Invesco ETFs

Explore our lineup of ETFs and see how they can be cost-effective and tax-efficient for maximizing your investments and building long-term wealth.

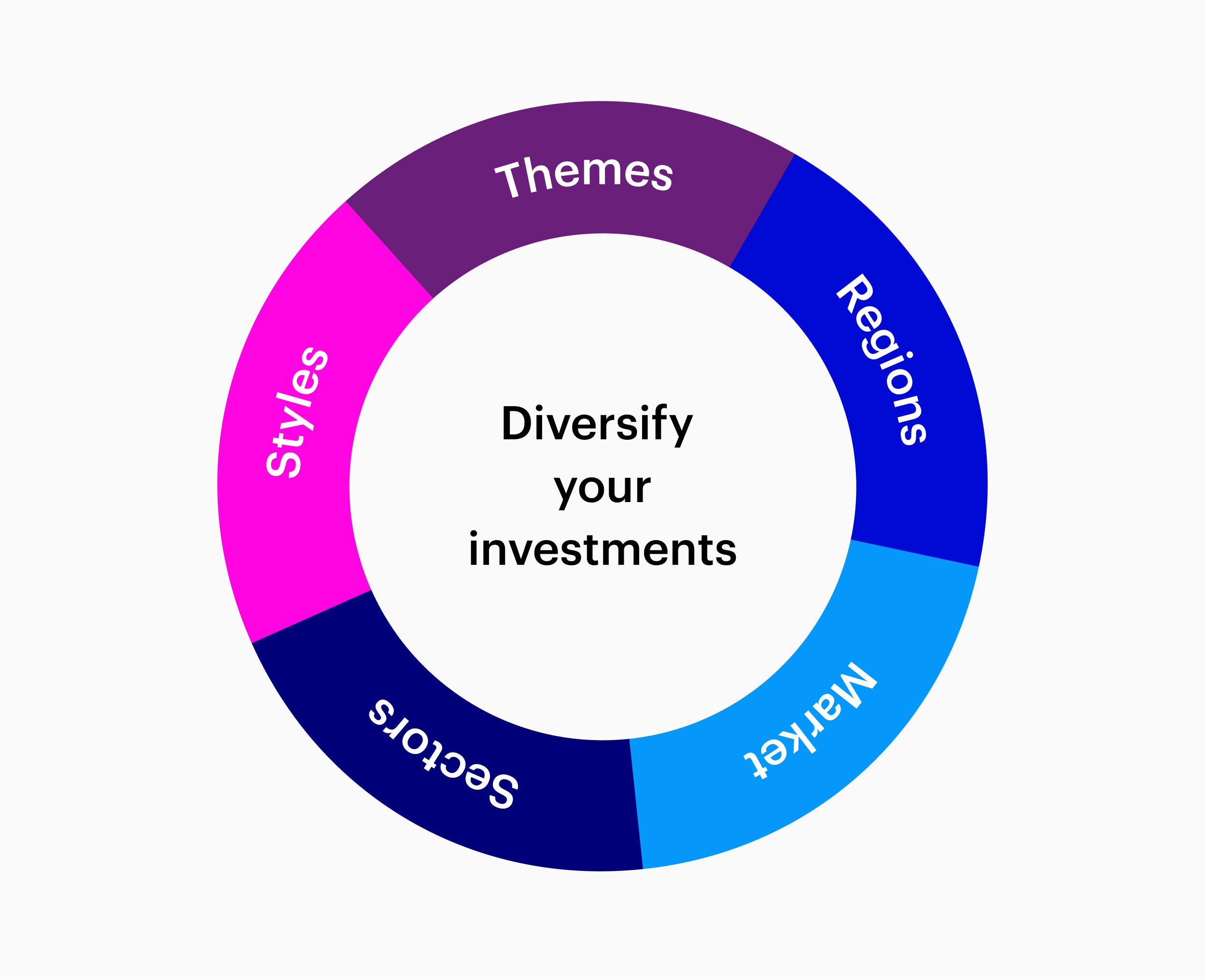

Diversifying your investments across many different types and geographies is a way to control risk. It can help smooth out the ups and downs of financial markets. So even if a portion of your portfolio is declining, the rest may be growing, or at least not declining as much.

| Fund | Ticker | Description | Asset class | Learn more |

|---|---|---|---|---|

| Invesco S&P 500 Equal Weight ETF | RSP | Equal weight exposure to the largest 500 companies in the US as defined by S&P. | US Equity |

Fact sheet |

| Invesco S&P 100 Equal Weight ETF | EQWL | Will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is an equal-weight version of the S&P 100® Index. The Fund and the Index are rebalanced quarterly. | US Equity | Fact sheet |

| Invesco S&P 500 Revenue ETF | RWL | Uses a rules-based approach that re-weights securities of the S&P 500 Index according to the revenue earned by the companies, with a maximum 5% per company weighting. | US Equity | Fact sheet |

| Invesco S&P SmallCap 600 Revenue ETF | RWJ | The Index is constructed using a rules-based approach that re-weights securities of the S&P SmallCap 600® Index according to the revenue earned by the companies, with a maximum 5% per company weighting. | US Equity | Fact sheet |

No matter what you’re looking to achieve financially, our ETFs can help you invest with confidence.

Explore our lineup of ETFs and see how they can be cost-effective and tax-efficient for maximizing your investments and building long-term wealth.

Access our latest insights on investment opportunities and ways to use ETFs in your portfolio.

Learn how ETFs work and why they can be cost-effective, tax-efficient tools for pursuing your investing goals.

Diversifying investments across asset classes can help to protect your wealth, reduce risk, and potentially give you the confidence to stay invested across market cycles. Reason being is that certain types of investments, like stocks, may perform differently than others, such as commodities, in certain circumstances.

Our broad lineup of ETFs includes:

Across asset classes, we offer ETFs that attempt to mirror the returns of broad market indexes, such as the S&P 500 Index and Nasdaq-100 Index , as well as actively managed ETFs that seek to outperform the market. Our ETFs also provide exposure to domestic and international markets.

NA5265786

Since ordinary brokerage commissions apply for each ETF buy and sell transaction, frequent trading activity may increase the cost of ETFs.

Invesco does not offer tax advice. Please consult your tax adviser for information regarding your own personal tax situation.

Diversification does not guarantee a profit or eliminate the risk of loss.