Markets and Economy Keeping long-term perspective as the Iran conflict continues

It’s unknown how long the conflict will last, but oil and other commodity exposure may help hedge the risk of a prolonged Strait of Hormuz closure.

Fresh perspectives on economic trends and events impacting the global markets.

Get timely investment ideas, an overview of what’s happening in the markets, and tips to help optimize your portfolios in our monthly playbook.

It’s unknown how long the conflict will last, but oil and other commodity exposure may help hedge the risk of a prolonged Strait of Hormuz closure.

The gold price has reached a series of new all-time highs over the past year, driven partly by demand from investors.

Day-to-day angst can overshadow the markets. Here’s a bigger-picture take on recent headlines like the software correction, US-Iran conflict, and more.

Markets are influenced by short‑term narratives and longer-term fundamentals. Emerging markets, Japan, and Europe have experienced improvements in both.

Following the US-Israel strikes on Iran, we offer four possible scenarios for what we could face in the coming weeks and explore the possible reaction of various asset classes.

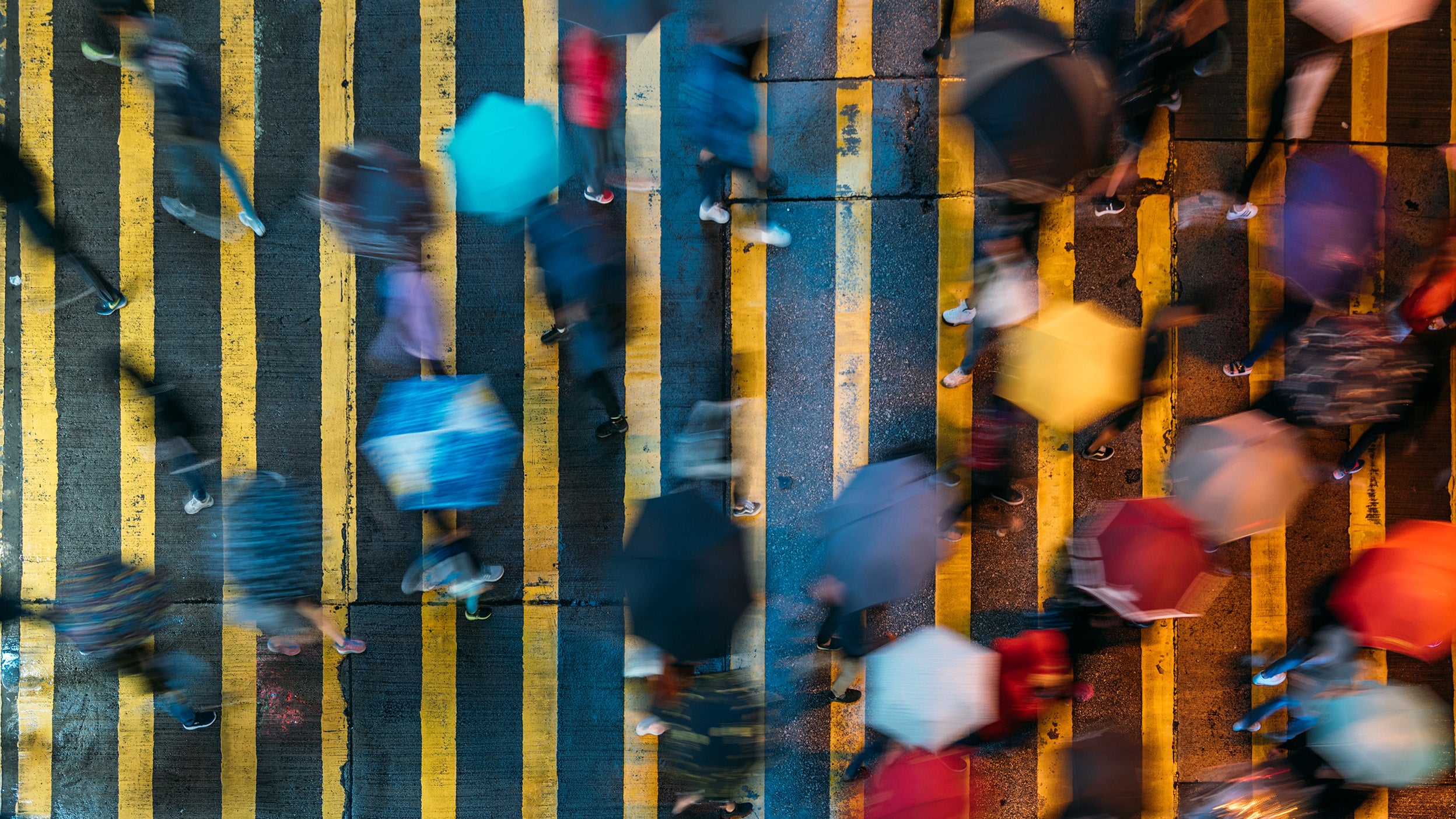

Global unrest can tempt investors to change investment plans, but long-term market growth has continued throughout history despite wars.

Markets largely expected last week’s tariff decision and the flare-up in US-Iran tensions, while new US economic data was weaker than anticipated.

The US Supreme Court struck down IEEPA tariffs, but alternative statutes may mean tariffs remain, although the market impact appears limited.

On one side, weaker growth makes Fed easing more likely. On the other side, stronger growth supports an intact business cycle. Either can be supportive of markets if inflation stays contained.

Get straightforward insight from our market and economic experts on what investors need to know about soft landings, inflation, the economy, government debt, election season, and more.

Insights from our income experts on investing opportunities around the globe.

Our latest thinking on opportunities and potential ways to use ETFs in a portfolio.

Learn about investing in ETFs, including the basics, benefits, and choosing one.

Candid conversations with fund managers, market strategists, and more.

AEM723/ AEM731

This link takes you to a site not affiliated with Invesco. The site is for informational purposes only. Invesco does not guarantee nor take any responsibility for any of the content.