China Mid-Year outlook – Position for a sustained rebound

Key Talking Points:

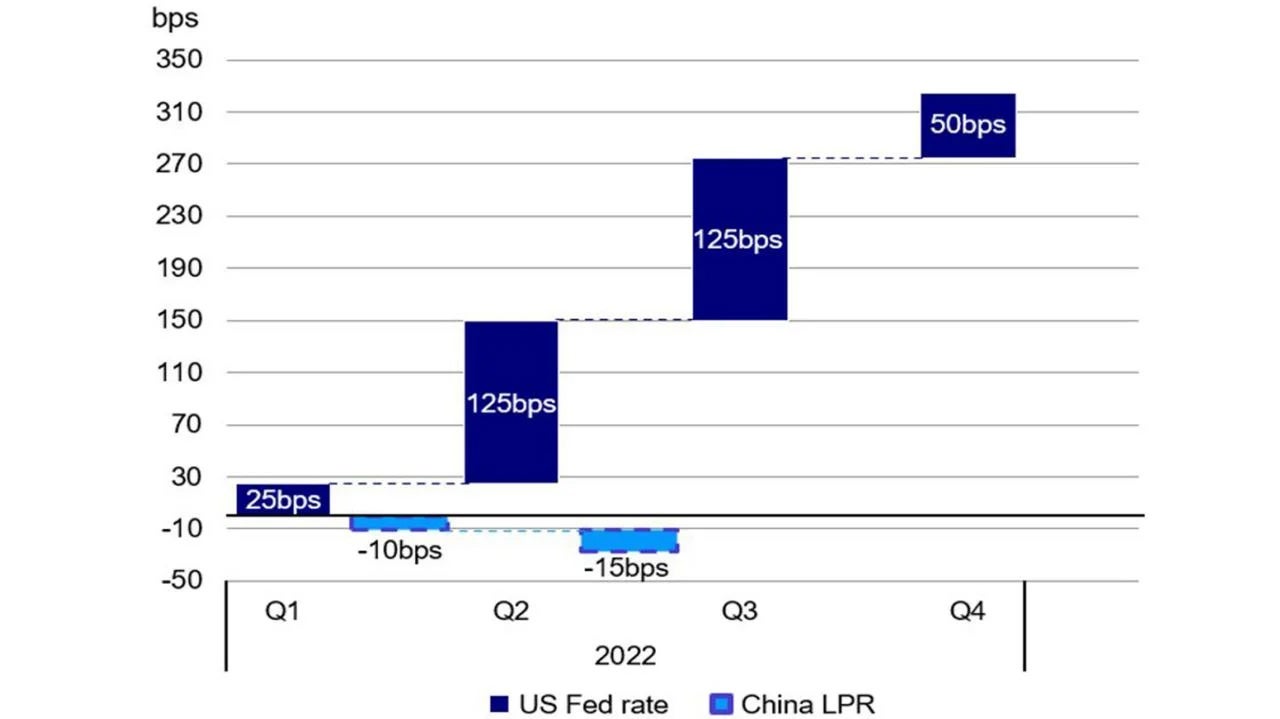

- China’s easing monetary policy bias in stark contrast to peers

- China’s equity market is less correlated to the rest of the world

- The nation’s COVID policy poses short-term downside risks

- Growth is expected to pick up in 2H

- Chinese equity valuation is relatively attractive

Chinese equities had a bumpy ride since the start of the year as concerns over COVID-related lockdowns could dampen the domestic economy. Externally, inflation and rate hikes in western countries also led to weaker sentiment.

However, with the easing in domestic COVID restrictions, improvement in economic data and the easy monetary bias, Chinese equities have recently rebounded and outperformed global peers. We believe that, with the emergence of these catalysts, Chinese equities may see a sustained rebound especially with a relatively attractive valuation.

Source: Bloomberg, as of June 24, 2022. Past performance is not a guide to future returns.

China’s easing monetary policy bias in stark contrast to peers

Chinese policy makers have opted for an easing bias, contrary to the tightening measures by other major economies. While the Fed has started to hike interest rate, China, on the other hand, has cut its lending rate and lowered banks’ reserve requirement ratios.

Inflation has become a primary concern in developed markets, with US inflation reaching 8.6%1 in May, a 40-year high, and still showing no sign of cooling down. In China, inflation is currently at 2.1%2. Although consumer price will likely pick up from its current level, with an official inflation target of 3%3, there is no urgency for Chinese policy makers to raise interest rates drastically.

We expect a further reduction in the policy and reserve requirement rates. The divergence in the monetary policies, in our view, is constructive to Chinese equities. Chinese authorities have emphasized their intention to support growth in recent months. Several high-profile Chinese party and government meetings have highlighted the supportive policies stance, including the Vice Premier’s statement on March 16, the politburo statement on April 29 and the Premier teleconference on May 25.

In addition, China has rolled out an array of measures to support business and stimulate demand. For example, China's 2022 tax cut is expected to exceed 2020 when COVID first started.

While some feel that the policy support needs to be stronger, we believe that the China's policy put option takes time to kick in. We have already seen May's total social financing, RMB loans and M2 all came in above market expectations.

In our view, the rebound of May credit data is a combination of growth and credit demand recovery, given the strong policy response and easing COVID restrictions. Effects of the easing policy should be even more evident in the 2H.

Source: Goldman Sachs Global Investment Research, June 2022.

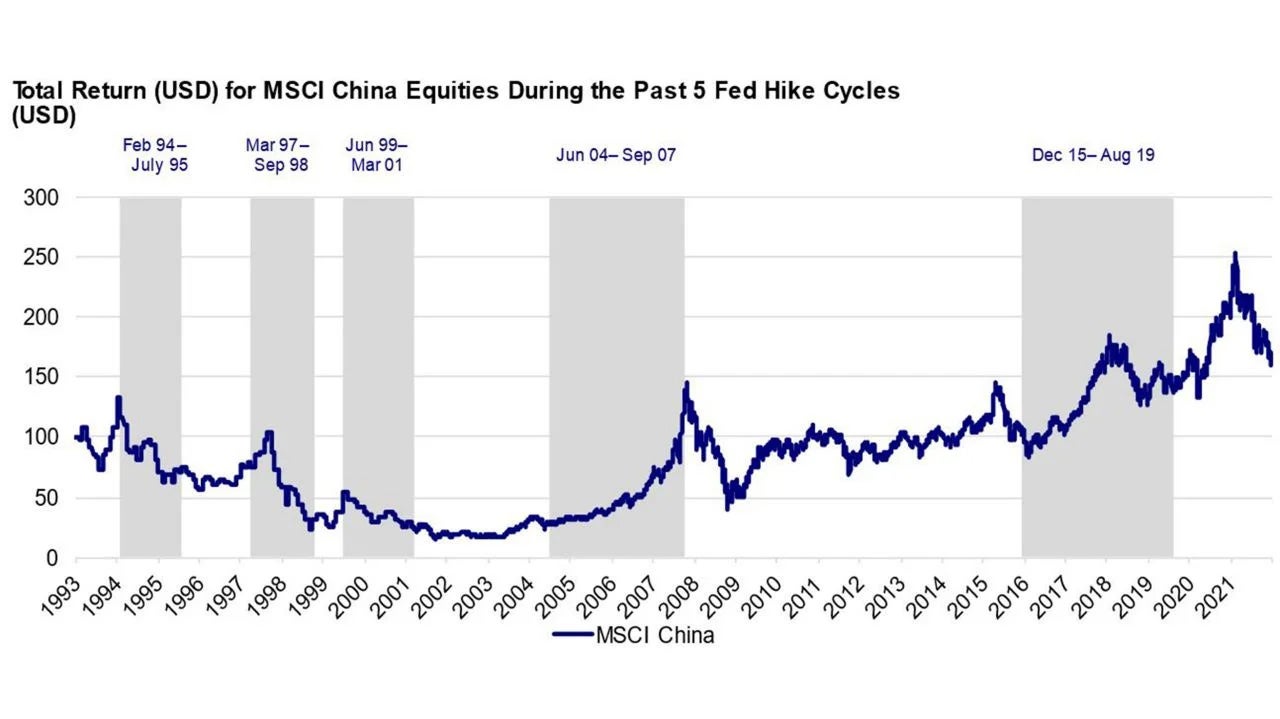

China’s equity market is less correlated to the rest of the world

Regarding the current global monetary tightening backdrop, historically Chinese equity's performance was mixed, different from the view that Chinese equities deliver negative performance amid rising US interest rate. For example, Chinese equities recorded strong performances of 270% and 40%4 in the last two US interest rate hike cycles during the period from Jun 2004 to Sep 2007 and from Dec 2015 to Aug 2019.

Chinese equity's performance is less correlated to the rest of the world. First, most of the participants are domestic players for onshore Chinese equities, and foreign participation is around 3% of total market capitalization5. Second, China's policy cycle and dynamics often differ from the rest of the world. For example, China is currently going through an easing policy cycle compared to tightening bias for the rest of the world. Although we may see reduced allocation to EM/China in times of rising volatility, given negative sentiment globally and investors' asset allocation decisions, a correlation on a relative basis is smaller.

Source: Invesco, Haver, MSCI, Morgan Stanley Research, as of May 2022. Past performance is not a guide to future returns.

Note: We define the end of rate hike cycles as the day before 1st rate cut.

More importantly, we believe Chinese equity is an attractive asset class and offers excellent diversification opportunities. China has a large domestic market and is the second-largest economy in the world. As a result, we believe investment opportunities are ample and broad-based. They are also unique and not available elsewhere. A few opportunities may include those from the internet and technology-related sectors to healthcare and domestic consumption. There are also new opportunities brought about through the transition to net-zero.

MSCI China has rallied 15% in the past one month and 25% since the market bottom in the mid-March this year 6. We believe that most of the negative news has already been priced in. From an asset allocation perspective, we have started seeing flows returning to the asset class. While market volatility may persist in the near term, we believe now may be the time for long-term investors to consider bottom fishing.

China’s COVID policy poses short-term downside risks

China's zero COVID policy has successfully combated the pandemic since the outbreak in 2020. The authorities have reiterated the stance to adhere to the policy. While China's COVID situation continues to improve, and we have seen the easing of knockdown in Shanghai recently, there are still risks of full or partial knockdown, given the highly infectious nature of Omicron.

In the near term, we believe this is a key risk that needs monitoring, as the disruption to economic activity, both on domestic demand and production/manufacturing, poses challenges. The impact will differ from industry to industry, depending on their supply chain situation.

China's growth to pick up in 2H

Sentiment is currently negative. Externally, we have high inflation, a rising interest rate environment, and disruptions from the Russia/Ukraine war. Domestically, there are concerns on the impact of regulatory tightening and the Zero- COVID policy on growth.

We believe that domestic affairs and policies will matter significantly more for China's economic growth compared with external events. China is a huge domestic market and stands in good stead to withstand external shocks. For example, China's exports and imports to Russia are relatively small at 2% and 3%7, respectively.

Domestically, the Omicron wave since March led to the escalation of COVID policy measures. While we believe this is a key risk for the near term, the disruption to economic activity should gradually fade away. We expect economic growth momentum to start firming up in the coming quarters. Economic activity numbers in May have already shown signs of bottoming out. For example, China's export growth rebounded significantly to 16.9% yoy in May 8, much higher than the consensus forecasts. In addition, monetary data also surprised the market on the upside.

The recovery is consistent with our view that production/manufacturing should resume first in leading growth, substantially reducing supply chain concerns. Domestic consumption recovery will follow suit. Although domestic recovery is still at its early stage, we are optimistic that the trend could be sustained and drive growth in the next phase.

Chinese authorities have reiterated their stance to support growth, domestic recovery and employment this year. In particular, on the Internet side, there are signs that the worst is over for regulatory tightening. The Chinese government has pledged more robust policy support for platform economy and technology sector, which signalled an end of structural policy reform in 2 years. Policy makers also promote platform economy, encourage innovation and entrepreneurship to stabilize employment.

In terms of opportunities, we favour areas that will benefit from the domestic recovery and selected financials, technology-related and materials leaders.

Relatively attractive valuation

Chinese equities are currently at an relatively attractive level, trading at 10.6x for 12-month forward P/E 9 and towards the low end (over -1 standard deviation) of its five-year average range. The PER valuations discount compared to US equities is also high at 40%. Although US equities corrected YTD and retraced down to 17.8x 10, it is still at the upper quartile of their historical range.

In terms of sector performance, different sectors showed substantial divergence in the Chinese equity space over the past year. Consumer and internet-related sectors have been lagging because of the sell-off following several severe regulatory tightening.

One of the catalysts for valuation re-rating would be the regain of confidence in China's 'Internet' sector. With Chinese authorities reiterating their stance on supporting growth, domestic recovery and employment, we believe that the worst is over for regulatory tightening.

In addition, we believe the regulatory tightening cycle has transitioned from an announcement phase to implementing and finalizing regulatory oversight. As a result, we expect further regulation visibility and clarity, which could be a strong catalyst for re-rating.

We have, in recent months, started to see investors interest back in Chinese equities as an asset class. Data 11 also shows that international investors are adding back to China, with both EM and Asia funds allocation to China on the rise. In fact, in the recent rally, the Chinese internet sector has been leading the charge, posting around 17% gains 11 in the past month and likely leading the re-rating process in future. Therefore, we believe now may be the time for long-term investors to accumulate especially given the attractive valuation.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-045

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html