Where are we in the corporate profit cycle?

Key takeaways

Fundamentals

Softer manufacturing activity suggests peak earnings growth is likely behind us.

Upside

In my view, investors should participate but lower their expectations for absolute returns.

As my regular readers know, I’ve been bullish on earnings for over a year (and bullish on stocks for even longer), and I believe that has been the right view. But where are we in the corporate profit cycle today? Has the fundamental outlook changed?

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) is one of my preferred gauges for assessing where we are in the corporate profit cycle. The ISM PMI is a direct measure of expectations captured by business surveys of production and the general economic climate. More importantly, as shown in Figure 1, this sentiment indicator has helped to foresee earnings trends roughly half a year in advance.

After correctly signaling a V-shaped earnings recovery, manufacturing activity now suggests that peak earnings growth is likely behind us. Looking ahead, softer output suggests we may see slower but still robust earnings growth in 2022 (Figure 1).

Sources: Bloomberg, Institute for Supply Management, Standard & Poor’s, Invesco, 4/1/22. Notes: PMI = Purchasing Managers Index. EPS = Earnings per share. NBER = National Bureau of Economic Research. Shaded areas represent NBER-defined US economic recessions. A correlation coefficient measures the strength of the relationship between the relative movements of two variables. The values range between -1 and 1. A perfect positive correlation is 1, and a perfect negative correlation is -1. There is no guarantee the forecast will come to pass. An investment cannot be made in an index. Past performance does not guarantee future results.

Where are we in the market cycle?

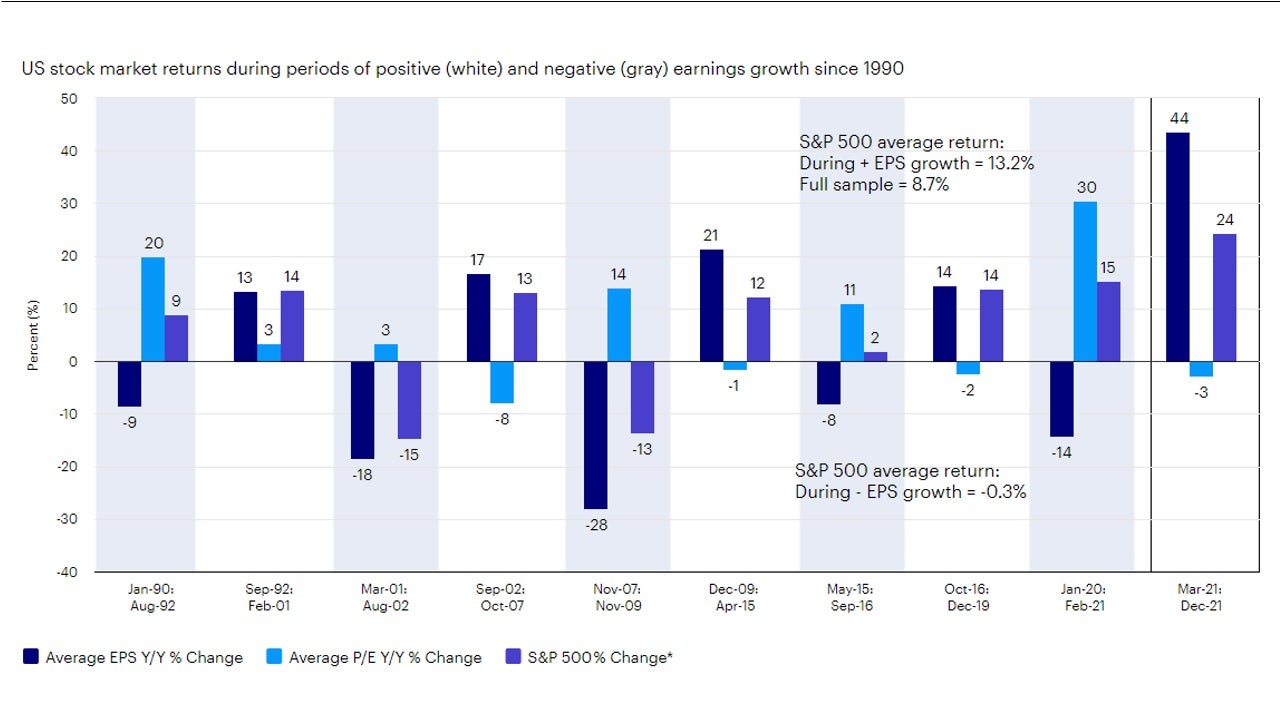

Historically, investors have been amply rewarded by simply sticking to stocks in periods when earnings growth was positive, as it is now. While I believe stocks remain the place to be amidst a moderating economy, peak earnings growth should compel investors to lower their expectations for absolute returns. In other words, I expect stocks to continue doing well in 2022, just probably not as well as they did in 2021 and 2020 (Figure 2).

Sources: Bloomberg L.P., Standard & Poor’s, Invesco, 12/31/21. Notes: Y/Y = Year-over-year. *S&P 500 % change = Compound annual growth rate (CAGR). Shaded areas represent periods of negative earnings growth. White areas represent periods of positive earnings growth. An investment cannot be made in an index. Past performance does not guarantee future results.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-026

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html