Innovation may drive growth stocks during volatility

Key takeaways

History has tended to reward those who maintain an unwavering long-term strategy.

The strength and strategic savvy of innovative sectors served them well.

Innovative companies have already begun looking to the future.

How innovation may drive growth stocks through volatile times

It’s human nature for investors to lose focus after an eye-popping market drawdown. As previous gains slowly slip away, investors often can’t resist trying to outmaneuver the market. But that could be the wrong move. History has tended to reward those who maintain an unwavering long-term strategy.

This resilient, but often challenging to implement, approach has worked particularly well when investing in sectors with a track record for innovation. Companies in these sectors are accustomed to adapting to a rapidly changing world by constantly developing new technologies and groundbreaking solutions. The recent performance of Invesco QQQ ETF (QQQ), which provides access to the NASDAQ-100 Index, demonstrates this potential to handle periods of volatility better.

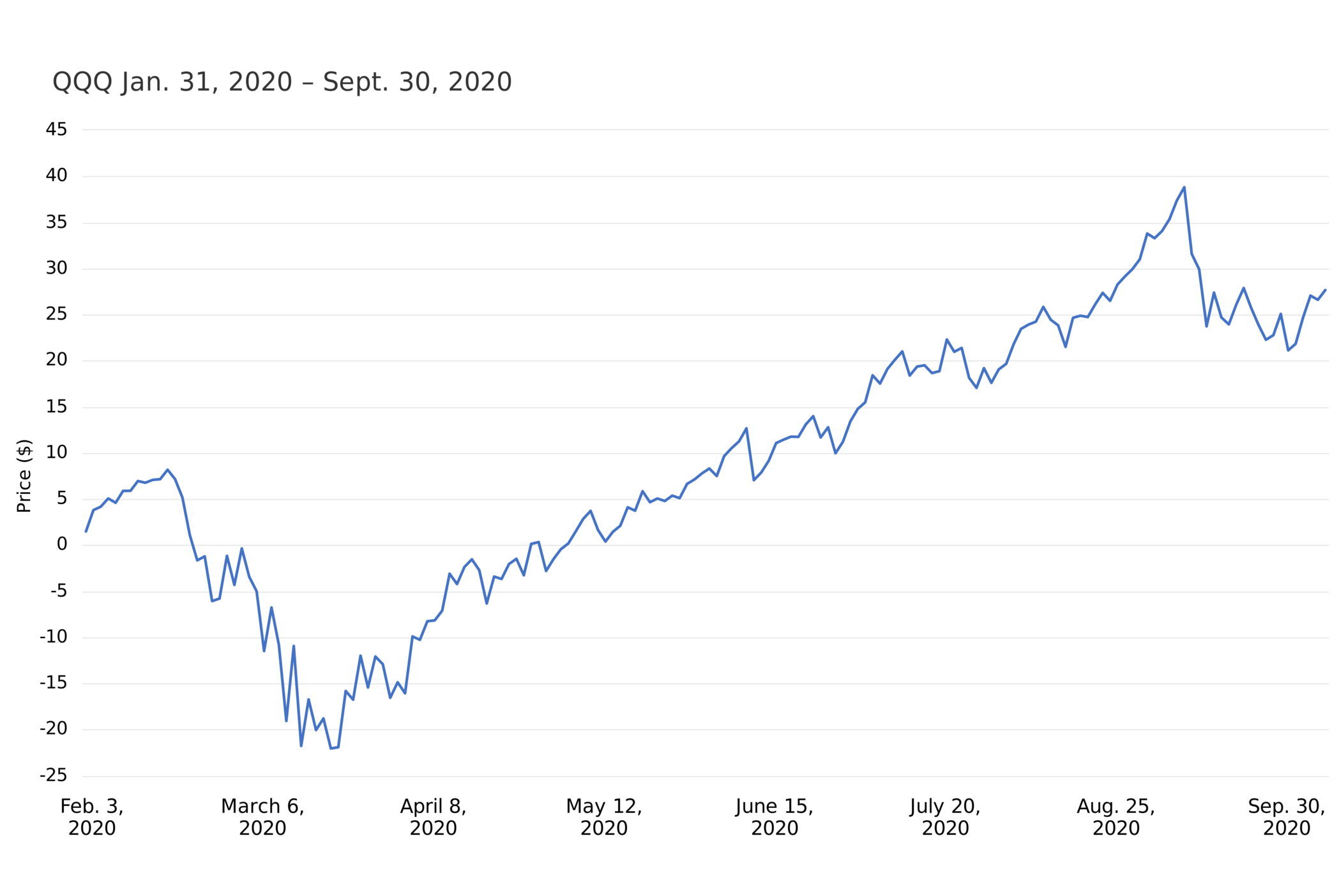

In the weeks during which the coronavirus outbreak became front-page news (February 19 through March 25), QQQ had slightly outperformed (at NAV) the broader market, as measured by the S&P 500 Index. This outperformance has been aided in part by two important factors.

First, QQQ didn’t have significant exposure to the broader market’s worst-performing sectors: energy and financials. Since the NASDAQ-100 doesn’t include financial services companies and has limited exposure to the energy sector, QQQ was mostly immune to the market’s more than 30% drawdown.

Second, the rebound in QQQ is most likely attributable to the strength and strategic savvy of the innovative tech, biotech and communications leaders that are in the fund. When an unprecedented challenge like a worldwide pandemic hit, these well-positioned companies were prepared. Given that this particular crisis brought a dramatic increase in virtual vs. in-person experiences, many of the NASDAQ-100 companies, with their digital first business models, were able to thrive.

It’s not enough to just bounce back, the innovative companies that make up QQQ have already begun looking to the future with an eye on how they can continue to pivot and sustain the cutting-edge innovation that serves as their principal driver of growth.

Past performance is not a guarantee of future results; current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. See invesco.com to find the most recent month-end performance numbers. Market returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times. Fund performance reflects fee waivers, absent which performance data quoted would have been lower. An investment cannot be made directly into an index. Index returns do not represent fund returns.