As the Fed fights inflation, where should fixed income investors focus?

Key takeaways

The path ahead for rates.

We expect another 2% worth of hikes over the last four Federal Reserve meetings this year.

The economy remains strong.

There is low unemployment, and consumer and corporate balance sheets are fairly strong.

The short answer.

In fixed income markets, we favor a focus on short- or intermediate-term bonds.

As the Fed fights inflation, where should fixed income investors focus?

On June 15, the Federal Reserve raised the federal funds target rate by 0.75% to reach a level of 1.75%. Fed Chair Jerome Powell has historically striven to be transparent and consistent, keeping the market stable even through the COVID recession. That said, things are moving quickly, and the Fed has shown its willingness to get more aggressive to combat inflation.

The Fed is now motivated to get to the neutral rate — a level that neither boosts nor restrains the economy — as quickly as possible. More hiking now means less later, and hopefully gets us to a place where we can get back on track. Think of a car on the highway with traffic stopped in the distance. It’s always better to start braking early than to wait and be forced to slam on the brakes at the last moment.

Connecting the dots

Back in December 2021, the Fed’s “dot plot” projected that the target rate would be 0.875% at year-end 2023.1 We started 2022 with two to three rate hikes priced in. Fast forward to the June meeting, and the median dot plot projection for year-end shot up to 3.75%.1 What a difference a few months can make.

Even after June’s rate hike, it is looking likely that there are another 2% worth of hikes on the horizon – one at each meeting for the rest of the year, which would end 2022 at 3.75%.1 This means likely moves of +0.75% in July, +0.50% in September, +0.50% in November, and +0.25% in December.1

Longer-term (past 2024) the dot plot indicates that Fed members expect a lower target rate between 2.25% and 2.50%. This highlights the Fed’s seriousness about getting inflation under control.1

The challenge of inflation

We started the year with the belief that inflation would be brief and transitory. That is no longer the case. Consumer Price Index (CPI) prints for March, April, and May were all above 8%.2 These are levels not seen since the 1980s. The surprising part was that inflation has been broad based rather than showing up in only a few sectors. This has clearly worried the Fed.

On a historical basis, a fed funds rate of 1.75% is still very low. The Fed is going to want to get to the neutral rate as quickly as possible so they can begin to control inflation. But they need to be very careful here. Overshooting the efforts to control inflation may cause a recession.

The economy remains in good shape

Despite the market’s jitters, the economy is currently in good shape. There is low unemployment, and consumer and corporate balance sheets are fairly strong. With higher rates, there will be less overall demand, which should help prevent economic overheating. There will still be inflation in areas, but the overall inflation picture should improve.

Corporate bond supply/demand

A key factor to maintaining stability in the corporate bond space is whether the supply/demand picture remains in balance. Over the past few years, many companies front-loaded their issuance and were able to get much of their financing complete when rates were low. The “maturity wall” (the amount of debt maturing in the short term) has been pushed out, with only 2.5% of investment grade credit rolling off in 2022 and another 5% in 2023.3 High yield is also healthy with only 6.1% of the outstanding market maturing over the next two years.4

This means we should not have a default wave caused by a maturity wall. It also means corporations won’t be forced to reinvest at higher rates and the reduced supply should help stabilize spread levels.

Treasury yields

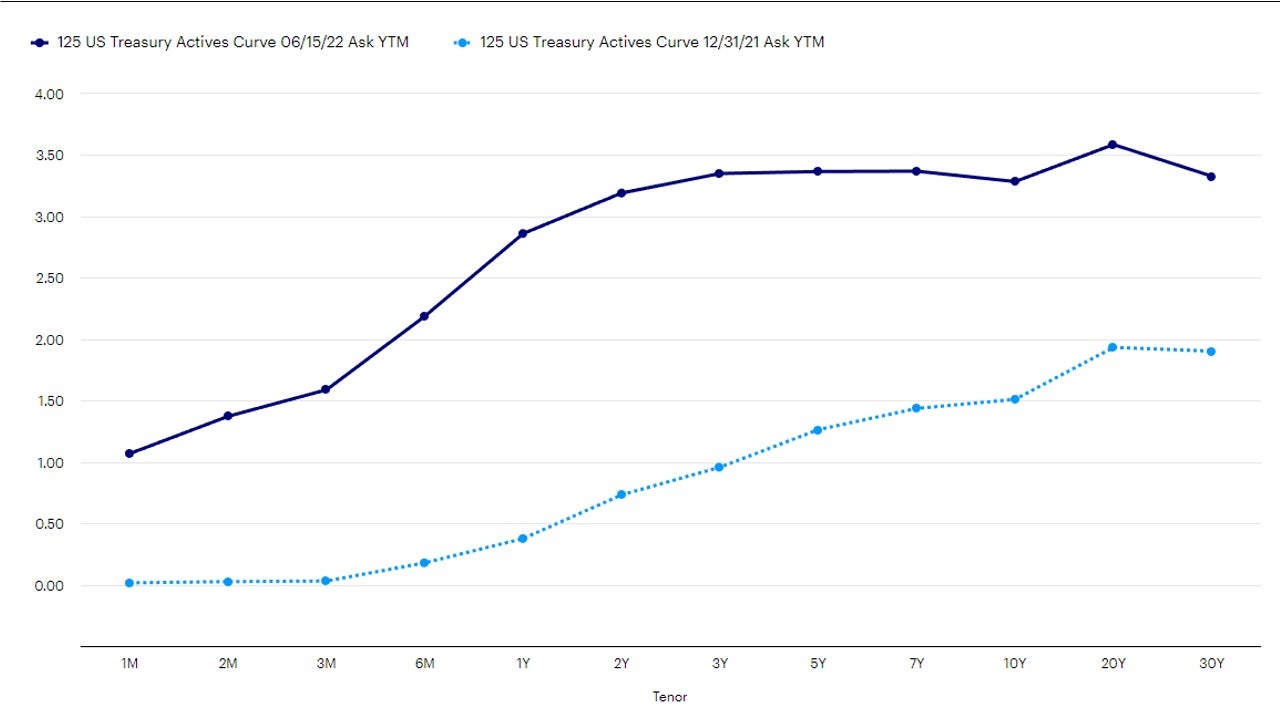

The US Treasury yield curve has moved up substantially, but the front end remains steep inside of two years. A simple breakeven analysis shows that the two-year Treasury yield (3.36% as of June 13, 2022) would have to increase by 1.77% before the total return turns negative. This same breakeven calculation from last September was 20 basis points when the two-year Treasury yield was 0.28%. Many of our clients are moving into fixed income products with shorter duration to take advantage of this part of the yield curve.

Source: Bloomberg, L.P., as of June 15, 2022

The short answer

The best is behind us from an economic perspective. You hear the expression “catch a falling knife” a fair amount in these types of markets because it’s partially true. It’s also flawed because no one can time the market perfectly, so we believe it’s best to find a sensible way to stay invested the parts of the market where the risk/reward equation is more favorable.

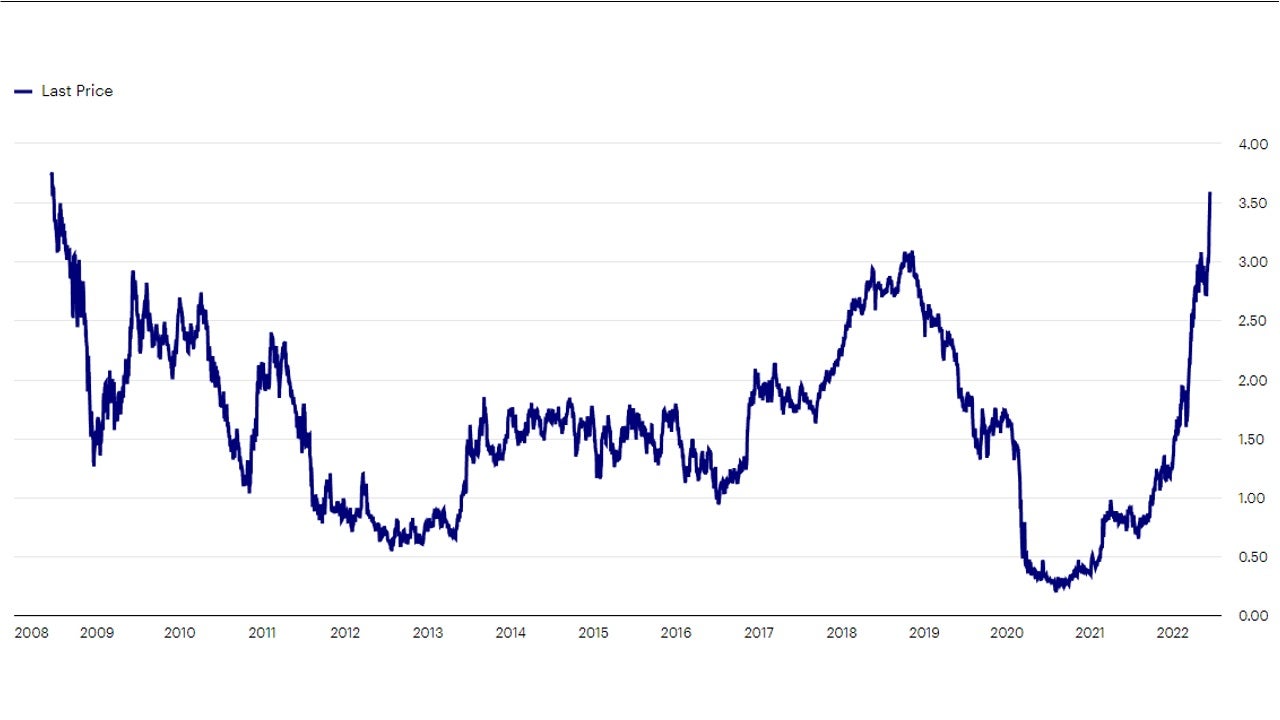

It will be important to be properly positioned to minimize the risk but still take advantage of what the market is offering. The chart below shows that we are at 14-year highs on the five-year Treasury yield. If the Fed can get this right, we believe current valuations are attractive. If not, rates have a way to go and we would favor investing in shorter bonds.

Source: Bloomberg, L.P., as of June 15, 2022

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-042

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html