Peak inflation and stock performance: Lessons from the 1970s

Key takeaways

What happens when inflation peaks?

We examine stock performance after inflation peaks in 1974 and 1980.

Has inflation peaked today?

It’s too soon to say, but we see a few reasons to take some solace.

Per the numerous questions I’m receiving, investors remember the 1970s well — and they’re concerned about the obvious parallels we see today: Elevated inflation,1 a US Federal Reserve that appears slow to respond, a global conflict that’s exacerbating the problem. On top of that, Paul McCartney, Elton John, and Bob Weir are on tour once again. Those tickets have hit my checking account as hard as $5.00/gallon gasoline has.

While investors may try to forget about their polyester leisure suits and their crocheted sweater vests, they can vividly recall the 34% decline in the S&P 500 Index from March 1973 (when the year-over-year inflation rate climbed above 4.5%) to December 1974 (when the rate of change in inflation peaked).2 The early 1980s wasn’t much better as inflation climbed to nearly 15%.3 That much is known. But what happened once inflation peaked?

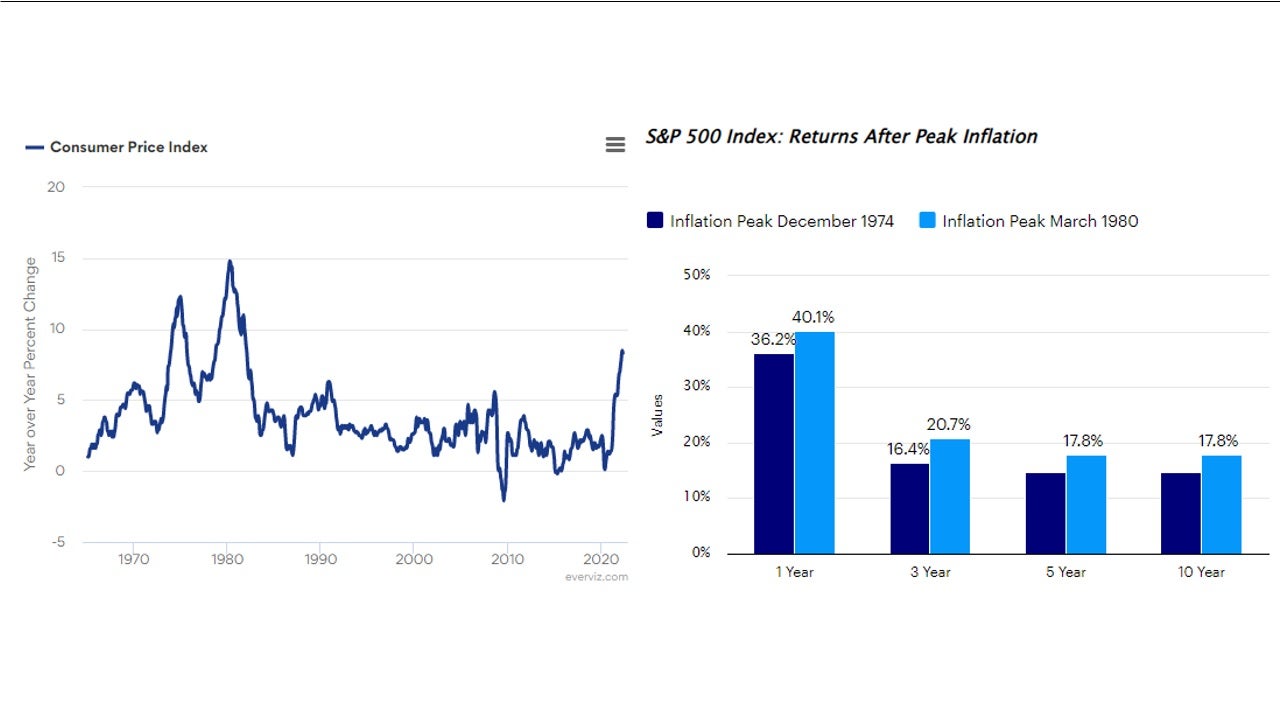

The chart below illustrates how stocks performed after the inflation peaks of December 1974 and March 1980. In both instances, markets staged sound returns over the following 1-, 3-, 5-, and 10-year periods.4

Source: Bureau of Labor Statistics. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. Indices cannot be purchased directly by investors. Past performance does not guarantee future results.

It’s not about ‘good’ or ‘bad’

As we know, markets don’t trade on whether conditions are good or bad, but rather on whether they are getting better or worse relative to expectations. As a result, peak inflation in 1974 and 1980 were times when things were “bad” but soon to get “better” and not the times to become long-term bears on stocks. Sure, markets didn’t move in a straight line. The economy even entered a recession in mid-1981,5 and there were many moments when it was feared that inflation was returning — but ultimately, long-term investors were rewarded.

Has inflation peaked?

That brings us to today. Has inflation peaked? It’s too soon to say. April was the first month of the past eight months in which the year-over-year percent change in the Consumer Price Index was below that of the prior month, albeit barely and it was still worse than expectations.6 Nonetheless it’s a start. In fact, I see a few reasons to take some solace: the bond market’s expectations of inflation have come down meaningfully in recent weeks,7 the Fed’s preferred measure of inflation (core personal consumption expenditure) have begun to roll over on a year-over-year basis,8 average hourly earnings have been slowing,9 M2 money supply growth has been plunging,10 and retailers have reported ballooning inventories.11 Admittedly, the risk to the peak inflation view is commodity prices, which continue to rise.

As I used to ask in the 1970s from the back of the wood-panel station wagon, “Are we there yet?” Not necessarily. “Are we getting closer?” It feels like it. It’s all about inflation now, and history suggests that signs of a peak in inflation can create a good backdrop for equities.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-039

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html