Invesco Total Beta ETF 10/90 Portfolio

These diversified portfolios target specific levels of risk and return using ETFs.

The Invesco Total Beta ETF Series offers core ETF portfolios designed using strategic long-term asset class allocations based on our long-term capital market assumptions. The lineup includes a range of potential solutions to suit an investor’s risk profile and return objective. See the holdings overview of the entire series' lineup or access the fact sheet for each individual portfolio:

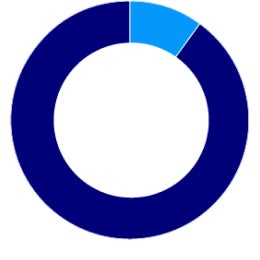

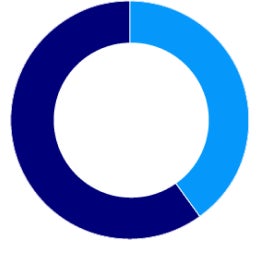

Invesco Total Beta ETF 10/90 Portfolio

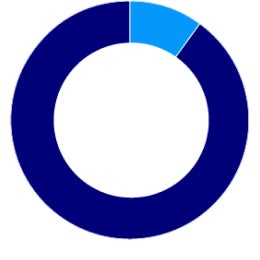

Invesco Total Beta ETF 20/80 Portfolio

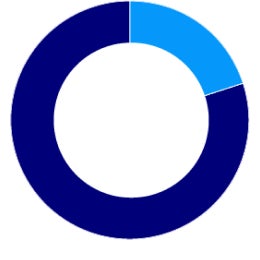

Invesco Total Beta ETF 30/70 Portfolio

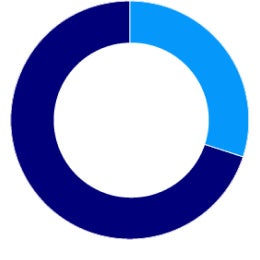

Invesco Total Beta ETF 40/60 Portfolio

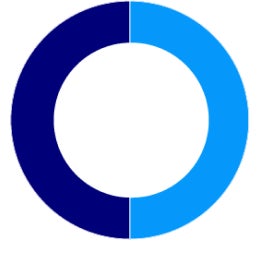

Invesco Total Beta ETF 50/50 Portfolio

Invesco Total Beta ETF 60/40 Portfolio

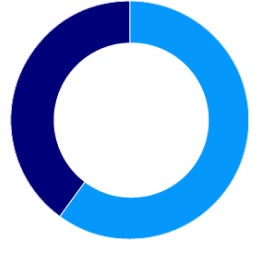

Invesco Total Beta ETF 70/30 Portfolio

Invesco Total Beta ETF 80/20 Portfolio

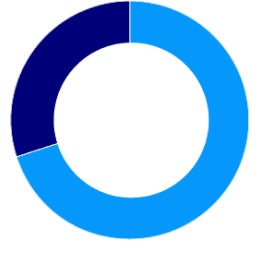

Invesco Total Beta ETF 90/10 Portfolio

Invesco Total Beta ETF 100/0 Portfolio

Invesco Pinnacle Series: Total Beta Income Portfolio

Check out these other models designed for investors seeking to efficiently build a core portfolio that targets a desired level of risk.

Invesco Dynamic Active/Passive

Offers core portfolios of mutual funds and ETFs designed using strategic long-term asset class allocations based on our long-term capital market assumptions.

Explore model portfolios

We offer a range of efficient solutions to help build a core portfolio for a targeted level of risk or compliment your core with specific exposures.

Provide your contact information to get our latest perspectives on the markets and model portfolio allocations delivered right to your inbox.

Invesco does not offer tax advice. Investors should consult their own tax professionals for information regarding their own tax situations.

Beta is a measure of risk representing how a security is expected to respond to general market movements. Smart beta represents an alternative and selection index-based methodology that seeks to outperform a benchmark or reduce portfolio risk, or both in active or passive vehicles. Asset allocation and diversification do not guarantee a profit or eliminate the risk of loss.

The Invesco models are overseen by the Invesco Solutions team. The team is a part of Invesco Advisers, Inc., an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. It is an indirect, wholly owned subsidiary of Invesco Ltd.

The Investment Advisers Act of 1940 requires investment advisory firms, such as Invesco Advisers, Inc., to file and keep current with the Securities and Exchange Commission a registration statement of Form ADV. Part II of Form ADV contains information about the background and business practices of Invesco Advisers, Inc. Under the Commission’s rules, we are required to offer to make available annually Part II of Form ADV to our clients along with our privacy policy. Accordingly, if you would like to receive a copy of this material, please write to Invesco Advisers, Inc., Managed Accounts Operations Department, 11 Greenway Plaza, Suite 1000, Houston, Texas 77046. For more complete information about our separately managed portfolio, please contact your financial advisor.

Invesco Vision, designed by the Invesco Solutions team, is a decision support system that combines analytical and diagnostic capabilities to foster better portfolio management decision-making. By helping investors and researchers better understand portfolio risks and

trade-offs, it helps to identify potential solutions best aligned with their specific preferences and objectives. The Invesco Vision tool can be used in practice to develop solutions across a range of challenges encountered in the marketplace.

Invesco Solutions develops Capital Market Assumptions (CMAs) that provide long-term estimates for the behavior of major asset classes globally. The CMAs, which are based on a 10-year investment time horizon, are intended to guide these strategic asset class allocations.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.