Alternatives Private credit quarterly roundup: Liberation Day market responses

The experts from Invesco’s bank loan, direct lending, and distressed credit teams to share their views for the second quarter of 2025

Invesco’s US$1.1 trillion1 investment management platform puts us in an excellent position to offer a vast array of investment solutions to fit almost any investor need

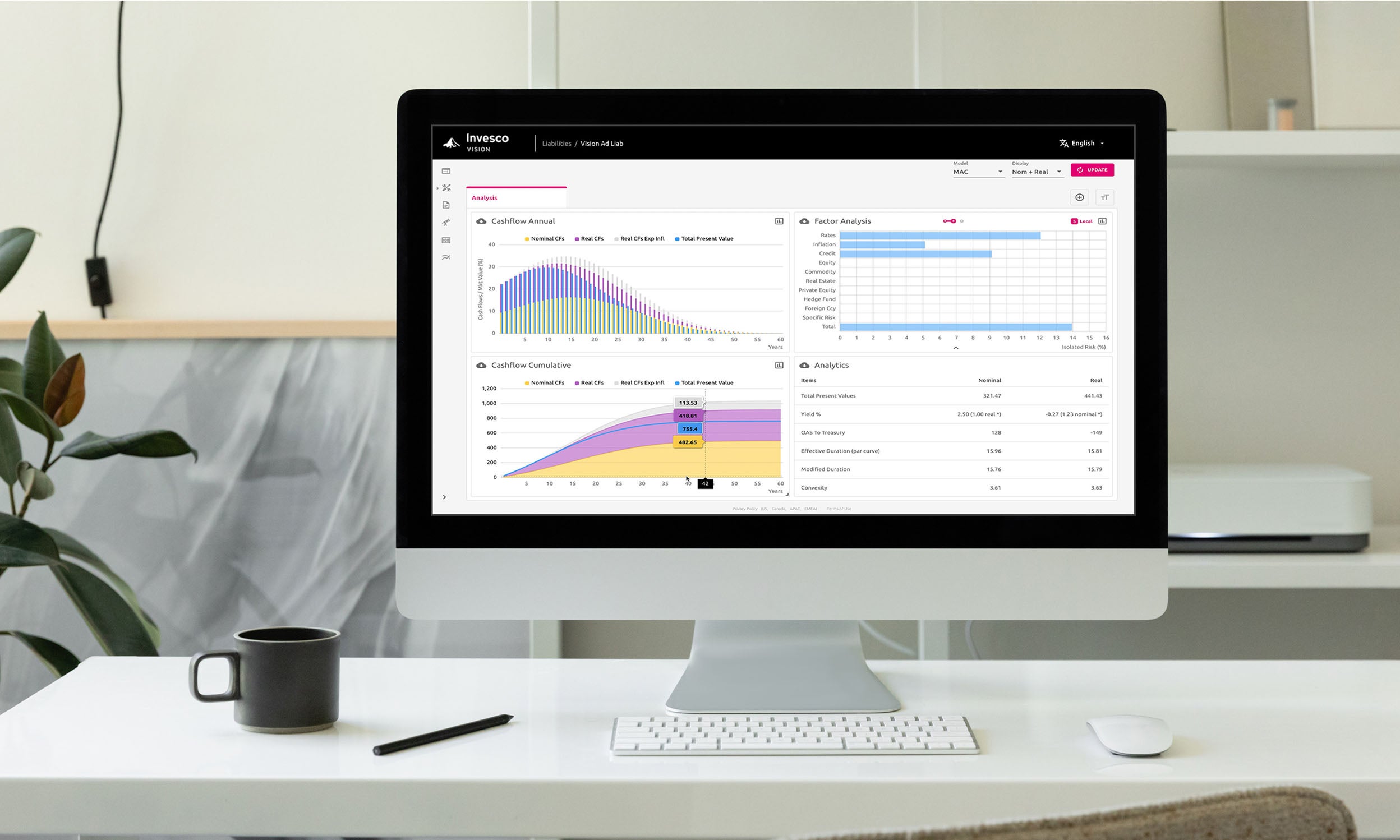

Institutional portfolios are carefully designed to deliver predictable outcomes and insulation from market volatility. Yet even the most sophisticated portfolios can have blind spots, concealing unintended exposures which could undermine those goals. That’s where we come in.

Our experienced investment professionals work as an extension of your team to develop tailored solutions that meet your needs and help you target your unique objectives. We combine an outcomes-based focus with innovative analytics to develop a wide range of custom solutions designed around your goals.

Learn more about our unique custom portfolio analysis service.

Translate portfolio theory into practical solutions with our capital markets forecasts for returns, risk, and correlations.

Invesco Solutions team

The experts from Invesco’s bank loan, direct lending, and distressed credit teams to share their views for the second quarter of 2025

Get an in-depth Q2 report from our alternatives experts including their outlook, positioning, and insight on valuations, fundamentals, and trends.

The Invesco Solutions team shares their views on a range of private market asset classes and investment implications for insurers.

We can connect you with a team focused on your investment needs. Reach out to learn more about how our capabilities and services can help support your goals.

NA3443687

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.