Tactical Asset Allocation: May 2022

Our macro framework dismisses recession risks and remains in an expansionary regime. We are overweight risk relative to benchmark, via equities, emerging markets, cyclicals, and value.

Synopsis

- Despite turbulent financial markets and the broadbased deterioration in leading economic indicators over the past month, our macro regime framework continues to dismiss recession risks at this stage, pointing to an expansionary regime ahead.

- We maintain an overweight risk stance relative to benchmark in the Global Tactical Asset Allocation model1, overweighting equities relative to fixed income, primarily via emerging market equities, and tilting in favor of cyclical sectors and factors. We are neutral credit and underweight duration.

Macro update

Equity, credit, and government bond markets around the world experienced meaningful underperformance over the past month, hit by a confluence of adverse developments.

- First, central banks continue to increase their hawkish tone in response to stubbornly high and rising price pressures, with inflation statistics still printing well above market consensus. Markets are now pricing a slightly restrictive policy stance in the US and the UK, and a normalization of policy in the Eurozone back to positive deposit rates by year end2. The era of unconventional, ultra-accommodative monetary policy has effectively come to an end.

- Second, China continues to battle the spread of COVID-19 with renewed selective lockdown measures, which inevitably provide downside risks to growth and upside risks to inflation given their likely impact on local and global supply chains, transportation, and production channels.

- Finally, the conflict between Russia and Ukraine continues to impact market confidence, as the threat of energy supply shocks to the European continent skews future outcomes toward the poisonous mix of additional downside growth and upside inflation risks.

Our leading economic indicators declined noticeably over the past month, especially for the Eurozone, UK, and China. Unsurprisingly, consumer confidence, manufacturing surveys, and global trade were hard hit across European countries following the start of the conflict. In China, real estate surveys and housing indicators still point to weakness, which has led the People’s Bank of China to ease policy.

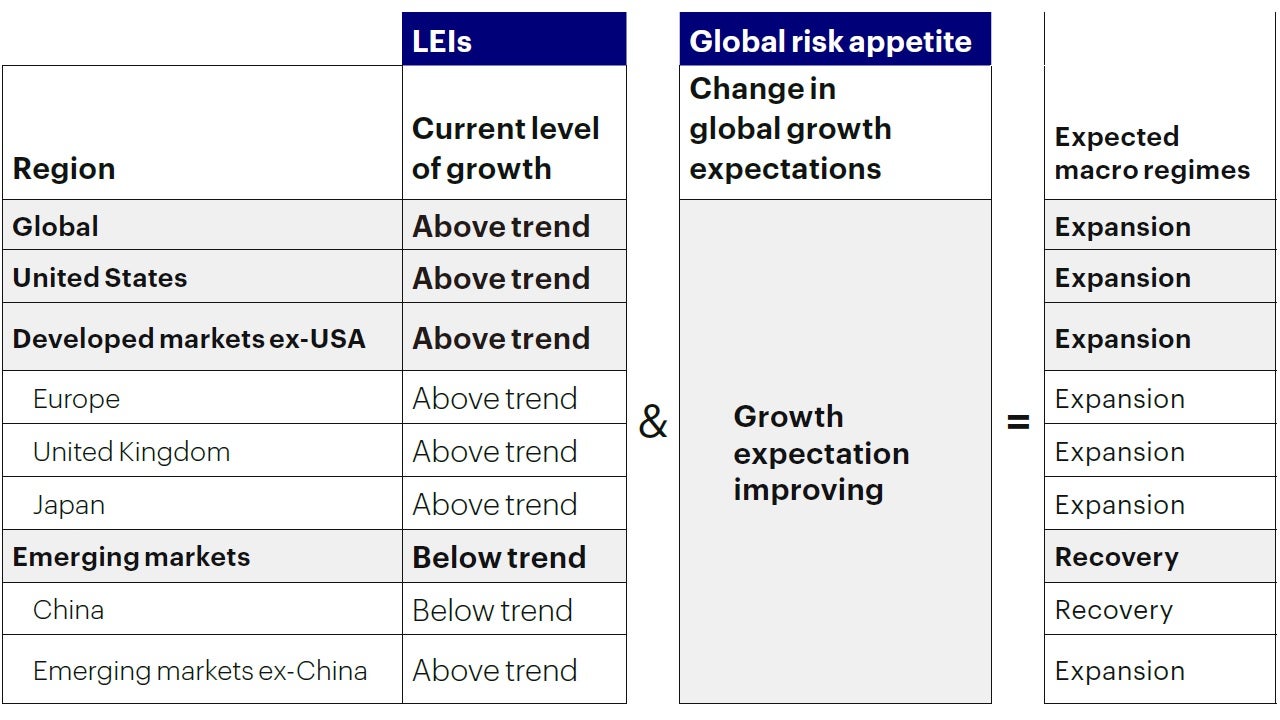

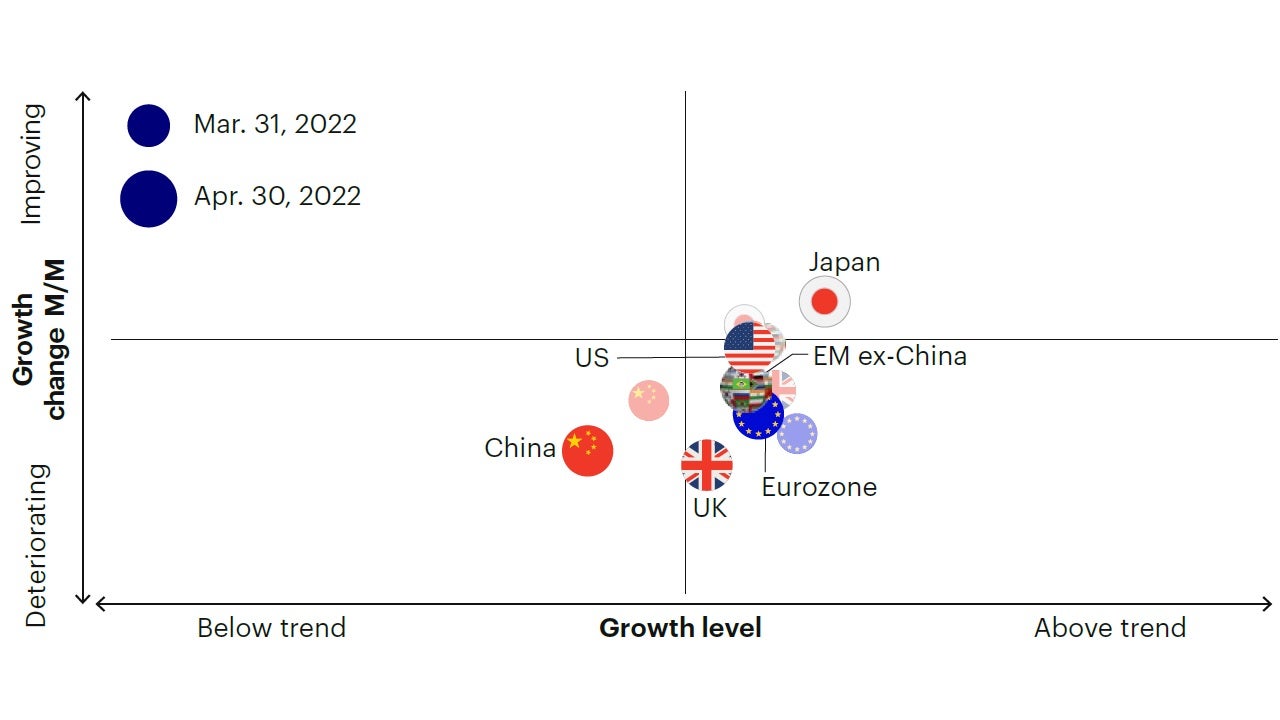

Despite turbulent financial markets and the broad-based deterioration in leading economic indicators over the past month, our macro regime framework continues to dismiss recession risks at this stage. On the contrary, it suggests growth expectations are likely to improve from here, anticipating an expansionary environment in developed markets and a recovery in emerging markets following a decline to below-trend growth rates (Figure 1 and Figure 2).

Growth expectations are likely to improve from here, anticipating an expansionary environment in developed markets and a recovery in emerging markets.

Sources: Bloomberg L.P., Macrobond. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions. Macro regime data as of Apr. 30, 2022. The Leading Economic Indicators (LEIs) are proprietary, forward-looking measures of the level of economic growth. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment.

The violent repricing of higher discount yields has not led to a repricing of lower growth expectations via lower equity or credit excess returns, which are directly related to growth risk in the economy.

Figure 2: Global risk appetite is accelerating, signaling improving growth expectations

GRACI and the global LEI

Sources: Bloomberg L.P., MSCI, FTSE, Barclays, JPMorgan, Invesco Investment Solutions research and calculations, from Jan. 1, 1992 to Apr. 30, 2022. The Global Leading Economic Indicator (LEI) is a proprietary, forward-looking measure of the growth level in the economy. A reading above (below) 100 on the Global LEI signals growth above (below) a long-term average. The Global Risk Appetite Cycle Indicator (GRACI) is a proprietary measure of the markets’ risk sentiment. A reading above (below) zero signals a positive (negative) compensation for risk taking in global capital markets in the recent past. Past performance does not guarantee future results.

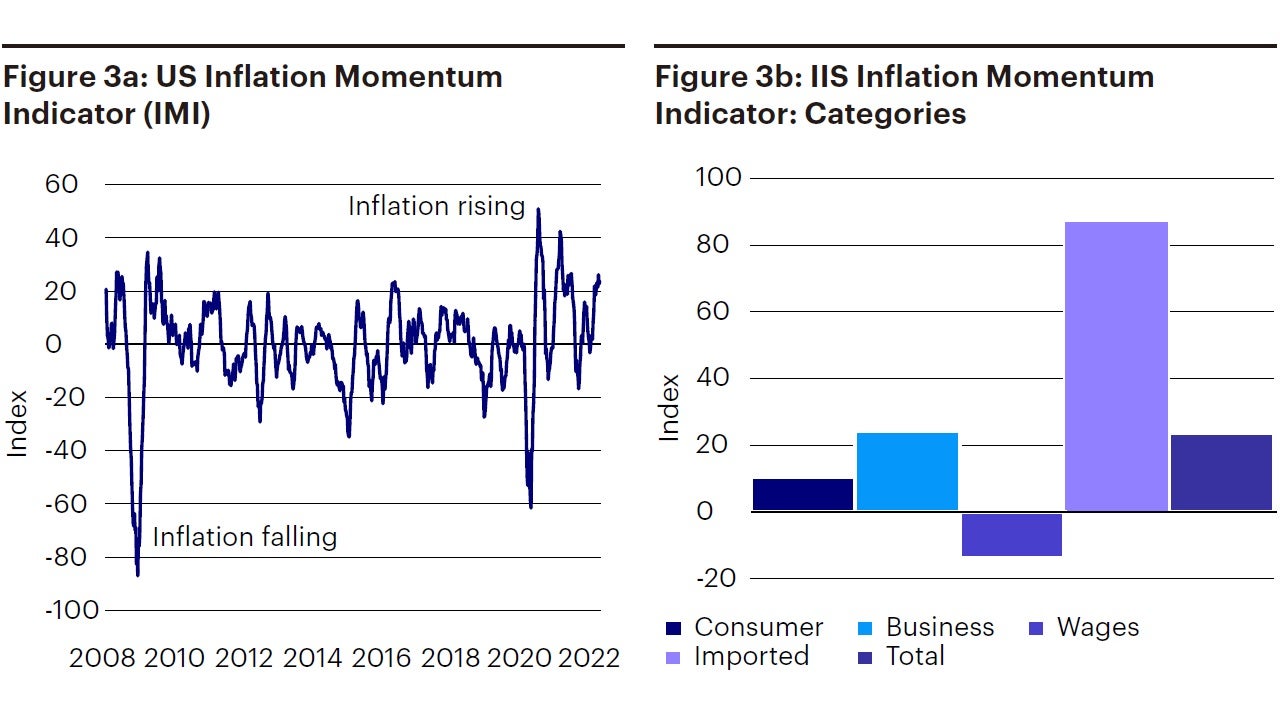

We discussed the drivers of this seemingly counterintuitive conclusion in our last note, and those considerations remain in place today. The violent repricing of higher discount yields has not led to a repricing of lower growth expectations via lower equity or credit excess returns, which are directly related to growth risk in the economy. Over the past month, for example, global equity markets and government bond markets have both posted large negative returns but performed roughly in-line, suggesting that, at least at this stage, the repricing in risky assets is largely due to a repricing in bond yields rather than deteriorating growth. Inflation remains the primary driver of markets, and we continue to register upside risks to inflation in the near term (Figure 3). In our opinion, downside surprises in inflation statistics may represent the most powerful catalyst for a rebound in markets, alleviating risks of excessively restrictive monetary policy.

Downside surprises in inflation statistics may represent the most powerful catalyst for a rebound in markets, alleviating risks of excessively restrictive monetary policy.

Sources: Bloomberg L.P. data as of Apr. 30, 2022, Invesco Investment Solutions calculations. The US Inflation Momentum Indicator (IMI) measures the change in inflation statistics on a trailing three-month basis, covering indicators across consumer and producer prices, inflation expectation surveys, import prices, wages, and energy prices. A positive (negative) reading indicates inflation has been rising (falling) on average over the past three months.

Investment positioning

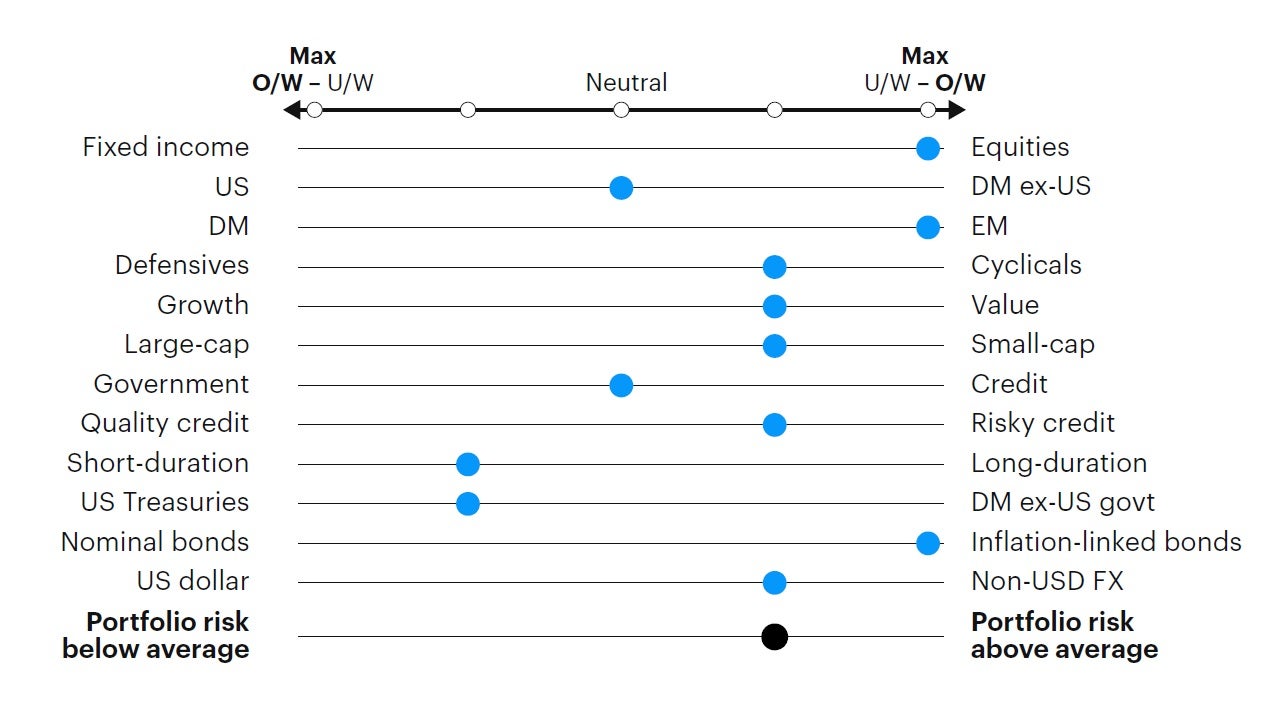

We have implemented no changes in our portfolio over the past month and maintain an overweight risk stance relative to benchmark in the Global Tactical Asset Allocation model.1 We are overweighting equities relative to fixed income, primarily via emerging market equities, and tilting in favor of cyclical sectors and factors. We maintain a neutral posture in credit risk2, with a higher allocation to short and intermediate credit maturities, and remain underweight duration risk in aggregate while maintaining a flattening yield curve bias. (Figure 4, 5, 6). In particular:

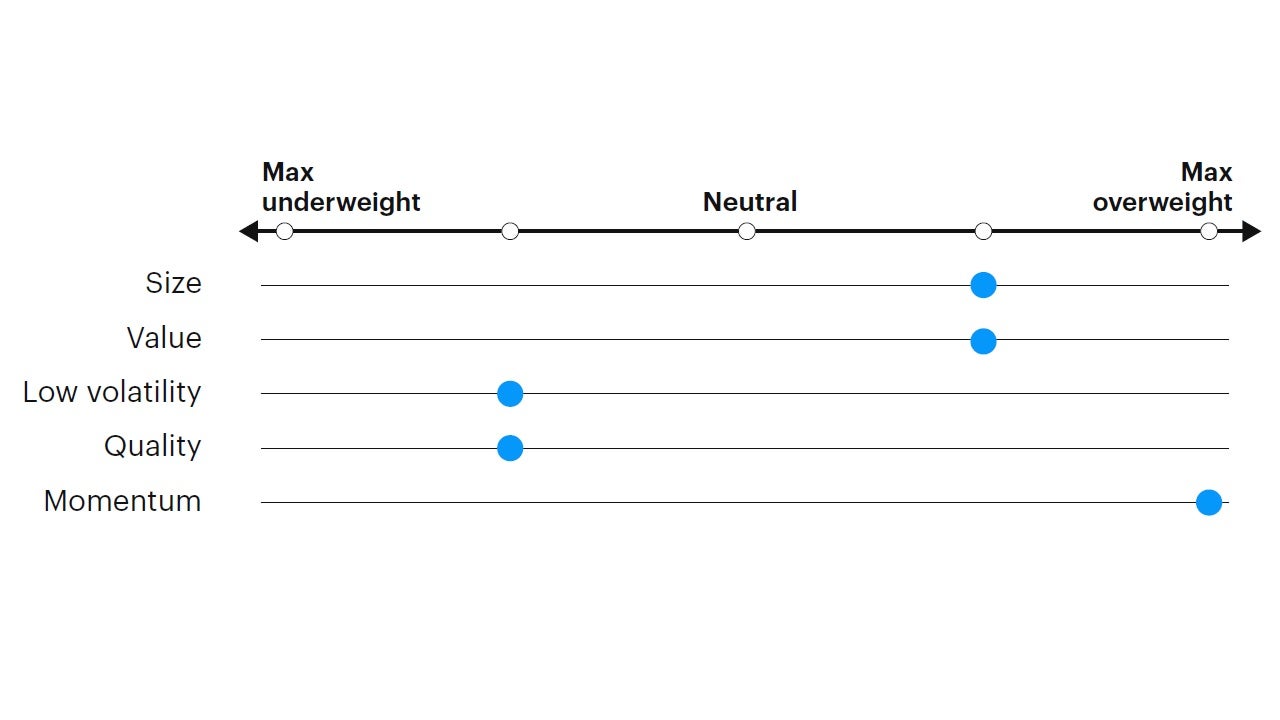

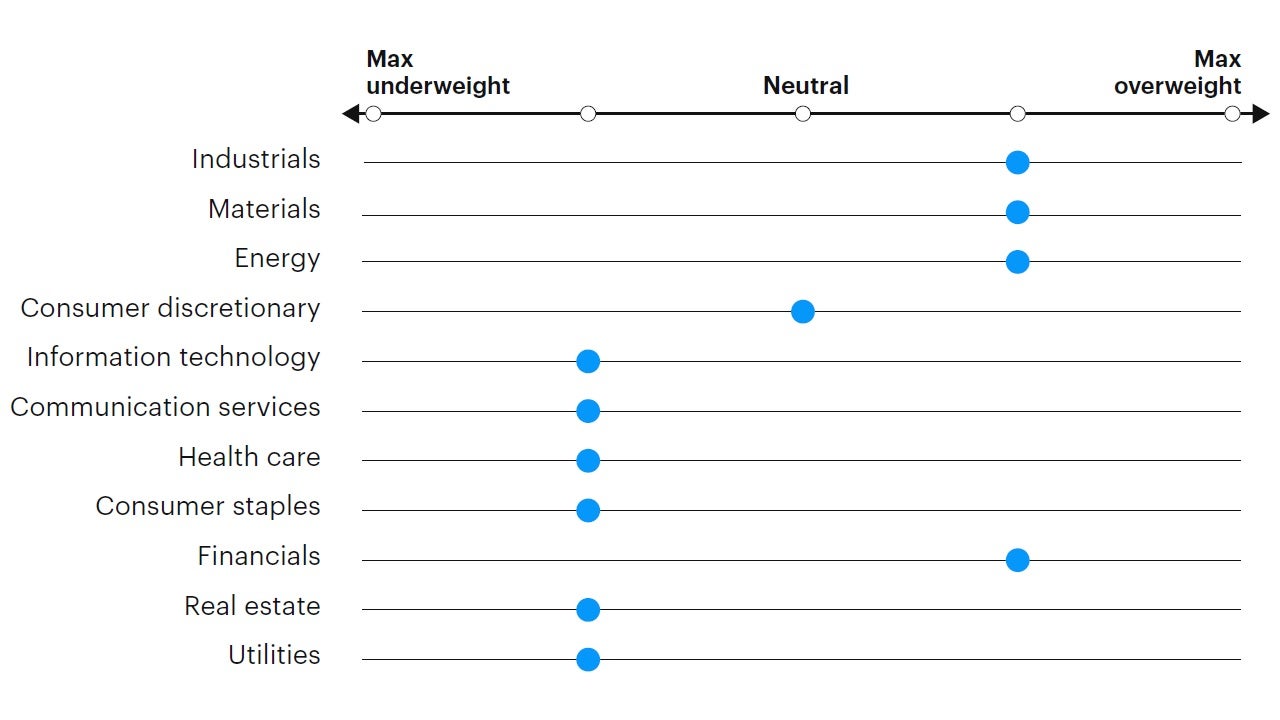

- Within equities we overweight cyclical factors like (small) size, value, and momentum and favor cyclical sectors such as financials, industrials, materials, and energy at the expense of information technology, communication services, and other defensive sectors (Figure 6). From a regional perspective, we overweight emerging markets relative to developed markets as improving risk appetite and attractive valuations tend to benefit the asset class.

- In fixed income we remain overweight inflation-linked bonds relative to nominal Treasuries and concentrate our credit exposure in short-dated high yield and bank loans, with no exposure to emerging markets debt, seeking to harvest higher income per unit of risk rather than capital appreciation. We reduced the overweight in US Treasuries over other developed government bond markets given the reduced yield advantage on a hedged basis.

- In currency markets we remain underweight the US dollar, favoring the euro, Japanese yen, Canadian dollar, Singapore dollar, Norwegian kroner, and Swedish krona within developed markets. In EM we favor high yielders with attractive valuations such as Indonesian rupiah, Colombian peso, and Brazilian real. We underweight the British pound, Swiss franc, Australian dollar and Korean won.

We remain overweight inflation-linked bonds relative to nominal Treasuries and concentrate our credit exposure in short-dated high yield and bank loans, with no exposure to emerging markets debt, seeking to harvest higher income per unit of risk rather than capital appreciation.

Figure 4: Relative tactical asset allocation positioning

Positioning remains above average portfolio risk with an overweight to EM equities, cyclical factors and credit risk.

Source: Invesco Investment Solutions, Apr. 30, 2022. DM = developed markets. EM = emerging markets. FX = foreign exchange. For illustrative purposes only.

Figure 5: Tactical factor positioning

Factor tilts within the expansion regime are toward size, value and momentum

Source: Invesco Investment Solutions, Apr. 30, 2022. For illustrative purposes only. Neutral refers to an equally weighted factor portfolio.

Figure 6: Tactical sector positioning

In an expansionary regime, sector tilts favor cyclicals relative to defensives.

Source: Invesco Investment Solutions, Apr. 30, 2022. For illustrative purposes only. Sector allocations derived from factor and style allocations based on proprietary sector classification methodology. As of April 2022, Cyclicals: energy, financials, industrials, materials; Defensives: consumer staples, health care, information technology, real estate, communication services, utilities; Neutral: consumer discretionary.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

20220512-2193979-JP

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html