Can the Fed get comfortable with elevated inflation?

Key takeaways

Markets are concerned

The Federal Reserve’s hawkish stance hasn’t done much to calm concerns about long-term inflation.

Has inflation peaked?

The irony of this pessimistic narrative is that the much-anticipated peak in inflation may now finally be here, albeit at a very elevated level.

Will the Fed adjust its view?

The directional path of inflation for this cycle may prove more important to the Fed than the ultimate level.

US Federal Reserve (Fed) Chair Jerome Powell’s comments on Thursday at a panel hosted by the International Monetary Fund were viewed as exceedingly hawkish, and yet long-term inflation expectations rose. What, as investors, do we make of this? Maybe it’s not as dire as it seems at first blush.

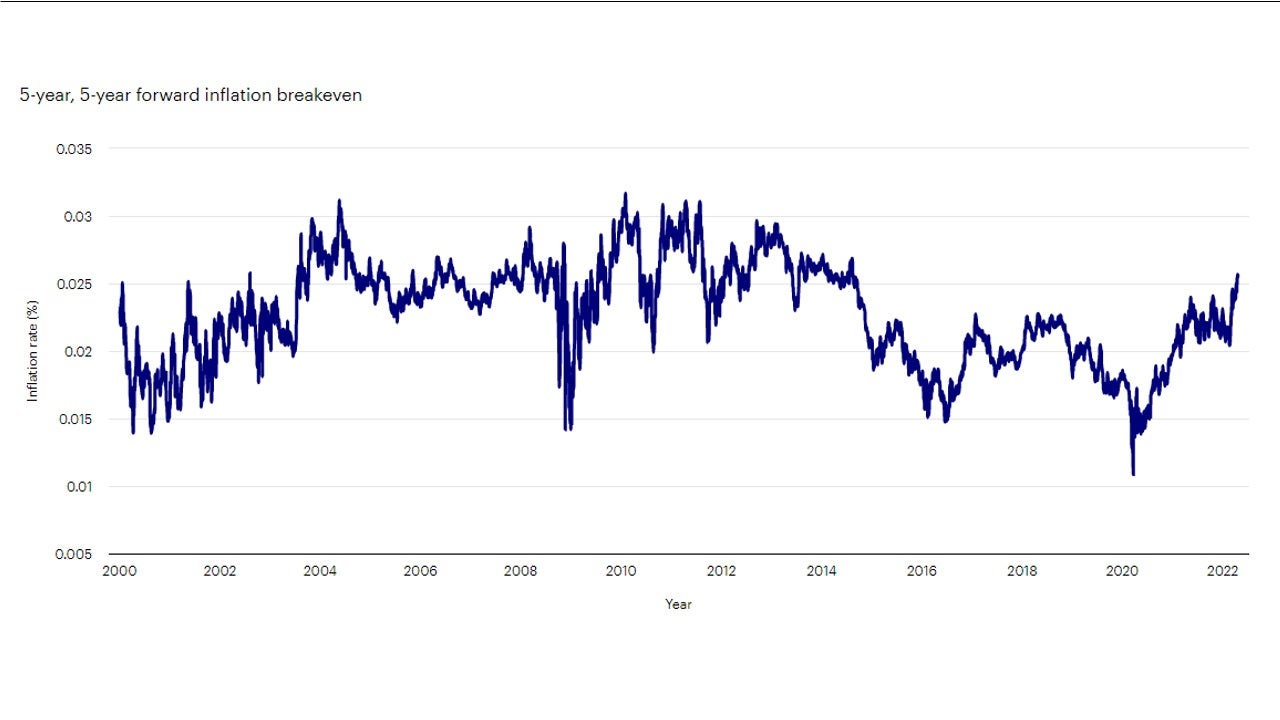

Equity investors seemed to have voted on Thursday and Friday, with the S&P 500 Index falling over 4% from Wednesday’s close.1 The pessimistic narrative hinges on the fact that long-term inflation expectations have climbed by nearly 30 basis points this month and are now close to 2.6% — despite all of the hawkish talk by Fed members in recent weeks.2 Clearly, the market still views the Fed as being woefully behind the curve. Imbedded in that view is that we can hold out hope for a soft landing, but we shouldn’t hold our collective breaths that the Fed can make this happen. To suppress long-term inflation expectations, the Fed may ultimately have to hit the brakes harder than any of us would have hoped — and beyond what the market has priced in so far.

Has inflation already peaked?

I acknowledge that is a reasonable assessment. The risks to the cycle are, in fact, elevated. However, the irony of the narrative is that the much-anticipated peak in inflation may now finally be here, albeit at a very elevated level. Used car prices have been declining.3 Commodity prices have cooled.4 Consumers appear to even be balking at higher Netflix subscription costs!5 I believe disinflation will likely persist in the coming months as the economy slows. Nonetheless, I believe it will be very difficult for the Fed to get inflation to 2% without a meaningful rise in the unemployment rate, which would probably cause a recession.

As such, the directional path of inflation for this cycle may prove more important to the Fed than the ultimate level. Perhaps, the rise in inflation expectations is simply the market coming to grips with a Fed that may be comfortable with a higher-than-2% inflation rate. The probability of that scenario is still reasonably high, in my view, so long as long-term inflation expectations do not become unanchored, which does not yet seem to be the case.

Source: Bloomberg, 4/22/22. The 5-Year, 5-Year Forward Inflation Breakeven Measures the expected inflation rate (on average) over the five-year period that begins five years from today.

Conclusion

Investors can likely expect volatility to persist. Financial conditions are likely to further tighten in the weeks ahead. However, it may yet be premature to call the end of this cycle. If the Fed does become comfortable with a falling, but still-elevated, inflation rate, I believe stocks potentially stand to benefit.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-027

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html