Are stocks already sniffing out an economic recession?

Key takeaways

Outlook

Investors should at least consider the possibility of a tactical contraction.

Positioning

Bonds and defensive sectors have usually outperformed in such regimes.

Risk

Greater exposure to stocks and cyclicals likely awaits a peak in inflation and a less hawkish Fed.

If you’re a blissful investor with a 20-year or longer investment horizon, stay the course and stop reading this blog immediately! If not, you’ll have to pardon me for indulging in the doom and gloom that has understandably engulfed the tactical investment community. To be clear, the scenario I’m about to explore doesn’t represent the Global Market Strategy Office’s base case. Rather, it’s a tail risk scenario — the probability of which may be increasing.

After all, the S&P 500 Index fell 14% from its high on Jan. 3, 2022, through the end of April, with no major low in sight.1 True, a playable rally of 11% did develop from March 8-29,1 but that brief bounce ultimately faded into what now appears to be a sequence of lower highs and lower lows.

Broad economic recession or tactical contraction?

Admittedly, I had been working under the assumption that stocks would experience some typical volatility in anticipation of Federal Reserve (Fed) liftoff, but that the market would have time to fully recover (and then some) before the onset of the next recession.

Now, I’m not so sure. Inflation has broadened – exacerbated by food and energy supply disruptions related to the Russian invasion of Ukraine – the Fed is behind the curve with its interest rate hikes, and real economic growth seems to be stagnating. As such, I’m concerned that the US monetary authorities may be unable to get price pressures under control without causing even more harm to the economy.

Given the discouraging downward trajectory of manufacturing activity and the overall economy's recent direction of travel, at the very least I think investors should consider the possibility of a tactical contraction regime in the next six to nine months.

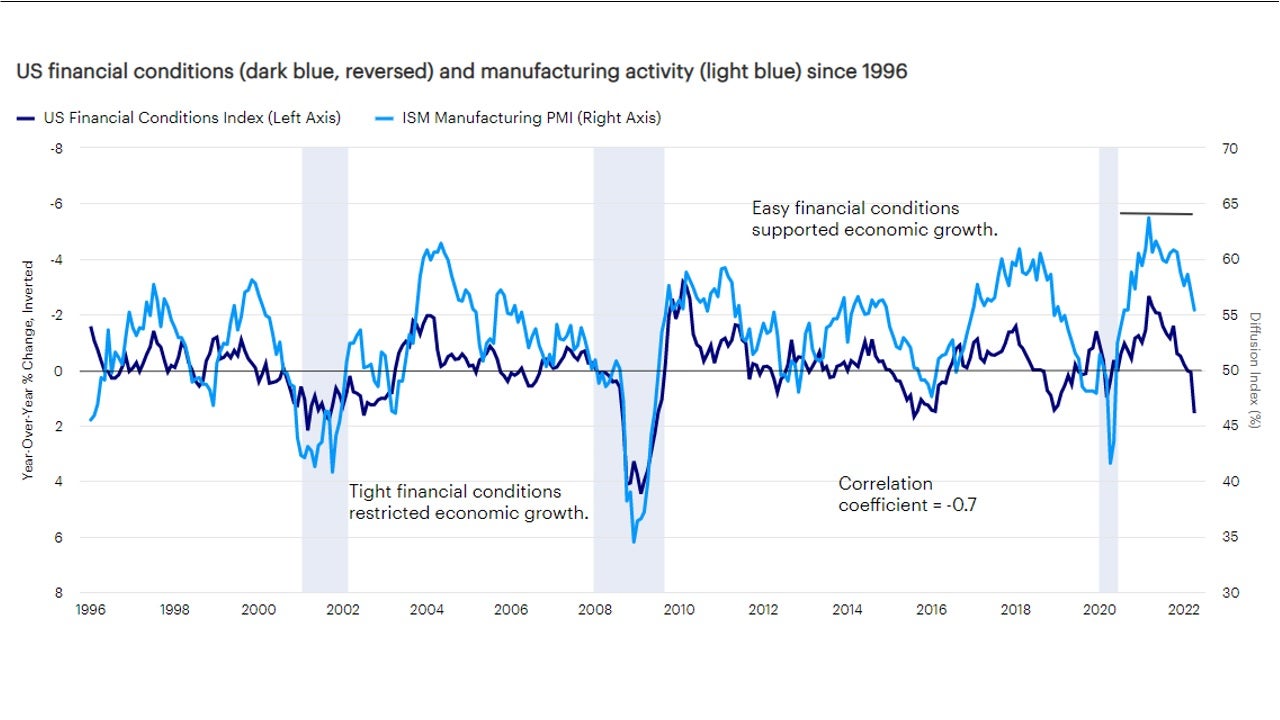

Indeed, an incrementally hawkish Fed alongside tight financial conditions is worrisome, pointing to declining industrial production and a potential earnings recession sometime later this year (Figure 1).

Sources: Bloomberg L.P., Goldman Sachs, Invesco, 5/2/22. Notes: The US Financial Conditions Index is calculated by Goldman Sachs and includes the federal funds rate, 10-year Treasury bond yield, BBB corporate bond spread, S&P 500 and US dollar. ISM = Institute for Supply Management. PMI = Purchasing Managers Index. NBER = National Bureau of Economic Research. Shaded areas denote NBER-defined US recessions. The line at 50% represents when the PMI is in expansion (over 50%) or contraction (under 50%). Correlation coefficient measures the strength of the relationship between the relative movements of the two indexes, with 1.0 being a perfect positive correlation and -1.0 being a perfect negative correlation. The circle highlights where we are now. Specifically, that financial conditions are tight and restricting growth. An investment cannot be made in an index. Past performance does not guarantee future results.

Recessionary deflation or “immaculate” disinflation?

Is there a scenario where the Fed doesn’t have to hike so much because of the sharp tightening in financial conditions? Will negative wealth effects curb demand enough to cool down an overheating US economy? Could falling oil prices alongside easing supply chain disruptions create a sort of “immaculate” disinflation?

Despite my bearish apprehension, I can see a path out of this grim situation, but I doubt the road to recovery 2.0 will be easy. A lot has to start going right for a change when so many things have been going wrong.

From my lens, a potentially positive chain of events could include:

- Moderating economic activity – check

- Lower oil prices – check

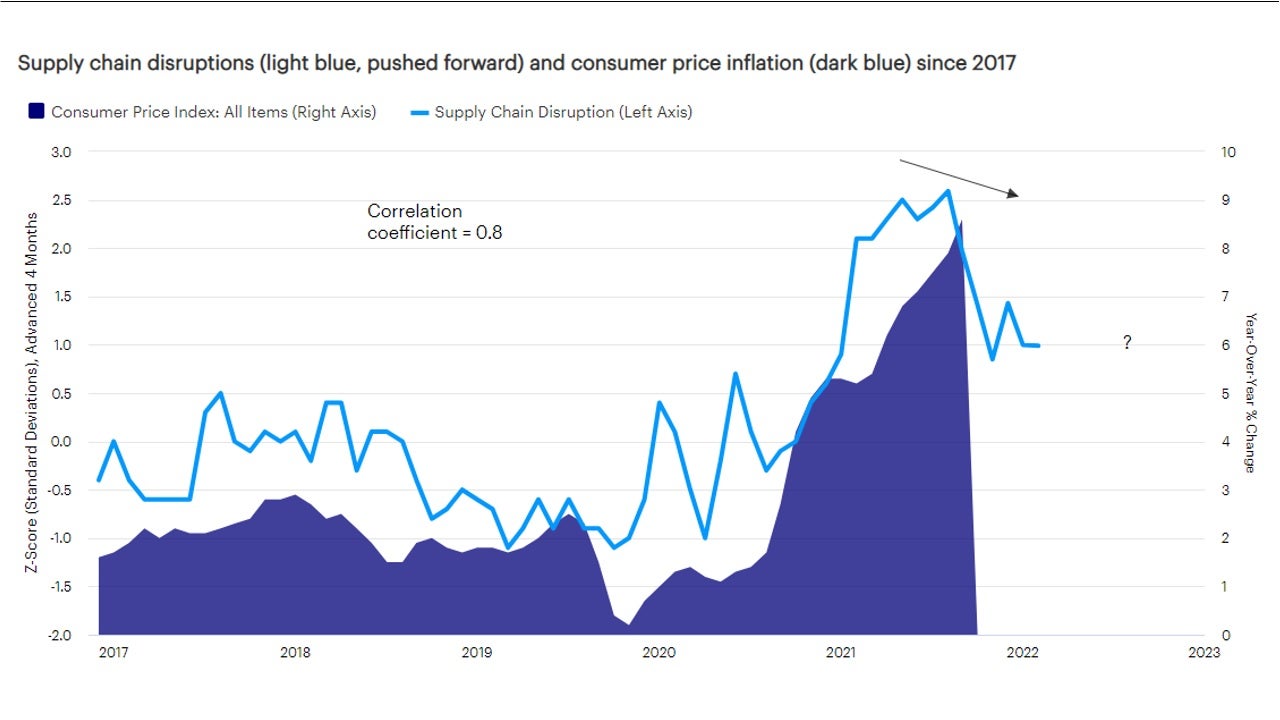

- Easing supply chain disruptions – early signs of hope (Figure 2)

- Peaking inflation – ?

- A less hawkish or even slightly dovish Fed – ?

Sources: Bloomberg, L.P., Bureau of Labor Statistics, FRED, Invesco, 5/4/22. Notes: The supply chain disruption shown in the chart includes the Institute for Supply Management (ISM) manufacturing and services supplier deliveries, backlog of orders, and inventories (inverted); the Baltic Exchange Baltic Dry Index (BDI) which is a composite of the dry bulk timecharter averages; inSpectrum Tech Inc DRAM spot prices (DDR4 4Gb 512Mx8 2133/2400 MHz); and the Drewry Hong Kong-Los Angeles Container Rate per 40-foot box. An investment cannot be made in an index. Past performance does not guarantee future results.

Defensive rotation or buying opportunity for risk assets?

Whether a tactical contraction devolves into a broad economic recession depends on the intensity of the Fed’s tightening cycle and threshold for pain. Regardless, either scenario would probably feel just as bad to stock market investors in real time.

In the months ahead, watch for a dip in the Institute for Supply Management Manufacturing Purchasing Managers Index below 50 for confirmation of a tactical contraction. In such regimes, market dynamics are typically characterized by a rotation from stocks and cyclicals to bonds and defensives, the beginnings of which we could already be witnessing.

It may be a bit early, but I believe balanced investors may want to consider raising their exposure to bonds. There’s a compelling argument to be made that higher bond yields may already reflect the path to a neutral federal funds rate target. Moreover, that asset class now offers better income and more attractive valuations, in my view, and could benefit from a downshifting economic outlook. Indeed, yields usually melt when output comes under pressure.

As for stocks and cyclicals, I’m inclined to reduce exposure by lightening up into any spontaneous rally that materializes. Granted, we’ve made some progress on my list of positive events. However, a clear signal to take risk and increase exposure likely awaits an inflection point in consumer prices and a calmer Fed reaction function. Stay alert.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2022-029

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html