It’s crunch time. Is the Fed going to pivot?

Key takeaways

Inflation may have peaked

The market has recently taken heart from what appears to be a peak in inflation pressure and the passing of “peak inflation angst.”

Pressure on the Fed remains

The concern is that the Federal Reserve and other global central banks seem to be under tremendous political pressure to do whatever it takes to bring inflation down.

What comes next?

If central banks continue to deliver in such a hawkish way, the market, which we believe is starting to price for a pivot, could find the rest of the year quite challenging.

Growth has been slowing across major economies, financial conditions have tightened a lot, and we believe the peak in inflation is behind us. Given this set of conditions, Invesco Fixed Income sees value in high quality fixed income, and we would favor embracing duration in portfolios. At the same time, the market is priced for continued rate hikes from the Federal Reserve (Fed) and other central banks, and the Fed continues to sound very hawkish, downplaying the potential for a pause or “pivot” to a more dovish stance. This raises the very real risk of a policy mistake if central banks overtighten. We believe central bank actions over the next couple months will be key to economic and market developments in the coming quarters.

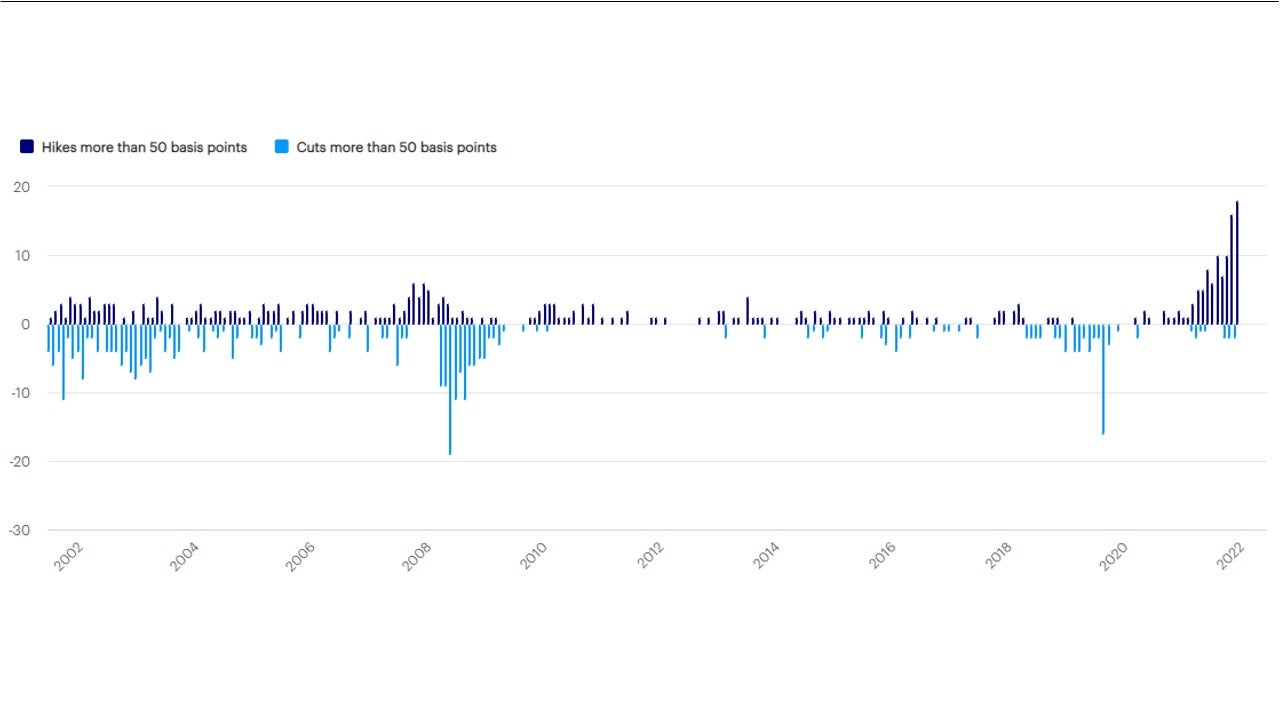

Source: Macrobond. Data from Jan. 1, 2002, to June 1, 2022. A basis point (bp) is one hundredth of a percentage point.

Can the Fed justify a pivot?

The market has recently taken heart from what appears to be a peak in inflation pressure and the passing of “peak inflation angst.” Bond yields have dropped since mid-June, and global equity and credit markets have performed well across the board.1 The market seems to have concluded that the peak in inflation against a backdrop of slowing growth may allow central banks to make a dovish “pivot.”

To execute this pivot, the Fed would have to acknowledge that current levels of high inflation are being driven by fiscal and monetary policy decisions from past years, and that nothing the Fed does today can immediately bring down current measured inflation. The Fed would also have to conclude that fiscal and monetary policy have already tightened substantially post-pandemic, and that in the face of slowing growth, the prudent move would be to pause and see how that recent tightening will impact growth and inflation going forward. If we are right that inflation is already on a glide path toward the Fed’s 2% target, then we believe this would be the right policy. It would maximize the possibility of a soft landing, in our view, and would likely be favorable for financial markets.

Could political pressure get in the way?

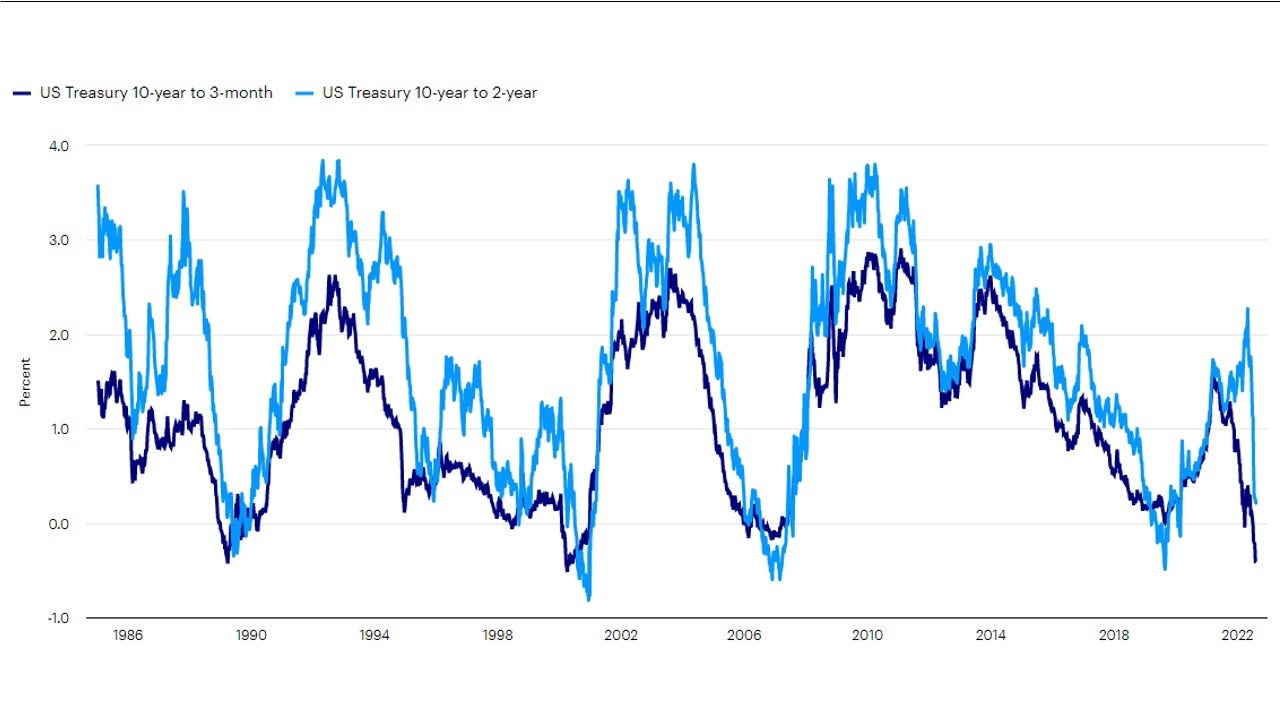

The concern is that the Fed and other global central banks seem to be under tremendous political pressure to do whatever it takes to bring inflation down. Central bank policymakers continue to sound hawkish, and they continue to deliver historically large rate hikes while speaking to an urgency to get interest rates much higher. If central banks continue to deliver in such a hawkish way, the market, which we believe is starting to price for a pivot, could find the rest of the year quite challenging. The US Treasury yield curve is inverted in many tenors, and we believe the key 3-month to 10-year yield curve could likely invert soon if the Fed delivers on its hawkish rhetoric. This would make a recession likely and create continued volatility in the equity and credit markets. In addition, a very tight Fed is also usually associated with increased stresses and financial accidents in the global financial system.

Source: Macrobond. Data from Jan. 7, 1985, to Aug. 8, 2022. Past performance does not guarantee future results. An investment cannot be made directly in an index.

The Fed faces a critical decision

It’s crunch time for the Fed. If inflation is declining and growth is slowing, why risk recession and financial accident by continuing to tighten monetary policy aggressively? Monetary policy works with a delay, and the Fed should be forward looking. This would argue for a pivot, and the market is beginning to price for one. But if the Fed carries on with aggressive tightening instead, we believe a correction in risky assets is increasingly likely.

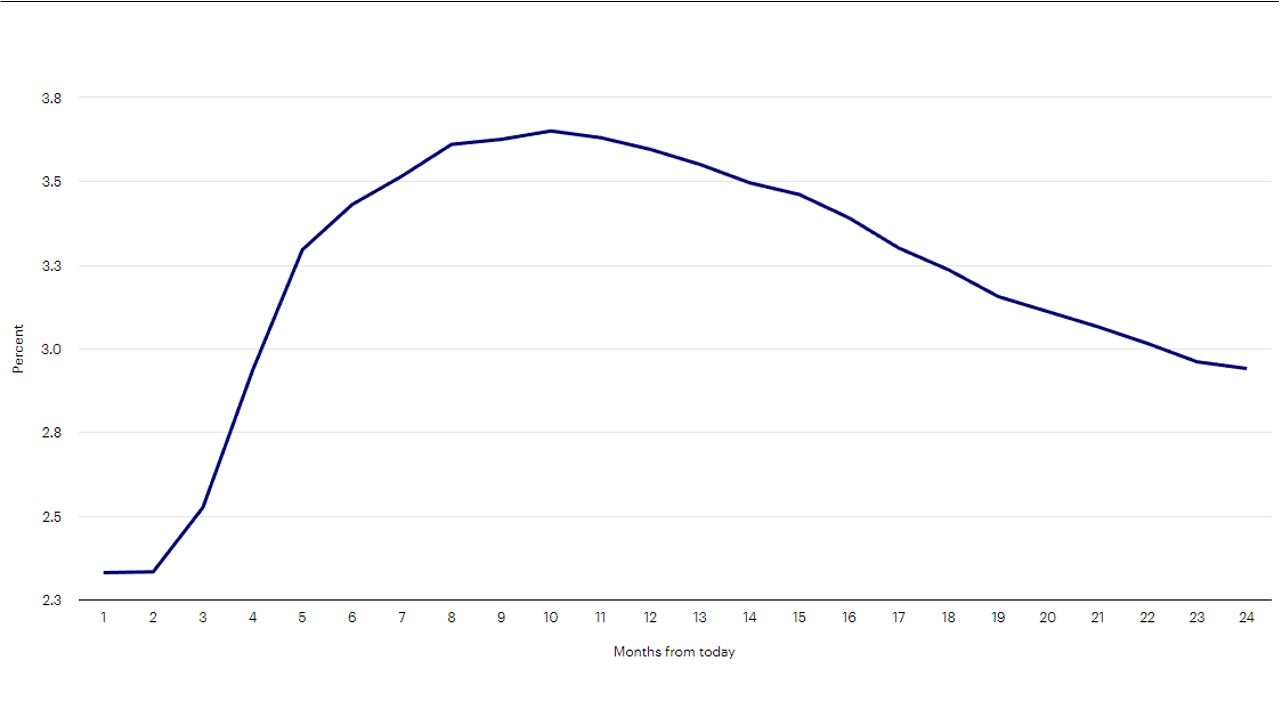

Source: Macrobond. Data as of Aug. 17, 2022.

What does this mean for fixed income?

We believe high quality fixed income assets are well positioned in this environment. If the Fed pivots and the cycle extends, stable interest rates and tightening spreads would likely benefit investors. If the Fed keeps tightening and recession looms, the yield curve will likely continue to invert, and the duration in fixed income assets would likely help cushion portfolios.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも特定ファンド等の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-060

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html