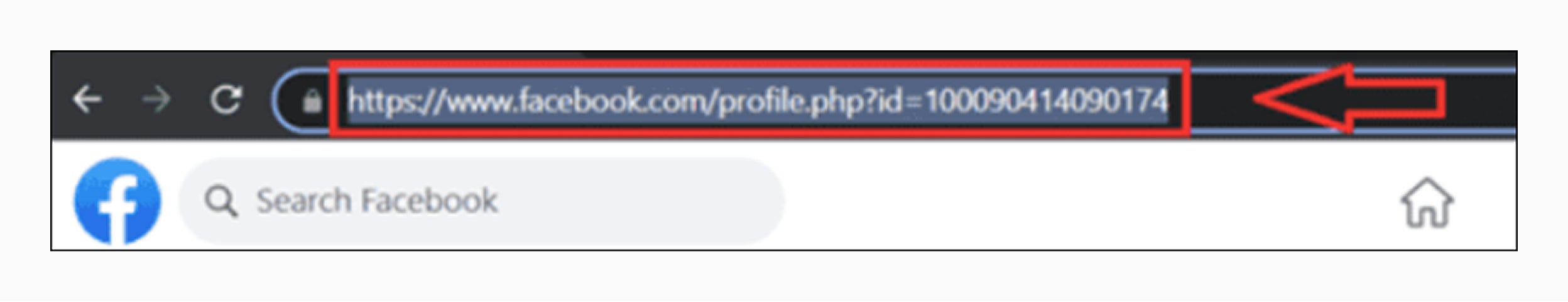

- For any Facebook profiles or groups, please provide a screenshot that includes the page URL:

Please see our current regional or country-specific alerts on known scams

- https://www.invesco.com/ch/en/insights/investment-scam-alert.html

- https://www.invesco.com/de/de/insights/warnung-vor-anlagebetrug.html

- https://www.invesco.com/es/es/analisis-de-inversion/informacion-importante-sobre-estafadores-de-inversiones.html

- https://www.invesco.com/apac/en/institutional.html

- https://www.invesco.com/uk/en/resources/online-security-and-fraud-centre/fraudulent-activity-other-parties-claiming-to-be-invesco-or-invesco-perpetual.html

Additional information

Risks and how to protect yourself from scams |

|

|---|---|

Australia

|

Learn about fraud | Commonwealth Fraud Prevention Centre Home | National Anti-Scam Centre

|

Europe |

Ireland: FraudSMART France: Public Notice Scams Germany: BKA Cybercrime Portugal: Safe Communities Portugal Fraud and Scams

|

Hong Kong |

Home | Anti-Deception Coordination Centre(ADCC) Cyber Security and Technology Crime | Hong Kong Police Force

|

Japan |

|

Singapore

|

|

Taiwan |

|

United Kingdom |

FCA ScamSmart Investment Checker

|

United States |

FTC Identity Theft and Online Securty Internet Crime Complaint Center (IC3): Home Page Fraud and scams | Consumer Financial Protection Bureau

|

How to report a scam |

|

|---|---|

Australia

|

Report fraud | Commonwealth Fraud Prevention Centre Report and recover | Cyber.gov.au

|

Europe |

|

Hong Kong |

Hong Kong Police Force | e-Report Centre

|

Japan |

SNS上の投資詐欺が疑われる広告等に関する情報受付窓口の設置等について:金融庁

|

Singapore

|

|

Taiwan |

|

United Kingdom |

|

United States |

|

Our products and services

At Invesco, we want to make sure you have access to the right information, including regional products, tools and insights. Explore our investment capabilities, vehicles and other content by selecting the appropriate region and role.