Responding to downturns: What history tells us about perseverance

Key takeaways

A tough day for the market

Thursday, May 5, was the 54th worst day in the US stock market since 1995.1

Lessons from history

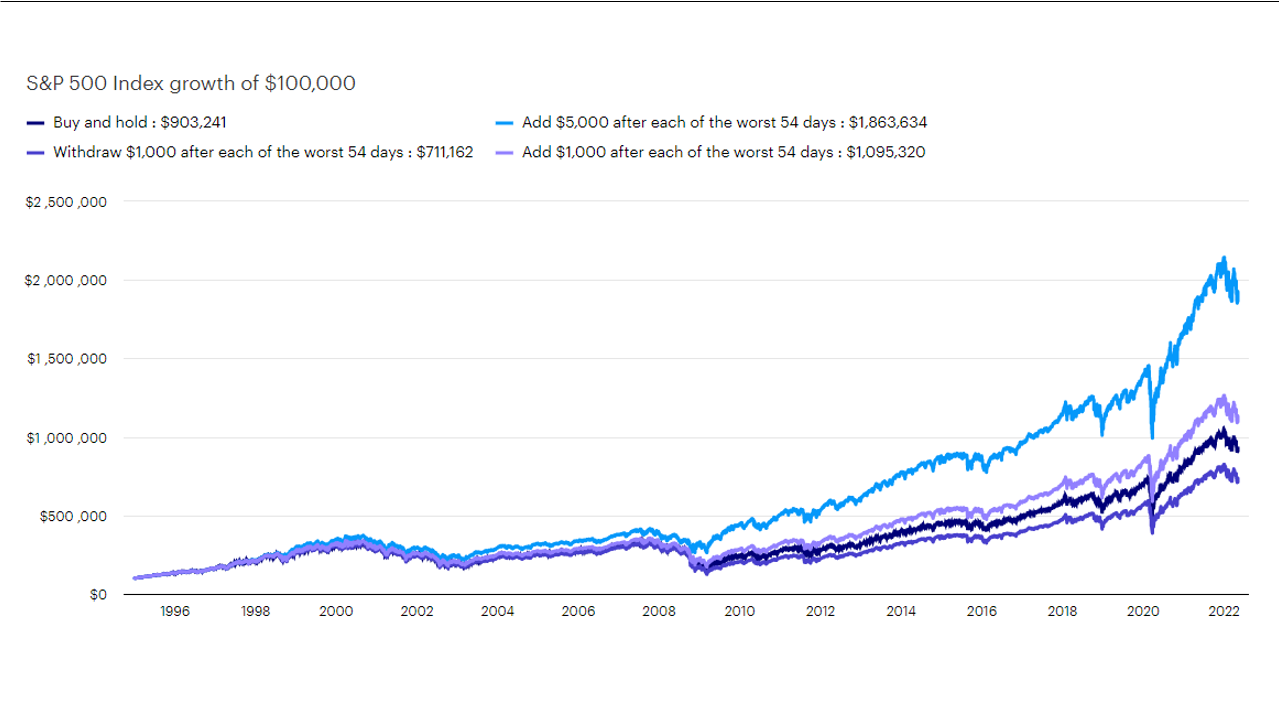

I examine how different responses to those 54 bad days would have impacted a $100,000 investment in the stock market.

Thursday, May 5, was the 54th worst day in the US stock market since 1995.2 I have 54 wrinkles on my forehead commemorating these days. To paraphrase the Goo Goo Dolls song “Name” (coincidentally released in 1995), these markings are souvenirs you never lose. But like any good souvenir they’re meant to be looked at when you need to take a walk down memory lane. Some of those days are as vivid today as they were then. Sept. 17, 2001, the day the market opened after the 9/11 terror attacks. Sept. 15, 2008, the day after the Lehman Brothers collapse. March 16, 2020, the day COVID-19 shut down the global economy. It’s all still painful.

Responding to market downturns

Our success as investors, however, has been determined by how we responded to these agonizing days. Did we break from our investment plans, or did we adhere to principles of sound investing such as consistency and courage? Frequent readers of my writing know that I like to look at how our portfolios would have done based on decisions that our emotions and biases were asking us to make during difficult times. Did we succumb to our instincts, or did we channel George Costanza of Seinfeld fame and do the opposite (apologies for another mid-1990s reference)?

The chart below shows how investors would have fared pulling $1,000 out of the market after each of the worst 54 days since 1995 versus adding money into the market after each of those days. The results are clear. Investors would have been better served adding money into the market following the worst days. Obviously, the more money added, the better the outcome.3

Source: Bloomberg, L.P., May 5, 2022. As represented by the S&P 500 Index. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. Indicies cannot be purchased by investors. Past performance does not guarantee future results. This is a hypothetical example shown for illustrative purposes only and does not predict or depict the performance of any investment.

Now, I know what you may be thinking. That was then. This is now. There’s still a lot of monetary policy tightening likely to come. Inflation still needs to peak. Plus, investors still haven’t fully capitulated. After all, 30% of the New York Stock Exchange stocks are still trading above their 200-day moving averages and markets have typically bottomed when that figure is closer to 10% to15%.4 All true. But the market downturns weren’t over on most of the 54 days analyzed in the chart above.

I don’t begrudge the tactically minded investors who are de-risking their portfolios to get the market right over the next weeks. Admittedly, there are still challenges to be worked through and more investor capitulation to come. Nonetheless, ask yourself how you were feeling on April 14, 2000, during the early days of the tech wreck, or on Nov. 5, 2008, during the height of the Global Financial Crisis. The point is that although there were more down days to come, long-term investors were still ultimately better served investing than withdrawing.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-030

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html