Why consider Invesco ETFs?

Learn more about Invesco's lineup of fixed income, equity, and alternative ETFs.

In-kind ETF creation and redemption may be facilitated by authorized participants in large quantities.

ETFs typically generate fewer capital gains than mutual funds given how they’re structured and traded.

Portfolio rebalancing, stock splits, shareholder redemptions, and other events often don’t lead to more taxes.

Many investors may turn to exchange-traded funds (ETFs) for more transparency1 or lower costs.2 But ETFs are also tax efficient.3 They typically generate fewer capital gains than mutual funds due to how they’re structured and traded in the marketplace. Fewer capital gains to tax means investors potentially get to keep more of their returns.

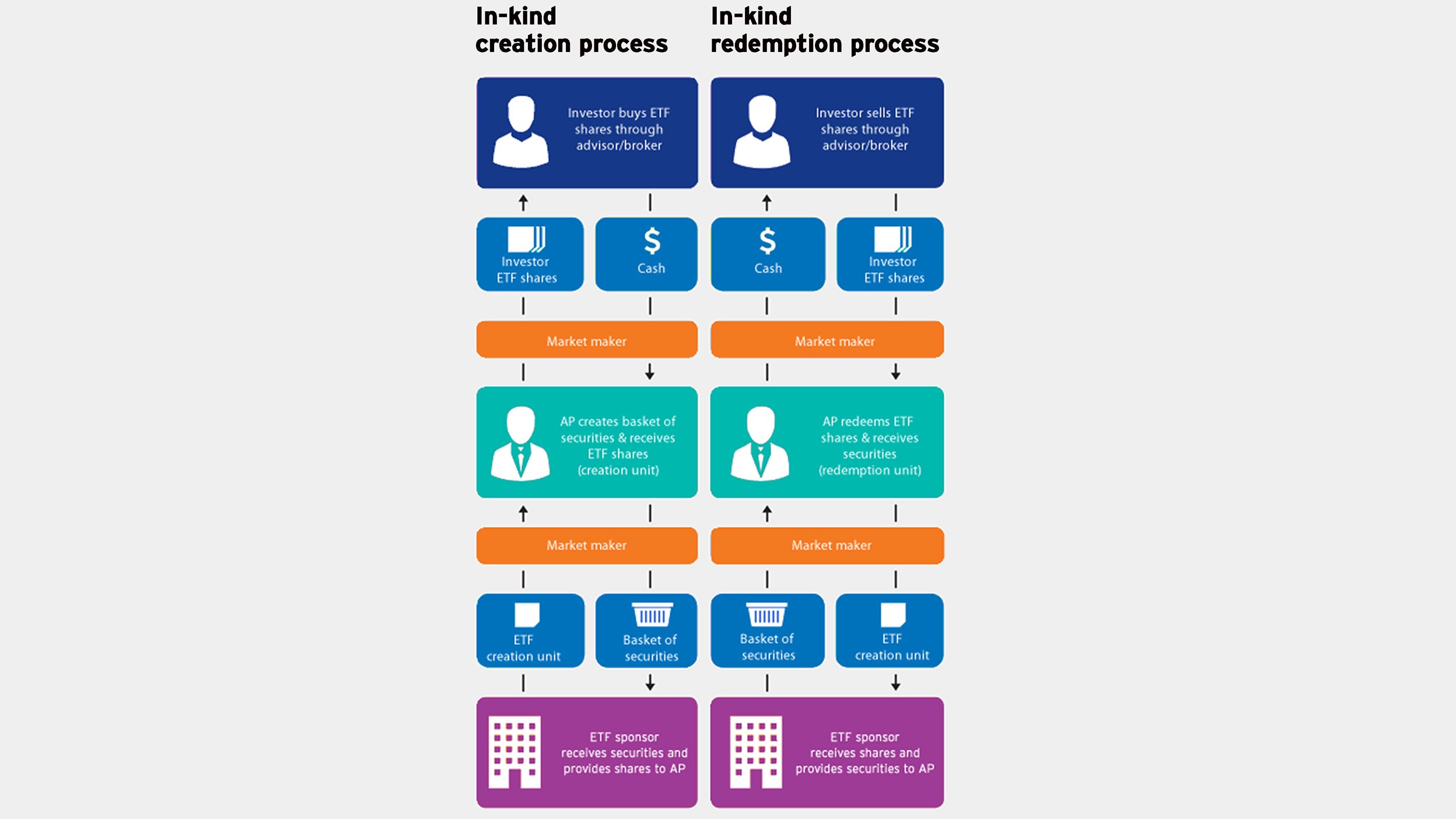

ETF creation and redemption typically avoid the cash transactions that may trigger capital gains distributions. Generally, an ETF issuer creates and redeems ETF shares through an “in-kind” process involving large institutional investors and market makers called authorized participants (APs). The APs have an agreement with the ETF manager that lets them create or redeem ETF shares in large blocks known as creation units. A creation unit typically consists of 10,000, 20,000, 25,000, 50,000, 80,000, 100,000, or 150,000 shares.

During the creation process, when demand for the ETF exceeds supply, the AP delivers a basket of securities held in the ETF to the issuer in exchange for a creation unit. In a redemption, however, the process is reversed. The AP receives a basket of securities while the ETF manager takes back a creation unit. ETF shares can be quickly created or redeemed elastically without cash transactions to help meet supply and demand in the marketplace.

Since these transactions happen in shares (in-kind) and not in cash, there are typically no capital gains. What’s more, current tax law states that capital gains are not recognized at the time of the transaction and thereby not considered a taxable sale. The ETF creation and redemption structure may create meaningfully different after-tax returns between an ETF and an index-tracking mutual fund — even if both track the same index.

With ETFs, capital gains and taxes are generally recognized only when investors sell their own shares. On the other hand, mutual fund investors can see gains and taxes impacted by the selling activity of the fund’s other shareholders.

Rebalancing a portfolio is typically handled in-kind with transactions and generally not taxable for the ETF and its shareholders. If the ETF must sell securities no longer in the index and buy additional securities, though, this may be a cash transaction and a taxable event for the ETF.

Stock splits, mergers, acquisitions, and other corporate events are also typically handled in-kind. But if the ETF must sell or buy securities for cash, there may be a taxable event for the ETF.

When APs redeem their shares, this is usually handled with in-kind transactions rather than cash, which helps prevent distributions and taxes for shareholders.

Important information

NA4628039

Investors should be aware of the material differences between mutual funds and ETFs. ETFs generally have lower expenses than actively managed mutual funds due to their different management styles. Most ETFs are passively managed and are structured to track an index, whereas many mutual funds are actively managed and thus have higher management fees. Unlike ETFs, actively managed mutual funds have the ability react to market changes and the potential to outperform a stated benchmark. Since ordinary brokerage commissions apply for each ETF buy and sell transaction, frequent trading activity may increase the cost of ETFs. ETFs can be traded throughout the day, whereas, mutual funds are traded only once a day. While extreme market conditions could result in illiquidity for ETFs. Typically they are still more liquid than most traditional mutual funds because they trade on exchanges. Investors should talk with their advisers regarding their situation before investing.

There are risks involved with investing in ETFs, including possible loss of money. Index-based ETFs are not actively managed. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Both index-based and actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The Fund's return may not match the return of the Index. The Funds are subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Funds.

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.