Connect with your clients

Elevate your client interactions with the support of our time-tested client-management strategies, insights, research, and resources.

Research, tools, and resources built to help you benchmark your practice, build a reliable pipeline of new clients, increase your capacity, and build client confidence.

Elevate your client interactions with the support of our time-tested client-management strategies, insights, research, and resources.

Grow your practice, optimize your team’s performance, and drive efficiencies in a complex environment with our research-based programs.

Strengthen your investment process and client outcomes with our wide range of products, expert guidance, and portfolio management tools.

Estate attorneys and accountants likely have clients that you’d like too. Learn how to partner with them for pipelines to high-net-worth referrals in our Referral Code program.

To win new business, your story needs to be concise, compelling, and consistent, and told with conviction and skill. Learn how to do that in our "How to tell your story to prospective clients" program.

Referrals could be a good source of new clients, but you may be apprehensive about asking for them. Get a research-based approach in our business-building program, “Preferrals.”

Our Boardroom Presenting program helps financial professionals create and execute clear, concise, compelling, and coordinated client presentations.

Our tips can help you prepare for discovery meetings, write an introduction script, and ask the right questions to capture critical client insights.

Client engagement messaging, social prospecting, a compelling value proposition, and niche marketing can help you create a strong referral pipeline.

Get timely investment ideas, an overview of what’s happening in the markets, and tips to help optimize your portfolios in our monthly playbook.

Model portfolios can help provide professional investment management and allow financial professionals the time to nurture relationships and prospect too.

Login to see what your peers are doing with their portfolios and get insight on market and investing trends our Solutions team strategists uncovered from advisor portfolio reviews.

An allocation to real estate, the third largest asset class after stocks and bonds, has potential benefits. Our "Build a case for investing in real estate" program can help you build a case for it.

Our investment experts share their views on equities, fixed income, real estate, alternatives and other asset classes to help you make portfolio decisions.

Access our latest insights on investment opportunities and ways to use ETFs in your portfolio.

Invesco's capital market assumptions offer a comprehensive long-term view on asset class returns, risks, and correlations, informing investment decisions.

Connect with your clients by sharing conversations that help them adopt sound investing principles, navigate markets, and stick with investment plans.

Join us for candid conversations with portfolio managers, market strategists, economists, political experts and more, about the possibilities they see ahead.

Ensure you successfully land your message. What you say and how you say it is critical. Effective communication is essential in any professional relationship.

Get the latest perspectives on markets, the economy, and asset classes from our portfolio managers, market strategists, and other investment experts.

With Invesco — we can be your partners in private markets. We offer what you need to incorporate private markets into your business, practice, and portfolios.

Adopting alternative investments may lead to deeper client relationships, increased retention, and more assets under management. Learn how in our “Differentiate your practice with alternatives” program.

Clients need to know your value. Learn the words that resonate with them, particularly when talking about fees and your value and conducting client reviews, in our program.

Learn how to build a practical marketing plan, develop a clear and client-centric brand story, and integrate these concepts into your business to drive growth.

It's not the clients you win; it's the clients you keep. Our business-building program, The Golden Hour, shares how to use a “golden” touch to help you keep at-risk clients.

Explore a framework for segmenting your client base, stratifying your client service, and systematizing your communications with a pod-based service model.

Ensure you successfully land your message. What you say and how you say it is critical. Effective communication is essential in any professional relationship.

Connect with your clients by sharing conversations that help them adopt sound investing principles, navigate markets, and stick with investment plans.

As wealth managers embrace holistic financial planning, relatively few offer multi-generational transition planning. How can practices catch up and get ahead?

Learning as much about a client as possible in the shortest period of time can help you capture more assets. This program shows you how.

An allocation to real estate, the third largest asset class after stocks and bonds, has potential benefits. Our "Build a case for investing in real estate" program can help you build a case for it.

Get timely investment ideas, an overview of what’s happening in the markets, and tips to help optimize your portfolios in our monthly playbook.

Join us for candid conversations with portfolio managers, market strategists, economists, political experts and more, about the possibilities they see ahead.

Model portfolios can help provide professional investment management and allow financial professionals the time to nurture relationships and prospect too.

Implement comprehensive wealth management strategies using our helpful framework of critical topics curated for the needs of financial professionals.

Female clients are key to a practice — they control a large portion of US wealth. Connect with female clients using our Your Prosperity Picture client workshop.

High-net-worth clients are important for your practice. Learn how to ensure your business can meet their needs with our program, "Crafting a Higher Performing Practice".

Review the elements of comprehensive client reviews, including managing client emotions, implementing review checklists, and providing context for your strategy.

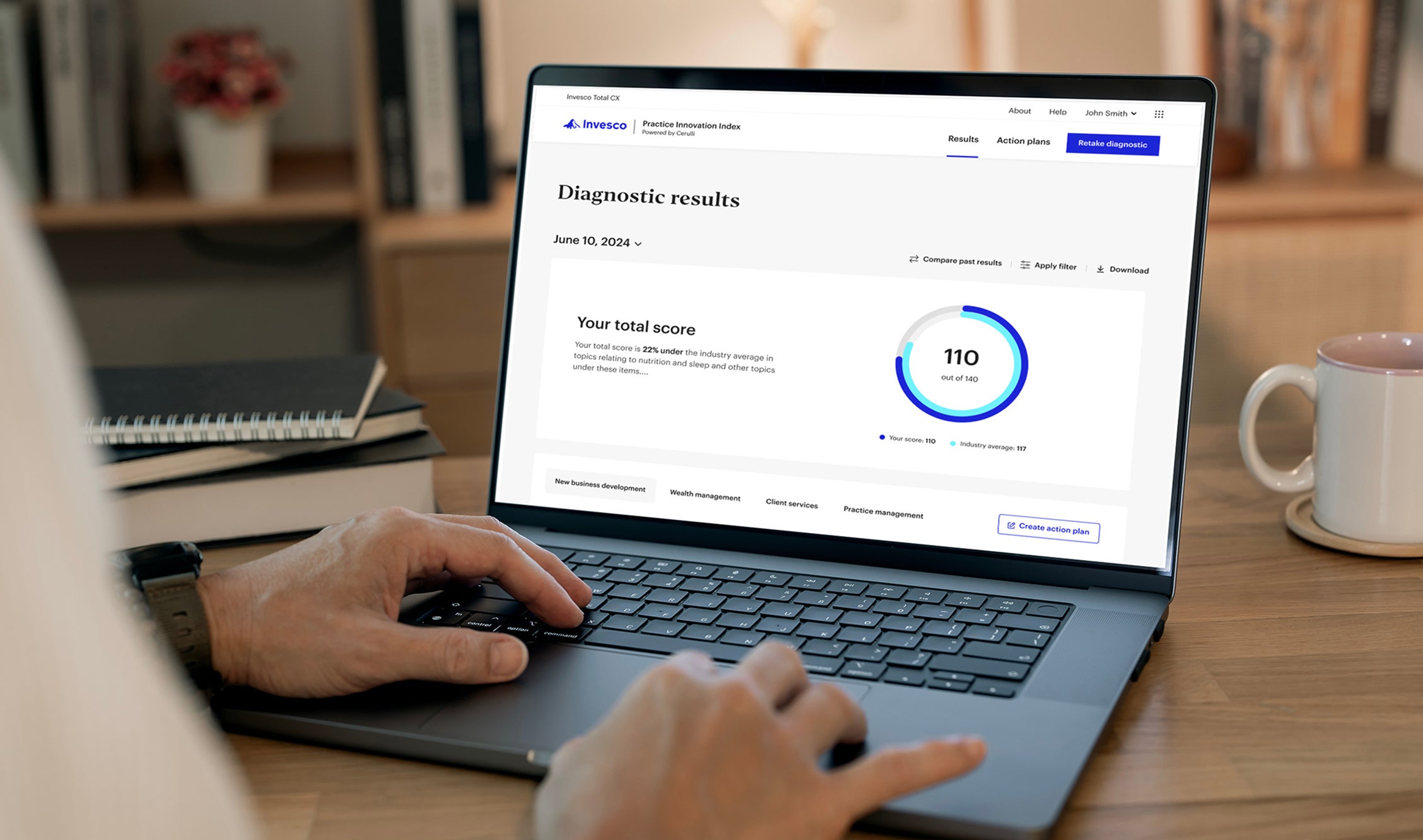

How does your practice stack up against your peers? The Practice Innovation Index diagnoses your practice in four key areas and provides a detailed action plan just for you.

Managing a practice is all about teamwork. Learn how to create an efficient and effective team with our program, "Constructing and Managing a Synergistic Team".

To make the most of their practice, financial professionals needs to be effective and impactful leaders. Learn how to do that in our Transformational Leadership program.

Learn strategies for high-performance team meetings, including daily huddles, weekly strategy meetings, development meetings, and building esprit de corps.

Create an environment that helps you build an engaged, fulfilled, and high-performing team and motivate them to deliver successful long-term results.

Develop your team members by exploring capacity issues, aligning roles and responsibilities with the needs of your practice, and overlaying personality styles.

Revisit your team’s long-term compensation structure by exploring key foundational strategies for recognizing and rewarding performance excellence.

Acquiring and retiring financial professionals need a clear concise communication strategy for clients. Learn how to create a succession plan in this program.

We share important insights from leading financial professionals on how to develop effective marketing, leverage relationships, and reach target clients.

Our tips can help you prepare for discovery meetings, write an introduction script, and ask the right questions to capture critical client insights.

How does your practice stack up against your peers? The Practice Innovation Index diagnoses your practice in four key areas and provides a detailed action plan just for you.

Our Client Conversation guides are designed to help you address market concerns, put current events into context, and explain the fundamentals of accumulating and protecting wealth.

Our monthly overview of what’s happening in the markets and economy provides timely and actionable ideas for strategically and tactically positioning your client portfolios.

We’re here to partner with you in every aspect of your practice so that you can focus on what matters most. Your Invesco consultant can help you harness the expertise of our specialists, from investment professionals to business coaches to account specialists. Use the paths below to see more of what we offer, or contact us through the form below to discuss how we can help you.

Easily access all of your Invesco client portals in one convenient location.

See our comprehensive range of investment products, organized by vehicle.

Learn how our investment capabilities can help you meet your objectives.

For more on how we can partner with you, submit a request for a call back or contact us directly today.

NA4660610

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

All investing involves risk, including risk of loss.

Diversification/asset allocation does not guarantee a profit or eliminate the risk of loss.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is affiliated with neither Cerulli Associates nor Cerulli, Inc.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

All data created by Invesco unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.