Tactical Asset Allocation: April 2022

Improving risk appetite signals resilience in the economy. Our framework moves back into expansion. We increase portfolio risk to overweight, via emerging markets, cyclical factors/sectors and risky credit.

Synopsis

Market dynamics and investor sentiment are indicative of improving global growth expectations, leading us to reposition for an expansionary regime.

It is premature to read recessionary signals from the yield curve at this stage, as a positive 200 basis point slope between 3-month and 10-year yields indicates favorable credit conditions.

We increased our portfolio risk stance to overweight relative to benchmark in the Global Tactical Asset Allocation model1, increasing the overweight in equities relative to fixed income via emerging markets, and tilting in favor of cyclical sectors and factors. We increased credit risk back to neutral and reduced aggregate duration relative to benchmark, while maintaining a flattening yield curve bias.

Macro update

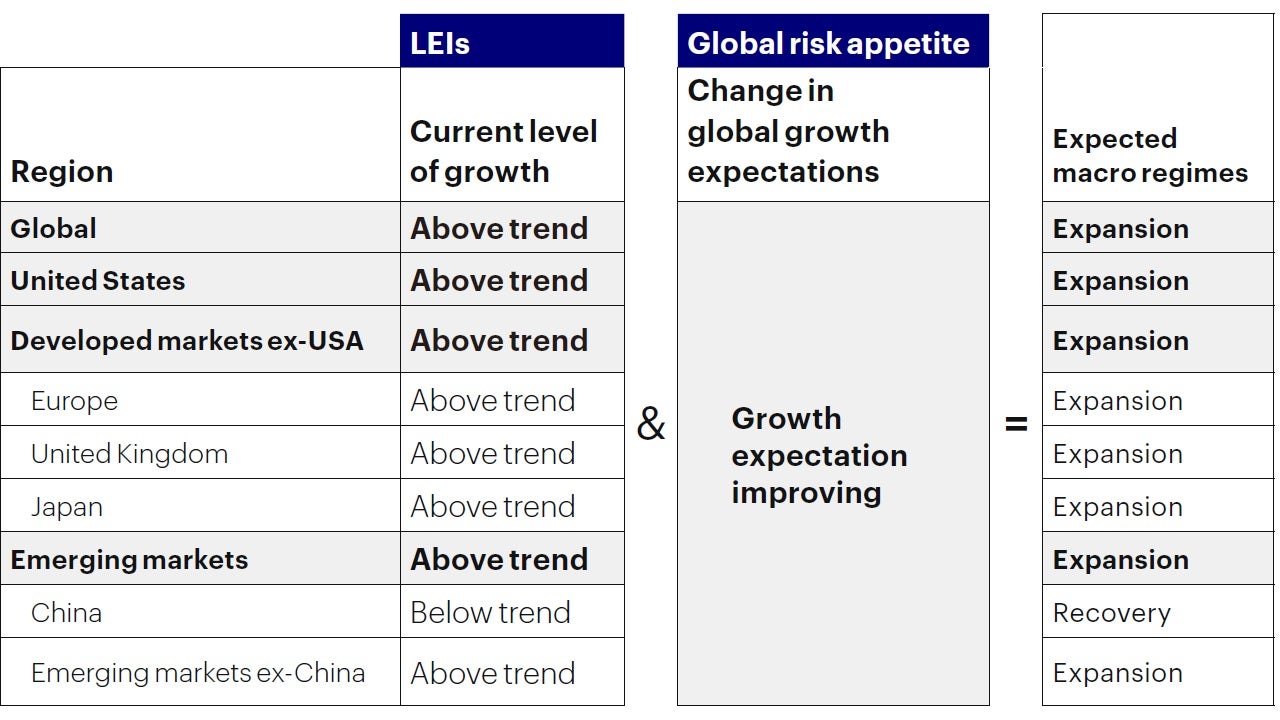

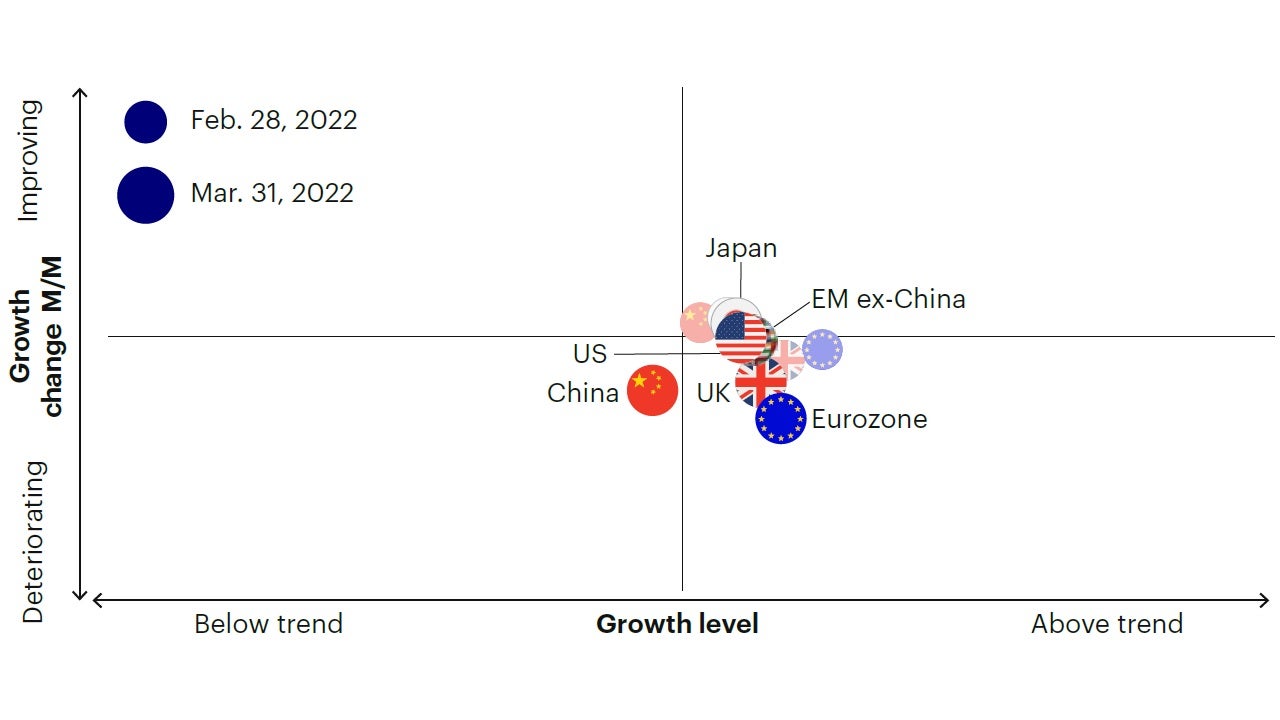

Equity, credit, and government bond markets around the world have posted negative returns in Q1 2022, driven by a rare combination of an historic repricing of tighter monetary policy expectations, rising inflation expectations, and higher geopolitical risk. Since the end of Q3 2021, Federal Reserve policy expectations have evolved from pricing-in one rate hike at the end of 2022, to expecting a sequence of eight or nine consecutive rate increases leading to a Fed Funds rate between 225-250 basis points by December 20222. Monetary policy expectations around the world have followed a largely similar hawkish repricing. These developments, coupled with an additional 30% increase in energy and agricultural commodity prices year-to-date, and rising economic risks from the Ukraine/Russia conflict, raise the question on whether markets are signaling a premature end to this economic cycle. At this stage, our macro regime framework suggests the answer is no. On the contrary, it suggests market dynamics are actually indicative of improving global growth expectations, leading us to reposition for an expansionary regime (Figure 1 and Figure 2). What are the drivers of this seemingly counterintuitive conclusion?

Sources: Bloomberg L.P., Macrobond. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions. Macro regime data as of March 31, 2022. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

Market dynamics and investor sentiment are indicative of improving global growth expectations, leading us to reposition for an expansionary regime.

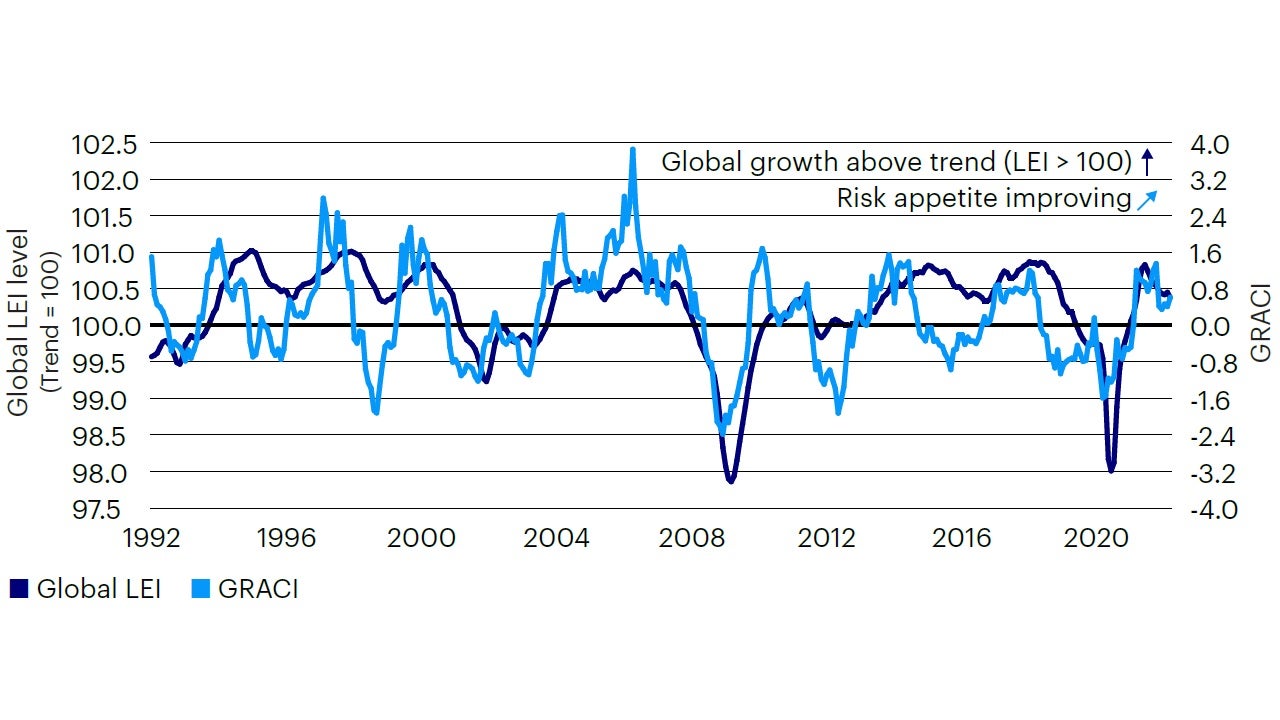

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Investment Solutions research and calculations, from Jan. 1, 1992 to March 31, 2022. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk taking in global capital markets in the recent past. Past performance does not guarantee future results.

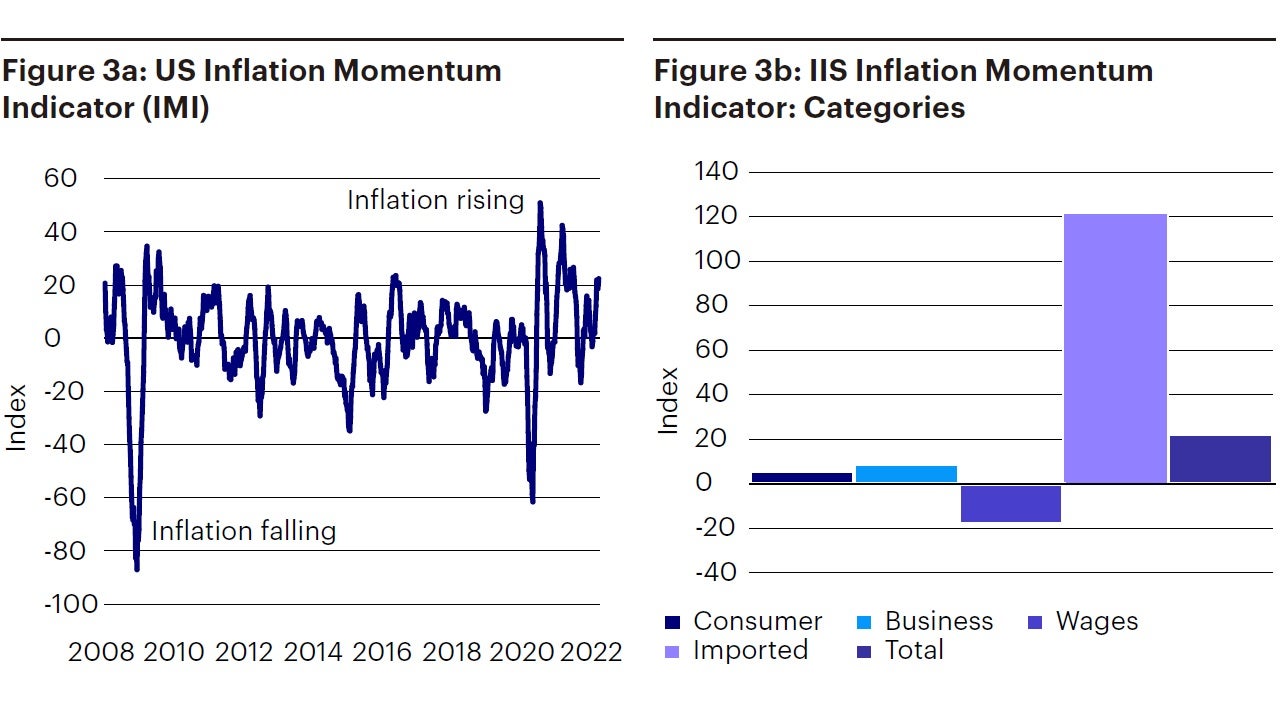

Despite the sharpest increase in bond yields since the Fed tightening cycle of 1994, growth sensitive assets such as equity and risky credit have outperformed, on average, safer asset classes such as government bonds and investment grade credit over the past three, six, and 12 months. The repricing of higher discount yields has not led to a repricing of lower growth expectations via lower equity or credit excess returns, which are directly related to growth risk in the economy. As a result, our indicator of global risk appetite is pointing again toward improving growth expectations for the first time since November 2021, before the Omicron shock. In other words, the downside risks to growth flagged in our last update did not materialize. However, we continue to register upside risks to inflation (Figure 3), as the commodity shock from the Russia/Ukraine conflict puts upward pressure on commodity prices, yet to be reflected in headline and core inflation statistics.

The commodity shock from the Russia/Ukraine conflict puts upward pressure on commodity prices, yet to be reflected in headline and core inflation statistics.

Sources: Bloomberg L.P. data as of March 31, 2022, Invesco Investment Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

It is premature to read recessionary signals from the yield curve at this stage, as a positive 200 basis point slope between 3-month and 10-year yields indicates favorable credit conditions.

Yield curve inversion

The inversion of the yield curve beyond 2-year and 5-year maturities indicates markets expect the economy to meaningfully slow and potentially fall into a recession at the end of the tightening cycle. However, the tightening cycle has just begun, and the Fed remains meaningfully behind the curve, as indicated by the slope between the policy rate and 2-year bond yields at about +200 basis points. In fact, the well-earned fame of the yield curve as a leading indicator of recessions pertains to the spread between 3-month rates and long-term bond yields (i.e., 10-year), as financial institutions borrow predominantly at short-term deposit rates and extend credit to long-term maturities3. An inversion of the 10-year to 3-month yield curve has historically presaged a recession by about 12 to 24 months, as monetary policy conditions transmit to the real economy with a lag. At present, this slope remains very steep at about +200 basis points, providing ample profit margins for credit creation and a positive signal for economic growth, as confirmed by the outperformance of financials. In other words, we believe it is premature to read recessionary signals and draw bear market conclusions from the yield curve at this stage4.

Investment positioning

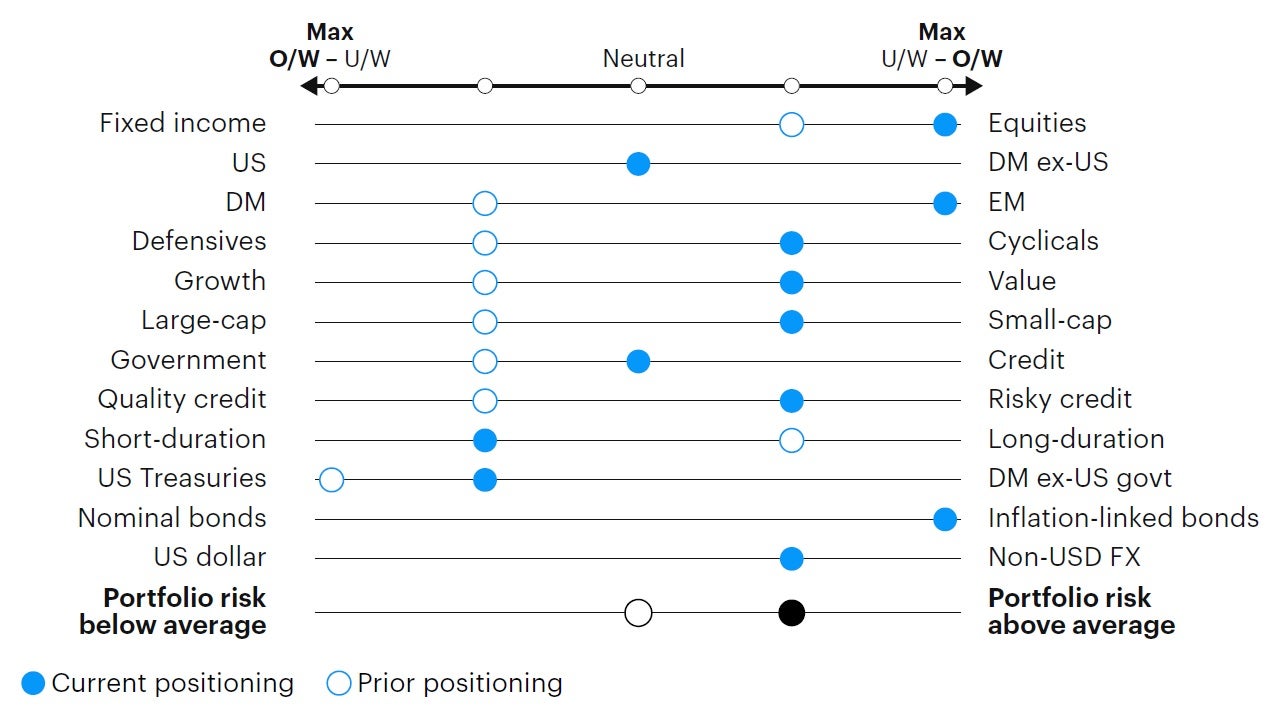

We increased our portfolio risk stance to overweight relative to benchmark in the Global Tactical Asset Allocation model1, increasing the overweight in equities relative to fixed income, primarily via emerging market equities, and tilting in favor of cyclical sectors and factors. We increased credit risk back to neutral after last month’s reduction5, with a higher allocation to short and intermediate credit maturities. We reduced aggregate duration relative to benchmark, while maintaining a flattening yield curve bias. (Figure 4, 5, 6). In particular:

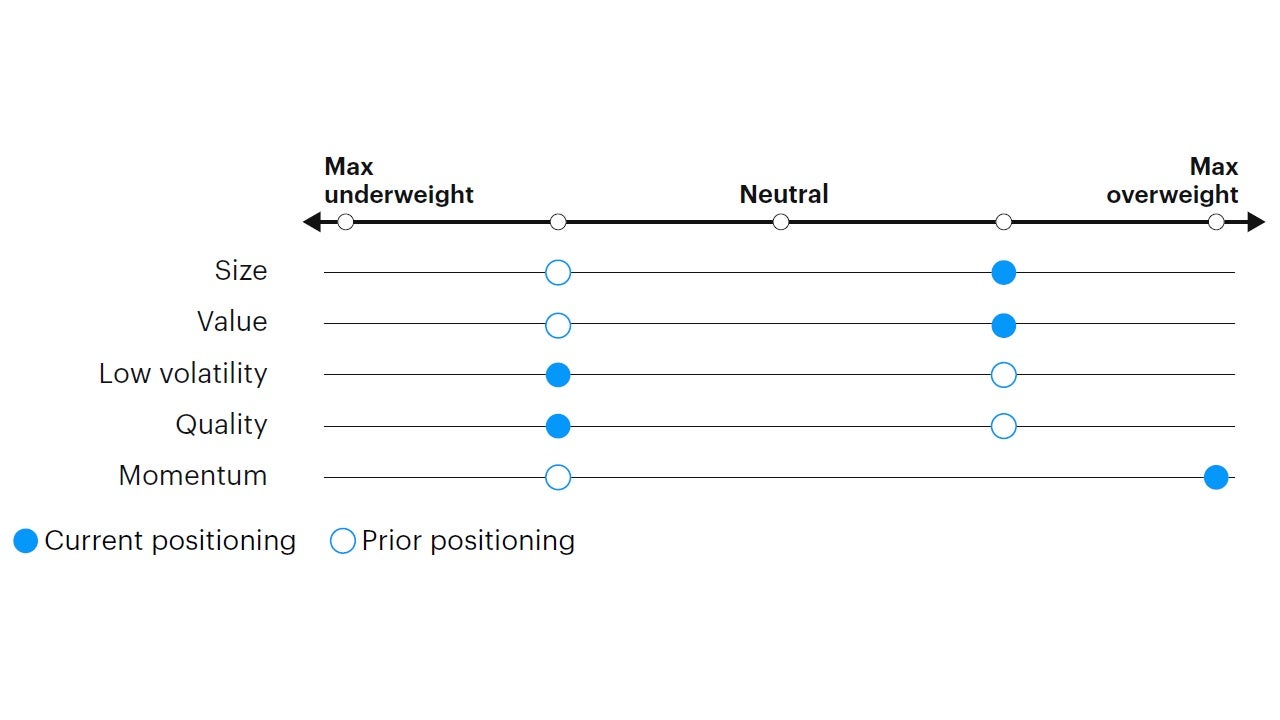

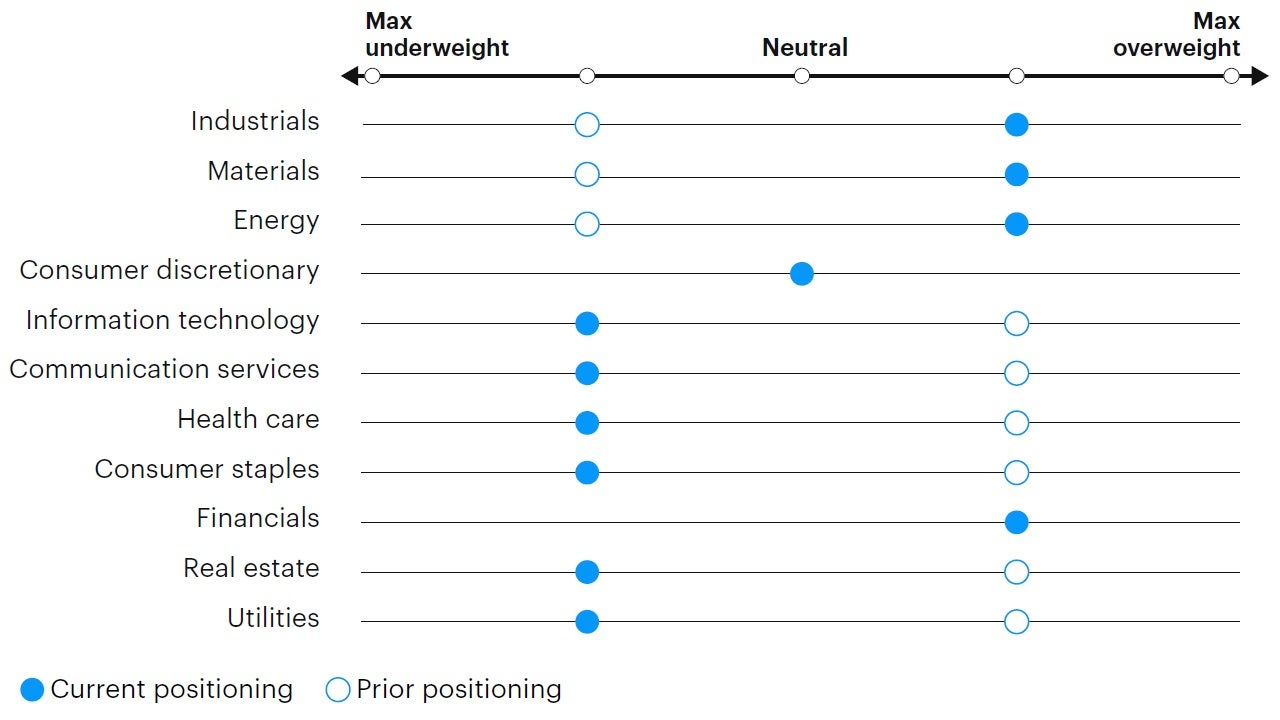

- Within equities we overweight cyclical factors like (small) size, value and momentum and favor cyclical sectors such as financials, industrials, materials, and energy (Figure 6). From a regional perspective, we move to an overweight exposure in emerging markets relative to developed markets as improving risk appetite and attractive valuations tend to benefit the asset class.

- In fixed income we cut aggregate duration to underweight relative to benchmark, given rising growth expectations and elevated inflation momentum, but maintain a flattening bias and expect the entire term structure to be inverted by year-end. We remain overweight inflation-linked bonds relative to nominal Treasuries. We added credit exposure back to neutral after last month’s reduction, with a higher allocation to short-dated high yield and bank loans, and no exposure to emerging markets debt. We reduced the overweight in US Treasuries over other developed government bond markets given the reduced yield advantage on a hedged basis.

- In currency markets we remain underweight the US dollar, favoring the euro, Canadian dollar, Singapore dollar, Norwegian kroner, and Swedish krona within developed markets. In EM we favor high yielders with attractive valuations such as the Indian rupee, Colombian peso, Mexican peso, and Brazilian real. We underweight the British pound, Swiss franc, Japanese yen, and Australian dollar.

Figure 4: Relative tactical asset allocation positioning

Increasing portfolio risk, going overweight EM equities, cyclical factors and adding back credit risk.

Source: Invesco Investment Solutions, March 31, 2022. DM = developed markets. EM = emerging markets. FX = foreign exchange. For illustrative purposes only.

Figure 5: Tactical factor positioning

Factor tilts within the expansion regime are toward size, value and momentum

Source: Invesco Investment Solutions, March 31, 2022. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Figure 6: Tactical sector positioning

In an expansionary regime, sector tilts favor cyclicals relative to defensives.

Source: Invesco Investment Solutions, March 31, 2022. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of March 2022, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, communication services, utilities; Neutral: consumer discretionary.

Footnotes

- Global 60/40 benchmark (60% MSCI ACWI / 40% Bloomberg Barclays Global Agg USD hedged)

- For an overview of equity market performance following yield curve inversions see “What could a yield curve inversion mean for stocks”, from Brian Levitt, March 24, 2022.

- For extensive literature and FAQ on the yield curve as a leading indicator see Federal Reserve Bank of New York at https://www.newyorkfed.org/research/capital_markets/ycfaq#/

- For an overview of equity market performance following yield curve inversions see “What would a yield curve inversion mean for stocks”, from Brian Levitt, March 24, 2022.

- Credit risk defined as duration times spread (DTS).

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

20220413-2122077-JP

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html