How will recent regulatory updates impact China equities?

In this Q&A we speak with Chris Liu and Andrew Tong in the China A-shares team on the investment implications of recent regulatory changes impacting China equity markets and where they believe investors may find opportunities.

Q: In late December 2022, Hong Kong and China securities regulators announced that they plan to expand the two stock connect schemes linking the Hong Kong, Shanghai, and Shenzhen bourses to cover more than 80% of listed stocks, including foreign equities with primary listing in Hong Kong.1 What are the main changes this expansion will bring about?

A: According to the plan, the screening universe for northbound trading eligibility will be based on all listed A-share companies on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) instead of select indices after the implementation. Eligible companies will also be subject to a minimum market capitalization of RMB 5 billion and additional liquidity criteria.

Based on our estimate, we expect the amended rules to add about 1,100 companies to the northbound eligible universe2 and raise the A-share access of Stock Connect from 76% to 91% of total market capitalization.

What are the investment implications of this move for China A-shares?

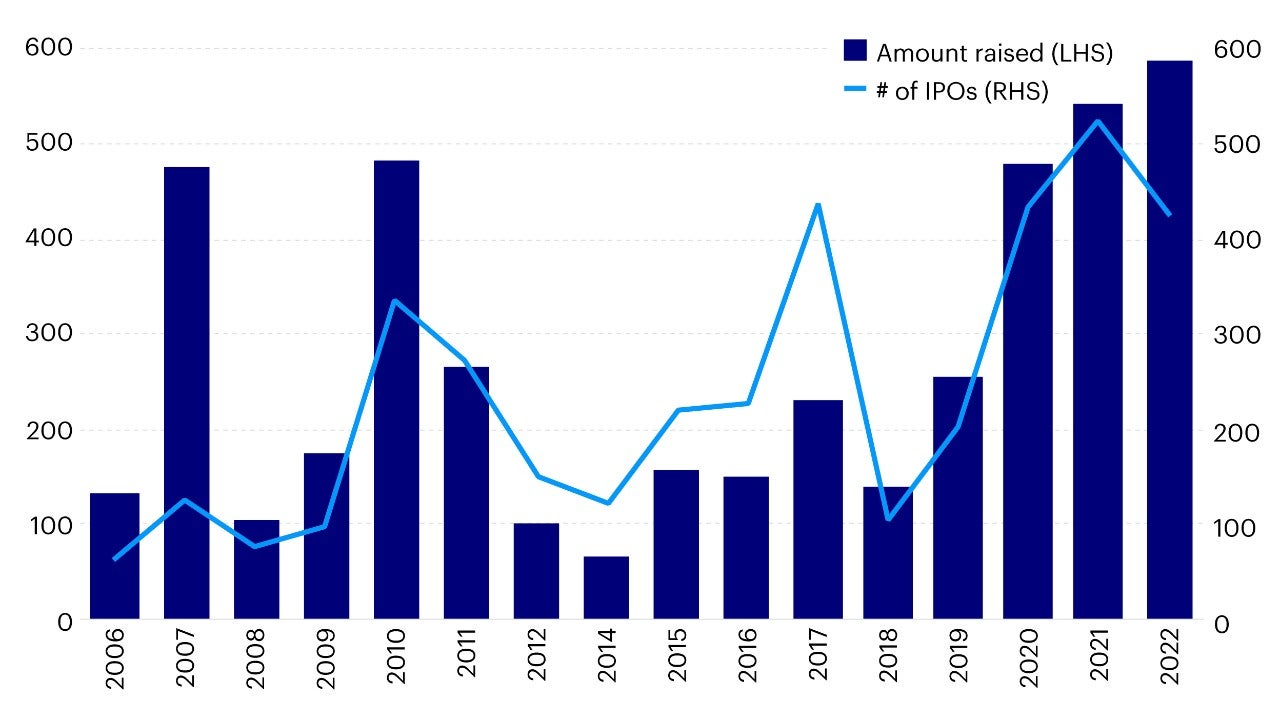

A: This latest expansion, as well as the upcoming trading calendar enhancement, signal the regulator’s commitment to ongoing market reform aimed at improving A-share accessibility to foreign investors. The amendments can also help the Stock Connect keep pace China’s rapidly growing primary market especially after the registration-based IPO reform.

We believe the expansion will give foreign investors easier access to investing in small cap companies in China without utilizing the Qualified Foreign Investor (QFI) scheme.

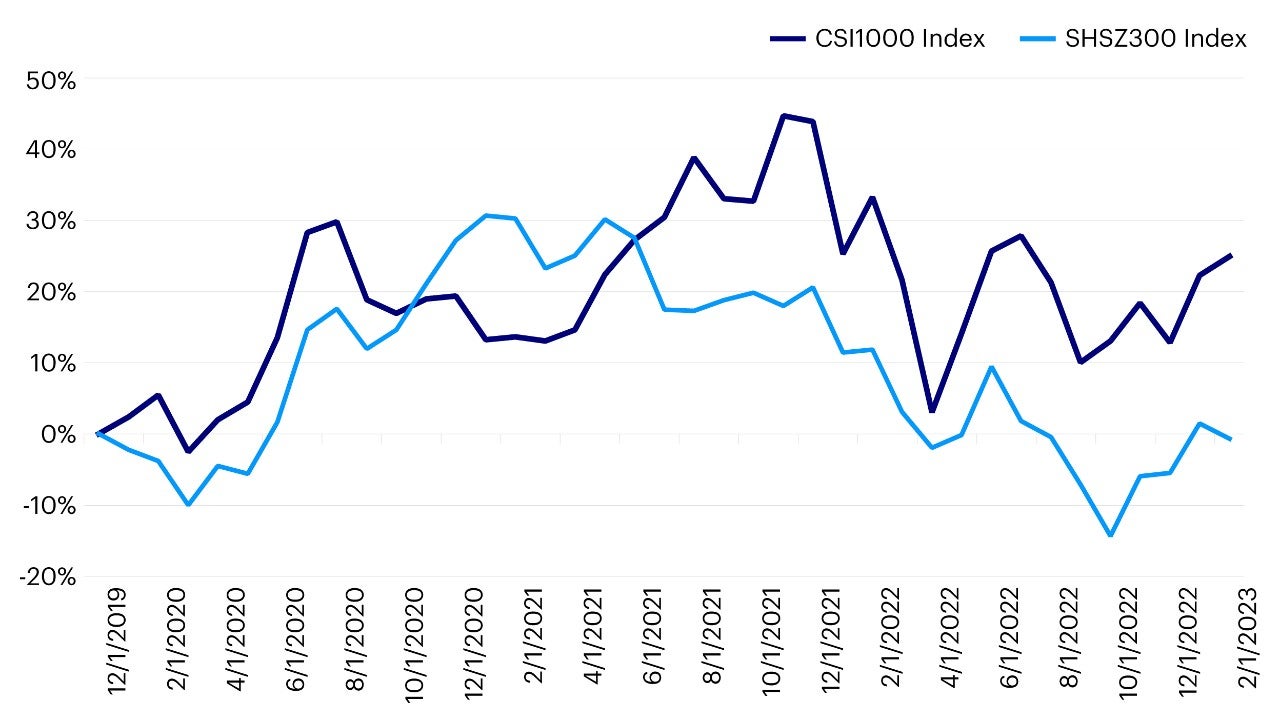

Source: Bloomberg, data as of 28 February 2023.

Small cap firms have outperformed large cap companies by 19.3% since the end of 2019.3 The long-term appeal of Chinese small caps is increasing due to policy support for small and medium enterprises (SMEs) as well as supply chain security.

We do not anticipate a significant increase in Stock Connect trading turnover immediately after the expansion as investors may not yet have extensive research coverage on small caps.

Q: China officially rolled out its registration-based initial public offering (IPO) system in February. This system is designed to simplify listing requirements and improve registration and vetting procedures, so the process becomes more regulated, transparent, and predictable. How may this development impact China’s capital markets and particularly the A shares market?

A: This latest rollout marks the last step in China’s registration-based IPO reform which started a few years ago. The reform was first carried out in the ChiNext and Shanghai Stock Exchange Science and Technology Innovation Board (STAR Market) and has now expanded to the main boards which holds the largest proportion of A share listings in terms of market cap.

Short-term, we expect the introduction of the system to lead to an increase in the supply of stocks in the China A share market as the listing approval process is now simpler and listing requirements are less stringent. The increased supply could also dampen valuations of listed small cap names with poor fundamentals in the short run. We expect the value of small cap shell companies (similar to penny stocks) to decrease significantly, and as a result, the overall valuations of small caps could come down. While on the contrary, valuations of blue-chip high-quality names could continue to stand out in the longer term.

In parallel to the relaxation of listing requirements after the implementation of registration-based IPO reform, we anticipate that the delisting of companies with poor fundamentals/corporate governance will increase, which could help improve the overall investment experience for investors in the long run.

Securities firms could benefit in the short to medium term since the underwriting business may boom as more and more IPOs are registered. In the long term however, securities firms may need to bear the risk of holding the IPOs that are not fully subscribed.

We believe the risk-free return gained by participating in IPOs subscriptions in the A share market will gradually disappear for both retail and institutional investors and therefore the return on IPO trading may become less attractive over time.

Since the registration-based IPO system could increase the number of listings in the market significantly it could cause retail investors to face more difficulty in picking stocks. At the same time, we expect institutional investors with strong research capabilities to have a significant advantage given their ability to pick high quality stocks that deliver better alpha.

Source: Wind, data as of 22nd February 2023.

Q: The China Securities Regulatory Commission (CSRC) recently published rules to regulate offshore listings, reviving foreign IPOs by Chinese firms after a regulatory freeze imposed in July 2021. What might the investment implications of this move be for the A shares market?

A: Data privacy and national security concerns were the main reasons for the 2021 regulatory freeze on offshore listings.

As the latest rules come into effect, we expect regulators to start to allow more foreign IPOs by Chinese companies. China and the US have also reached a certain level of agreement on allowing Chinese companies to provide auditing materials to US regulators, so we anticipate the delisting risk for Chinese American depository receipts (ADRs) to decrease.

The reopening of this offshore listing channel could help reduce the stock supply pressure on the China A-share market that may occur after the implementation of registration-based IPO reform.

The publishing of clear rules to regulate offshore listings is a positive development towards greater regulatory transparency, which has been a major concern for China investors in the last few years. In particular, regulators can allow filings by companies with a VIE (Variable Interest Entity) structure subject to certain review.

We believe an overall improvement in the equity funding situation for Chinese companies will be an important catalyst for a stronger business sentiment and economic recovery.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2023-024

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html