Asset allocation Capital market assumptions | 2025

Invesco Solutions develops capital market assumptions (CMAs) that provide long-term estimates for the behaviour of major asset classes globally.

As investors seek to enhance growth, income and diversification, alternative assets have become an increasingly important part of institutional portfolios. Our flexible multi-manager platform offers streamlined access to high quality investments.

Access to a diversified global set of investment opportunities through Invesco’s in-house alternative capabilities as well as leading partner firms.

As the long-term return expectations across traditional markets are declining and concerns around the impact of inflation rising, navigating the markets will be even more challenging.

The unique characteristics of alternative assets means that they typically generate higher returns than what might be found in public market assets, so capturing the benefits of private markets will be increasingly critical to achieving key investment outcomes.

The Alternatives Opportunities Dashboard is proprietary research developed by the IIS team and is intended to provide detailed insights on market positioning, fundamentals, and valuations across private markets asset classes: private credit, private equity, and real assets. The dashboard helps guide investors through the private markets landscape.

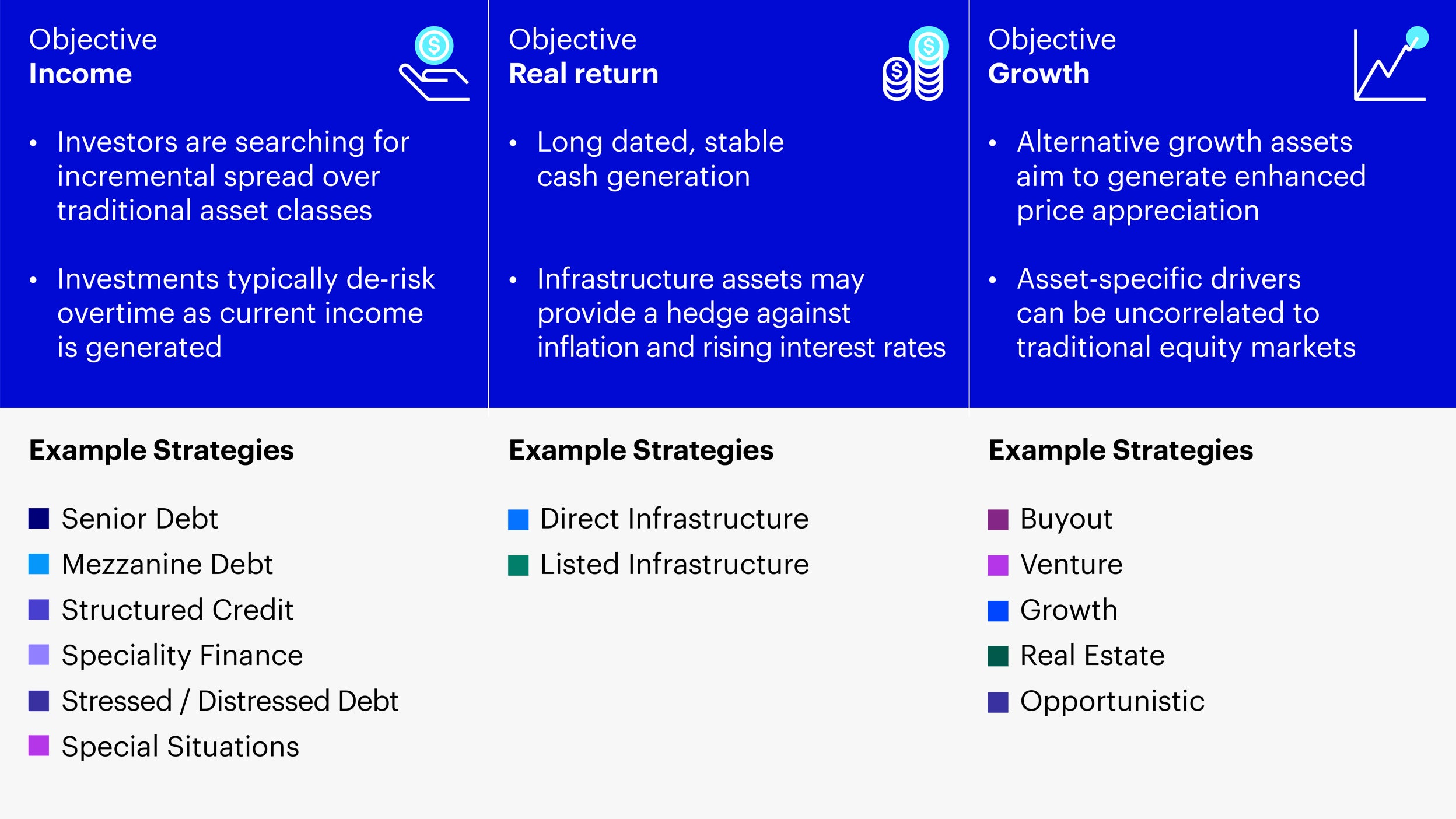

With allocations to alternatives increasing, investors need to consider the drivers of risk and return to align investments with desired outcomes. Below are three thematic objectives that institutions may seek when designing alternative portfolios; income, real return and growth.

Streamlined: Our multi-manager alternatives platform simplifies the process of investing in alternative assets – bridging the gap between your investment strategy and execution.

Diversification: Alongside Invesco’s in-house capabilities, we have sourced high-quality third-party managers who offer scale, global presence and complementary expertise in private market investments.

Analysis: Using Invesco Vision, we can understand forecasted risks, returns and correlations between portfolio assets, and integrate alternatives to improve your portfolio’s ability to meet its investment objectives.

Flexibility: Acting as an extension of your team, we can offer advisory services as well as customised and commingled solutions.

Reporting: Through the platform clients have access to investment and operational monitoring with integrated reporting.

To learn more about our alternatives expertise, please get in touch.

Connect with us for an in-depth presentation focused on your investment challenges and opportunities.

Capital Market Assumptions (CMAs)

Invesco Investment Solutions develops CMAs that provide long-term estimates for the behavior of major asset classes globally. The team is dedicated to designing outcome-oriented, multi-asset portfolios that meet the specific goals of investors. The assumptions, which are based on a 10-year investment time horizon, are intended to guide these strategic asset class allocations. We also utilize 5-year CMAs to give a half-cycle view. For each selected asset class, we develop assumptions for estimated return, estimated standard deviation of return (volatility), and estimated correlation with other asset classes.

Fixed income returns are composed of; the average of the starting (initial) yield and the expected yield for bonds, estimated changes in valuation given changes in the Treasury yield curve, roll return which reflects the impact on the price of bonds that are held over time, and a credit adjustment which estimates the potential impact on returns from credit rating downgrades and defaults. Equity returns are composed of; a dividend yield, calculated using dividend per share divided by price per share, buyback yield, calculated as the percentage change in shares outstanding resulting from companies buying back or issuing shares, valuation change, the expected change in value given the current Price/Earnings (P/E) ratio and the assumption of reversion to the long-term average P/E ratio, and the estimated growth of earnings based on the long-term average real GDP per capita and inflation. Volatility estimates for the different asset classes, we use rolling historical quarterly returns of various market benchmarks. Given that benchmarks have differing histories within and across asset classes, we normalize the volatility estimates of shorter-lived benchmarks to ensure that all series are measured over similar time periods.

For additional details regarding the methodology used to develop these estimates, please see our white paper Capital Market Assumptions: A building block methodology.

This information is not intended as a recommendation to invest in a specific asset class or strategy, or as a promise of future performance. These asset class assumptions are passive, and do not consider the impact of active management. Given the complex risk-reward trade-offs involved, we encourage you to consider your judgment and quantitative approaches in setting strategic allocations to asset classes and strategies. This material is not intended to provide and should not be relied on for tax advice.

References to future returns are not promises or estimates of actual returns a client portfolio may achieve. Assumptions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. Estimated returns can be conditional on economic scenarios. In the event a particular scenario comes to pass, actual returns could be significantly higher or lower than these estimates.

Indices are unmanaged and used for illustrative purposes only. They are not intended to be indicative of the performance of any strategy. It is not possible to invest directly in an index.

The CMAs included are based on Invesco’s return expectations for the asset classes shown. The indices referenced are included as proxies for the asset classes and have been selected because they are well known and are easily recognisable by investors. The inclusion of these indices is not linked to the promotion of any investment products or services.

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Alternative investment products, including private equity, may involve a higher degree of risk, may engage in leveraging and other speculative investment practices that may increase the risk of investment loss, can be highly illiquid, may not be required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as mutual portfolios, often charge higher fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager. There is often no secondary market for private equity interests, and none is expected to develop. There may be restrictions on transferring interests in such investments.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.