Holistic financial planning to grow your wealth management practice

As wealth managers embrace holistic financial planning, relatively few offer multi-generational transition planning. How can practices catch up and get ahead?

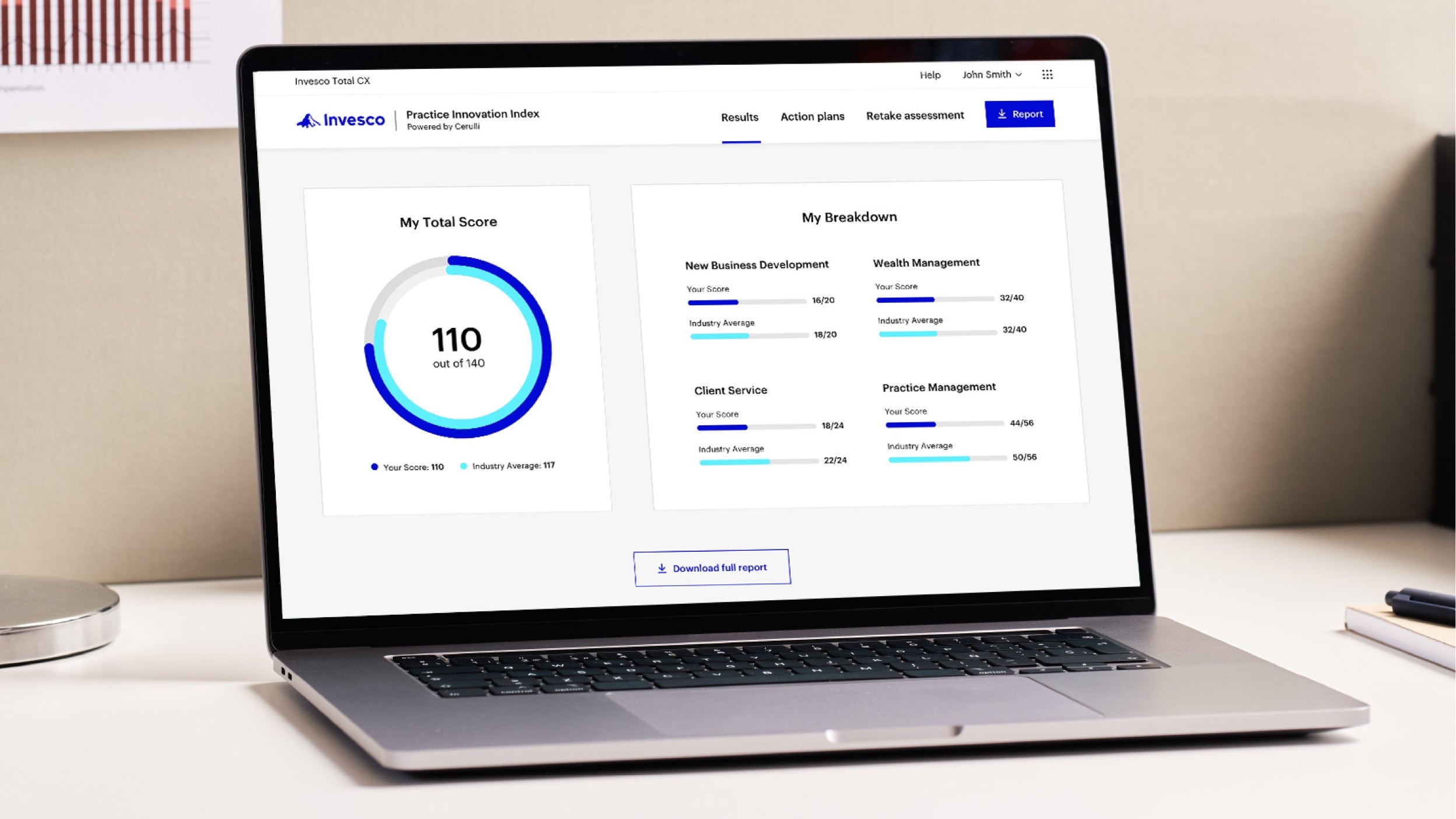

Invesco Total CX — the Total Client Experience — is a powerful platform of tools and resources designed to help financial professionals achieve greater possibilities for their clients, businesses, and portfolios. Through December 2024, we’ve helped more than 2,900 financial professionals benchmark their practices with the the Practice Innovation Index (PII), a diagnostic assessment focusing on four areas: New Business Development, Wealth Management, Client Service, and Practice Management.¹

from top-performing financial professionals, in key areas of management

of assessment participants, who represent various channels and practice types

across wealth management practices that contributed experiences

The new Total CX Insights, created jointly with Cerulli Associates, explores how your peers craft a marketing message in order to help build a referral network and reach ideal clients.

Marketing and branding may help potential clients tell companies apart. We believe wealth managers need to define an actionable marketing strategy with a clear, consistent, and compelling message in order to attract prospects that turn into clients.

Existing clients, centers of influence (COIs), external strategic partnerships, and internal strategic alliances may all lead to new clients. Wealth managers looking for long-term growth and sustainability may need to build a culture that generates referrals.

Source: The Cerulli Report—U.S. Advisor Metrics 2024.

Analyst Note: Advisors were asked, “Over the past year, what percent of your practice’s new clients were acquired through the following sources?” Traditional prospecting and marketing includes hosting seminars, cold calling, networking, and advertising, whereas digital marketing refers to written thought leadership, videos, and social media content, for example.

Wealth managers, in our view, can’t necessarily rely on a rising market to sustain a practice. They may need to identify an ideal client type, articulate a value proposition, and develop strategic relationships in order to help deliver growth.

Sources: Federal Reserve, US Census Bureau, Cerulli Associates

0:06

Hi, I'm Jay Therian, Managing Director of Executive Consulting for Invesco Global Consulting.

0:10

And I'm excited to share with you today Invesco's latest total client experience insights, which is focused on creating sustainable practice growth.

0:18

Now it's no secret that in our ever changing wealth management industry, staying ahead of the curve is a necessity.

0:24

In a fiercely competitive marketplace.

0:26

Invesco believes organic growth remains critical to cultivating new clients, expanding our wallet share and creating long term sustainability in our businesses.

0:36

It should also be no surprise that Invesco's recent data indicates the most successful practices in our industry have created a truly growth oriented culture.

0:45

In other words, they naturally generate referrals from ideal clients and centers of influence by investing deliberate time and resources into crafting a unique value proposition and activating specific marketing and brand strategies.

0:58

Now, these practices excel in generating referrals from both current clients and strategic partners, and they are also among the fastest growing and most successful.

1:07

In fact, according to the PII data, wealth management practices with a more consistent referral stream have achieved the strongest compound annual growth rate of approximately 21.2% over the past five years.

1:21

An essential part of this growth in our view, is generating client referrals and developing relationships with strategic partners including Cpas, attorneys and estate planners.

1:30

According to the PII, wealth managers indicate that 13.8% of clients and strategic partners have provided a qualified client referral in the last year.

1:39

That equates to approximately 23 clients on average.

1:42

While generating referrals from existing clients and Key Co is plays a critical role in organic growth, most firms simply don't spend enough time in this area.

1:51

Another key area of growth that our latest report shows is developing relationships with the next generation of wealth holders.

1:58

Simply put, these relationships are crucial for long term client retention and business continuity.

2:04

We've seen that multi generational transitional planning are essential to retaining these relationships, yet only 11% of respondents are actively providing these services.

2:14

One final notable piece of data we uncovered in our latest report is that nearly half of wealth managers lack a consistent marketing message.

2:22

Invesco believes that capturing new growth is centered in part around a practice's ability to both communicate their unique value proposition and brand their messaging effectively.

2:33

While developing a strong brand can be time consuming, the payoff may be huge for practices that hold firm to the values they define and how they articulate them in a clear, concise, and compelling way during their client and prospect interactions.

2:47

Invesco is dedicated to helping you grow your practice and apply actionable strategies based on industry leading data.

2:53

Please contact your Invesco representative today to help you apply our latest PII research powered by Cerulli Associates in a way that truly helps you create sustainable, organic growth in your practice.

An introductory video for the highlights of our most recent Total CX Insights report, which is focused on creating sustainable practice growth.

Look back at previous Total CX Insights articles and download recent reports.

Screen image and scores are shown for illustrative purposes only.

The latest Practice Innovation Index report tells us that wealth managers need a comprehensive plan to better manage their time, find unique solutions, and support their clients' goals and objectives.

Holistic financial planning to grow your wealth management practice

As wealth managers embrace holistic financial planning, relatively few offer multi-generational transition planning. How can practices catch up and get ahead?

Personalize wealth management with model portfolios

Every client is unique and deserves their own individualized investment strategy. Model portfolios can provide a shortcut to personalization.

Alternative investments and their role in wealth management

Incorporating alternative investments can help clients expand their portfolios and let wealth managers enhance their value proposition.

Lisa Kueng

I'm Lisa Kueng, Managing Director of Business Development for Invesco Global Consulting, and I'm privileged today to share the latest Total Client Experience insights. This time, we're focusing on building a sustainable practice.

Our data shows that more than a third of financial professional’s plan to retire, or at least take a significant step back from daily operations over the next decade.1 Paul Brunswick, Head of Invesco Global Consulting, is going to dive deeper into these actionable solutions.

Paul Brunswick

Thanks, Lisa. Well, before a financial professional approaches retirement, we believe they should consider developing their practice through effective teaming. Our latest research also shows that 89% of practices with greater than 500 million in AUM operate in a team-based structure.2

As a growing number of financial professionals approach retirement, they see the benefits of joining forces to create capacity and position themselves for long term growth through teaming. Teams ultimately provide a wider range of services to clients while creating career paths for internal successors. The key here is identifying those internal successors sooner rather than later. Why? Because integrating a successor on a team early helps not only to ensure a smooth transition but mitigates client flight risk when the lead financial professional retires.

According to our latest research, 47% of respondents indicated that roles and responsibilities in their practice are well-defined. Of those who are on teams, the average practice headcount is between five and six team members.2

A well-defined team creates continuity, client trust, and efficiency. Invesco believes practice leaders should openly discuss expectations with their team and align skill sets with the appropriate function.

Our final topic is preparing to transition your practice. Financial professionals know the importance of planning for a successor, but what holds them back? The emotional aspect. Matter of fact, our data indicates that 73% of respondents view emotional aspects of transferring clients to a new financial professional as a hurdle.3

This is followed by finding a qualified buyer with 59% of respondents reporting it as a succession challenge. The third is transferring clients to the buyer, which represents 50% of respondents.3

Invesco believes, however, that no matter if you are buying or selling a practice, that there are four critical variables that determine success or failure of your succession plan. The right time, the right reason, the right person, and the right communication. To help you in preparing to transition your practice, we offer a program called “Changing the Guard” that includes five steps to successfully transition your practice. Contact your senior Advisor consultant to learn more.

Lisa Kueng

All of these insights were brought to you by Invesco Total CX, the Total Client Experience. Which is a powerful platform of tools, coaching, and content.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

We’ve helped more than 2,000 financial professionals to benchmark their practices with the Practice Innovation Index (07/13/2021-09/15/2023).

There is no guarantee that any stated outlooks will come to pass.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).”

All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

1Sources: Cerulli Associates, Investment Company Institute, Insured Retirement Institute, Morningstar Direct/ AnnuityIntelligence, Investment News, Judy Diamond, Department of Labor, PLANSPONSOR, S&P Capital IQ MMD, Financial Planning, Financial Advisor magazine, and Investment Advisor magazine | Analyst Note: Cerulli's projections for advisor headcounts and advisor assets are based on both the historical movement of advisors between channels and stated channel preferences of advisors for future affiliation. In addition, Cerulli accounts for retiring advisors, trainees, and one-time occurrences such as layoffs and announced hiring plans.

2Sources: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/31/2022; Invesco and Cerulli Associates.

3Source: The Cerulli Report --U.S. Advisor Metrics 2022

Not a Deposit | Not FDIC Insured | Not Guaranteed by the Bank | May Lose Value | Not Insured by any Federal Government Agency

invesco.com/ic ©2023 Invesco Ltd. All rights reserved. IGC-PIITCX-VIDTS-2E 10/23 Invesco Distributors, Inc. NA3102773

Teaming may help build a sustainable practice by focusing complementary skills toward a common goal. Effective integration can potentially lay the foundation for a smooth transition from wealth manager to successor. Learn the main factors that can determine your success.

Succession planning for your wealth management practice

Grow your wealth management practice through effective teaming

We are excited to introduce the new Total CX Insights for your business.

Invesco Total CX – the Total Client Experience – is a powerful platform of tools, coaching and content. As part of that platform, we’ve helped more than 1,000 financial professionals to benchmark their practices with the Practice Innovation Index.1

The latest report2 evaluates your peers’ experiences using the Practice Innovation Index results to help you drive efficiency in your practice. We focus this quarter’s research in four primary areas: boosting productivity, maximizing time with clients, optimizing coverage ratios, and client touchpoints.

We strongly believe that high productivity can be directly attributed to thoughtful segmentation and client prioritization. In fact, the results show that almost half of respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.3 Bottom line, an effective segmentation strategy will help practices not only determine how they allocate their limited time, but it also creates capacity across their growing business.

As we looked at insights around maximizing time with clients, the research indicated that wealth managers spend most of their time on client facing activities with client meetings, accounting for 21%.4 We strongly believe that by leveraging technology, wealth management practices can create automated workflows to streamline standard client service processes and communication.

This will ultimately reduce the administrative burden on senior team members, and in the end free up more time for important client- facing activities.

The numbers we saw in the research were that across all practices in the industry, senior financial professionals manage, on average, 161 client relationships.4 The takeaway here is that even though best practices on optimal client coverage are always relative, wealth managers should be mindful not to diminish client engagement or exceed their staff capacity. To strike this balance, we believe teams can establish defined segments that factor in the complexities and the needs of individual clients.

The data showed us that nearly one third, specifically, 32% of respondents who managed greater than a billion dollars in assets, utilize a pod-based approach to meet with clients. In addition, the research indicated that they meet with clients at least 11 times per year.5 Why? Because many clients will opt for a mix of both virtual and in- person meetings going forward.

Stay tuned in the quarters to come as we deliver new Total CX Insights for your business and if you haven’t already, benchmark your practice today with the Practice Innovation Index.

Not a Deposit | Not FDIC Insured | Not Guaranteed by the Bank | May Lose Value | Not Insured by any Federal Government Agency

1

1,043 participants, 7/13/2021-12/30/2022

2

"Enhancing Client Relationships and Capacity to Drive Growth" (IGC-PII-QTR-BRO-2-E)

3

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

(Nearly half (48%) of Practice Innovation Index respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.)

4Sources: The Cerulli Report—U.S. Advisor Metrics 2021, Cerulli Associates, in partnership with the

Investments & Wealth Institute and the Financial Planning Association® (FPA®).

5

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).” All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

invesco.com/ic Invesco Distributors, Inc. IGC-PIITCX-VIDTS-1 04/23 ©2023 Invesco Ltd. All rights reserved. NA2853843

20230424-2853843-NA

1 - 1,043 participants, 7/13/2021-12/30/2022

2 -"Enhancing Client Relationships and Capacity to Drive Growth" (IGC-PII-QTR-BRO-2-E)

3 - Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

(Nearly half (48%) of Practice Innovation Index respondents have implemented a customized client service model based on platinum, gold, and silver segmentation.)

4Sources: The Cerulli Report—U.S. Advisor Metrics 2021, Cerulli Associates, in partnership with the

Investments & Wealth Institute and the Financial Planning Association® (FPA®).

5

Source: Practice Innovation Index diagnostic survey results of 1,043 participants, 7/13/2021-12/30/2022.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is not affiliated with Cerulli Associates or Cerulli, Inc. The Cerulli Associates logo is used with permission.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

The opinions expressed are those of the author and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Cerulli Associates utilizes the term “advisor(s)” instead of “financial professional(s).” All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

invesco.com/ic Invesco Distributors, Inc. IGC-PIITCX-VIDTS-1 04/23 ©2023 Invesco Ltd. All rights reserved. NA2853843

The Total CX Insights video is an overview of the May 2023 Report results of the Practice Innovation Index. It touches on four primary areas: boosting productivity, maximizing time with clients, optimizing coverage ratios, and client touchpoints.

Boosting Productivity

Financial professionals can use a segmented approach to client service with the goal of creating capacity and prioritizing their most valuable client relationships.

Maximizing time with clients

Focusing wealth managers’ time on high-impact client-facing activities and redistributing other responsibilities may help fuel growth.

Optimizing coverage ratios

Serving a limited number of clients may help enrich client experiences, improve business efficiencies, and promote growth opportunities.

Balancing client touchpoint quality and quantity

A proactive client engagement strategy, implemented effectively, may help grow a practice's capacity and improve the quality of their client service.

Screen image and scores are shown for illustrative purposes only.

The Practice Innovation Index — powered by Cerulli Associates — is the first diagnostic2 to analyze peer ranking and provide custom resources designed to help in every area of your practice.

Screen image and scores are shown for illustrative purposes only.

This report leverages insights from practices that participated in the Practice Innovation Index 7/13/2021-12/31/2024 as well as Cerulli Associates’ broader research findings throughout 2024. See how top practices are implementing a more holistic and personal approach to financial planning.

The ”Practice Innovation Index” program is based on Invesco Global Consulting’s work with Cerulli Associates. Invesco Distributors, Inc. is affiliated with neither Cerulli Associates nor Cerulli, Inc.

Invesco Global Consulting programs are for illustrative, informational and educational purposes. We make no guarantee that participation in any programs or utilization of their content will result in increased business for any financial professional.

Please note that the terms "partnership" and “alliances” herein do not signify formal legal relationships; they are simply intended to describe mutual, informal relationships among professionals. This program is neutral to the practice of fee-sharing with other professionals. This program espouses the potential benefits of using indirect financial incentives as one of the ways to build your business and should be considered in conjunction with your firm's overall review of its business practices for potential conflicts.

It is important to remember that any outside business activity including referral networks be conducted in accordance with your firm's policies and procedures. Should you have any questions on these programs, please consult your branch manager and/or compliance representative for additional information.

Invesco Global Consulting: HNW = high-net-worth = $1 million to $5 million in liquid financial assets (USD). UHNW = ultra-high-net-worth = >$5 million in liquid financial assets (USD). Cerulli Associates defines high-net-worth (HNW) as $10-20 million in investable assets (USD). Cerulli Associates defines ultra-high-net-worth as $20-50 million in investable assets (USD).

The opinions expressed are those of the author and are subject to change without notice.

These opinions may differ from those of other Invesco investment professionals.

All data created by Invesco Global Consulting unless otherwise noted.

Note: Not all products, materials or services available at all firms. Financial professionals should contact their home offices.

NA4373908

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.