Last week, we saw several important developments in Asia that have implications for markets, including elections in Taiwan, a new high for Japanese equities, and disappointing data on consumer and producer prices in China. What could this news mean for investors?

Taiwan: Election results could help reduce tensions with China

Democratic Progressive Party (DPP) candidate Lai Ching-te, also known as William Lai, was elected as Taiwan’s next president. However, the DPP lost its majority in the legislature. The end result looks like divided government: The more pro-independence candidate won the presidency, while the less pro-independence Kuomintang party gained seats in the legislature.

Overall, the DPP has lost momentum compared to the 2016 and 2020 elections, which could open the way for reducing tensions between Taiwan and China on cross-strait issues. It’s worth noting that Lai also dialed down his rhetoric in recent months and has struck a more conciliatory tone, sounding more like his predecessor. Also of note, the US government delegation to Taiwan will consist of former rather than current officials, in line with previous post-election delegations since Taiwan established direct presidential voting. All this adds up to an approximate return to the status quo, which in our view should help stabilize cross-strait relations and calm China-US relations too.

One key reason for a maintenance of the status quo is a desire to avoid possible disruption of economic growth for China and Taiwan. Heightened tensions could cause significant economic disruption, and such realities may discourage a ratcheting up of hostilities.

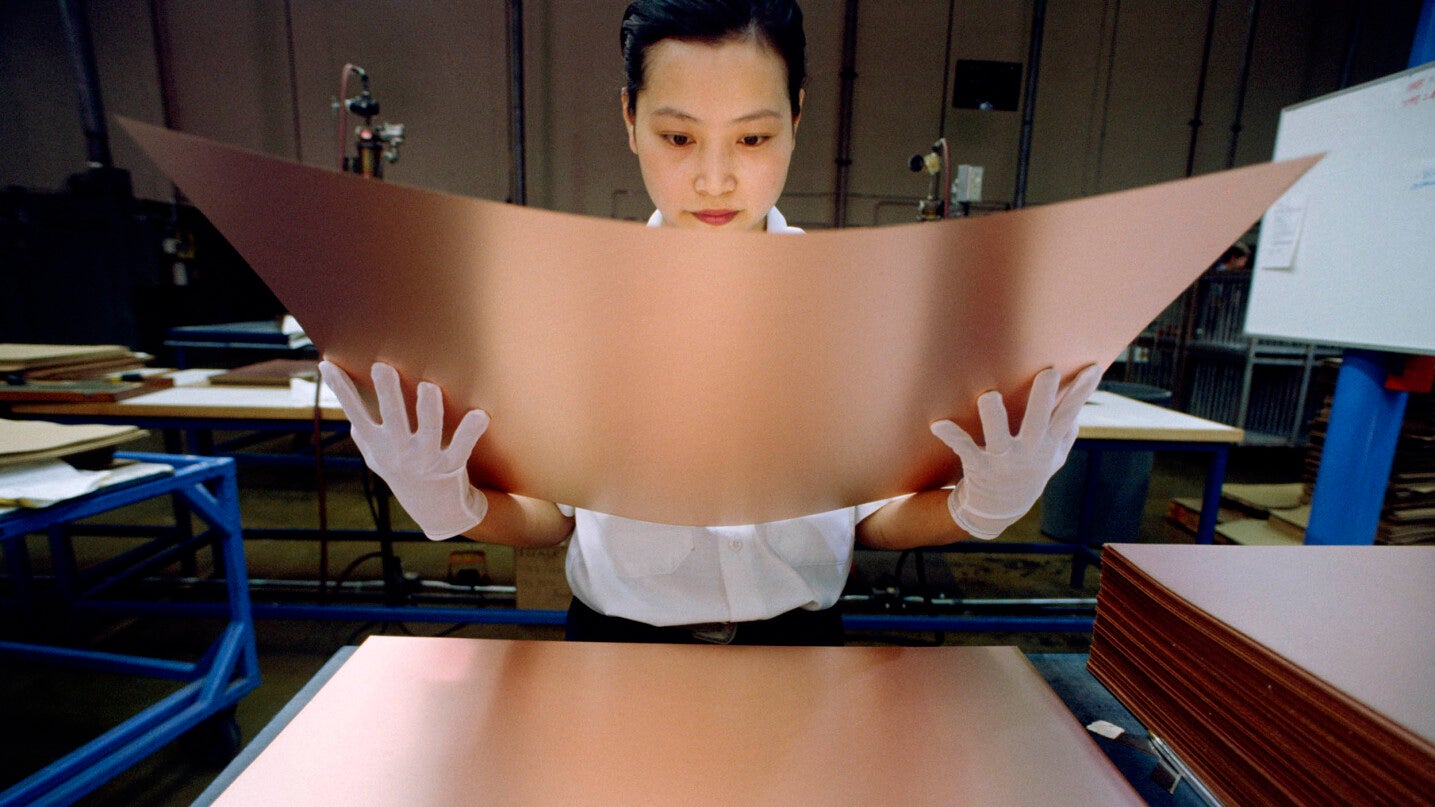

As a result, we believe the political risk premia for Taiwan assets is likely to fade as investor interest shifts back to fundamentals. In particular, we anticipate that Taiwan's all-important tech sector, which bottomed in 2023, could benefit from a continuation of the increased tech exports we have seen in recent months, which were boosted by artificial intelligence-related products.

Japan: An improving macro environment led to a new market high

On Jan. 15, the Nikkei 225 Index reached its post-bubble high of 36,008.23 Japanese yen1 — a 34-year high1 — before finishing the day at 35901.73 JPY. In just a few short weeks in January, we have seen strong gains made by the index.

Japanese equites have been helped by the macro environment in the United States, where moderate economic growth and slowing inflation has resulted in expectations that the US Federal Reserve could likely reduce its policy rate sizably this year. This has created a basis for an improving macro environment for Japan. Depreciation of the Japanese yen against the US dollar since the start of this year also boosted confidence in Japan’s manufacturing companies.

There seems to be a good chance that Japanese policymakers will succeed in bringing about structural change to the economy. Over the last several years, fiscal stimulus has provided a solid boost to economic growth. Now more than ever before in the last several decades, it seems possible for Japan to experience a long period of solid economic growth and a healthy level of inflation.

Stock prices are supported by the expectations that 1) Japan’s economy will undergo structural change to become an economy with a sustainable level of moderate inflation, and 2) Japanese corporate earnings will continue to rise at a healthy pace. Capital inflows by foreign investors and Japanese retail investors also seem to be driving Japanese equity markets. In our view, these positive factors are likely to support higher prices for Japanese stocks this year.

We believe that decent reflation in Japan — somewhat higher growth and inflation that has been more sustained than past ‘false dawns’ — is consistent with a somewhat stronger yen and somewhat higher bond yields and equity prices because it all hinges on higher nominal and real gross domestic product growth on a running basis. This is in stark contrast to the higher bond yields and lower risk asset prices in the West that resulted from the urgent need to tighten policy to slow both growth and inflation. In Japan, we expect the Bank of Japan to continue to move ever so slowly toward policy normalization, not aggressive tightening, so as not to interfere with reflation.

China: Price data raises concerns about deflation

We got some disappointing consumer and producer price data from China last week. While December’s pace of price decline was not as severe as the previous month, concerns have arisen about the economy falling into a deflationary cycle. Corporate revenues in China look poised to weaken and sales expectations for the year are being lowered. However, this has a positive implication: It could spur further and significant policy stimulus, which could be a powerful catalyst for Chinese assets.

Conclusion: We expect inflows to broaden across Asia

In summary, it’s important to stress our belief that there is significant potential in Asia for investors in both equities and fixed income. As mentioned above, we see potential for Japanese, Chinese and Taiwanese equities for different reasons — but there is opportunity beyond that. We expect the Bank of Japan to normalize and the Federal Reserve to ease, and we anticipate likely less easing coming from the European Central Bank and the Bank of England — all of which should support major currencies against a softer dollar.

We expect this backdrop to promote global recovery and a reflow into emerging markets as a whole, including a broadening of inflows to EM Asia beyond India (which has been the main destination for flows recently due to its strong macro performance and role as a geopolitical hedge) as well as strong local investment into stocks. We expect these factors to remain supportive, helped by more attractive valuations in the rest of Asia, anticipated geopolitical calming, and continued recovery in Asia’s largest economies, which should draw a global rebalancing in flows.

Looking ahead

Looking ahead, I will be focused on what lagged effects of monetary policy tightening might be showing up in Western developed economies. This is all about a balancing act, and so, while it appears central banks have gotten inflation well under control, we have to worry about the damage they have done to their respective economies. We got a large drop in the Empire State Manufacturing Survey on Jan. 16 and, while it could be something of an aberration, it reminds us that we need to be vigilant. That’s why I will be paying close attention to the anecdotal information in the Federal Reserve Beige Book and the Bank of England Credit Conditions Survey, as well as US retail sales and industrial production.

With contributions from David Chao, Arnab Das and Tomo Kinoshita