Asian Equities Mid-Year outlook – On the road to recovery backed by reopening of the economy and attractive valuations

Key Talking Points:

- Asia ex-Japan delivered mixed performances in previous US rate hike cycles.

- Asia is in a relatively better financial position to weather potential macro economic headwinds.

- China’s zero COVID policy may pose downside risk to Asian economies.

- Re-opening of Asia (ex China) may boost growth further.

- Asian equities are at a highly comfortable valuation and may likely bottom out before others.

Asia ex-Japan delivered mixed performances in previous US rate hike cycles

Rising inflation and interest rates are key concerns for investors around the globe. Inflation in the US reached a 40-year high in May and still shows no signs of slowing down. The market is expecting more rate hikes. Sentiment remains weak for most asset classes.

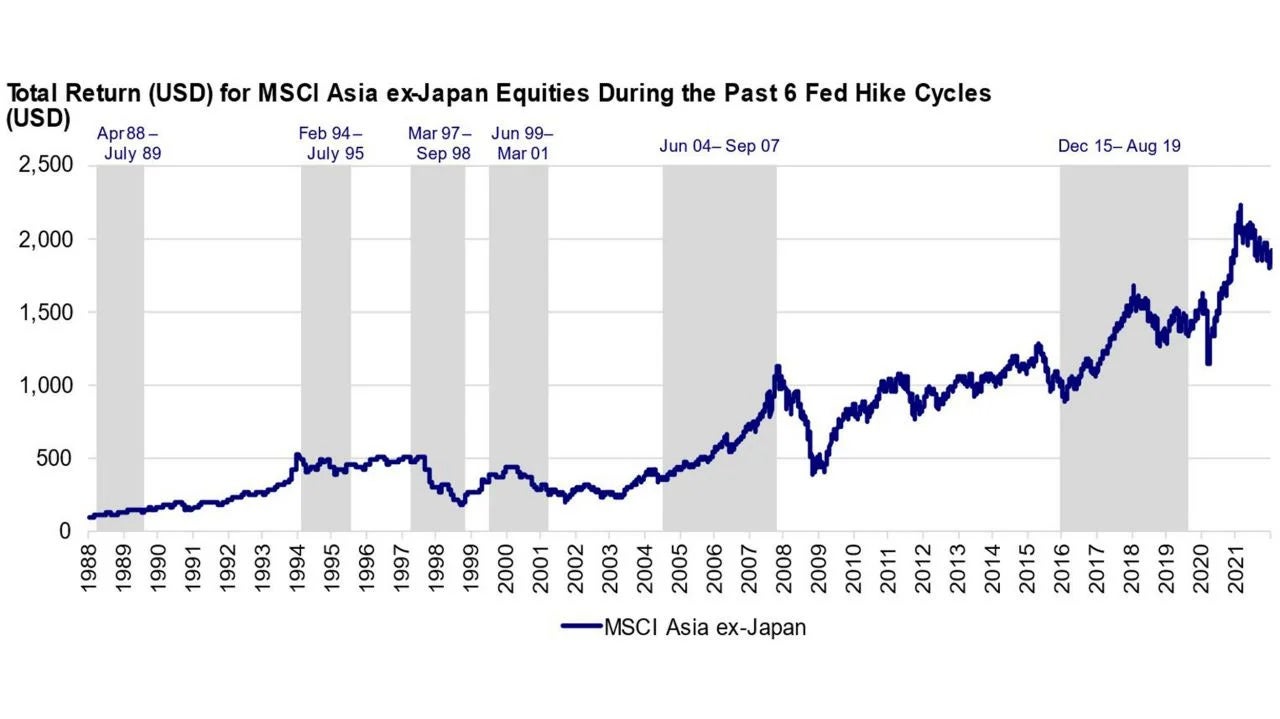

At this juncture, we look at Asian equity’s performance in the past six interest rate hike cycles. Historical data showed that Asian equity's performance was mixed, different from the view that Asian markets will deliver negative performance amid rising US interest rates.

In fact, the two most recent interest rate hike cycles showed that Asian equities delivered positive performance. From June 2004 to September 2007, MSCI Asia ex-Japan rose 150%, outperforming MSCI World (57%) and MSCI US (40%) 1, although interest rates more than tripled.

Regarding the last rate hike cycle between December 2015 and August 2019, Asian equities delivered positive performance of 40%, on the back of solid GDP and decent earnings growth.

Source: Invesco, Haver, MSCI, Morgan Stanley Research, as of May 2022. Note: We define the end of rate hike cycles as the day before 1st rate cut. Past performance is not a guide to future returns.

Asia is in a relatively better financial position to weather potential macro economic headwinds

Asia's financial position is much stronger than in the past. First, Asia's exports have seen the best recovery in the past three cycles. A comparison of exports growth, after COVID this time, to the Greater Financial Crisis in 2008, Tech Bubble Burst in 2000 and Asian Financial crisis in 1997 showed that exports growth is 30% stronger 2.

Second, Asian governments’ balance sheets are much healthier. Apart from China, which remains financially sound, Asia ex China's current balance as a percentage of GDP is more than 1.5 times that of a decade ago 3. Emerging Asian countries also demonstrated solid financial strength, e.g., Indonesia has recently recorded the biggest capital account surplus in ten years, thanks to its solid commodity exports.

Despite COVID, we have seen excess savings and further accumulation of wealth from Asian households helped by mobility restrictions in the last two years. In Korea, we have seen savings of 8.1% of house annual disposable income during 2020-2021, which is higher than historical average. 4

While rising interest rates in the US will inevitably impact investors' sentiment and asset allocation, Asia is in a better position to withstand external shock this time. Its unique economic dynamics and investment opportunities could offer diversification for global investors.

China’s zero COVID policy may pose downside risk to Asian economies

China's zero COVID policy has successfully combated COVID since the outbreak's start. The authorities have reiterated the stance to adhere to the policy, and so far, there is no clear roadmap to normalization. China is the global manufacturing powerhouse and is heavily involved in the worldwide supply chain. The disruption brought about by the potential stop in production and business activities will undoubtedly impact business in Asia and the rest of the world.

Asian countries, one of the largest trading partners with China with a share of 17% and 15% of export and import, will not be immune 5. Korea and Taiwan are most exposed, as they are critical suppliers of technology components and have strong trading relationship with China.

Within ASEAN, Vietnam is most impacted by the decline in China's demand, as reflected by the softening of recent textile exports. Singapore also has a relatively high exports and supply chain linkage to China. In comparison, India is the least vulnerable to China's slowdown, with its total exports to China limited to only around 1% of its GDP 6.

Re-opening of Asia (ex China) may boost growth further

Asia (ex-China) is reopening their economies at a swift pace. With over 80% of its population fully vaccinated, Asia's mobility has reached a new peak post the pandemic, and we see room for further recovery. We expect activity in the contact-intensive services sectors to rebound quickly, lifting employment and further spurring domestic consumption.

COVID restrictions have been lifted in most parts of the region. For example, Thailand now allows quarantine-free travel (since June), and Singapore has reopened its border since April. With a significant portion of their GDP coming from tourism and related sectors, Thailand and Singapore will likely benefit from reopening.

We see a strong start of tourism in Singapore - major conferences, exhibitions and sports events such as Shangri-La Dialogue and Formula One competition have been held recently or are planned later for this year, leading to a strong rebound in passenger flows. We expect to see the same for the rest of Asia ex-China and are hopeful to see a substantial uptick in growth and activities.

Asian equities are at a highly comfortable valuation and may likely bottom out before others

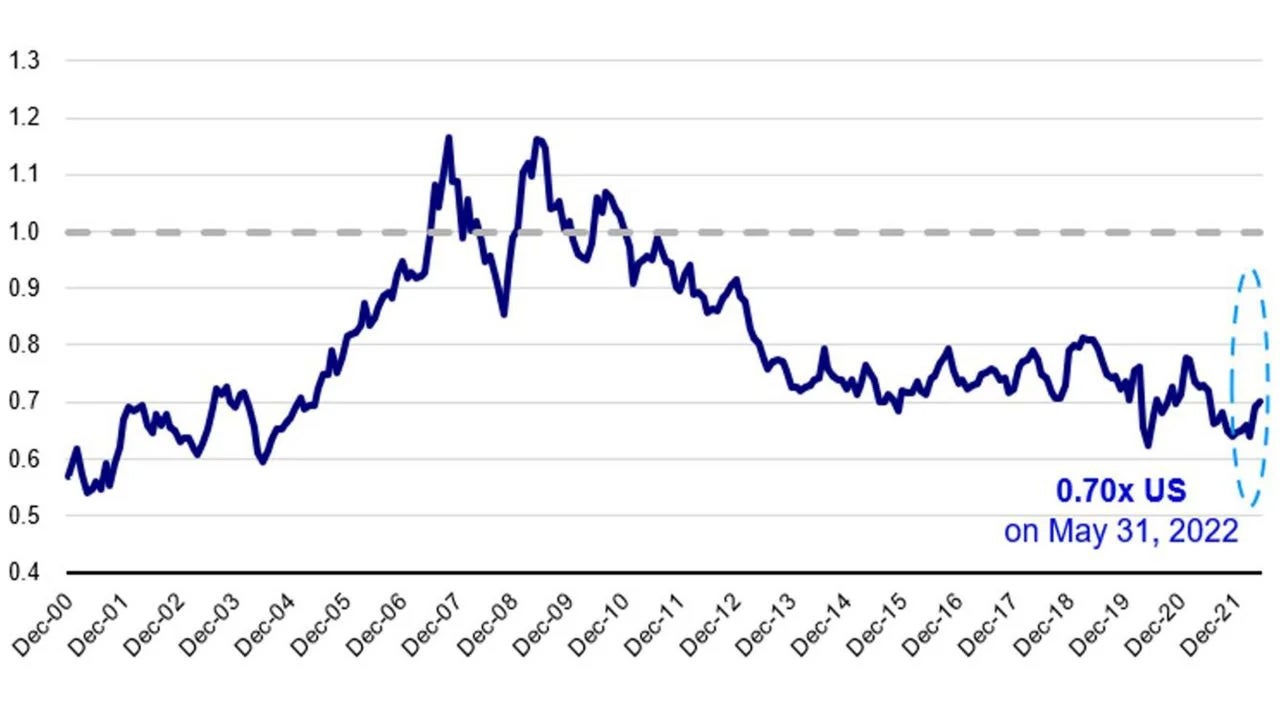

The relative price-to-earnings ratio (PER) valuation discount for Asian equities compared to US equities provides a better valuation cushion for Asian equities in the face of global macro headwinds.

Asian equities are currently trading at 12.5x, at the lower quartile of its historical range, while US equities though corrected early this year, have only retraced down to 17.8x,7 still above upper quartile of its historical range, suggesting potentially more downside risk.

Source: Factset, data as of May 2022. Relative P/E of Asia vs US refers to Priece-Earnings ratio for the next 12 months of MSCI Asia ex Japan vs MSCI US

We see the same from the price-to-book perspective, where MSCI Asia ex-Japan is at ~1.7x, and again towards the low end of its 5-year range 8.

Valuations for selected countries such as China, Taiwan and Korea are particularly low, as the market priced in concerns on slower export growth. We believe that the risk premium may be over elevated. Asian equities were already down 23% in the past year as compared to MSCI World (-6.21%) and MSCI US (-3.63%). 9 The valuation gap is evident - Asian equities are now trading at around 30% discount to the US. 10

Meanwhile, earnings growth in Asia is at 11.6x (2022E), and we are hopeful to see earnings picking up as the market normalizes. 11 We believe that Asia is likely to bottom out before others.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When investing in less developed countries, you should be prepared to accept significantly large fluctuations in value.

Investment in certain securities listed in China can involve significant regulatory constraints that may affect liquidity and/or investment performance.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-046

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html