Five reasons why the October lows should hold

Key takeaways

Fear

Investor risk aversion peaked at the end of last year.

Inflation and interest rates

Headline consumer prices and government bond yields peaked in June and October of 2022, respectively.

US dollar and financial conditions

The US currency and broader financial conditions have eased in the same timeframe.

Over the past few weeks, we’ve experienced a tactical risk-off rotation in the form of bonds outperforming stocks and the defensive sectors of the stock market outperforming their cyclical counterparts.1 While those trends may foreshadow another pullback at the S&P 500 Index level – akin to what we saw in December of 2022 or February of 2023 – I believe the primary uptrend (as defined by a series of higher highs and higher lows) should remain intact.

For US stocks to test and fail their October 2022 lows, I think five big concepts or peaks would have to reverse course and reach new highs, which I don’t see happening any time soon.

What does a stock market recovery depend on?

In my view, it relies on five peaks, four of which are clearly visible. Moreover, a monetary policy pivot may be on the horizon.

- Peak fear – My technical checklist of market bottom indicators suggests investor risk aversion peaked at the end of last year. Peak fear has usually coincided with major troughs in the US stock market.

- Peak inflation – Headline consumer price inflation peaked in June 2022.2 Pandemic-related supply chain disruptions seem to be easing, with positive knock-on effects for inflation and stocks. I suspect policymakers and investors will be caught off guard by how quickly the disinflationary impulse asserts itself.

- Peak bond yields – The 10-year Treasury bond yield peaked in October 2022.3 Peak inflation points to lower bond yields for now. Indeed, cooler inflation enhances fixed coupon payments, thereby increasing the value or attractiveness of outstanding debt issues (i.e., higher bond prices and lower bond yields).

- Peak US dollar – The US dollar index (DXY) peaked in September 2022.4 Generally, strong US currency cycles end when Fed tightening cycles end. US policymakers seem closer to the end than the beginning of monetary tightening.

- Peak Federal Reserve (Fed) – Since October 2022, we’ve enjoyed a broad easing of financial conditions, helped by falling government bond yields, a depreciating US currency, tighter corporate bond spreads above their Treasury counterparts, and rising stock prices. Together, those trends imply the Fed may soon pause its interest rate hikes.

Unfortunately, cycles don’t die of old age … the Fed kills them with rate hikes! True, recent bank failures are the types of major credit events that end old market cycles. From a different perspective, however, financial crises can also begin new market cycles.

Is the herd right or wrong?

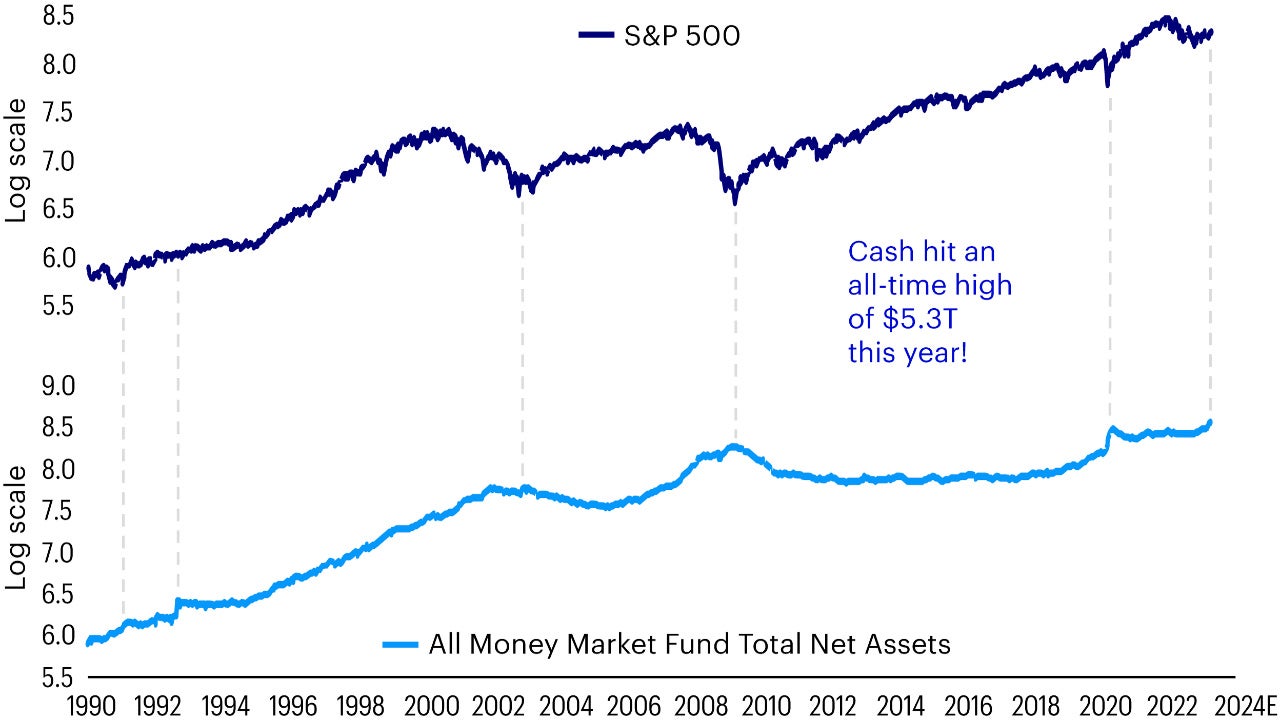

It’s wrong. Ironically, mountains of cash have generally accumulated near big turning points in US stocks.

Cash hit an all-time high of $5.3 trillion this year

Sources: Bloomberg, L.P., Investment Company Institute, Invesco, 4/21/23. Notes: Assets in taxable (i.e., Treasuries, repurchase agreements, agencies, large bank certificates of deposit, commercial paper, and banker’s acceptances) and tax-exempt (i.e., federal, state, and municipal debt) money market mutual funds are short-term, high-grade securities. Natural log. Vertical dotted lines are used to highlight times when peaks in cash corresponded to troughs in stocks. An investment cannot be made in an index. Past performance does not guarantee future results.

In my experience, investors can be their own worst enemies, especially when it comes to making asset allocation decisions. Unlike shoppers at department stores, the investment community tends to run away from the stock exchanges when there’s a significant markdown in prices.

Coming full circle, this is just another way of illustrating my first point about peak fear. I know it feels awful, but some of the best days in the stock market occur in the worst of times. As I’m fond of saying, chaos can create opportunities for patient, long-term investors … if they just stay the course.

当資料ご利用上のご注意

当資料は情報提供を目的として、インベスコ・アセット・マネジメント株式会社(以下、「当社」)のグループに属する運用プロフェッショナルが英文で作成したものであり、法令に基づく開示書類でも金融商品取引契約の締結の勧誘資料でもありません。内容には正確を期していますが、必ずしも完全性を当社が保証するものではありません。また、当資料は信頼できる情報に基づいて作成されたものですが、その情報の確実性あるいは完結性を表明するものではありません。当資料に記載されている内容は既に変更されている場合があり、また、予告なく変更される場合があります。当資料には将来の市場の見通し等に関する記述が含まれている場合がありますが、それらは資料作成時における作成者の見解であり、将来の動向や成果を保証するものではありません。また、当資料に示す見解は、インベスコの他の運用チームの見解と異なる場合があります。過去のパフォーマンスや動向は将来の収益や成果を保証するものではありません。当社の事前の承認なく、当資料の一部または全部を使用、複製、転用、配布等することを禁じます。

IM2023-039

そのほかの投資関連情報はこちらをご覧ください。https://www.invesco.com/jp/ja/institutional/insights.html